2Q 2014 Earnings Release

advertisement

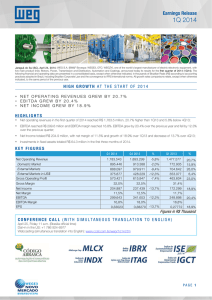

Earnings Release 2Q 2014 Jaraguá do Sul (SC), July 23, 2014: WEG S.A. (BM&F Bovespa: WEGE3, OTC: WEGZY), one of the world’s largest manufacturer of electric-electronic equipment, working mainly in capital goods in five main product lines: Motors, Power, Transmission and Distribution, Automation and Coatings, announced today its results for the second quarter of 2014 (2Q14). The following financial and operating data are presented in a consolidated basis, except when otherwise indicated, in thousands of Brazilian Reais (R$) according to accounting practices adopted in Brazil, including Brazilian Corporate Law and the convergence to IFRS international norms. The Growing rates and other comparisons are, except when otherwise indicated, made in relation to the same period of the previous year. GROWTH IN A CHALLENGING QUARTER NET OPERATING REVENUES GREW BY 7.2% Net operating revenues in the second quarter of 2014 reached 1,821.5 million, for 7.2% growth over the 2Q13 and 2.1% growth over the 1Q14; EBITDA UNCHANGED EBITDA reached R$ 311.5 million and EBITDA margin reached 17.1%. EBITDA was stable over the previous year and grew by 4.0% over the previous quarter; NET INCOME GREW BY 11.3% Net income totaled R$ 228.0 million, with net margin of 12.5% and growth of 11.2% over the previous year and 11.3% over the previous quarter; INVESTIMENTS OF R$ 158.3 MILLION IN 2014 Investments in fixed assets totaled R$ 158.3 million in the first six months of 2014, being 80% in Brazilian units and 20% in expansion projects abroad. KEY FIGURES Net Operating Revenue Domestic Market External Markets External Markets in US$ Gross Operating Profit Gross Margin Net Income Net Margin EBITDA EBITDA Margin EPS (adjusted for splits) Q2 2014 Q1 2014 % Q2 2013 1.821.547 1.783.543 2,1% 1.699.639 900.348 921.198 413.147 577.325 31,7% 227.985 12,5% 311.500 17,1% 0,28265 895.446 888.097 375.677 570.421 32,0% 204.887 11,5% 299.643 16,8% 0,25403 0,5% 3,7% 10,0% 1,2% 11,3% 4,0% 11,3% 873.354 826.285 399.171 557.996 32,8% 204.968 12,1% 312.547 18,4% 0,25413 % 7,2% 3,1% 11,5% 3,5% 3,5% 11,2% -0,3% 11,2% 06M14 06M13 % 3.605.090 1.795.794 1.809.295 788.825 1.147.746 31,8% 432.872 12,0% 611.143 17,0% 0,53667 3.177.216 1.646.289 1.530.927 752.247 1.021.600 32,2% 377.267 11,9% 561.445 17,7% 0,46776 13,5% 9,1% 18,2% 4,9% 12,3% 14,7% 8,9% 14,7% Figures in R$ Thousands CONFERENCE CALL (WITH SIMULTANEOUS TRANSLATION TO ENGLISH) July 24, Thursday 11 a.m. (Brasília official time) Dial–in in the US: +1 786 924-6977 Webcasting (simultaneous translation into English): www.ccall.com.br/weg/2q14.htm PAGE 1 Earnings Release 2Q 2014 ECONOMIC ACTIVITY AND INDUSTRIAL PRODUCTION In this second quarter of 2014, the gradual recovery of the economic and industrial activity conditions in mature economies was accompanied by better conditions in China. The analysis of purchasing manager indexes (PMI) shows the continuation of the expansion of industrial activity (PMI’s above 50 indicate expansion whereas below 50 indicate contraction of industrial activity), both the USA and, to a lower intensity, Germany. China’s recovery is discreet, but June brought the first signal of expansion in this year. June 2014 May 2014 April 2014 Manufacturing ISM Report on Business ® (USA) 55,3 55,4 54,9 Markit/BME Germany Manufacturing PMI® 52,0 52,3 54,1 HSBC China Manufacturing PMI™ 50,7 49,4 48,1 This recovery did not reach Brazil, which continued showing contraction of industrial production. The available data indicates that until May 2012, there was a contraction of 1.6% and, in the last 12 months, the expansion was of only 0.2%, showing further deterioration compared to 2013 growth, of only 1.2%. The expectations of the financial market, collected by the Focus survey of the Brazilian Central Bank, are of contraction of 0.7% in industrial production in 2014. Industrial Indicators in Brazil According to Large Economic Categories Change (%) Categories of Use Acummulated May 14 / Apr 14* May 14 / May 13 Capital Goods Intermediary Goods Consumer Goods Durable Goods Semi-durable and non-durable General Industry -2,6 -0,9 -0,3 -3,6 1,0 -0,6 On Year 12 months -5,8 -1,8 -0,1 -3,2 1,0 -1,6 4,1 -0,8 1,1 -0,4 1,5 0,2 -9,7 -2,8 -2,2 -11,2 0,8 -3,2 Source: IBGE, Research Office, Industry Cordination (*) Series with seasonal adjustmentsr We note that this deterioration has been widespread, with a negative performance in practically all economic categories, even those that maintained positive performance over the previous year, like capital goods. In this case, there was a clear inflection, with the accumulated indicator in 2014 showing a 5.8% drop, although still maintaining a 4.1% expansion over the previous 12 months. NET OPERATING REVENUE Net Operating Revenues totaled R$ 1,821.5 million in the second quarter of 2014 (2Q14), with 7.2% growth over the previous year (2Q13), and 2.1% growth over the previous quarter (1Q14). Organic growth (adjusting net revenues for the transactions occurred in the period) was of 6.0% over 2Q13. Net Operating Revenue per Market (R$ million) External Market Brazilian Market 1.758 1.700 1.893 1.784 1.822 1.478 48% 52% Q1 50% 52% 50% 51% 51% 50% 48% 50% 49% Q2 Q3 Q4 Q1 Q2 49% 2013 2014 PAGE 2 Earnings Release 2Q 2014 The second quarter showed continuation of the gradual growth recovery in external markets and better performance in the long cycle products related to energy infrastructure, especially in the Brazilian market. On the other hand, we noticed a clear loss of dynamism in the domestic market for short cycle, serial products. These were the products that beneficiated the most from the more competitive conditions brought by the appreciated exchange rate from 2013, with our domestic customers of these products recovering market share over their foreign competitors. This was no longer a growth factor in this quarter, both because this market share driven growth has reached its limitations in a market that is expanding a very low rate, as because the Brazilian Real has started to appreciate against the US Dollar recently. Besides theses conditions, we also observed a clear preference of our Brazilian clients for reducing exposure to inventories approaching the period of the FIFA World Cup play, avoiding the unfavorable seasonality and the negative impacts of the various formal and informal holidays. Finally, the comparison of average rates of Real became less favorable during this period, decreasing the contribution to revenue growth this 2Q14. Net Operating Revenue in 2Q14 splits as follows: Brazilian Market: R$ 900.3 million, representing 49% of Net Operating Revenue, with 3.1% growth over 2Q13 and 0.5% growth over 1Q14; External Market: R$ 921.2 million, equivalent 51% of Net Operating Revenue. The comparison in Brazilian Reais shows growth of 11.5% over the same period last year and growth of 3.7% over the previous quarter. Considering the average US dollar, comparison shows growth of 3.5% compared to 2Q13 and growth of 10.0% over the 1Q14. Organic growth (excluding the transactions) in the external market was 9% over 2Q13. Evolution of Net Revenue according to Geographic Market (R$ Million) Q2 2014 Net Operating Revenues - Brazilian Market - External Markets - External Markets in US$ 1.821,5 900,3 921,2 413,1 Q1 2014 1.783,5 895,4 888,1 375,7 Change 2,1% 0,5% 3,7% 10,0% Q2 2013 1.699,6 873,4 826,3 399,2 Change 7,2% 3,1% 11,5% 3,5% External Market – Distribution of Net Revenue according to Geographic Market North America South and Central America Europe Africa Australasia Q2 2014 Q1 2014 Change Q2 2013 38,0% 15,2% 27,4% 10,5% 8,9% 36,0% 15,5% 26,5% 13,1% 8,9% 2 pp -0,3 pp 0,9 pp -2,6 pp 0 pp 32,1% 18,0% 25,8% 12,5% 11,6% Change 5,9 pp -2,8 pp 1,6 pp -2 pp -2,7 pp Distribution of Net Revenue per Business Area Q2 2014 Electro-electronic Industrial Equipments Q1 2014 % Q2 2013 % 61,7% 57,7% 3,9 pp 61,5% 0,2 pp Brazilian Market 24,1% 23,0% 1,1 pp 25,7% -1,6 pp External Market 37,5% 34,7% 2,8 pp 35,8% 1,8 pp 25,3% 23,5% 1,8 pp 21,2% 4,1 pp Brazilian Market 15,1% 12,8% 2,3 pp 12,3% 2,8 pp External Market 10,2% 10,8% -0,5 pp 8,9% 1,3 pp 7,0% 12,4% -5,4 pp 10,9% -3,9 pp Brazilian Market 4,8% 8,8% -4 pp 7,7% -2,9 pp External Market 2,2% 3,6% -1,4 pp 3,2% -1 pp Energy Generation , Transmission and Distribution Electric Motors for Domestic Use Paints and Varnishes 6,1% 6,4% -0,3 pp 6,5% -0,4 pp Brazilian Market 5,4% 5,6% -0,2 pp 5,7% -0,3 pp External Market 0,6% 0,7% -0,1 pp 0,8% -0,1 pp PAGE 3 Earnings Release 2Q 2014 BUSINESS AREAS In the Industrial Electro-Electronic Equipment area, performance in the Brazilian market was characterized by de retraction of industrial activity in anticipation of the FIFA World Cup hosting, mainly in serial, short-cycle products, which normally used in machinetools, with limited customization. As discussed above, we noticed that the recovery cycle created by the new level of the exchange rate from 2013 onwards, which increase the competitiveness of local machinery manufacturers compared to the imported competitors and allowed them to regain some market share back, has probably run its course. In the long-cycle products, which commonly applied in large projects, such as process and infrastructure industries, the market continues to show limited activity and is concentrated in few specific segments. In the external market, the results were better, due to a more aggressive competitive positioning and the continued expansion of products and applications. In some markets, these factors were compounded by improved macroeconomic conditions, with a gradual recovery of activity providing some additional expansion opportunities, mainly in places like North America and Europe. In other cases, such as China, we were able to maintain a good performance even without the additional macroeconomic push. Finally, in some smaller markets, such as Africa, Australia, and South America, the relative importance of industries like mining, which are in a cyclical slowdown, limits our growth. In the Energy Generation, Transmission and Distribution (GTD) business area, we still observing a gradual improvement in competitive conditions, with stronger demand combined with a gradual elimination of global production capacity excess, resulting in positive impacts over prices and profitability. In Brazil, the weak rainy season and its impact on the generation capacity of hydroelectric plants has resulted in growing the demand for wind generation and making viable energy sources such as small hydroelectric plants (PCH) and biomass, as well as increasing the urgency of investments in T&D. We continue to observe a consistent expansion in this quarter and positive trends for the coming quarters, when we should begin to see delivery of the orders captured over the recent months and, thus, recognized as revenues. On the other hand, the Motors for Domestic Use business area showed deceleration this quarter. This was a combination of unfavorable seasonality, with the natural reduction of business, and of the anticipation of the FIFA World Cup, that typically causes a shift in consumer demand, from the WEG electric motors’ bearing “white goods” towards TV sets. Furthermore, we also note in this case the exhaustion of positive impact of the exchange rate on the competitiveness of local production and of the incentives for Brazilian consumer. Finally, in Paint and Varnishes business area, we also observe the effect of decrease in durable consumer goods activity and industrial production in Brazil, which was counterbalanced by the diversity of market segments. We continue to explore business synergies with other WEG business areas and expand the product portfolio, entering in new segments. COST OF GOODS SOLD Cost of Goods Sold (COGS) totaled R$ 1,244.2 million in 2Q14, 9.0% above 2Q13 and 2.6% above 1Q14. Gross margin reached 31.7%, with a reduction of 1.1 percentage points over 2Q13 and reduction of 0.3 percentage points over 1Q14. The interruption of the consistent expansion trend of gross margin was mainly due to: (i) the difficulty of realign sales prices at the necessary speed, especially under unfavorable domestic market conditions; (ii) lower than expected revenue growth. The positive impacts of productivity gains from product and process engineering innovations and of the reduction of payroll taxes were not sufficient to compensate the negative impacts mentioned above. Average London Metal Exchange (LME) spot copper prices rose by 4.6% in the 2Q14 compared to the average of 2Q13 and fell by 5.1% compared to the average of 1Q14. Steel prices in the international markets rose by 7% over 2Q13 and fell by 1% over 1Q14. It is important to note that these price variations are denominated in US dollar and are compounded by the exchange rate. SELLING, GENERAL AND ADMINISTRATIVES EXPENSES Consolidated selling, general and administrative expenses (SG&A) represented 15.8% of net operating revenue in the 2Q14, 0.9 percentage points higher than the 14.9% of the 2Q13 and 0.2 percentage points lower than 16.0% of the 1Q14. In absolute terms, operating expenses grew by 13.3% over 2Q13 and by 0.8% over the previous quarter. EBITDA AND EBITDA MARGIN As a result of aforementioned impacts, EBITDA in 2Q14, calculated according to the methodology defined by CVM in the Instruction nº 527/2012, totaled R$ 311.5 million, nearly unchanged over 2Q13 and 4.0% above the 1Q14. EBITDA margin reached 17.1%, 1.3 percentage points lower than 2Q13 and 0.3 percentage points higher than 1Q14. PAGE 4 Earnings Release 2Q 2014 Q2 2014 Net Operating Revenues Consolidated Net Income for the Period Net Margin (+) Income taxes & Contributions (+/-) Financial income (expenses) (+) Depreciation & Amortization EBITDA EBITDA Margin Q1 2014 % Q2 2013 2,1% 1.783,5 207,3 10,0% 11,6% 62,0 -10,5% -28,5 13,6% 2,5% 58,8 4,0% 299,6 16,8% 1.821,5 228,1 12,5% 55,5 -32,3 60,3 311,5 17,1% 1.699,6 204,8 12,0% 51,7 2,5 53,6 312,5 18,4% % 7,2% 11,4% 7,4% n.a. 12,4% -0,3% Figures in R$ Millions 66,0 (97,3) 55,9 (18,5) FX Impact on Revenues 312,5 Volumes, Prices & Product Mix Changes EBITDA Q2 13 COGS (ex depreciation) Selling Expenses (19,9) (0,8) 13,5 General and Administrative Expenses Profit Sharing Program Other Expenses 311,5 EBITDA Q2 14 NET FINANCIAL RESULTS In this quarter, net financial result was positive in R$ 32.3 million (negative result of R$ 2.5 million in 2Q13 and positive R$ 28.5 million in 1Q14). Financial revenues totaled R$ 142.2 million in 2Q14 (R$ 145.6 million in 2Q13 and R$ 152.8 million in 1Q14). Financial expenses totaled R$ 109.9 million (148.1 million in 2Q13 and R$ 124.4 million in 1Q14). Net financial result growth of 13.6% over the previous quarter is a result of increase in interest rates obtained on financial instruments in the Brazilian market and reduced exchange rate exposure in debt compared to 2013. INCOME TAX Income Tax and Social Contribution on Net Profit provision in 2Q14 reached R$ 53.1 million (R$ 59.6 million on 2Q13 and R$ 70.7 million on 1Q14). Additionally, R$ 2.4 million were recorded as “Deferred income tax / social contribution” debt (credit of R$ 7.9 million in 2Q13 and R$ 8.7 million in 1Q14). NET INCOME As a result of aforementioned impacts, net income for 2Q14 was R$ 228.0 million, an increase of 11.2% over 2Q13 and 11.3% over the previous quarter. The net margin of the quarter was 12.5%, 0.5 percentage points higher than 2Q13 and 1.0 percentage point higher than the 1Q14. PAGE 5 Earnings Release 2Q 2014 CASH FLOW 708,0 (454,4) (341,5) 3.373,8 3.285,9 Investing Operating Financing Cash June 2014 Cash December 2013 Cash flow from operating activities totaled R$ 708.0 million in the first half of 2014, an increase of 46% over the same period last year. The expansion was due to the increase in cash generated from operations, mainly with increase in net income before depreciation, besides the reduction of the working capital needs, especially the reduction of receivables, more than offsetting the higher consumption of cash with payments of income tax and profit sharing, which reflect the results obtained in 2013. Investing activities consumed R$ 454,4 million in the first half of 2014, reverting a cash flow situation observed in 2013. Highlights were the acquisitions of WEG Balingen, in Germany, Sinya Group and CMM, and the acceleration of investments in expansion and modernization of productive capacity program. Finally, financing activities consumed R$ 341.5 million in the first half of the year, also reverting the cash flow situation observed in the previous year. We performed net amortizations of R$ 37.0 million (new debt issued of R$ 385.9 million and amortizations of R$ 423.0 million), which compares with net increase of R$372.2 million in new funding in 2013. INVESTMENTS Investments in fixed assets for capacity expansion and modernization totaled R$ 158.3 million in the first six months of 2014, being 80% of it destined to the industrial plants and other installations in Brazil and the remaining amount to production units and other subsidiaries abroad. The consolidation of Sinya e CMM acquisition added approximately R$ 57.2 million in additional fixed assets. Outside Brazil Brazil 94,0 56,8 6,0 61,3 11,8 63,9 15,6 61,1 13,1 64,3 8,4 50,7 49,5 48,3 48,0 55,9 Q1 Q2 Q3 Q4 Q1 2013 23,5 70,6 Q2 2014 Our industrial production capacity expansion and modernization program for 2014 foresees investments of approximately R$ 592 million, the highlights being the first stages of new industrial plants in China and México, with expansion and verticalization of the production capacity of industrial electric motors. In other less dynamic markets, investments are being reassessed so that execution match effective demand expansion. PAGE 6 Earnings Release 2Q 2014 DEBT AND CASH POSITION On June 30, 2014 cash, cash equivalents and financial investments totaled R$ 3,363.8 million, mainly in short-term, invested in Brazilian currency in first-tier banks, in fixed income instruments linked to the CDI. Gross financial debt totaled R$ 3,243.6 million, being 22% in short-term and 78% in long-term. June 2014 December 2013 June 2013 Cash & Financial instruments 3.363.850 3.376.029 3.036.107 - Current - Long Term 3.362.435 1.415 3.373.799 2.230 3.034.080 2.027 Debt 3.243.553 100% 3.209.004 100% 3.048.764 100% 712.711 22% 912.796 28% 1.327.078 44% - In Brazilian Reais 381.728 12% 462.336 14% 855.787 28% - In other currencies 330.983 10% 450.460 14% 471.291 15% - Current - Long Term - In Brazilian Reais - In other currencies Net Cash (Debt) 2.530.842 78% 2.296.208 72% 1.721.686 56% 1.936.275 60% 2.048.766 64% 1.454.531 48% 594.567 18% 247.442 8% 267.155 9% 120.297 167.025 (12.657) At the end of the 2Q14 WEG had net cash of R$ 120.3 million (net debt of R$ 12.7 million in June 30, 2013). Over the quarter we raised new funding on attractive terms of maturities and fees, increasing the duration and lengthening the debt total profile. The characteristics of the debt are: The total duration debt is 22.8 months and the long-term portion is 28.1 months. Duration portion denominated in Brazilian Reais is 20.1 months and for the portion in foreign currencies is 29.6 months. The weighted average cost of fixed-rate denominated in Brazilian Reais is approximately 6.1% per year. Floating rate contracts are indexed mainly by the Brazilian long-term interest rate (TLJP). DIVIDENDS Over the first half of 2014, the Board of Directors approved the following compensation events to shareholders: On March 25, as interest on stockholders’ equity (JCP), to shareholders on said date, in the gross amount of R$ 51.8 million; On June 24, as interest on stockholders’ equity (JCP), to shareholders on said date, in the gross amount of R$ 56.9 million; In addition, on July 22, the Board of Directors approved intermediate dividends related to the net income for the first half of 2014, in the total amount of R$ 125.3 million to the shareholders on said date. These proceeds will be paid from August 13, 2014 onwards. Amounts declared as remuneration to shareholders in the first half represent 54.1% of net income for the period. Dividends Interest on Stockholders' Equity Gross Total Net Earnings Total Dividends / Net Earnings 1st Half 2014 125,3 108,8 234,1 432,9 54,1% 1st Half % 2013 114,8 83,9 198,7 17,8% 377,3 52,7% Our policy is to declare interest on stockholders equity quarterly and declare dividends based on profit earned each semester, thus, we reported six different earnings each year, which is paid semiannually. PAGE 7 Earnings Release 2Q 2014 WEGE3 SHARE PERFORMANCE The common shares issued by WEG, traded under the code WEGE3 at BM&F Bovespa, ended the last trading session on June 2014 quoted at R$ 28.29, with nominal gain of 18.0% in the year. Considering the dividends and interest on stockholders equity declared in the first half, the increase was of 19.7% in 2014. 3.500 30,00 Shares Traded (thousands) 3.000 2.500 20,00 2.000 15,00 1.500 Traded shares (thousands) WEGE3 share prices 25,00 WEGE3 10,00 1.000 5,00 0,00 500 0 The average daily traded volume in 2Q14 was R$ 15.6 million (R$ 16.3 million in 2Q13). Throughout the quarter 133,501 stock trades were carried out (134,061 stock trades in 2Q13), involving 35.3 million shares and moving R$ 938.6 million (R$ 1,027.8 million in 2Q13). CAPITAL INCREASE WITH SHARES The Extraordinary Shareholders’ Meeting, held on April 23, 2014, approved the Company’s capital increase, in the amount of R$ 815,532,131.00, increasing it from R$ 2,718,440,437.00 to R$ 3,533,972,568.00, with a 30% stock bonus (three new ordinary shares for each 10 ordinary shares held) The shareholders registered in the Company’s book on April 23, 2014 were benefited. The bonus shares were included in the shareholders’ positions on April 28, 2014, and they were available on April 29, 2014. After a period in which shareholders could, if they wished to, transfer fractions of shares resulting from the stock bonus, these fractions were grouped and sold at auction on June 13, 2014, at BM&FBOVESPA. In this auction, were sold 1.458 ordinary shares, without par value. The values obtained with the sale of shares in the auction (R$ 28.391083676 per share) were paid to shareholders, pro rata to the fractions held by them before the auction, on June 26, 2014. PAGE 8 Earnings Release 2Q 2014 RESULTS CONFERENCE CALL WEG Will hold, on July 24, 2014 (Thursday), conference call and webcast to discuss the results. The call will be conducted in Portuguese with simultaneous translation in English, following scheduled time: 11 a.m. 10 a.m. 3 p.m. – Brasíiia time – New York (EDT) – London (BST) Connecting phone numbers: Dial–in for connecting from Brazil: Dial–in for connecting from USA: Toll-free for connecting from USA: Code: (11) 3193-1001 / (11) 2820-4001 +1 786 924-6977 +1 888 700-0802 WEG Acess to the webcast: Slides and Portuguese audio: Slides and English translation: www.ccall.com.br/weg/2t14.htm www.ccall.com.br/weg/2q14.htm The presentation Will be available in Investor Relations page of WEG website (www.weg.net/ri). Please, call approximately 10 minutes before the call is scheluded to start. PAGE 9 Earnings Release 2Q 2014 BUSINESS AREA Industrial Electro-Electronic Equipment The industrial electrical-electronic equipment area includes low and medium voltage electric motors, drives & controls, industrial automation equipment and services, and maintenance services and parts. We compete in all major markets with our products and solutions. Electric motors and other related equipment find applications in practically all industrial segments, in equipment such as compressors, pumps and fans, for example. Energy Generation, Transmission and Distribution (GTD) Products and services included in this area are electric generators for hydraulic and thermal power plants (biomass), hydro turbines (small hydroelectric plants or PCH), wind turbines, transformers, substations, control panels and system integration services. In the GTD area in general and specifically in power generation, investment maturing terms are longer, with slower investment decisions and longer project and manufacturing lead times. As such, new orders are recorded as revenue after a few months, upon effective delivery to buyers. Motors for Domestic Use In this business area, our operations have traditionally focused in Brazil, where we hold a significant share in the market of singlephase motors for durable consumer goods, such as washing machines, air conditioners, water pumps, among others. This is a short cycle business and variations in consumer demand are rapidly transferred to the industry, with almost immediate impacts on production and revenue. Paints and Varnishes In this area, including liquid paints, powder paints and electro-insulating varnishes, we have very clear focus on industrial applications in Brazil, and are expanding to Latin America. Our strategy in this area is cross selling to customers from other operating areas. The target markets ranging from shipbuilding industry to the manufacturers of white line home appliances. We seek to maximize the scale of production and efforts to developed new products and new segments of production and efforts to developed new products and new segments. The information contained in this report relating to WEG’s business perspectives, the projections and results and to the company’s growth potential should be considered as only estimates and were based on the management expectations relating to the future of the company. These expectations are highly influenced by the market conditions and the general economic performance of the country and of the foreign markets which may be subject to sudden change. PAGE 10 Earnings Release 2Q 2014 Annex I Consolidated Income Statement - Quarterly Figures in R$ Thousands 2T14 51 2nd Quarter 2014 R$ VA% Net Operating Revenues Cost of Goods Sold Gross Profit Sales Expenses Administrative Expenses Financial Revenues Financial Expenses Other Operating Income Other Operating Expenses EARNINGS BEFORE TAXES Income Taxes & Contributions Deferred Taxes Minorities NET EARNINGS 1T14 49 1st Quarter 2014 R$ VA% 2T13 42 2nd Quarter 2013 R$ VA% Changes % Q2 2014 Q2 2014 Q1 2014 Q2 2013 1.821.547 (1.244.222) 577.325 (191.300) (96.418) 142.242 (109.893) 1.739 (40.107) 283.588 (53.088) (2.405) 110 227.985 100% -68% 32% -11% -5% 8% -6% 0% -2% 16% -3% 0% 0% 13% 1.783.543 (1.213.122) 570.421 (196.661) (88.703) 152.842 (124.363) 1.846 (46.065) 269.317 (70.669) 8.683 2.444 204.887 100% -68% 32% -11% -5% 9% -7% 0% -3% 15% -4% 0% 0% 11% 1.699.639 (1.141.643) 557.996 (174.312) (79.701) 145.637 (148.120) 4.991 (50.038) 256.453 (59.551) 7.860 (206) 204.968 100% -67% 33% -10% -5% 9% -9% 0% -3% 15% -4% 0% 0% 12% 2,1% 2,6% 1,2% -2,7% 8,7% -6,9% -11,6% -5,8% -12,9% 5,3% -24,9% n.m -95,5% 11,3% 7,2% 9,0% 3,5% 9,7% 21,0% -2,3% -25,8% -65,2% -19,8% 10,6% -10,9% n.m n.m 11,2% EBITDA 311.500 17,1% 299.643 16,8% 312.547 18,4% 4,0% -0,3% EPS (adjusted for splits) 0,28265 11,3% 11,2% 0,25403 0,25413 PAGE 11 Earnings Release 2Q 2014 Annex II Consolidated Income Statement 06M14 51 6 Months 2014 R$ VA% Net Operating Revenues Cost of Goods Sold Gross Profit Sales Expenses Administrative Expenses Financial Revenues Financial Expenses Other Operating Income Other Operating Expenses EARNINGS BEFORE TAXES Income Taxes & Contributions Deferred Taxes Minorities NET EARNINGS 06M13 Figures in R$ Thousands 42 6 Months 2013 R$ VA% % 2014 2013 3.605.090 (2.457.344) 1.147.746 (387.961) (185.121) 295.084 (234.256) 3.585 (86.172) 552.905 (123.757) 6.278 2.554 432.872 100% -68% 32% -11% -5% 8% -6% 0% -2% 15% -3% 0% 0% 12% 3.177.216 (2.155.616) 1.021.600 (331.341) (152.974) 268.673 (246.505) 10.559 (92.146) 477.866 (110.856) 10.823 566 377.267 100% -68% 32% -10% -5% 8% -8% 0% -3% 15% -3% 0% 0% 12% 13% 14% 12% 17% 21% 10% -5% -66% -6% 16% 12% -42% 351% 15% EBITDA 611.143 17,0% 561.445 17,7% 9% EPS (adjusted for splits) 0,53668 0,60809 -12% PAGE 12 Earnings Release 2Q 2014 Annex III Consolidated Balance Sheet Figures in R$ Thousands June 2014 (A) R$ % CURRENT ASSETS December 2013 (B) R$ % June 2013 (C) R$ % (A)/(B) (A)/(C) 6.886.608 66% 6.851.787 68% 6.339.494 66% 1% 9% 3.362.435 32% 3.373.799 33% 3.034.080 32% 0% 11% Receivables 1.637.568 16% 1.658.806 16% 1.554.042 16% -1% 5% Inventories 1.541.091 15% 1.445.927 14% 1.368.012 14% 7% 13% Other current assets 345.514 3% 373.255 4% 383.360 4% -7% -10% LONG TERM ASSETS Long term securities Deferred taxes 124.207 1.415 58.767 1% 0% 1% 123.866 2.230 60.376 1% 0% 1% 98.741 2.027 40.762 1% 0% 0% 0% -3% 26% -30% 44% 64.025 1% 61.260 1% 55.952 1% 5% 14% 3.351.857 32% 3.165.640 31% 3.104.687 33% 6% 8% 8.223 0% 7.264 0% 7.585 0% 13% 8% 2.680.579 26% 2.614.556 26% 2.570.042 27% 3% 4% Cash & cash equivalents Other non-current assets FIXED ASSETS Investment in Subs Property, Plant & Equipment Intangibles TOTAL ASSETS CURRENT LIABILITIES 663.055 6% 543.820 5% 527.060 6% 22% 26% 10.362.672 100% 10.141.293 100% 9.542.922 100% 2% 9% -13% 2.484.307 24% 2.578.048 25% 2.840.488 30% -4% Social and Labor Liabilities 245.082 2% 216.553 2% 244.200 3% 13% 0% Suppliers 420.498 4% 420.250 4% 362.605 4% 0% 16% Fiscal and Tax Liabilities 102.357 1% 139.570 1% 113.854 1% -27% -10% Short Term Debt 712.711 7% 912.796 9% 1.327.078 14% -22% -46% Dividends Payable 121.897 1% 87.723 1% 89.310 1% 39% 36% Advances from Clients 485.371 5% 459.130 5% 395.904 4% 6% 23% 73.952 1% 34.191 0% 24.450 0% 116% 202% Profit Sharring Other Short Term Liabilities 322.439 3% 307.835 3% 283.087 3% 5% 14% LONG TERM LIABILITIES 3.170.626 31% 2.920.978 29% 2.380.354 25% 9% 33% Long Term Debt 2.530.842 24% 2.296.208 23% 1.721.686 18% 10% 47% Other Long Term Liabilities 106.603 1% 95.031 1% 113.323 1% 12% -6% Deferred Taxes 290.117 3% 294.405 3% 310.429 3% -1% -7% Contingencies Provisions 243.064 2% 235.334 2% 234.916 2% 3% 3% 75.866 1% 84.495 1% 81.513 1% -10% -7% MINORITIES STOCKHOLDERS' EQUITY TOTAL LIABILITIES 4.631.873 45% 4.557.772 45% 4.240.567 44% 2% 9% 10.362.672 100% 10.141.293 100% 9.542.922 100% 2% 9% PAGE 13 Earnings Release 2Q 2014 Annex IV Consolidated Cash Flow Statement Figures in R$ Thousands 06M14 06M13 6 Months 2014 Operating Activities Net Earnings before Taxes Depreciation and Amortization Provisions: Changes in Assets & Liabilities (Increase) / Reduction of Accounts Receivable Increase / (Reduction) of Accounts Payable (Increase) / Reduction of Investories Income Tax and Social Contribution on Net Earnings Profit Sharing Paid Cash Flow from Operating Activities Investment Activities Fixed Assets Intagible Assets Results of sales of fixed assets Accumulated Conversion Adjustment Long term securities bought Goodwill in Capital Transactions Acquisition of Stakes of non-controlling shareholders 6 Months 2013 552.905 119.066 167.308 (131.280) 110.039 78.717 (68.663) (156.338) (95.035) 477.866 105.747 184.987 (282.634) (163.450) 142.807 (64.721) (128.334) (68.936) 707.999 485.966 (158.315) (8.708) 4.195 (85.559) (75.755) (2.699) (118.040) (1.483) 1.125 33.812 261.119 (5.169) (5.947) (6.268) Aquisition of Subsidiaries (136.528) Cash Flow From Investment Activities (454.394) 165.096 Financing Activities Working Capital Financing Long Term Financing Interest paid on loans and financing Treasury Shares Dividends & Intesrest on Stockholders Equity Paid 385.963 (422.998) (83.101) 323 (221.726) 1.109.750 (736.534) (88.114) (204.467) Cash Flow From Financing Activities (341.539) 80.635 (87.934) 731.697 Beginning of Period 3.373.799 2.302.256 End of Period 3.285.865 3.033.953 Change in Cash Position - Cash & Cash Equivalents PAGE 14