Eagle P3 Project Procurement Lessons Learned Acronyms

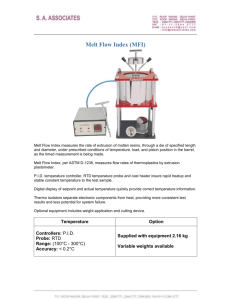

advertisement