W P N 2 3

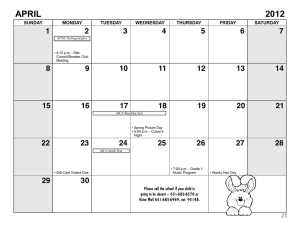

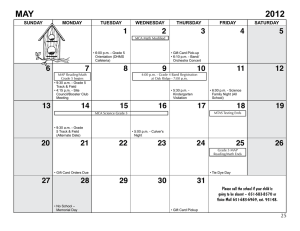

advertisement