Document 12448356

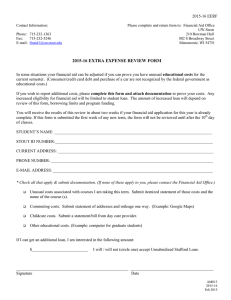

advertisement