Do Director Elections Matter?

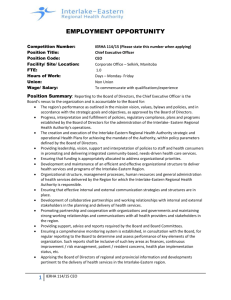

advertisement