American-type options with parameter uncertainty Saul D. Jacka, Adriana Ocejo

advertisement

American-type options with parameter uncertainty

Saul D. Jacka, Adriana Ocejo∗

Department of Statistics, The University of Warwick

5 September 2013

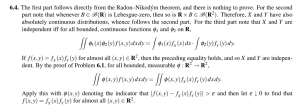

Abstract

Consider a pair (X, Y ) of processes, where X satisfies the equation dX =

X( Y dB +µ dt) and Y is a stochastic process controlled by a predictable parameter π. We study a zero-sum game of stopping and control, in which the stopper chooses a stopping rule τ to maximize the expected payoff Ex,y e−ατ g(Xτ ),

whereas the controller chooses the parameter π in order to minimize this expectation. Under suitable sufficient conditions, we show that the game has a

value by exhibiting a saddle point. The value of the game coincides with the

worst-case scenario for the holder of an American-type option in the presence

of parameter uncertainty. We cover both finite and infinite horizon cases.

Key words: American option, uncertainty, stochastic volatility, optimal stopping,

zero-sum game, stochastic control.

MSC 2010: Primary 91G80, 93E20; secondary 49J20, 60G40.

1

Introduction and problem statement

Suppose that X is an Itô process evolving with the dynamics

dXt = Xt ( Yt dBt + µ dt)

where µ ∈ R and B is a standard Brownian motion. Here, Y is another stochastic

process and is to be referred to as the (stochastic) volatility of X. If Y takes the

constant value σ ∈ R\{0}, then X is a geometric Brownian motion.

In the context of option pricing in Mathematical Finance, X stands for the stock

price process. In an effort to better capture the behavior of X from market data,

∗

This author acknowledges the support of CONACYT under the Ph.D. scholarship #309247.

1

many authors relax the classical assumption of constant volatility (as in the Black

and Scholes model) and assume instead that volatility is stochastic. For instance

Buffington and Elliot [4], Guo and Zhang [7], Jobert and Rogers [14], and Yao et al [22]

use the so-called regime-switching or Markov-modulated model where Y is a (function

of a) continuous-time Markov chain (MC) that switches among a finite number of

states. In another formulation, Heston [9], and Hull and White [12] (amongst many

others) assume that Y solves an autonomous stochastic differential equation (SDE).

Whether it be a MC or a diffusion process modeling Y , it is difficult to make

precise the parameters driving its dynamics because of the uncertain nature of the

volatility of stock prices. In the MC case, the transition rates model the occurrence

of sudden economic movements (switches) but, in practice, these rates are not fully

observable (see Hartman and Heaton [8] and references therein). In the other case,

the drift of volatility typically characterizes the choice of the pricing measure, but

there is no definite criterion telling us which measure should be used (see Hobson

[10, 11]).

There is some work on model uncertainty that takes account of uncertainty in the

volatility model. For instance, Avellaneda et al. [2] and Frey [5] assume that the

volatility is a predictable process which is only known to be bounded between two

constant values.

In this paper, we take the model for the volatility to be either a MC or a diffusion

process, but allow for some parameter uncertainty in its dynamics. The uncertainty

is incorporated through the Q-matrix or the drift of the volatility, and is represented

in either case by the parameter π. More precisely, we assume that the jump rates

or the drift are only known to be predictable and to lie within two level-dependent

values at each time. Remark that Y may still be unbounded in the diffusion case, in

contrast to the setting of model uncertainty.

The purpose of this paper is to study the worst-case scenario for the holder of an

American option in the setting with parameter uncertainty. Assume that the payoff

function is g, the instantaneous interest rate α is a positive constant, and that the

time to expiration is T ∈ (0, ∞] (we admit both finite and infinite horizon). If the

holder performs optimally, then the worst-case scenario in the presence of uncertainty

is the expected payoff:

inf sup Ex,y e−ατ g(Xτπ ),

(1.1)

π

τ ≤T

where the notation Ex,y indicates the expectation conditional on (X0 , Y0 ) = (x, y).

Of course, the roles of writer and holder are antithetical and so the above value

also corresponds to the best-case scenario for the writer.

2

The main goal is to find τ̂ and π̂ attaining the value in (1.1). To this end, we

concentrate on the following game problem.

Problem 1.1. Find a stopping rule τ̂ and a control π̂ such that

sup inf Ex,y e−ατ g(Xτπ ) = Ex,y e−ατ̂ g(Xτ̂π̂ ) = inf sup Ex,y e−ατ g(Xτπ ).

τ ≤T π

π τ ≤T

(1.2)

We say that (τ̂ , π̂) is a saddle point and Ex,y e−ατ̂ g(Xτ̂π̂ ) is the value of the game,

which coincides with the scenario in (1.1).

In Section 2 we fix the notation and state the main result, Theorem 2.3. This

theorem exhibits, under suitable conditions, a saddle point and so solves the above

problem. Our guess for the saddle point is based on our results with Assing [1],

which assert that prices of American options are increasing as a function of the initial

volatility value (see Proposition 2.1 below). In Section 3, we review some aspects of

the classical theory of optimal stopping for two reasons: to address the existence of

optimal stopping rules and to deduce some smoothness of the value function. For

the latter, we use techniques from the theory of partial differential equations (PDE’s)

which are widely known in the diffusion case (for instance Jacka [13, Prop. 2.3.1])

but rarely in the MC case. The proof of the main theorem is presented in Section

4 and is based on Bellman’s principle. Finally, in Section 5 we consider sufficient

conditions under which the assumptions on g may be weakened, which is the content

of Theorem 5.2.

2

Notation and results

Let (X, Y ) be a bi-variate process with state space E = R+ × S (S ⊆ (0, ∞)) and

defined on a filtered probability space (Ω, F, (Ft )t≥0 , P ), where the filtration F :=

(Ft )t≥0 satisfies the usual conditions. The process X evolves with the dynamics

dXt = Xt ( Yt dBt + µ dt)

(2.1)

where B is a standard F-Brownian motion, µ ∈ R, and Y = Y π is a continuous-time

and F-adapted controlled process which belongs to either of two classes:

- Diffusion: Y π satisfies the equation

dYt = η(Yt ) dBtY + πt dt,

(2.2)

where B Y is a standard F-Brownian motion independent of B; η is a continuous, realvalued function, η 2 (·) > 0; and the control π = (πt )t≥0 is in the class UIP consisting

of F-predictable processes with values in R.

3

- Markov chain: Y π is a time-inhomogeneous Markov chain (MC) with finite state

space1 S = {1, 2, . . . , d}, where the control π = (πt )t≥0 is in the class UM C consisting

of F-predictable processes with values in the space of S × S-valued Q-matrices of

jump rates.

Rt

Note that the stochastic integral 0 Ys dBs , t ≥ 0, is well-defined in either of the

above cases since Y is F-adapted and either a continuous or a piecewise-constant

process. Then, X is an exponential local martingale of the form

Z

Z t

1 t 2

Y ds , t ≥ 0, a.s.

(2.3)

Ys dBs −

Xt = X0 exp µ t +

2 0 s

0

We introduce the set A of admissible controls and the associated operators Lπt for

π ∈ A:

- In the diffusion case,

A = {π = (πt )t≥0 ∈ UIP : 0 ≤ a(Yt ) ≤ πt ≤ b(Yt ), t ≥ 0}

where the extremal drifts a, b are continuous functions satisfying a(y) ≤ b(y). Note

that the controls π ∈ A are locally bounded because of the continuity of a and b.

- In the MC case,

A = {π = (πt (i, j))t≥0 ∈ UM C : πt (Yt , j) = 0 for |j − Yt | > 1,

λlYt ≤ πt (Yt , Yt + 1) ≤ λuYt , and µlYt ≤ πt (Yt , Yt − 1) ≤ µuYt , t ≥ 0},

where the extremal jump rates are such that 0 ≤ λli ≤ λui and 0 ≤ µli ≤ µui , i ∈ S.

Note that if π = (πt (i, j)) ∈ A, the Q-matrices (πt (i, j)), t ≥ 0, are tridiagonal.

We denote the admissible controls set by A in both cases for ease of presentation,

but the precise description of the family will be apparent from the context.

As it is common in the literature, a Markov time τ : Ω → [0, ∞] satisfies the

condition {τ ≤ t} ∈ Ft , t ≥ 0, and it is referred to as a stopping time if it is finite.

Denote by M the family of all Markov times and, for each T ∈ (0, ∞], by MT those

which are no greater than T .

Fix a time horizon T in (0, ∞]. Under suitable conditions on the gains function

g and on the dynamics of (X, Y ), we shall show the existence of a saddle point

(τ̂ , π̂) ∈ MT × A satisfying (1.2).

1

We choose S = {1, 2, . . . , d} for ease of presentation, but we may re-label the states and assume

that S is a finite subset of (0, ∞) without loss of generality.

4

Our result relies on a monotonicity condition on the value function

v π (x, y) := sup Ex,y e−ατ g(Xτπ )

(2.4)

τ ∈MT

with respect to y, associated to the extremal volatility value π ≡ π min defined as

πtmin := a(Yt ),

t≥0

(2.5)

in the diffusion case; or as

l

λ Yt

πtmin (Yt , j) := µuYt

0

if j = Yt + 1

if j = Yt − 1

otherwise,

j ∈ S, t ≥ 0,

(2.6)

in the MC case.

Sufficient conditions under which such monotonicity holds have been provided in

[1] for a very general class of gains functions g. For ease of reference we adapt these

results to the case where g is non-negative.

Proposition 2.1. (Monotonicity) Suppose that g is a non-negative measurable

min

function. Then the function v π (x, ·) is non-decreasing on S provided the following

condition is satisfied:

(M1) either the process X is driftless (i.e. µ = 0) or g is non-increasing;

and if Y is in the diffusion class, further assume that for each (x, y) ∈ E,

(M2) Px,y (limt↑∞

Rt

0

Ys2 ds = ∞) = 1; and

(M3) there exists a unique, non-exploding strong solution to the system

Z t

Z t

Z t

−1

ξ

Gt = x +

Gs dWs ,

ξt = y +

η(ξs )ξs dWs +

a(ξs )ξs−2 ds

0

0

(2.7)

0

where (W, W ξ ) is a Brownian motion and (G, ξ) takes values in E.

For the proof we refer to [1]. Specifically, see Theorem 2.5 (MC case, µ = 0),

Theorem 3.5 (diffusion case, µ = 0), and Corollary 5.1 (both cases2 , µ 6= 0).

2

The dynamics of the process X in [1] is either dXt = a(Xt )Yt dBt where a(x) is a measurable

function, or dXt = Xt (Yt dBt +µ dt) as in our setting. In [1], it is assumed that µ equals the discount

rate α for applications to option pricing, however no argument changes in the proof of Corollary 5.1

if we take µ 6= α instead.

5

Remark 2.2. (i) In [1], it is required that the Markov chain Y is skip-free, but

remember that this property is implicit from our assumption that the generator

π is in the family A.

(ii) Of course, the linear equation dGt = Gt dWt in (2.7) has a unique, non-exploding

strong solution. Then Condition (M3) becomes a condition only on the autonomous equation for ξ.

We are now ready to state the main result. Consider the following assumption on

the gains function:

(A) g is a non-negative, continuous and bounded function.

The assumption (A) can be relaxed. We may allow gains functions with polynomial growth, but of course, at the price of imposing some integrability conditions.

To keep things simple, we state and show our results under the assumption that g

is bounded and refer to Section 5 for the extension to the case where g is possibly

unbounded.

Theorem 2.3. (Saddle point) Suppose that the conditions of Proposition 2.1 and

the assumption (A) are satisfied. Then the pair (τ̂ , π̂), where π̂t ≡ πtmin and τ̂ attains

the associated supremum in (2.4), is a saddle point.

3

Optimal stopping and regularity

In this section we address the existence of an optimal Markov time attaining the

supremum in (2.4), which is implicit in the statement of Theorem 2.3. Throughout

this section we assume that π· ≡ π·min , which places us in the context of a Markov

process (X π , Y π ).

When T < ∞, we need to emphasize the dependence of the value function on the

time to expiration for the proof of Theorem 2.3, so we write

v π (x, y, t) = sup Ex,y e−ατ g(Xτπ ),

0 ≤ t ≤ T.

τ ∈Mt

Note that v π (x, y, 0) = g(x) for all (x, y) ∈ E.

We recall some well-known results from the theory of optimal stopping for Markov

processes to guarantee the existence of such optimal rules. We also use classical

techniques from the PDE’s theory to deduce sufficient smoothness for the payoff

function in order to be able to use Itô’s formula later on.

6

3.1

Diffusion case

Fix the drift π ≡ π min as in (2.5) (i.e. π(·) = a(·)).

Let (X, Y ) = (X π , Y π ) denote the corresponding diffusion solving the system

(2.1)-(2.2) with state space E = R+ × S (S ⊆ (0, ∞)). Also denote by Lπ the

infinitesimal generator of (X, Y ), acting on functions h : E → R with h ∈ C 2,2 (E),

1

1

Lπ h(x, y) = hxx (x, y)x2 y 2 + hyy (x, y)η 2 (y) + hx (x, y)µ x + hy (x, y)π(y).

2

2

(3.1)

Thanks to the conditions: η continuous, η 2 (·) > 0 and y ∈ S ⊆ (0, ∞); the

operator Lπ (and so Lπ − α) is elliptic in E and uniformly elliptic3 in any bounded

subset of E. This is used in the proofs of smoothness.

The following statement is an adaptation of well-known results of Krylov [15].

Proposition 3.1. (Attainability and continuity) Suppose that g satisfies the con∗

ditions in (A) and that the time horizon T is infinite. Then v π (x, y) = Ex,y e−ατ g(Xτ ∗ ),

where τ ∗ denotes the first exit time of (Xt , Yt ) from the continuation set C := {(x, y) ∈

E : v π (x, y) > g(x)}. Moreover, v π is continuous everywhere in E.

Proof. The first assertion about v π is corollary of Theorem 6.4.8 in [15], since

here, the conditions on g in (A) are weaker. The continuity of v π follows by Theorem

6.4.14 in [15], which asserts that the region where v π is continuous coincides with the

set where the operator Lπ is elliptic.

The continuity of v π is key, together with the strong Markov property of the

diffusion (X, Y ), to deduce some smoothness for v π .

Proposition 3.2. (Smoothness) In the context of Proposition 3.1, the function v π

solves the Dirichlet-type problem

(Lπ − α)h(x, y) = 0,

h(x, y) = g(x),

in C

on ∂C.

π

π

In particular, the partial derivatives vxx

, vyy

, vxπ , vyπ exist and are continuous in C.

Proof. The assertion v π (x, y) = g(x) on ∂C follows by the Proposition 3.1 and

the definition of τ ∗ . Fix (x0 , y0 ) ∈ C and let U be an open ball centered at (x0 , y0 )

3

See Section 6 in [6] for the definition of elliptic and parabolic operators. In our setting, the

operator Lπ is uniformly elliptic in any bounded subset U of E since min(x,y)∈U {x2 y 2 + η 2 (y)} > 0.

7

strictly contained in C (recall that C is open). Now consider the revised Dirichlet-type

problem (cf. system in (2.2)-(2.3) of [6]):

(Lπ − α)h(x, y) = 0,

in U

π

h(x, y) = v (x, y), on ∂U.

(3.2)

Given that Lπ −α is uniformly elliptic in U and v π is continuous, there exists a unique

solution h in C 2,2 (U ) to (3.2). Applying Itô’s formula to e−αt h(Xt , Yt ) it follows that

the probabilistic representation of h in U is given by

h(x, y) = Ex,y e−ατU v π (XτU , YτU ), (x, y) ∈ U,

where τU is the first exit time of (X, Y ) from U (see [6, Theorems 6.2.4 and 6.5.1]).

Moreover, by the strong Markov property of the diffusion and using the fact that

τU ≤ τ ∗ , one can see that h(x, y) = v π (x, y) everywhere in U . In particular, the partial

π

π

derivatives vxx

, vyy

, vxπ , vyπ exist and are continuous at (x0 , y0 ). Since (x0 , y0 ) ∈ C was

arbitrary the claim of the proposition follows.

3.2

MC case

Fix the Q-matrix π ≡ π min as in (2.6) (i.e. π(i, j) = 0 if |i − j| > 1, π(i, i + 1) = λli ,

and π(i, i − 1) = µui ).

Let (X, Y ) = (X π , Y π ) denote the strong Markov process such that X solves

(2.1) and Y is a Markov chain with generator π with state space E = R+ × S (S =

{1, 2, . . . , d}). Also denote by Lπ the infinitesimal generator of (X, Y ), acting on

functions h : E → R with h(·, y) ∈ C 2 (R+ ) and h(x, ·) bounded,

1

Lπ h(x, y) = hxx (x, y)x2 y 2 + hx (x, y)µ x + (πh(x, ·))(y).

2

(3.3)

where

(πh(x, ·))(y) = [h(x, y + 1) − h(x, y)]λy + [h(x, y − 1) − h(x, y)]µy ,

and λy , µy are the upwards and downwards jump rates, respectively. Set κ(y) =

λy + µy , the rate of leaving y.

Proposition 3.3. (Attainability) Suppose that g satisfies Condition (A) and that

∗

the time horizon T is infinite. Then v π (x, y) = Ex,y e−ατ g(Xτ ∗ ), where τ ∗ denotes the

first exit time of (Xt , Yt ) from the continuation set C := {(x, y) ∈ E : v π (x, y) > g(x)}.

Proof. The result follows by the part (2) of Theorem 3 in [20, Page 127].

8

For each y ∈ S, let Cy be the y-section of the continuation set, that is,

Cy := {x ∈ R+ : (x, y) ∈ C}.

The idea in the proof of the smoothness of v π (·, y) is very similar to the corresponding one in the case of a diffusion. Again, we make use of the theory of PDE’s

and the strong Markov property of the process (X, Y ). Recall the argument in the

proof of Proposition 3.2 which uses the continuity of v π in order to ensure the existence and uniqueness of a solution to a revised Dirichlet-type problem. In what

follows, we first show the continuity of v π (·, y) in Cy and then deduce smoothness.

Unlike the diffusion case, we are not aware of general results in the literature in the

present context.

Lemma 3.4. (Continuity) In the context of Proposition 3.3, for each y ∈ S the set

Cy is open and v π (·, y) is continuous in Cy .

Proof. Fix y ∈ S. Let τ ∗ be the optimal Markov time for the problem with initial

condition (X0 , Y0 ) = (x, y) in (2.4). For any δ ∈ R satisfying x + δ ∈ R+ , the form of

X in (2.3) implies that

x+δ

π

−ατ ∗

−ατ ∗

Xτ ∗ .

v (x + δ, y) ≥ Ex+δ,y e

g(Xτ ∗ ) = Ex,y e

g

x

Since g is non-negative and continuous, the Fatou’s lemma yields the inequality

lim inf δ→0 v π (x + δ, y) ≥ v π (x, y), i.e., v π (·, y) is lower semi-continuous in R+ . This in

turn implies that the set Cy is open.

Let I be a bounded open interval contained in Cy . It is enough to show that

x 7→ v π (x, y) is continuous in I.

Let T1 be the first exit of X from I and T2 be the first jump of the Markov chain

Y from y, and set τ = T1 ∧ T2 . We have that τ ≤ τ ∗ and given that (X, Y ) is a strong

Markov process it follows that

v π (x, y) = Ex,y e−ατ v π (Xτ , Yτ ),

∀ x ∈ I.

We shall show that the functions

F1 (x) :=Ex,y [ e−αT1 v π (XT1 , YT1 ) I{T1 < T2 } ],

and

−αT2 π

F2 (x) :=Ex,y [ e

v (XT2 , YT2 ) I{T2 < T1 } ]

are continuous in I, so that the result follows because v(x, y) = F1 (x) + F2 (x) (since

Px,y (T1 = T2 ) = 0).

Let X̃ be the solution to the equation dX̃t = X̃t (y dBt + µ dt) started at X̃0 = x,

and killed at an independent, exponentially distributed random time eγ ∼ Exp(γ).

9

That is, X̃ is a geometric Brownian motion started at X̃0 = X0 = x and killed at

rate γ. We know that X̃ is a strong Feller process (see [21]) and therefore, for every

¯ the functions

bounded measurable function φ on I,

x 7→ E [φ(X̃T1 ) | X̃0 = x] and x 7→ E [φ(X̃t ) I{t < T1 } | X̃0 = x]

are continuous in I (see [3, Theorem 2.1 and Lemma 2.2]). We will use this fact below

by setting γ = α + κ(y) for the first function and γ = α for the second one.

Set φ(x) = v π (x, y) and eγ = eα + T2 where eα ∼ Exp(α) is independent of T2 ,

that is, γ = α + κ(y). Since X̃ is independent of Y0 = y, and X̃T1 = XT1 , YT1 = y on

{T1 < T2 } a.s., we have that

E [φ(X̃T1 ) | X̃0 = x] = E [φ(X̃T1 ) I{T1 < eγ } | X̃0 = x, Y0 = y ]

= E [v π (X̃T1 , y) I{T1 < T2 } I{T1 < eα } | X̃0 = x, Y0 = y ]

= E [v π (XT1 , YT1 ) I{T1 < T2 } I{T1 < eα } | X0 = x, Y0 = y ]

Z ∞

−αs π

αe v (XT1 , YT1 ) I{T1 < T2 } I{T1 < s} ds

= Ex,y

0

Z ∞

−α(s−T1 ) −αT1 π

= Ex,y e

v (XT1 , YT1 ) I{T1 < T2 }

αe

ds

T1

= Ex,y [ e

−αT1 π

v (XT1 , YT1 ) I{T1 < T2 }] = F1 (x).

Hence F1 (x) is continuous in I.

Let us now fix y 0 6= y. Observe that

Z ∞

F2 (x) =

κ(y) e−κ(y) t Ex,y [ e−α t v π (Xt , Yt ) I{t < T1 } | T2 = t] dt,

Z0 ∞

X π(y, y 0 )

Ex,y [ e−α t v π (Xt , y 0 ) I{t < T1 } | T2 = t] dt.

=

κ(y) e−κ(y) t

κ(y)

0

y 0 6=y

Now, set φ(x) = v π (x, y 0 ) and eγ = eα where eα ∼ Exp(α) is again independent of T2 .

Note that, conditional on T2 = t, Xt = X̃t on {t < eα } a.s. Then, analogously to the

arguments above we obtain

E [φ(X̃t ) I(t < T1 ) | X̃0 = x] = E [φ(X̃t ) I{t < T1 } | X̃0 = x, Y0 = y]

= E [v π (X̃t , y 0 ) I{t < T1 } I{t < eα } | X̃0 = x, Y0 = y]

= E [v π (Xt , y 0 ) I{t < T1 } I{t < eα } | X0 = x, Y0 = y, T2 = t]

= Ex,y [e−αt v π (Xt , y 0 ) I{t < T1 } | T2 = t]

for each t > 0. Since the LHS of this chain of equalities is continuous with respect to

x and v π (·, y 0 ) is bounded on I, it follows that F2 (x) is continuous in I by dominated

convergence.

10

Proposition 3.5. (Smoothness) In the context of Proposition 3.3, the payoff function v π solves the Dirichlet-type problem

(Lπ − α)h(x, y) = 0,

h(x, y) = g(x),

in C

on ∂C.

In particular, for each y ∈ S, v π (·, y) belongs to C 2 (Cy ).

Proof. The assertion v π (x, y) = g(x) on ∂C follows by Proposition 3.3 and the

definition of τ ∗ . Fix y ∈ S and x0 ∈ Cy . Let I = (a, b) be an open interval centered

at x0 such that I ⊂ Cy .

P

Define f (x) := y0 6=y π(y, y 0 )v π (x, y 0 ) and the linear ordinary differential operator

L̃ given by L̃H(x) := 12 H 00 (x)x2 y 2 + H 0 (x)µ x − H(x)κ(y).

Consider the Dirichlet problem (in the variable x):

(L̃H − αH)(x) = −f (x),

H(a) = v π (a, y),

H(b) = v π (b, y)

in I

(3.4)

Thanks to Lemma 3.4, f (·) and v π (·, y) are continuous. Theorem 6.2.4 in [6]

yields the existence and uniqueness of a solution H : I¯ → R to (3.4) such that

¯

H ∈ C 2 (I) ∩ C 0 (I).

¯ set h(x, y) := H(x) and h(x, y 0 ) :=

Define h on I¯ × S as follows: for each x ∈ I,

0

0

v (x, y ) for y 6= y. Now, we aim to give a probabilistic representation of h(x, y),

x ∈ I. To this end, let T1 be the first exit of X from I and T2 be the first jump of

the Markov chain Y from y, and set τ = T1 ∧ T2 . We can apply Dynkin’s formula to

obtain

Z τ

−ατ

−αs

π

h(x, y) = Ex,y e h(Xτ , Yτ ) − Ex,y

e (L h − αh)(Xs , Ys )ds ,

∀ x ∈ I.

π

0

But note that (Lπ h − αh)(Xs , Ys ) = (L̃h − αh)(Xs , Ys ) + f (Xs ) = 0 for all s ≤ τ , as

well as h(Xτ , Yτ ) = v π (Xτ , Yτ ). Therefore, using the strong Markov property and the

fact that τ ≤ τ ∗ we have that

H(x) = Ex,y e−ατ v π (Xτ , Yτ ) = v π (x, y),

∀ x ∈ I,

which implies that (Lπ v π − αv π )(x, y) = 0, for all x ∈ I, as required. In particular,

v π (·, y) ∈ C 2 (I). Since x0 ∈ Cy was arbitrary the claim of the proposition follows.

Remark 3.6. Although the PDE techniques are fairly well-known in the diffusion

case, we are not aware of their use in the case where Y π is a Markov chain. So Lemma

3.4 and Proposition 3.5 are somewhat a novelty in the literature.

11

Remark 3.7. The arguments in the above proofs are not restricted to the case where

π is tridiagonal (this is only used in the next section). Then we could use the more

general notation

X

(πh(x, ·))(y) =

π(y, y 0 )h(x, y 0 ) − κ(y)h(x, y)

y 0 6=y

where κ(y) =

3.3

P

y 0 6=y

π(y, y 0 ).

Finite horizon

We end this section by stating the corresponding attainability and regularity results

in the finite horizon case, T < ∞. We consider both cases in our statements but the

precise definition of the state space E and the operators Lπ is understood from the

context.

Proposition 3.8. (Attainability, T < ∞) Suppose that g satisfies the conditions

in (A) and that the time horizon is finite. Then, for each t ∈ [0, T ],

t

v π (x, y, t) = Ex,y e−ατ g(Xτ t ),

(x, y) ∈ E,

where τ t denotes the first exit time of (Xs , Ys , t − s) from the continuation set C :=

{(x, y, t) ∈ E × (0, T ] : v π (x, y, t) > g(x)}.

See for instance Theorem 3.1.10 in [15] and Theorem 3 in [20, Page 127] for a

proof.

Proposition 3.9. (Smoothness, T < ∞) In the context of Proposition 3.8, the

payoff function v π solves the initial-boundary value-type problem

(Lπ − α − ∂/∂t)h(x, y, t) = 0,

h(x, y, 0) = g(x),

h(x, y, t) = g(x),

in C

on ∂C.

Remark 3.10. The idea for the proof of Proposition 3.9 is very similar to that of

the infinite horizon case. Here, one can show that the payoff function v π identifies

with the solution of a revised initial-boundary value-type problem (involving now a

parabolic equation) by restricting the domain to a bounded rectangle contained in

C with v π as the boundary condition. Again, the strong Markov property of (X, Y )

plays an important role for this identification to hold. As a consequence of Proposition

3.9, the payoff function v π possesses the required smoothness to be able to apply Itô’s

formula in the next section.

12

4

Proof of Theorem 2.3

The complete proof is given for the case T = ∞. The arguments for the case T < ∞

only require some obvious changes, see Remark 4.1 below.

All the statements below assume that π̂t = πtmin and τ̂ is the associated optimal stopping rule as described in Propositions 3.1 and 3.3. Specifically, v π̂ (x, y) =

supτ ∈M Ex,y e−ατ g(Xτπ̂ ) = Ex,y e−ατ̂ g(Xτ̂π̂ ) and τ̂ is the first exit time of the controlled

process from the continuation set C = {(x, y) ∈ E : v π̂ (x, y) > g(x)} corresponding to

the extremal volatility value π̂. That is, given π,

τ̂ ≡ τ̂ π = inf{t ≥ 0 : (Xtπ , Ytπ ) ∈

/ C}.

Note that in order to show that (τ̂ , π̂) is a saddle point it is enough to verify that,

for each (x, y) ∈ E,

Ex,y e−ατ g(Xτπ̂ ) ≤ Ex,y e−ατ̂ g(Xτ̂π̂ ) ≤ Ex,y e−ατ̂ g(Xτ̂π )

for all strategies τ ∈ M and π ∈ A.

Let us set w(x, y) := Ex,y e−ατ̂ g(Xτ̂π̂ ) to indicate the candidate value of the game.

Of course, w ≡ v π̂ and so Proposition 2.1 yields that w(x, ·) is non-decreasing on S

for each x ∈ R+ .

(i) We first show that (τ̂ , π̂) is a saddle point in the setting where Y is a controlled

diffusion processes.

Step 1. The first inequality above is guaranteed by Proposition 3.1. Let us now

concentrate on the second inequality, or equivalently, on the optimization problem

inf Ex,y e−ατ̂ g(Xτ̂π ).

(4.1)

π∈A

Fix (x, y) ∈ E. Pick an arbitrary π ∈ A and define the Bellman process (Nt (π))t≥0

associated to the minimisation problem above by

Nt (π) := e−ατ̂ ∧t w(Xτ̂π∧t , Yτ̂π∧t ),

t ≥ 0.

For each R > 0, let UR denote the open ball centered at (x, y) of radius R, and let

τR denote the first exit time of the controlled process (X, Y ) from UR . Let us show

that the stopped Bellman process N·∧τR (π) = (Nt∧τR (π))t≥0 is a submartingale.

Proposition 3.2 yields that w is a smooth function in C 2,2 (C). Applying Itô’s

formula for semimartingales (see Theorem II.33 in [17]) we have that, for 0 ≤ s < t,

Z t∧τR

Nt∧τR (π) − Ns∧τR (π) =

e−αu (Lπu w − αw)(Xτ̂π∧u , Yτ̂π∧u )du + Mt − Ms ,

s∧τR

13

R t∧τ

where the local martingale Mt is given by Mt = 0 R e−αs wx (Xτ̂π∧s , Yτ̂π∧s ) Xτ̂π∧s Yτ̂π∧s dBs +

R t∧τR −αs

e wy (Xτ̂π∧s , Yτ̂π∧s )η(Yτ̂π∧s )dBsY , and for each ω ∈ Ω,

0

1

1

Lπt (ω)w(x, y) = wxx (x, y)x2 y 2 + wyy (x, y)η 2 (y) + wx (x, y)µ x + wy (x, y) πt (ω).

2

2

We have that Mt is actually a true martingale because wx , wy , η are continuous

and hence bounded in UR . Moreover, the non-decreasing property and smoothness of

w(x, ·) yields wy ≥ 0. Since πu ≥ πˆu ≥ 0, u ≥ 0, we obtain wy πu ≥ wy π̂u and so

(Lπu w − αw)(x, y) ≥ (Lπ̂ w − αw)(x, y) = 0,

in C,

(4.2)

with equality if π ≡ π̂ thanks to Proposition 3.2. Hence for each R > 0, the process

N·∧τR (π) is a submartingale and a martingale if π ≡ π̂.

Step 2. By the previous step we know that w(x, y) ≤ Ex,y NR∧τR (π) for each R > 0.

Using the fact that τR → ∞ as R → ∞, we obtain

lim NR∧τR (π) = e−ατ̂ w(Xτ̂π , Yτ̂π )

R→∞

on {τ̂ < ∞} a.s.

Furthermore, w is bounded because g is bounded by assumption. Consequently,

NR∧τR (π) vanishes for sufficiently large R on the event {τ̂ = ∞}. Hence, dominated

convergence and the definition of Nt (π) yield

lim Ex,y NR∧τR (π) = Ex,y e−ατ̂ w(Xτ̂π , Yτ̂π )I{τ̂ < ∞} = Ex,y e−ατ̂ g(Xτ̂π )

R→∞

where, in the last equality, we have used the definition of τ̂ and the fact that

e−αT g(XTπ ) = 0 on {T = ∞} a.s. because again, g is bounded.

We conclude that w(x, y) ≤ Ex,y e−ατ̂ g(Xτ̂π ) for arbitrary π ∈ A, and this completes the proof of the first part of the theorem. (ii) To show that (τ̂ , π̂) is a saddle point in the setting where Y is a controlled Markov

chain, we follow the same arguments as those in the part (i).

In Step 1, we simply use Propositions 3.3 and 3.5 instead of Propositions 3.1 and

3.2, respectively. The crucial consideration to bear in mind in this setting is the

validity of (4.2), where now Lπt (ω) is given by

1

Lπt (ω)h(x, y) = hxx (x, y)x2 y 2 + hx (x, y)µ x + [h(x, y + 1) − h(x, y)]πt (y, y + 1)

2

+ [h(x, y − 1) − h(x, y)]πt (y, y − 1).

14

Indeed, given that

arg min [w(x, y + 1) − w(x, y)] π = λly ,

λly ≤π≤λu

y

and

arg min [w(x, y − 1) − w(x, y)] π = µuy ,

µly ≤π≤µu

y

the comparison in (4.2) is true, with equality if π ≡ π̂ thanks to Proposition 3.5.

Step 2 is unchanged. Remark 4.1. If T < ∞ then the arguments in the above proofs are virtually the

same, except for natural changes in the notation. We only outline these:

• Now the candidate optimal stopping rule τ̂ of v π̂ (x, y, T ) = supτ ∈MT Ex,y e−ατ g(Xτπ̂ )

is such that, given π,

τ̂ ≡ τ̂ π = inf{t ≥ 0 : (Xtπ , Ytπ , T − t) ∈

/ C}

where C = {(x, y, t) ∈ E × (0, T ] : v π̂ (x, y, t) > g(x)}.

• Set w(x, y, t) := v π̂ (x, y, t) so that the candidate value of the game is w(x, y, T ).

Now fix an initial condition (x, y) and pick an arbitrary π ∈ A.

• In Step 1, now define

Nt (π) := e−ατ̂ ∧t w(Xτ̂π∧t , Yτ̂π∧t , T − τ̂ ∧ t),

t ≥ 0.

The stopping times τR still denote the first exit time of the controlled process

(X, Y ) from an open ball UR centered at (x, y).

After application of Itô’s formula to N·∧τR (π), we are led to the comparison

(Lπu w − αw − wt )(x, y, t) ≥ (Lπ̂ w − αw − wt )(x, y, t) = 0,

in C,

which holds because w(x, ·, t) is non-decreasing for each x and t. Then we obtain

that N·∧τR (π) is a submartingale for each R > 0.

• In Step 2 we use that τ̂ < ∞ (in fact τ̂ ≤ T ) a.s. and dominated convergence

to conclude that

w(x, y, T ) ≤ lim Ex,y NR∧τR (π) = Ex,y e−ατ̂ w(Xτ̂ , Yτ̂ , T − τ̂ ) = Ex,y e−ατ̂ g(Xτ̂π )

R→∞

for arbitrary π ∈ A, completing the proof when T < ∞.

15

5

The case where g is unbounded

Condition (A) on the gains function g enables us to develop the ideas in the proof

of the Theorem 2.3 rather neatly. It turns out that our results can be extended to

allow for more general payoff functions under suitable conditions on the dynamics of

(X, Y ). More precisely, let us replace Condition (A) by the weaker condition

(A’) g is a non-negative and continuous function with polynomial growth, that is,

g(x) ≤ K(1 + |x|m ) for some constants K, m ≥ 0.

Under Condition (A’), both the monotonicity result of Proposition 2.1 and the

attainability results of Propositions 3.1 and 3.3 still hold provided

Ex,y

sup e

−αt

g(Xt )I{t < ∞} < ∞,

for all (x, y) ∈ E.

(5.1)

0≤t≤T

An inspection of the proofs in Section 4 for the infinite horizon case, T = ∞,

reveals that we only used the boundedness of g in Step 2 to obtain

w(x, y) ≤ lim Ex,y NR∧τR (π) = Ex,y e−ατ̂ g(Xτ̂π ),

R→∞

where Nt (π) = e−ατ̂ ∧t w(Xτ̂π∧t , Yτ̂π∧t ). When we assume that g is bounded then the

above limit must hold by dominated convergence. Moreover, the contribution of the

gain function on the event of never stopping (i.e. on {τ̂ = ∞}) is zero because it

is killed by the discount factor α > 0. To compensate for this when assuming (A’),

there are some sufficient conditions to identify w with the value in (4.1), as we explain

below.

The arguments in Step 2 in Section 4 with (A’) instead of (A), read as follows:

Step 2 (revisited): we know that w(x, y) ≤ Ex,y Nt∧τR (π) for each t ≥ 0, R > 0. Now,

Ex,y Nt∧τR (π) = Ex,y e−α τ̂ w(Xτ̂π , Yτ̂π ) I{τ̂ ≤ t ∧ τR }

π

π

+Ex,y e−α (t∧τR ) w(Xt∧τ

,

Y

)

I{τ̂

>

t

∧

τ

}

R

t∧τ

R

R

On the one hand, w(Xτ̂π , Yτ̂π ) = g(Xτ̂π ) on {τ̂ < ∞}. Using (5.1), by monotone

convergence we obtain

lim Ex,y e−α τ̂ w(Xτ̂π , Yτ̂π ) I{τ̂ ≤ t ∧ τR } = Ex,y e−α τ̂ g(Xτ̂π ) I{τ̂ ≤ t} .

R→∞

16

If we assume that

(B1) lim inf t→∞ Ex,y e−αt g(Xtπ ) = 0 holds,

then lim inf t→∞ Ex,y e−α τ̂ g(Xτ̂π ) I{τ̂ ≤ t} = Ex,y e−α τ̂ g(Xτ̂π ).

On the other hand, if we further assume that

(B2) the transversality condition holds: lim inf t→∞ Ex,y e−αt w(Xtπ , Ytπ ) = 0; and that

π

π

(B3) the family {e−αt∧τ w(Xt∧τ

, Yt∧τ

) : bounded τ ≤ τ̂ } is uniformly integrable, for

each t ≥ 0.

Then τR → ∞ yields

π

π

lim Ex,y e−α (t∧τR ) w(Xt∧τ

, Yt∧τ

) I{τ̂ > t ∧ τR } = Ex,y e−α t w(Xtπ , Ytπ ) I{τ̂ > t}

R

R

R→∞

for each t ≥ 0, and finally

lim inf Ex,y e−α t w(Xtπ , Ytπ ) I{τ̂ > t} ≤ lim inf Ex,y e−αt w(Xtπ , Ytπ ) = 0.

t→∞

t→∞

We conclude that w(x, y) ≤ Ex,y e−ατ̂ g(Xτ̂π ) for arbitrary π ∈ A as required.

Remark 5.1. If T < ∞, with the notation of Remark 4.1, then the following condition is sufficient to identify w(x, y, T ) with the value of the game: for each initial

point (x, y) ∈ E and each control π ∈ A,

(C) the family {e−ατ w(Xτπ , Yτπ , T − τ ) : τ ≤ τ̂ } is uniformly integrable.

The above paragraphs can be summarized in the following:

Theorem 5.2. Suppose that the conditions of Proposition 2.1, Condition (A’) and

(5.1) are satisfied. Then the conclusion of Theorem 2.3 remains valid provided (B1)(B3) or (C) hold if T = ∞ or T < ∞, respectively.

In the remainder of this section we briefly discuss a situation where Conditions

(B3) and (C) are checkable.

Suppose that w is known to have the following polynomial growth property:

w(x, y) ≤ C(1 + |x|n ),

w(x, y, T − t) ≤ C(1 + |x|n )

or

for some constants C, n ≥ 0. Also, suppose that the moments of X satisfy4 , for each

π ∈ A,

π n

Ex,y sup (Xs ) < ∞

0≤s≤t

for all t ≥ 0. Therefore the uniform integrability property of the families in (B3) and

(C) must hold.

4

This condition is satisfied, for instance, under a linear growth condition on η, a, b. See [15,

Corollary 2.5.12] for the diffusion case and [16, Theorem 3.13] for the MC case.

17

References

[1] Assing, S., Jacka, S. D., Ocejo, A.: Monotonicity of the value function for a

two-dimensional optimal stopping problem. To appear in Ann. Appl. Probab.

[2] Avellaneda, M., Levy, A., Paras, A.: Pricing and Hedging Derivative Securities

in Markets with Uncertain Volatilities. Appl. Math. Finance 2, 73-88, (1995).

[3] Bhattacharya, R. N.: Criteria for recurrence and existence of invariant measures

for multidimensional diffusions. Ann. Probab. 6, 541-553, (1978).

[4] Buffington, J., Elliott, R.: American Options with Regime Switching. Internat.

J. Theoret. Appl. Finance, 5, 497-514, (2002).

[5] Frey, R.: Superreplication in stochastic volatility models and optimal stopping.

Finance Stochast. 4, 161-187, (2000).

[6] Friedman, A.: Stochastic Differential Equations and Applications: Vol 1. Academic Press, 1975.

[7] Guo, X., Zhang, Q.: Closed-form solutions for perpetual American put options

with regime switching. SIAM Journal on Applied Mathematics 64, 2034-2049

(2004).

[8] Hartman, B. M., Heaton, M. J.: Accounting for regime and parameter uncertainty in regime-switching models. Insurance: Mathematics and Economics 49,

429-437, (2011).

[9] Heston, S.: A closed-form solution for options with stochastic volatility with

applications to bond and currency options. Review of Financial Studies 6, 326343, (1993).

[10] Hobson, D.: Stochastic volatility models, correlation and the q-optimal measure.

Mathematical Finance 14, 537-556, (2004).

[11] Hobson, D.: Comparison results for stochastic volatility models via coupling.

Finance and Stochastics 14, 129-152, (2010).

[12] Hull, J., White, A.: The pricing of options on assets with stochastic volatilities.

The Journal of Finance 42, 281-300, (1987).

[13] Jacka, S. D.: Optimal stopping and the American put. Mathematical Finance 1,

1-14, (1991).

[14] Jobert, A., Rogers, L.C.G.: Option pricing with Markov-modulated dynamics.

SIAM Journal on Control Optimization 44, 2063-2078, (2006).

18

[15] Krylov, N. V.:

Heidelberg, 1980.

Controlled Diffusion Processes. Springer-Verlag, Berlin-

[16] Mao, X., Yuan, C.: Stochastic Differential Equations with Markovian Switching.

Imperial College Press, 2006.

[17] Protter, P.: Stochastic Integration and Differential Equations. 2nd Edition.

Springer, 2005.

[18] Rogers, L. C. G., Williams, D.: Diffusions, Markov Processes and Martingales:

Volume 2 Itô Calculus. 2nd Edition. Cambridge University Press, 2000.

[19] Revuz, D., Yor, M.: Continuous Martingales and Brownian Motion. 3rd Edition,

Corrected 3rd printing. Springer, New York-Berlin-Heidelberg, 2005.

[20] Shiryaev, A. N.: Optimal Stopping Rules. 1st Edition. Springer, 1978.

[21] Stroock, D. W., and Varadhan, S. R. S.: Diffusion processes with continuous

coefficients, I, II. Comm. Pure Appl. Math. 22, 345-500, (1969).

[22] Yao, David D., Zhang, Q., Zhou, X.: A Regime-Switching Model for European

Options. Stochastic Processes, Optimization, and Control Theory: Applications

in Financial Engineering, Queueing Networks, and Manufacturing Systems. International Series in Operations Research & Management Science 94, 281-300.

Springer US, 2006.

19