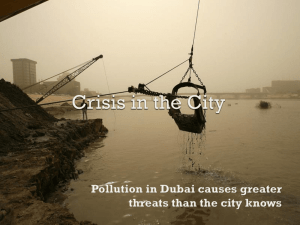

United Arab Emirates: 2009 Article IV Consultation—Staff Report; Public Information

advertisement