UNITED STATES

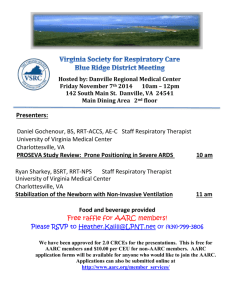

advertisement