Oil & Oilseeds Insight SOYBEAN

advertisement

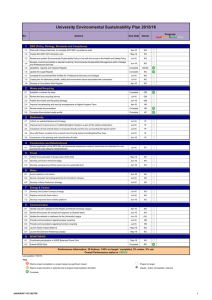

Oil & Oilseeds Insight Commodity Research Desk May 17, 2016 SOYBEAN TECHNICAL RECOMMENDATION Commodity Contract S2 S1 CLOSE R1 R2 Recommendations Soybean CBOT Jul-16 1052 1058 1065 1070 1076 Buy at 1063 TP 1070 SL 1060 Soybean NCDEX Jun-16 3980 3997 4015 4032 4048 Buy at 4005-4000 TP 4070 SL 3970 SOYBEAN PERFORMANCE Exchange Soybean ( NCDEX) Soybean ( NCDEX) Contract Jun-16 Jul-16 Open 4005 4067 High 4037 4095 Low 3989 4046 Last 4015 4073 Change(%) 0.70% 0.67% Vol 40920 6820 Change% -29.09% -47.25% OI 99020 31380 Change(%) -0.32% -0.44% *Note- Rs/quintal Exchange Soybean (CBOT) Soybean (CBOT) Contract Jul-16 Aug-16 Open 1063 1065 High 1071.75 1073.5 Low 1055 1057.75 Last Change(%) 1064.5 -0.05% Basis 1066.75 -0.02% *Note-Cent/bushel 100 Review: 150 50 0 In NCDEX, Soybean June’16 futures yesterday opened -50 -100 positively and traded higher throughout the trading session. -150 The prices closed positively on tepid demand from oil millers -200 at prevailing prices in the domestic markets. -250 In Indore, around 2300-2600 bags were reported with spot -300 29-Apr 2-May 3-May 4-May 5-May 6-May 9-May 10-May 11-May 12-May 13-May 16-May prices hovering in the range of Rs 3950-4040/quintal. According to Solvent Extractors’ Association of India, Indore Kota Nagpur soymeal exports in April’16 were 1,442 MT down by 92% on y/y. In CBOT, Soybean future yesterday extended its slump for the fourth day on weaker export demand scenario. As per USDA’s May WASDE report, soybean production in Spread Matrix US for 2016-17 is estimated to decline by 3.3% to 103.4 Spot Jun-16 Jul-16 Oct-16 million MT from 106.9 million in 2015-16. Spot 0 According to USDA, weekly crop progress report till May Jun-16 -72 0 th 15 , 2016 around 36% of soybean crop has been planted in Jul-16 -14 58 0 US against 41% last year during the same period. However, Oct-16 -369 -297 -355 0 it is higher than prior 5 year average of 32%. As per Buenos Grains exchange around 51% of soybean harvesting is completed in Argentina. In CBOT, Soybean July’16 future contract is trading at now Derivative Analysis 1065.75 cents/bushel up by 0.12%. 4100 Outlook: 120000 4080 100000 4060 For today, the prices may trade on a positive note as steady demand from crushing units at lower levels may support prices. It may also take cues from overseas soybean prices and trade higher during day. In CBOT soybean future prices may trade Oil the and Oilseeds Insight on a positive note as slower planting progress due to uncertain weather conditions in major growing regions of mid west and Mississippi delta in US is likely to push prices higher. However, any major gain in prices is unlikely as export demand during the week may remain subdued. 4040 80000 4020 60000 4000 3980 40000 3960 20000 3940 3920 0 3-May 4-May 5-May 6-May 9-May 10-May 11-May 12-May 13-May 16-May Mail Us at Commodity@karvy.com Open Interest Volume Price Oil and Oilseeds Insight REFINED SOY OIL TECHNICAL RECOMMENDATIONS Commodity Contract S2 S1 CLOSE Soy Oil CBOT Jul-16 32.26 32.51 Soy Oil NCDEX Jun-16 650.1 651.5 R1 R2 Recommendations 32.79 32.97 33.13 Trading range 32.60-33 653.0 654.8 656.4 Trading range 649-657 SOYOIL PERFORMANCE Exchange Contract Soyoil( NCDEX) Jun-16 Soyoil ( NCDEX) Jul-16 Open 655.50 661.00 High 655.85 661.90 Low 651.30 655.60 Last 653.00 658.95 Change(%) -0.38% 0.00% Vol 52220 12840 Change% OI -28.81% 123930 -53.28% 82080 Change(%) 2.37% -0.55% *Note: - Rs/10kg Exchange Contract Soyoil CBOT Jul-16 Soyoil CBOT Aug-16 Open 32.43 32.6 High 32.9 33.02 Low 32.28 32.39 Last 32.79 32.9 Change(%) Basis 0.89% 0.89% 5.00 *Note-Cents/lb 0.00 Review -5.00 Refined. Soy oil June’16 futures at NCDEX yesterday opened on a flat note. It traded down for most part of the day. The prices closed negatively on adequate supplies of soyoil due to higher imports in the domestic markets. As per Solvent Extractors Association (SEA), in April’16 around 348,195 MT of Soyoil were imported, up by 8.1% on m/m and 86.4% on y/y. In CBOT, Soyoil future yesterday closed positively on lower soybean crushing in April’16. According to USDAs May’16 WASDE report, Soyoil production in US for 2016-17 is likely to rise by 1% to 10.03 million MT. Meanwhile, globally production is increasing by 2.7% to 53.63 million MT. As per NOPA, US soybean crushing fell to 147.614 million bushels down by 5.79% on m/m and 1.83% on y/y. In CBOT, Soy oil July’16 future contract is now trading at 32.16 cents/ lbs. down by 0.09%. -10.00 -15.00 -20.00 -25.00 9-May 10-May 11-May 12-May 13-May 14-May 15-May 16-May Mumbai Soy Oil-Palm oil Spread Analysis: 120 105 10-May 11-May 12-May 13-May 16-May Derivative Analysis Outlook The supplies of soyoil have risen in the domestic markets due to higher imports and it may weigh on the prices today. However, chances of any major fall are limited as domestic demand may recover at lower levels. The RSO-CPO future price spread has declined in favor of ref. soyoil. It may further weaken on expectation of rise in CPO prices. In CBOT; Soyoil future prices may trade moderately higher on expectation of higher exports demand. It may also take positive cues from Malaysian palm oil prices. 680 130000 115000 100000 660 85000 70000 55000 640 40000 25000 620 10000 3-May 4-May 5-May 6-May 9-May 10-May 11-May 12-May 13-May 16-May Open Interest Mail Us at commodity@karvy.com Volume Price Oil and Oilseeds Insight MUSTARD SEED TECHNICAL RECOMMENDATIONS Commodity Contract RM Seed Jun-16 S2 S1 4386 4410 RM SEED PERFORMANCE Exchange Contract Open RM SEED (NCDEX) Jun-16 4393 Jul-16 RM SEED (NCDEX) 4464 CLOSE 4438 High 4460 4530 R1 R2 4460 4480 Low 4393 4464 Recommendations Sell at 4475-4480 TP 4390 SL 4520 Last 4438 4509 Change(%) Vol 0.29% 44970 0.31% 9800 Change% -36.85% 8.77% OI Change(%) 70670 -0.42% 23230 6.22% Note: NCDEX: Rs/Quintal Review RM Seed June’16 futures at NCDEX platform yesterday opened negatively. However it traded higher for most part of the day. The prices closed moderately higher as lower supplies in the physical markets supported the prices. According to Solvent Extractors’ Association around 14,163 MT of RM Seed Oil meals were exported in April’16 down by 80% on y/y Also around 51,087 MT of Canola Oil was imported in April ’16 up by 52.29% on y/y whereas on m/m the imports have rose by around 90.18% In Rajasthan, around 1-1.1 Lakh bags were reported with spot prices at Jaipur hovering in the range of Rs4525-4530/quintal. In Jaipur, Kachi Ghani traded in the range of Rs.830831/10 Kg and mustard oil cake prices hovered in the range of Rs2290-2295/quintal. Outlook Crush Margin Market price Recovery Rs/quintal (Rs/quintal) percentage Particulars A.Cost of Seed B.benefit of lab &weight tolerance C.Market price of mustard oil cake D.Market price of Kachi ghani oil E.Total Recovery F Gross Margin (E-(A-B)) G.Processing Cost H.Crush Margin (F-G) 2293 8305 62 37 4482 45 2293 3156 4554 117 125 -8 Spread Matrix Spot 0 -87 -16 62 Spot June July August June July 0 71 149 0 78 August 0 Derivative Analysis For today, the prices may trade down as subdued demand at higher levels amongst oil millers and crushing units. The demand for mustard oil is weak in the domestic market due to prevailing hot temperature in most part of Northern and Eastern India. Moreover, higher imports of canola oil are likely to add on to the existing supplies. This may pressurize RM Seed prices in the near term. 4650 106000 91000 76000 4500 61000 46000 4350 31000 16000 4200 1000 3-May 4-May 5-May 6-May Open interest Mail Us at commodity@karvy.com 9-May 10-May 11-May 12-May 13-May 16-May Volume Price Oil and Oilseeds Insight PALM OILs TECHNICAL RECOMMENDATION Commodity Contract S2 S1 CLOSE R1 R2 Recommendations CPO BMD July-16 2622 2629 2636 2642 2648 Buy at 2620-2615 TP 2660 SL 2590 CPO MCX June-16 536.1 538.4 541.0 543.0 544.9 Buy at 538.50-538 TP 546 SL 534 CRUDE PALM OIL PERFORMANCE Exchange BMD-CPO BMD-CPO BMD-CPO Contract Jul-16 Aug-16 Sep-16 Open 2605 2583 2540 High 2624 2599 2566 Low 2585 2562 2532 Last 2612 2587 2551 Change(%) 0.97% 1.05% 0.91% Vol 9206 17229 6703 Change% -64.41% 40.46% -25.13% OI 64551 55563 56728 Change(%) -2.41% 5.46% 2.28% Contract May-16 Jun-16 Jul-16 Open 548 541.2 535 High 549.2 543 537.9 Low 542.7 536.7 531.8 Last 546.6 541 536.1 Change(%) -0.13% 0.15% 0.13% Vol 1223 1415 294 Change% -52.00% -32.33% -28.81% OI 3065 4736 1309 Change(%) 0.72% 0.02% -1.13% *Note-MYR/MT Exchange MCX-CPO MCX-CPO MCX-CPO *Note-Rs/10Kg Review MCX CPO June’16 future prices yesterday opened on a marginally positive note. It traded up for most part of the day. The prices closed higher on anticipation of rise in domestic demand ahead of Ramzaan. BMD CPO future prices yesterday opened positively and traded up for most part of the day. It closed higher as rise in domestic demand ahead of Ramzaan amid lower inventories supported CPO prices. As per Malaysian custom dept., crude palm oil export taxation has been raised to 5.5% from June’16. As per MPOB, Inventories fell 4.5% to 1.80 million metric tons in April’16 from a month earlier, declining for a fifth month in the longest streak since June 2013. As per USDA’s WASDE report, global production of palm oil is likely to be at 61.5 million MT in 2015-16. st As per Intertek, Malaysian palm oil exports from May 1 th 15 2016 are at 563,172 MT up by 16.3% ON m/m during the same PERIOD. In BMD, CPO July’16 future contract is now trading at 2635 MYR/MT up by 0.88% Derivative Analysis 550 5000 4000 3000 540 2000 1000 530 0 10-May 11-May Open Interest 12-May 13-May Volume 16-May Price Basis 25 20 15 10 5 Outlook 0 For today, CPO futures at MCX may trade on a positive note as import demand may increase ahead of the implementation of revise Malaysian export taxes in June’16. Moreover, domestic demand is steady to moderately high which may push prices up. At BMD, CPO futures may trade on a moderately positive note on higher domestic demand due to Ramzaan amid lower inventories and production. 10-May Mail Us at commodity@karvy.com 11-May 12-May 13-May Kandla 14-May 15-May 16-May Oil and Oilseeds Insight To unsubscribe please mail us at commodity@karvy.com Disclaimer The report contains the opinions of the author that are not to be construed as investment advice. The author, directors and other employees of Karvy, and its affiliates, cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information which is believed to be accurate and no assurance can be given for the accuracy of this information. There is risk of loss in trading in derivatives. The author, directors and other employees of Karvy and its affiliates cannot be held responsible for any losses in trading. Commodity derivatives trading involve substantial risk. The valuation of the underlying may fluctuate, and as a result, clients may lose their entire original investment. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by, or from, Karvy Comtrade that you will profit or that losses can, or will be, limited in any manner whatsoever. Past results are no indication of future performance. The information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. Information is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management, or investment advisory services. The reports are only for information purposes and not to be construed as investment advice. For a detailed disclaimer please go to following URLs: Disclaimer http://www.karvycomtrade.com/v3/Disclaimer.aspx http://www.karvycomtrade.com/v3/RiskDisclaimer.aspx Mail Us at commodity@karvy.com