Conference Call 1Q14 April 25, 2014

advertisement

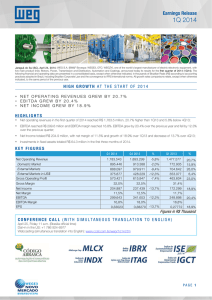

Conference Call 1Q14 April 25, 2014 Disclamer The statements that may eventually be made during this conference call relating to WEG’s business perspectives, projections and operating and financial goals and to WEG’s potential future growth are management beliefs and expectations, as well as information that are currently available. These statements involve risks, uncertainties and the use of assumptions, as they relate to future events and, as such, depend on circumstances that may or may not be present. Investors should understand that the general economic conditions, conditions of the industry and other operating factors may affect WEG’s future performance and lead to results that may differ materially from those expressed in such future considerations. 1Q14 Conference Call Page 2 April 25, 2014 Highlights Quarterly Figures Q1 2014 Q4 2013 1.783.543 1.893.299 -5,8% 1.477.577 Domestic Market 895.446 913.388 -2,0% 772.935 External Markets 888.097 979.911 -9,4% 704.642 375.677 570.421 32,0% 204.887 11,5% 299.643 16,8% 428.229 615.847 32,5% 237.439 12,5% 341.653 18,0% -12,3% -7,4% 353.077 463.604 31,4% 172.299 11,7% 248.898 16,8% 0,33023 0,38270 Net Operating Revenue External Markets in US$ Gross Operating Profit Gross Margin Net Income Net Margin EBITDA EBITDA Margin EPS % -13,7% -12,3% -13,7% Q1 2013 0,27772 % 20,7% 15,9% 26,0% 6,4% 23,0% 18,9% 20,4% 18,9% Figures in R$ Thousand 1Q14 Conference Call Page 3 April 25, 2014 Net Operating Revenue Quarterly Evolution In R$ million External Market Domestic Market 1.758 1.700 1.893 1.784 1.478 48% 52% Q1 50% 52% 50% 51% 50% 48% 50% Q2 Q3 Q4 Q1 49% 2013 1Q14 Conference Call 2014 Page 4 April 25, 2014 Business Area Revenue breakdown 1Q14 Conference Call Page 5 April 25, 2014 Costs of Goods Sold Materials 64% Materials 65% 1Q13 1Q14 Other Costs 8% Labor 23% Depreciation 4% Labor 23% 1Q14 Conference Call Other Costs 9% Page 6 Depreciation 4% April 25, 2014 Main impacts on EBITDA 138,4 (193,7) 167,6 FX Impact on Revenues (39,3) (14,5) COGS (ex depreciation) 248,9 Selling Expenses Volumes, Prices & Product Mix Changes Profit Sharing Program (0,9) 299,6 Other Expenses EBITDA Q1 14 EBITDA Q1 13 1Q14 Conference Call General and Administrative Expenses (6,8) Page 7 April 25, 2014 Working Capital In % of Net Revenue 50,0% 40,0% 30,0% Working Capital 20,0% Clients Inventories 10,0% Advances Suppliers 0,0% 1Q06 1Q14 Conference Call 1Q07 1Q08 1Q09 1Q10 Page 8 1Q11 1Q12 1Q13 1Q14 April 25, 2014 Capex Program In R$ million Outside Brazil Brazil 61,3 63,9 56,8 6,0 61,1 11,8 15,6 13,1 50,7 49,5 48,3 48,0 Q1 Q2 Q3 Q4 2013 1Q14 Conference Call 64,3 8,4 55,9 Q1 2014 Page 9 April 25, 2014 Contacts Sérgio Luiz Silva Schwartz Investor Relations Officer Luís Fernando M. Oliveira Investor Relations Manager +55 (47) 3276-6973 luisfernando@weg.net twitter.com/weg_ir 1Q14 Conference Call Page 10 April 25, 2014