Comprehensive Instructional Program Review Document Business – Bookkeeping (certificate of completion

advertisement

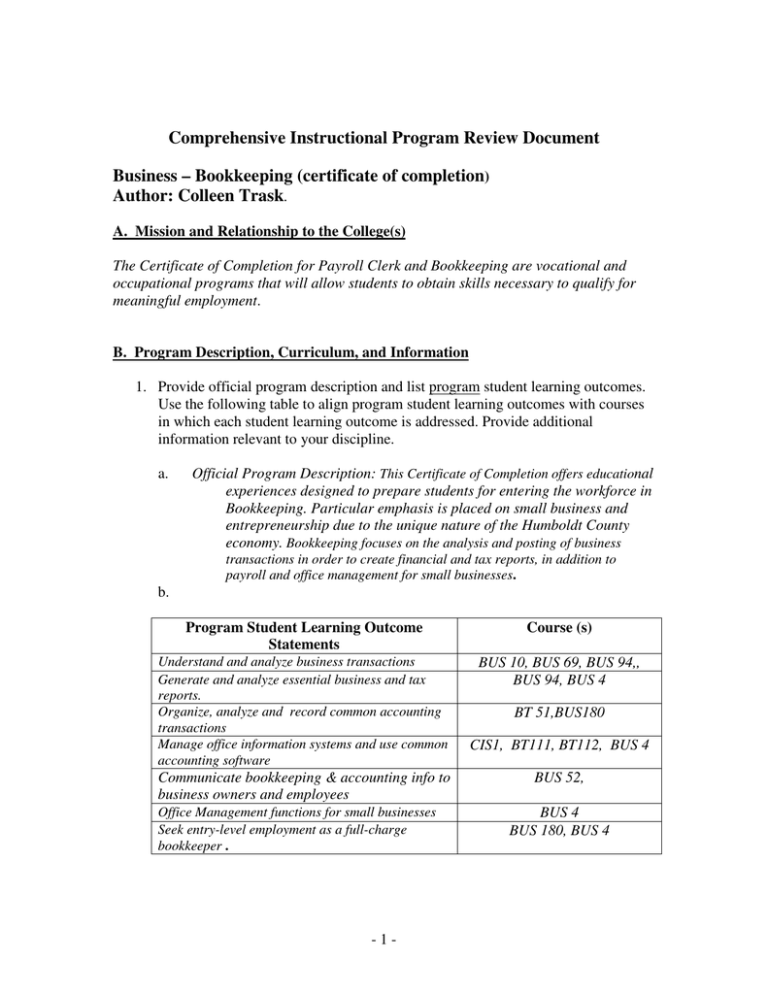

Comprehensive Instructional Program Review Document Business – Bookkeeping (certificate of completion) Author: Colleen Trask. A. Mission and Relationship to the College(s) The Certificate of Completion for Payroll Clerk and Bookkeeping are vocational and occupational programs that will allow students to obtain skills necessary to qualify for meaningful employment. B. Program Description, Curriculum, and Information 1. Provide official program description and list program student learning outcomes. Use the following table to align program student learning outcomes with courses in which each student learning outcome is addressed. Provide additional information relevant to your discipline. a. Official Program Description: This Certificate of Completion offers educational experiences designed to prepare students for entering the workforce in Bookkeeping. Particular emphasis is placed on small business and entrepreneurship due to the unique nature of the Humboldt County economy. Bookkeeping focuses on the analysis and posting of business transactions in order to create financial and tax reports, in addition to payroll and office management for small businesses. b. Program Student Learning Outcome Statements Course (s) Understand and analyze business transactions Generate and analyze essential business and tax reports. Organize, analyze and record common accounting transactions Manage office information systems and use common accounting software BUS 10, BUS 69, BUS 94,, BUS 94, BUS 4 Communicate bookkeeping & accounting info to business owners and employees Office Management functions for small businesses Seek entry-level employment as a full-charge bookkeeper . -1- BT 51,BUS180 CIS1, BT111, BT112, BUS 4 BUS 52, BUS 4 BUS 180, BUS 4 2. Program-Specific Criteria and/or Admissions Guidelines (as applicable to program) NA 3. Outline the curriculum as it is being implemented for a full-time student completing a degree or certificate in this program. The outline should include course number, course title, units, lecture hours, and lab hours for each semester for the complete curriculum. Course Outline 1st Semester - Payroll Clerk Certificate Units Updated BT 111 Keyboarding & Typing 3 Fall 05 or BT 112 Keyboarding Skill Development 1 Fall 05 BUS 10 Intro to Business 3 Spring07 BUS 180 Basic Bookkeeping 3 Fall 05 BUS 94 Business Math 3 Spring05 CIS 1 College Computer Literacy 4 Spring06 Total Units, 1st Semester: 14 or 16 2nd Semester - Full Charge Bookkeeping Certificate BT 51 Spreadsheet Applications 4 Fall 05 BUS 4 Advanced Computerized Bookkeeping 3 Fall 05 BUS 52 Business Communications 3 Fall 07 BUS 69 Small Business Entrepreneurship 3 Jan08 Total Units, 2nd Semester: 13 4. As part of your self-study, review and summarize the development of curriculum in the program. Include recent additions, deletions, or revisions of courses (attach current course outlines). Evaluate the timing, frequency and coordination of course offerings to determine the adequacy of course offerings relative to a transfer degree (articulation), vocational/occupational certificates, and other appropriate aspects of the district's/campus’/college’s mission. a) Please ensure that there is a thorough review of the course outlines of record and course content during this review period. Please indicate on the course outlines the date on which they were last revised. If the last major curriculum revision occurred more than five years ago, please indicate when the next major revision is planned. Please also review course prerequisites, co-requisites, and advisories as well as obtaining necessary approvals for distance education courses. This is the 5th year of the program’s existence. The next major curriculum review should occur next year. There have been some issues with the timing of course offerings over the past 2-3 years, mainly due to budget issues pushing the cancellation of classes. -2- b) Send updated course outlines to the Curriculum Committee. Current c) Please file the appropriate form with the Curriculum Committee to delete classes that have not been taught for three or more years unless you plan to teach them in the future. This will be done during the Program Review next year. d) e) With respect to updating course outlines of record, list any relevant trends in your discipline with regard to: 1. Knowledge requirements: The trend towards computerization of the bookkeeping profession has not slowed or changed. It is imperative for anyone seeking employment in this profession to be computer literate. 2. Skills/student learning outcome requirements: Trends in skill requirements (and therefore student learning outcomes) in this profession have moved from basic data entry and organization to include higher level office management and communication skills. These have been built into the current SLOs and course requirements. 3. Instructional methods: The trend for the capstone course of this certificate is to rely less on academic textbooks and focus more on practical application of professional bookkeeping skills using multiple case studies. Describe the various educational delivery methods currently being utilized by the program. Examples include but are not limited to traditional in-person classroom delivery, in-person lab, field studies, online, interactive television, telecourses, clinical instruction, etc. The majority of courses in this program are delivered in-person in classroom and lab settings. BUS 94 is an online course, and BUS 4 requires a field study of the bookkeeping system of a local small business as part of the coursework. f) Identify curricular revisions, program innovations, and new initiatives planned for the next five years. During the next five years, one of the most exciting program innovations will involve participation in the Center for Entrepreneurship Studies. This will provide “real-time” hands-on bookkeeping experience in an active business environment. The other new initiative planned for this program is to offer all of the classes required for the certificate at the downtown campus, in the evening. This will make the program accessible to a wider variety of students who are looking to improve their employment opportunities or increase their earnings in their current positions by bringing more valuable skills to their workplace. 5. If applicable, indicate the program external accreditation/approval status. Include a copy of the most recent notification of accreditation/approval status from the appropriate agency. If external accreditation is available but the program has chosen not to seek accreditation status, please explain. N/A -3- C. Program History History (update) since last review: What have been the major developments, activities, changes, and/or projects in your discipline over the past 2 or 4 years (longer if no recent review exists)? (This does not need to include curriculum updates, addressed above.) There have been no major developments, activities, or projects at CR for this program over the past 4 years. Demand for computerized bookkeeping skills and bookkeepers continues to be strong for local small businesses and CPA firms. 1. 2. What were the recommendations from your last program review (if any) and how has your discipline responded to those recommendations? N/A 3. If you have goals from your previous program review, please list them along with the objectives related to your goals, the strategies being used to achieve objectives, and the documentation or evidence that demonstrates success. If no prior program review exists, skip #3. N/A 4. If goals were not achieved, please explain. N/A 5. Discuss any collaborative efforts you have undertaken with other programs (instructional or non-instructional) at College of the Redwoods District and offer an assessment of success and challenges, and potential changes in collaborative efforts. This program’s main collaboration is planned for next year with the Center for Entrepreneurial Studies. We will report on the challenges and successes of that effort in our next update. 6. Discuss any activities or projects you have undertaken with other educational institutions, the community, or business/industry. The program has maintained a connection with the North Coast Small Business Development Center, which sponsors the Humboldt County Professional Bookkeepers Association. The HCPBA has provided sample client contracts for professional bookkeepers, additional training on topics of bookkeeping interest, resource lists and networking opportunities for bookkeepers. D. Measures of Effectiveness 1. Quality of Education a. Results of certifying, licensing, or registry examinations for each of the last five years (or list not applicable): This data has not been routinely collected. There is no government certification or -4- licensing for the bookkeeping profession. A voluntary certification (CB: Certified Bookkeeper) is available through the American Institute of Professional Bookkeepers. Students passing the final exams for the capstone courses of this certificate should be prepared to complete the AIPB review course and take the AIPB exam, but this is not a requirement for taking a job or starting a business as a bookkeeper. b. Faculty Qualifications: (1) Is there one full-time faculty member whose primary assignment is responsibility for this program? Yes No [X] If not, explain. The business faculty are already dealing with an expanding program. They are on overload to such an extent that primary responsibility cannot be solely supported. (2) Are minimum faculty qualifications according to standards set by accrediting/approval bodies met? Yes [X] No (a) State Chancellor’s Office? (b) External Accrediting/approval organizations Yes No If “No” for either response, explain. N/A – There is no state accreditation process for the bookkeeping profession. c. Student Outcomes Assessment: Attach course- and program-level outcomes and assessment reports for each of the last four years. (See Instructional Program Review Appendix A, pp. 44-49). All courses in this program have been updated in the last 3 years. Consequently, student learning outcomes have been developed for all courses. Program Learning outcomes and associated courses are listed in the table under question B1 (page 1). No systematic documentation and analysis of program and student learning outcomes has been performed. However, anecdotal data indicate that students completing the program are either finding entry-level jobs with local businesses or starting their own bookkeeping services. Capstone course test data includes questions about transaction analysis, tax reports, software and office management that provide a basic level of assessment of these outcomes. 2. Vitality The Bookkeeping program consists of courses from three disciplinary areas. Therefore it is not possible (at this time) to obtain data specific to students in this program. Many of these courses have students pursuing other certificates and degrees. However, two courses are specific to Bookkeeping (BUS 180 and BUS4). We have used these to estimate the following “Vitality” areas. The data used is listed in the grid below. -5- a. Attrition and Retention The Bookkeeping courses have a retention rate of approximately 90%. Success (a measure of attrition) ranges from 60% to 80%. Business - Bookkeeping Program Courses 2006-2007 Course BUS 4 BUS 10 BUS 52 BUS 69 BUS 94 BUS 180 BT 51 BT 53 BT 111 BT 112 CIS 1 CIS 90 CIS 80 CIS 81 CIS 83 Sections Ave Size 1 9 0 4 2 1 2 3 4 4 11 2 2 2 2 10 33 xx 25 33 20 16 7 18 15 22 10 15 6 5 Fill % 33 85 xx 69 98 67 63 27 71 48 69 32 48 16 15 Retention % 90 87 xx 78 83 85 94 91 92 78 91 100 100 100 100 V1/V2 Success 80/80 65/68 xx/xx 52/55 62/66 60/65 91/91 61/61 44/45 40/40 55/59 40/45 14/14 27/27 56/56 FT TLU % 0 33 xx 50 0 0 0 20 25 84 50 40 40 40 40 PT TLU % 100 67 xx 50 100 100 100 80 75 16 50 60 60 60 60 Bold = program specific courses. BUS4: Advanced Computerized Bookkeeping; BUS 180: Basic Bookkeeping Program Specific Courses: Approximately 20-40 students in program; 88% retention; Success varies from 52-80%; 100% part-time instruction Business - Bookkeeping Program Courses 2005-2006 Course BUS 4 BUS 10 BUS 52 BUS 69 BUS 94 BUS 180 BT 51 BT 53 BT 111 BT 112 CIS 1 CIS 90 Retention V1/V2 Success 14 31 18 29 30 17 xx xx xx Fill % 28 80 56 84 75 61 xx xx xx 93 87 89 83 82 85 xx xx xx 25 10 67 40 88 100 Sections Ave Size 1 12 3 6 2 2 0 0 0 0 18 2 -6- 64/86 67/71 70/72 67/67 70/73 52/58 xx xx xx FT TLU % 0 33 33 83 0 0 xx xx xx PT TLU % 100 67 67 17 100 100 xx xx xx 53/56 70/70 72 0 28 100 CIS 80 CIS 81 CIS 83 3 3 3 9 5 6 34 19 23 100 100 100 19/19 27/27 50/50 0 0 0 100 100 100 Bold = program specific courses. BUS4: Advanced Computerized Bookkeeping; BUS 180: Basic Bookkeeping Program Specific Courses: Approximately 15 students in program; 88% retention; Success varies from 52-80%; 100% part-time instruction Number of students entering program in fall of academic two years prior to this comprehensive program review year: The number of students in BUS 180 (basic bookkeeping) suggest entry rates of about 40 students in the 2005-2006 academic year (20 per semester) and about 20 students in the 2006-2007 academic year. This data is only approximate. The district is beginning to track student entry in a more systematic way. We hope to report those numbers in our next annual update. Number of students continuing in program (continuing students: all entering students except transfers or readmissions) Comparing the number of students in basic bookkeeping course to the advanced course suggests about 15 students continue in the program from one academic year to the next. b. Enrollment and Graduate Projections The numbers in the tables below are based on the approximations derived from enrollments in BUS 4 and BUS 180). Spring 2006 Enrollment (BUS 4 and 180) 20 Total Enrollment (unduplicated headcount) Graduates Fall 2006 Enrollment Spring 2007 Enrollment 20 20 Number Graduating in 2 years (Fall 2005 Entering Class) 30 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010 N=40 N=25 N= N= N= N=15 N=15 N= -7- N= N= c. Total number of 2006-2007 graduates by ethnic group and gender. This data has not been collected by the Bookkeeping Program or the CR District. Anecdotally, the majority of participants and graduates of this program are women. d. Indicate the number and percent of graduates from the most recent graduating class who are employed in positions related to the program major or continuing in a higher degree program. This data has not been collected by the Bookkeeping Program or the CR District. e. Indicate the beginning mean and median annual salary for graduates of the program employed full-time, as collected from alumni survey and program advisory meetings. This data has not been collected by the Bookkeeping Program or the CR District. 3. Efficiency a. Describe current student population in terms of enrollment by ethnic group and gender. This data has not been collected by the Bookkeeping Program or the CR District. b. Composition of enrollment for selective admissions programs: This program has an open admissions policy; therefore this portion does not apply. c. Faculty Staffing Pattern The Following numbers are based on an average of the courses included in the Bookkeeping Program. The program specific courses (BUS 4 and BUS 180) are staffed 100% by part time faculty. Refer to course data under question #2 above Faculty Load Distribution in the Program Discipline Name (e.g., Math, English, Accounting) Total Teaching Load for fall 2006 term % of Total Teaching Load by Full-Time Faculty BUS/BT/CIS Load for 30% the courses listed are not exclusively for this program % of Total Teaching Load Taught by PartTime Faculty 70% -8- Changes from fall 2005 Explanations and Additional Information (e.g., retirement, reassignment, etc.) This is an average of courses in the program. But students in these courses are not exclusively in the Bookkeeping Program Faculty Load Distribution in the Program Discipline Name (e.g., Math, English, Accounting) Total Teaching Load for spring 2007 term % of Total Teaching Load by Full-Time Faculty BUS/BT/CIS Load for 20 the courses listed are not exclusively for this program % of Total Teaching Load Taught by PartTime Faculty Changes from spring 2006 80 Explanations and Additional Information (e.g., retirement, reassignment, etc.) This is an average of courses in the program. But students in these courses are not exclusively in the Bookkeeping Program d. Please rate the resources indicated in the table below with respect to how they support this program. Feel free to supplement the resource categories in the extra space provided. The four rating categories are defined as follows: Adequate: Minimally Adequate*: Inadequate*: Not Applicable: This one resource is adequate to permit the program to function effectively. Program functioning at minimally effective level. The limitations imposed by this one resource render the program marginal and will require immediate review for program improvement or continuation. Does not apply to this program. -9- Resources a) Faculty Full-time Associate b) Support Staff Clerical Technical Instructional Support Other Personnel c) Current Expenses Office Supply Expenses Instructional/lab supply Expenses d) Equipment e) Library Resources f) Facilities g) Professional Development Rating Not Adequate Minimally Inadequate Adequate Applicable X X X X X X X X X X X X *If any component is rated Inadequate or Minimally Adequate, please explain. Include recommendations for reducing or eliminating the limitations. Faculty: There is no full-time faculty person whose primary assignment is responsibility for this program. The full-time business faculty are on overload to such an extent that primary responsibility cannot be solely supported. Most recently, the one full-time faculty member with expertise in this field has announced her retirement, making coordination of this program even more difficulty. Part-time associate faculty work hard to uphold this program, however the TLU limitation on part-timers keeps the program functioning at a minimally effective level. This limit prevents adequate involvement in curriculum development, review, and ongoing research in the local business community that provides employment to program graduates. If this limit was increased or removed, part-time faculty could take on more of the primary responsibility for this program. A decision needs to be made regarding compensating part-time faculty for program coordination or appointing a full-time faculty member to oversee this program. Instructional Supply Expenses: The capstone course for the Bookkeeping Certificate Program requires the current year’s version of QuickBooks. This has never been addressed in the budget and lack of access to current software seriously jeopardizes the job-readiness of the students in the program. - 10 - e. Budgetary Categories--Please provide funding amount budgeted for each category during the most recent academic year and for each of the previous four years. (Please replicate this table for each year) There is a lack of information, District-wide, concerning the budgets of specific programs. Data exists for Divisions and (sometimes) Departments, but these budgets are not subdivided into line-items for each program (as far as the author of this report is aware). As a result, the specific budget for this program is unknown. This is a problem that needs to be resolved. Explain any changes in funding and add any comments relevant to the adequacy of resources. The budget for program faculty has been consistent for the last two years. Line-item budgets for program-specific supplies, equipment, equipment repair and technical help have not existed. Summary and Recommendations 1. Summary ●Program Strengths The demand for trained bookkeepers is strong and steady from the local community (just check the help-wanted section of any local publication.) More than that, the report issued by the Humboldt County Workforce Investment Board, “Targets of Opportunity,” shows accounting (and therefore bookkeeping) as a source of living wage jobs in all six of the Target Industry Clusters expected to grow into Humboldt County’s main economic base over the next decade.1 College of the Redwoods has the only local program to educate students in the skills necessary for full-charge bookkeeping. The curriculum and teaching for this program is its greatest strength, covering the essentials and focusing students on working with or becoming the entrepreneurs that drive this county’s economy. Future plans for this program are also a strength, including participation in the Center for Entrepreneurial Studies, and the shift of classes to evenings at the downtown campus. Program Weaknesses Faculty levels, in terms of primary responsibility and continuing development, are minimally adequate. The recent retirement of the one full-time faculty member with expertise in this area will make program coordination more difficult. Current versions of software need to be budgeted and available so students are adequately prepared for employment. No one knows we are here! Local businesses don’t know about this program. More collaboration with the Humboldt County Professional Bookkeepers Association, the Northcoast Employers Advisory Council, and the local CPA professional group might bring enrollment up to higher levels. - 11 - 2. Recommendations for program improvement generated by self-study. (List by number and use these numbers in the Quality Improvement Plan.) #1 Faculty Recommendation: Either have a full-time Business Faculty be primarily responsible for this Program or allow a part-time Associate Faculty sufficient TLU's to be primarily responsible for this Program. Primary faculty would: a) collect information from IR about students in the program, b) coordinate with the Advisory Group for: post-graduate survey of employment information, c) engage in community outreach and information, d) assess SLO's by employers, e) update course material to reflect current needs of local employers #2 Advisory Group Recommendation: Form a local Advisory Group for this program, perhaps in partnership with a local Professional Bookkeepers Group and/or North Coast SBDC. Advisory Group would: a). conduct post-graduate survey of employment information, b) assist with community outreach and information, c) assist with assessment of SLO's by employers and, d) updating of course material to reflect current needs of local employers #3 Budget Recommendation: This recommendation would have to be implemented at the District level, down through the Division and Department levels. Each Department would have budget line items for specific program expenses, including supplies/software. . List program members who participated in completion of the self-study report. Colleen M. R. Trask (Associate Faculty) 1 .http://www.humboldtwib.com/files_public/Targets%20FINALrev%20report%208.20.07.pdf Vision and Goals 1. Based upon data from California 2025 and/or data from Institutional Research, briefly describe how you would like your discipline to evolve in the next five years. In what ways does your current state differ from your desired state? IR data for certificate programs is not yet available. Five years from now, the CR Bookkeeping Certificate program should be the first thing local business owners think about when they ask someone on their staff to take on bookkeeping duties. Students in this program should be gaining hands-on, real-time bookkeeping experience at the Center for Entrepreneurial Studies in addition to the current, relevant curriculum. There should be no question of finding funds for current software to train new bookkeepers for the local job market. The program should be continually developing and responsive to the bookkeeping needs of the local business and CPA community. - 12 - 2. What specific goals and objectives would you like to achieve to move you toward your vision? One specific goal would be at least a 25% increase in enrollment, retention, completion of the certificate, and employment, as measured in IR, over the next 5 years. 3. What support from the college or district is needed to help you achieve your goals and objectives? Business faculty levels need to be adequate to support the programs that the students and local business community need. The accounting software currently being used by many local businesses should be budgeted and available for students in its current version. 4. What documentation/evidence will demonstrate that you are making progress toward achieving your goals, objectives, and vision? Once IR gets a baseline for enrollment, retention, completion of this certificate, and employment or new business starts, we should see increases in all those numbers over the next 5 years. 5. What changes will make the self-study process more helpful to you? A self-study process for this program that involves input from all 3 disciplines represented in this certificate would have been more helpful. - 13 - Recommendation # 1 Either have a full-time Business Faculty be primarily responsible for this Program or allow a part-time Associate Faculty sufficient TLU's to be primarily responsible for this Program Planned Implementation Date Estimated Completion Date: Action/Tasks Unknown Unknown Measure of Success/Desired Outcome This action could not be done at the Program level. This action would need to be done at the District, Division, or Dept level Resulting Program improvements? Coordination among the 3 disciplines comprising this certificate would improve program content and student outcomes. Development of, and coordination with, an Advisory Committee would improve program content, post-graduation employment, and local employers' knowledge of the program. Resulting student/learning improvement? Program SLO's, retention, success rates, and student demographics post-graduation employment rates and salary information could be tracked and used for program improvement. Resulting impact on CR's mission? Would ensure a "rigorous, high quality program" that would prepare graduates for "meaningful employment." The cost of the additional TLU's for program coordination would depend on the status and level of designated primary faculty. Estimated Cost(s) Who is responsible? Consequence if not funded Unknown Impact on students Student SLOs, retention, success rates, and demographics remain unknown. Coordination of certificate among 3 disciplines remains confusing for students. Impact on the program Program remains marginally supported, with few resources for improvement. Impact on College Unknown Impact on the Community Program remains virtually unknown in the community. External Accreditation Recommendations (if applicable) None - 14 - Recommendation # 2 Planned Implementation Date Estimated Completion Date: Action/Tasks Measure of Success/Desired Outcome Form a local Advisory Group for this program, perhaps in partnership with a local Professional Bookkeepers Group and/or North Coast SBDC. (See recommendations section above for details of activities for this group) Fall 2009 Advisory Group activity would be ongoing Creation of a local Advisory Group from the membership of the local Professional Bookkeepers Association and local accounting professionals, in association with the North Coast Small Business Development Center. Resulting Program improvements? Program SLO's and post-graduation employment rates and salary information could be tracked and used for program improvement. Outreach of information on this program to local employers would increase. Resulting student/learning improvement? Access to knowledge of the bookkeeping needs of local employers would keep course material current and relevant. Resulting impact on CR's mission? Would ensure a "rigorous, high quality program" that would prepare graduates for "meaningful employment." Estimated Cost(s) Who is responsible? Consequence if not funded No costs to CR Colleen M. R. Trask N/A (see Estimated Costs) External Accreditation Recommendations (if applicable) None - 15 - Recommendation # 3 Each Department would have budget line items for specific program expenses, including supplies/software Planned Implementation Date Estimated Completion Date: Action/Tasks Unknown Unknown Specific program expenses would have a budget line Measure of Success/Desired Outcome Resulting Program improvements? Program curriculum could be built around the same current software in use by many employers in the local community. Resulting student /learning improvement? Learning the most current software would increase student "job-readiness". Resulting impact on CR's mission? Would ensure a "rigorous, high quality program" that would prepare graduates for "meaningful employment." Estimated Cost(s) $399.95 per year for a 25-user educational site license: http://quickbooks.intuit.com/product/training/stu dents_educators.jhtml Unknown Who is responsible? Consequence if not funded Impact on students Negative impact on student "job-readiness" Impact on the program Degrades curriculum as present software becomes increasingly out of date Impact on College Negative impact on CR's reputation for jobready graduates Impact on the Community Graduating certificate holders not prepared to use current software on the job External Accreditation Recommendations (if applicable) None - 16 -