Business and Technology BUS 82L Volunteer Income Tax Assistance

advertisement

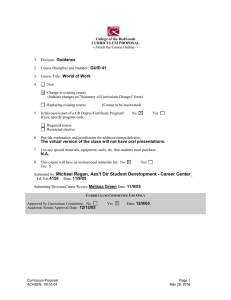

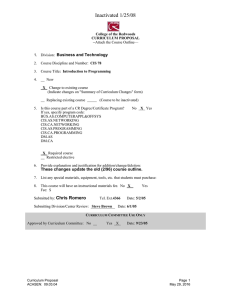

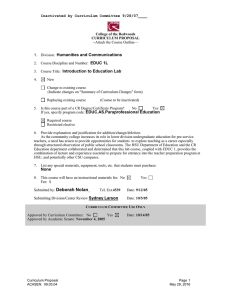

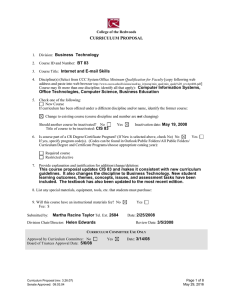

College of the Redwoods CURRICULUM PROPOSAL --Attach the Course Outline— 1. Division: Business and Technology 2. Course Discipline and Number: BUS 82L 3. Course Title: Volunteer Income Tax Assistance 4. New Change to existing course (Indicate changes on "Summary of Curriculum Changes" form) Replacing existing course 5. (Course to be inactivated) Is this course part of a CR Degree/Certificate Program? No If yes, specify program code: BUS.CC.Income Tax Prep Yes Required course Restricted elective 6. Provide explanation and justification for addition/change/deletion: This course follows BUS 82, providing the student with field experience in the application of current income tax assistance for the general public. 7. List any special materials, equipment, tools, etc. that students must purchase: 8. This course will have an instructional materials fee. No Fee: $ Submitted by: Helen L. Edwards_ Yes Tel. Ext.4367 Submitting Division/Center Review Sydney Larson Date: 9/14/05 Date: 09.15.05 CURRICULUM COMMITTEE USE ONLY Approved by Curriculum Committee: No Academic Senate Approval Date: 11/4/05 8/16/2005Curriculum Proposal ACASEN: 09.03.04 Yes Date: 10/28/05 Page 1 May 29, 2016 SUMMARY OF CURRICULUM CHANGES FOR AN EXISTING COURSE FEATURES OLD NEW Catalog Description Grading Standard Select Select Units Lecture Hours Lab Hours Prerequisites Corequisites Recommended Preparation Maximum Class Size RepeatabilityMaximum Enrollments Other If any of the listed features have been modified in the new proposal, indicate the "old" (current) information and proposed changes. Course Outline Senate Approved: 09.03.04 2 May 29, 2016 College of the Redwoods Course Outline DATE: 9/14/05 DISCIPLINE AND COURSE NUMBER: BUS 82L FORMER DISCIPLINE AND NUMBER (If previously offered): COURSE TITLE: Volunteer Income Tax Assistance TOTAL UNITS: 1 [Lecture Units: TOTAL HOURS: 54 [Lecture Hours: Lab Units: 1] Lab Hours: 54] MAXIMUM CLASS SIZE: 20 GRADING STANDARD: Letter Grade Only CR/NC Only Is this course repeatable for additional credit units: No Grade-CR/NC Option Yes how many total enrollments? 4 Is this course to be offered as part of the Honors Program? No Yes If yes, explain how honors sections of the course are different from standard sections. CATALOG DESCRIPTION: The catalog description should clearly state the scope of the course, its level, and what kinds of student goals the course is designed to fulfill. Provides students the opportunity to apply the income tax law and concepts learned in BUS 82. Students will be assisting members of the public with e-filing individual tax returns, answering basic tax questions, and identifying required data on various forms. Special notes or advisories: PREREQUISITES: No Yes Course: BUS 82 Rationale for Prerequisite? Describe representative skills without which the student would be highly unlikely to succeed . BUS 82 provides current/updated instruction in basic individual income tax law. Knowledge of the updated basic laws on an annual basis is necessary in order to provide accurate e-filing information in conformity with IRS requirements. COREQUISITES: No Yes Rationale for Corequisite? Course: RECOMMENDED PREPARATION: No Yes Course: BUS 1A Rationale for Recommended Preparation? Basic accounting skills provide the foundation for successful data collection and reporting. Course Outline Senate Approved: 09.03.04 3 May 29, 2016 COURSE LEARNING OUTCOMES: What should the student be able to do as a result of taking this course? State some of the objectives in terms of specific, measurable student accomplishments. Identify e-file software appropriate for client use. Analyze tax data for input. Assist client in identifying income and deductions. Assist with analyzing client eligibility for tax credits, exemptions, etc. Explain and apply basic tax law requirements. Locate information required for input on tax forms. Aid clients in entering tax information and completing tax filing. Refer clients to tax professionals for more complex tax issues. COURSE CONTENT Themes: What themes, if any, are threaded throughout the learning experiences in this course? Compliance with tax law requirements. Community assistance and support. Concepts: What concepts do students need to understand to demonstrate course outcomes? IRS tax code and requirements for e-filing. Issues: What primary issues or problems, if any, must students understand to achieve course outcomes (including such issues as gender, diversity, multi-culturalism, and class)? Income tax assistance with basic individual tax returns using software available over the internet is available for all taxpayers. More complex tax issues will be referred to paid tax professionals. Skills: What skills must students master to demonstrate course outcomes? Understanding of current basic individual income tax law. Identification of information needed for forms required. Ability to access internet software programs. Interaction and communication with the general public REPRESENTATIVE LEARNING ACTIVITIES: What will the students be doing (i.e., Listening to lectures, participating in discussions and/or group activities, attending a field trip, etc.)? Relate the activities directly to the Course Learning Outcomes. Working with the general public to answer questions, identify tax data, analyze filing requirements, and apply tax law, while using a variety of software programs. ASSESSMENT TASKS: How will the student show evidence of achieving the Course Learning Outcomes? Indicate which assessments (if any) are required for all sections. Representative assessment tasks: Complete timesheets. Document number of clients served. Document number of returns filed. Document number and types of questions answered. Required assessments for all sections – to include but not limited to: Course Outline Senate Approved: 09.03.04 4 May 29, 2016 EXAMPLES OF APPROPRIATE TEXTS OR OTHER READINGS Author Internal Revenue Service Title (Author, Title, and Date Fields are required): Volunteer Income Tax Assistance Guide Date current year Author Title Date Author Title Date Author Title Date Other Appropriate Readings: PROPOSED TRANSFERABILITY: UC CSU NONE General elective credit If CSU transferability is proposed (courses numbered 1-99), indicate whether general elective credit or specific course equivalent credit is proposed. Specific course equivalent If specific course equivalent credit is proposed, give course numbers/ titles of at least two comparable lower division courses from a UC, CSU, or equivalent institution. PROPOSED GENERAL EDUCATION: BOTH NONE 1. , (Campus) 2. , (Campus) CR UC CSU Rationale for General Education certification: College of the Redwoods General Education Applicability: AREA Natural Science Social Science Humanities Language and Rationality Writing Oral Communications Analytical Thinking Rationale for inclusion in this General Education category: Proposed California State University General Education Breadth (CSU GE) Applicability A. Communications and Critical Thinking A1 – Oral Communication A2 – Written Communication A3 – Critical Thinking C. Arts, Literature, Philosophy, and Foreign Language C1 – Arts (Art, Dance, Music, Theater) Course Outline Senate Approved: 09.03.04 B. Science and Math B1 – Physical Science B2 – Life Science B3 – Laboratory Activity B4 – Mathematics/Quantitative Reasoning D. Social, Political, and Economic Institutions D0 – Sociology and Criminology 5 May 29, 2016 C2 – Humanities (Literature, Philosophy, Foreign Language) D1 – Anthropology and Archeology D2 – Economics D3 – Ethnic Studies D5 – Geography D6 – History D7 – Interdisciplinary Social or Behavioral Science D8 – Political Science, Government and Legal Institutions D9 – Psychology E. Lifelong Understanding and Self-Development E1 – Lifelong Understanding E2 – Self-Development Rationale for inclusion in this General Education category: Same as above Proposed Intersegmental General Education Transfer Curriculum (IGETC) Applicability AREA 1A – English Composition 1B – Critical Thinking-English Composition 1C – Oral Communication (CSU requirement only) 2A – Math 3A – Arts 3B – Humanities 4A – Anthropology and Archaeology 4B – Economics 4E – Geography 4F – History 4G – Interdisciplinary, Social & Behavioral Sciences 4H – Political Science, Government & Legal Institutions 4I – Psychology 4J – Sociology & Criminology 5A – Physical Science 5B – Biological Science 6A – Languages Other Than English Rationale for inclusion in this General Education category: Course Outline Senate Approved: 09.03.04 Same as above 6 May 29, 2016 FOR VPAA USE ONLY PROGRAM AND COURSE NUMBER BUS-82L TECHNICAL INFORMATION 1. Department: INFSC Information Science 16. CoRequisite Course: none 2. Subject: BUS 17. Recommended Prep: BUS-1A Course No: 81L 3. Credit Type: D Credit Degree Applicable 18. Maximum Class Size: 20 4. Min/Maximum Units: 1.0 to 19. Repeat/Retake: R3 May enroll 4 times for credit variable units 5. Course Level: D Possibly Occupational 20. Count Retakes for Credit: yes no 6. Academic Level: UG Undergraduate 21. Only Pass/No Pass: yes no 7. Grade Scheme: UG Undergraduate 22. Allow Pass/No Pass: yes no 8. Short Title: Volunteer Income Tax Assist 23. VATEA Funded Course: yes no 9. Long Title: Volunteer Income Tax Assistance 24. Accounting Method: PAC Positive Attendance/CR 10. National ID (CIP): 52.1601 25. Disability Status: N Not a Special Class 11. Local ID (TOPS): 050210 26. Billing Method: T-Term 12. Course Types: Level One Basic Skills: NBS Not Basic Skills Level Two Work Experience: 27. Billing Period: R-Reporting Term 28. Billing Credits: 1.0 NWE Not Coop Work Experience 29. Purpose: I Occupational Ed Level Three: Placeholder for GE OR 30. Articulation No. (CAN): DOES NOT APPLY 31. Articulation Seq. (CAN): Level Four: If GE : Choose One: 32. Transfer Status: B Transfers to CSU only 13. Instructional Method: FEX Field Experience 33. Equates to another course? 14. Lec TLUs: Lab TLUs: Contact Hours: 54.0 Contact Hours: 34. The addition of this course will inactive number). Inactive at end of term. 15. Prerequisite: BUS-82 Particular Comments for Printed Catalog. . Curriculum Approval Date: October 28, 2005 Course Outline Senate Approved: 09.03.04 (course number). 7 May 29, 2016 (course