Business and Technology BUS 1B Principles of Accounting

advertisement

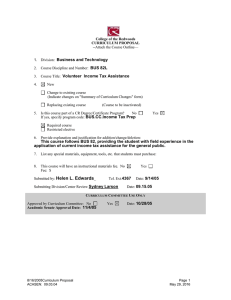

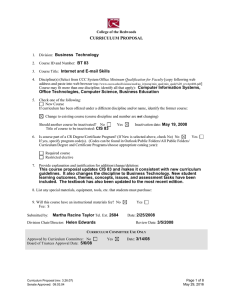

College of the Redwoods CURRICULUM PROPOSAL --Attach the Course Outline— 1. Division: Business and Technology 2. Course Discipline and Number: BUS 1B 3. Course Title: Principles of Accounting 4. New Change to existing course (Indicate changes on "Summary of Curriculum Changes" form) Replacing existing course 5. (Course to be inactivated) Is this course part of a CR Degree/Certificate Program? If yes, specify program code: No Yes BUS.CA.ADMIN.ASST BUS.AS.ADMIN.ASST BUS.AS.CMP.APP.OFF.SYS BUS.CA BUS.AS Required course Restricted elective 6. Provide explanation and justification for addition/change/deletion: Update course outline and catalog description 7. List any special materials, equipment, tools, etc. that students must purchase: 8. This course will have an instructional materials fee. No Fee: $ Submitted by: Helen L. Edwards_ Yes Tel. Ext.4367 Submitting Division/Center Review Sydney Larson Date: 9/1/05 Date: 9/26/05 CURRICULUM COMMITTEE USE ONLY Approved by Curriculum Committee: No Yes Academic Senate Approval Date: October 28, 2005 8/16/2005Curriculum Proposal ACASEN: 09.03.04 Date: 10/14/05 Page 1 May 29, 2016 SUMMARY OF CURRICULUM CHANGES FOR AN EXISTING COURSE FEATURES OLD NEW Catalog Description A continuation of BUS 1A with emphasis on managerial accounting. The special accounting issues related to partnerships and corporations are covered as is the statement of cash flows and methods to analyze financial statements. Control accounting includes cost systems, budgetary control, and standard cost systems. Managerial decision making considers cost, revenue concepts, and preparation of reports and special analysis. A continuation of BUS 1A with emphasis on managerial accounting. The statement of cash flows and methods to analyze financial statements are emphasized. Control accounting includes cost systems, budgetary control, and standard cost systems. Managerial decision making considers cost, revenue concepts, and preparation of reports and special analysis. Grading Standard Select Select 55 35 Units Lecture Hours Lab Hours Prerequisites Corequisites Recommended Preparation Maximum Class Size RepeatabilityMaximum Enrollments Other If any of the listed features have been modified in the new proposal, indicate the "old" (current) information and proposed changes. Course Outline Senate Approved: 09.03.04 2 May 29, 2016 College of the Redwoods Course Outline DATE: 9/1/05 DISCIPLINE AND COURSE NUMBER: BUS 1B FORMER DISCIPLINE AND NUMBER (If previously offered): COURSE TITLE: Principles of Accounting TOTAL UNITS: 4 [Lecture Units: 3 Lab Units: 1] TOTAL HOURS: 108 [Lecture Hours: 54 Lab Hours: 54] MAXIMUM CLASS SIZE: 35 GRADING STANDARD: Letter Grade Only CR/NC Only Is this course repeatable for additional credit units: No Grade-CR/NC Option Yes how many total enrollments? Is this course to be offered as part of the Honors Program? No Yes If yes, explain how honors sections of the course are different from standard sections. CATALOG DESCRIPTION: The catalog description should clearly state the scope of the course, its level, and what kinds of student goals the course is designed to fulfill. A continuation of BUS 1A with emphasis on managerial accounting. The statement of cash flows and methods to analyze financial statements are emphasized. Control accounting includes cost systems, budgetary control, and standard cost systems. Managerial decision-making considers cost, revenue concepts, and preparation of reports and special analysis. Special notes or advisories: PREREQUISITES: No Yes Course: BUS 1A Rationale for Prerequisite? Describe representative skills without which the student would be highly unlikely to succeed. Financial statement creation and formatting. The impact of transactions on accounts and financial statements. Internal control and its purpose and principles. Cost flows and operating activities. Inventory methods, computation and impact on financial statements. Depreciation methods. Corporate characteristics and reporting. Ratio snalysis. Ethics. Course Outline Senate Approved: 09.03.04 3 May 29, 2016 COREQUISITES: No Yes Rationale for Corequisite? Course: RECOMMENDED PREPARATION: No Yes Course: Rationale for Recommended Preparation? COURSE LEARNING OUTCOMES: What should the student be able to do as a result of taking this course? State some of the objectives in terms of specific, measurable student accomplishments. Upon successful completion of this course, the student will be able to: 1. Describe the types of bonds and the procedures for issuing them. 2. Explain the types and payment patterns of notes. 3. Compare bond financing with stock financing. 4. Compute and record amortization of bond discount and bond premium. 5. Record the retirement of bonds. 6. Explain the purpose and importance of cash flow information. 7. Distinguish among operating, investing, and financing activities. 8. Identify and disclose noncash investing and financing activities. 9. Describe the format of the statement of cash flows. 10. Prepare and analyze a statement of cash flows. 11. Explain and apply methods of horizontal analysis. 12. Describe and apply methods of vertical analysis. 13. Define and apply ratio analysis. 14. Determine cost estimates using three different methods. 15. Compute the break-even point for a single product company. 16. Graph costs and sales for a single product company. 17. Compute break-even point for a multiproduct company. 18. Describe and record the flow of materials, labor and overhead costs in job order and process cost accounting. 19. Determine adjustments for overapplied and underapplied factory overhead. 20. Compute equivalent units produced in a period. 21. Prepare a process cost summary. 22. Prepare each component of a master budget and link each to the budgeting process. 23. Define standard costs and explain their computation and uses. 24. Describe variances and what they reveal about performance. 25. Explain how standard cost information is useful for management by exception. 26. Prepare a flexible budget and interpret a flexible budget performance report. 27. Compute overhead, materials and labor variances. 28. Evaluate short-term managerial decisions using relevant costs. 29. Analyze a capital investment project using break-even time. 30. Compute payback period, accounting rate of return, net present value, and internal rate of return and describe its use. Course Outline Senate Approved: 09.03.04 4 May 29, 2016 COURSE CONTENT Themes: What themes, if any, are threaded throughout the learning experiences in this course? Accounting is a foreign language (rather than a math class) and has its own vocabulary. Business transactions and management decisions are expressed numerically rather than only in words. Consistant use of formats and terminology permits comparability between time periods and other companies. Successful analysis of financial data requires careful selection and application of such tools as ratios and trend information. The need for ethics is critcal, especially when preparing reports and making decisions. Concepts: What concepts do students need to understand to demonstrate course outcomes? Critical thinking and problem solving. Mathematic and algebraic computations. Generally accepted accounting principles. Financial statement creation and formatting. The impact of transactions on accounts and financial statements. Internal control and its purpose and principles. Cost flows and operating activities. Inventory methods, computation and impact on financial statements. Corporate characteristics and reporting. Ratio analysis. Ethics. Issues: What primary issues or problems, if any, must students understand to achieve course outcomes (including such issues as gender, diversity, multi-culturalism, and class)? The compressed information contained within the financial statements and records of any company can be misinterpreted without a clear understanding of the accounting principles and management decisions that form the foundation for the reports presented. Skills: What skills must students master to demonstrate course outcomes? Written and verbal presentation skills. Comparative analysis. Ethics in decision making. Teambuilding skills. Informational organization. Neatness and accuracy. Summarization and clarity in communications. Financial research. REPRESENTATIVE LEARNING ACTIVITIES: What will the students be doing (i.e., Listening to lectures, participating in discussions and/or group activities, attending a field trip, etc.)? Relate the activities directly to the Course Learning Outcomes. Listen to lectures and demonstrated problem solving Engage in class discussion Write formal essays, memos, and reports Research and analyze financial statement data and public companies Make oral presentations of homework, research, and group projects Course Outline Senate Approved: 09.03.04 5 May 29, 2016 ASSESSMENT TASKS: How will the student show evidence of achieving the Course Learning Outcomes? Indicate which assessments (if any) are required for all sections. Representative assessment tasks: Work in groups to complete problems and exercises. Complete Internet research assignments. Organize accounting data into financial statements and accounting reports. Apply problem solving, critical thinking and analytical skills to compare financial data over time, to competitors and within industries. Complete presentations and group projects. Required assessments for all sections – to include but not limited to: EXAMPLES OF APPROPRIATE TEXTS OR OTHER READINGS Author Larson, Wild, Chiappetta Author warren, Fess, Reeves Author Title Date Author Title Date Title Title (Author, Title, and Date Fields are required): Fundamental Accounting Principles 17th ed. Accounting Principles Date Date 2005 Other Appropriate Readings: Course Outline Senate Approved: 09.03.04 6 May 29, 2016 2005 PROPOSED TRANSFERABILITY: UC CSU BOTH NONE General elective credit If CSU transferability is proposed (courses numbered 1-99), indicate whether general elective credit or specific course equivalent credit is proposed. Specific course equivalent If specific course equivalent credit is proposed, give course numbers/ titles of at least two comparable lower division courses from a UC, CSU, or equivalent institution. 1. BA252, HSU (Campus) 2. ACCTG202, CSU, CHICO PROPOSED GENERAL EDUCATION: NONE CR UC (Campus) CSU Rationale for General Education certification: College of the Redwoods General Education Applicability: AREA Natural Science Social Science Humanities Language and Rationality Writing Oral Communications Analytical Thinking Rationale for inclusion in this General Education category: Proposed California State University General Education Breadth (CSU GE) Applicability A. Communications and Critical Thinking A1 – Oral Communication A2 – Written Communication A3 – Critical Thinking C. Arts, Literature, Philosophy, and Foreign Language C1 – Arts (Art, Dance, Music, Theater) C2 – Humanities (Literature, Philosophy, Foreign Language) B. Science and Math B1 – Physical Science B2 – Life Science B3 – Laboratory Activity B4 – Mathematics/Quantitative Reasoning D. Social, Political, and Economic Institutions D0 – Sociology and Criminology D1 – Anthropology and Archeology D2 – Economics D3 – Ethnic Studies D5 – Geography D6 – History D7 – Interdisciplinary Social or Behavioral Science D8 – Political Science, Government and Legal Institutions D9 – Psychology E. Lifelong Understanding and Self-Development E1 – Lifelong Understanding E2 – Self-Development Course Outline Senate Approved: 09.03.04 7 May 29, 2016 Rationale for inclusion in this General Education category: Same as above Proposed Intersegmental General Education Transfer Curriculum (IGETC) Applicability AREA 1A – English Composition 1B – Critical Thinking-English Composition 1C – Oral Communication (CSU requirement only) 2A – Math 3A – Arts 3B – Humanities 4A – Anthropology and Archaeology 4B – Economics 4E – Geography 4F – History 4G – Interdisciplinary, Social & Behavioral Sciences 4H – Political Science, Government & Legal Institutions 4I – Psychology 4J – Sociology & Criminology 5A – Physical Science 5B – Biological Science 6A – Languages Other Than English Rationale for inclusion in this General Education category: Course Outline Senate Approved: 09.03.04 Same as above 8 May 29, 2016 FOR VPAA USE ONLY PROGRAM AND COURSE NUMBER BUS-1A TECHNICAL INFORMATION 1. Department: INFSC Information Science 16. CoRequisite Course: none 2. Subject: BUS 17. Recommended Prep: none Course No: 1A 3. Credit Type: D Credit Degree Applicable 18. Maximum Class Size: 35 4. Min/Maximum Units: 4.0 to 19. Repeat/Retake: NR No repeats variable units 5. Course Level: D Possibly Occupational 20. Count Retakes for Credit: yes no 6. Academic Level: UG Undergraduate 21. Only Pass/No Pass: yes no 7. Grade Scheme: UG Undergraduate 22. Allow Pass/No Pass: yes no 8. Short Title: Principles of Accounting 23. VATEA Funded Course: yes no 9. Long Title: Principles of Accounting 24. Accounting Method: W Weekly Census 10. National ID 11. Local ID (CIP): (TOPS): 52.0301 050200 12. Course Types: Level One Basic Skills: NBS Not Basic Skills 25. Disability Status: N Not a Special Class 26. Billing Method: T-Term 27. Billing Period: R-Reporting Term 28. Billing Credits: 4.0 Level Two Work Experience: NWE Not Coop Work Experience 29. Purpose: I Occupational Ed Level Three: 30. Articulation No. Placeholder for GE OR (CAN): BUS4 BUSSEQA DOES NOT APPLY 31. Articulation Seq. Level Four: If GE : Choose One: 32. Transfer Status: A Transfers to both UC/CSU (CAN): 13. Instructional Method: LL Lecture/Lab 33. Equates to another course? 14. Lec TLUs: 4.5 Contact Hours: 54 Lab TLUs: 3.0 Contact Hours: 54 34. The addition of this course will inactive number). Inactive at end of term. 15. Prerequisite: BUS-1A Particular Comments for Printed Catalog. . Curriculum Approval Date: October 14, 2005 Course Outline Senate Approved: 09.03.04 9 May 29, 2016 (course number). (course