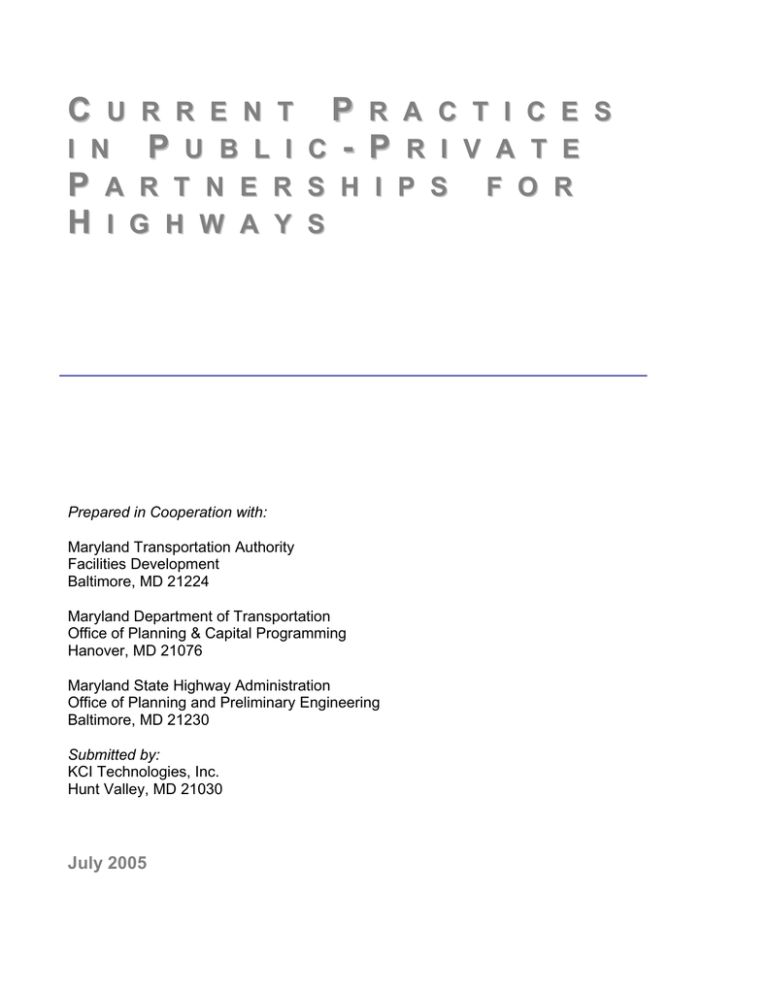

C P - H

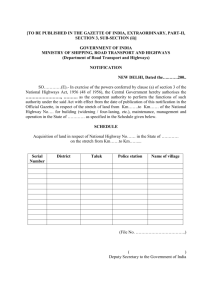

advertisement