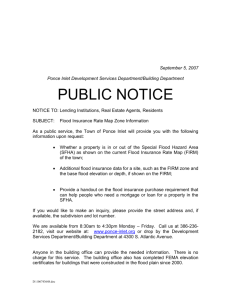

Flood-resilient waterfront development in New York City:

advertisement