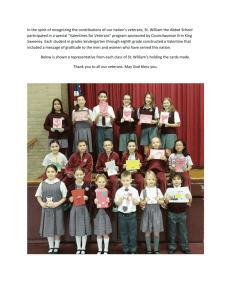

Fighting for Education:

advertisement