BUSINESS BUS 81B Corporate and Partnership Income Tax Law

advertisement

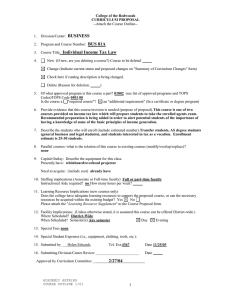

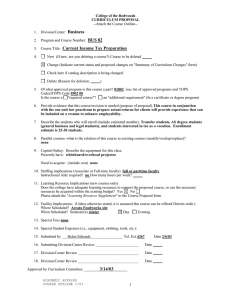

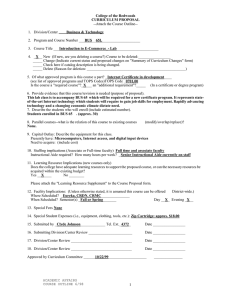

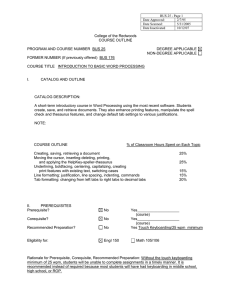

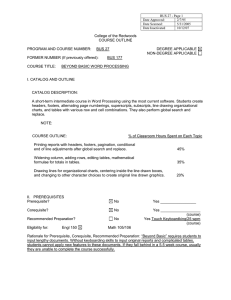

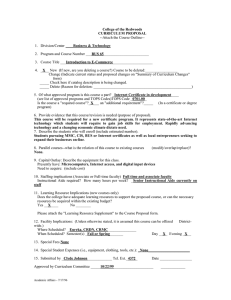

College of the Redwoods CURRICULUM PROPOSAL --Attach the Course Outline-- BUSINESS 1. Division/Center: 2. Program and Course Number: 3. Course Title: 4. BUS 81B Corporate and Partnership Income Tax Law New (If new, are you deleting a course?) Course to be deleted Change (Indicate current status and proposed changes on "Summary of Curriculum Changes" form) Check here if catalog description is being changed. Delete (Reason for deletion: ) 5. Of what approved program is this course a part? 01802 (see list of approved programs and TOPS Codes)TOPS Code 0502.00 Is the course a "required course"? an "additional requirement" (In a certificate or degree program) 6. Provide evidence that this course/revision is needed (purpose of proposal).This course is one of two courses provided on income tax law will prepare students to take the enrolled agents exam. 7. Describe the students who will enroll (include estimated number).Transfer students, AS degree students (general business and legal students), and students interested in tax as a vocation. Enrollment estimate is 25-30 students. 8. Parallel courses--what is the relation of this course to existing courses (modify/overlap/replace)? none 9. Capital Outlay: Describe the equipment for this class. Presently have: whiteboard/overhead projector Need to acquire: (include cost) already have 10. Staffing implications (Associate or Full-time faculty) Full or part-time faculty Instructional Aide required? no How many hours per week? 11. Learning Resource Implications (new courses only) Does the college have adequate learning resources to support the proposed course, or can the necessary resources be acquired within the existing budget? Yes No Please attach the "Learning Resource Supplement" to the Course Proposal form. 12. Facility Implications: (Unless otherwise stated, it is assumed this course can be offered District-wide.) Where Scheduled? Arcata Foodworks site When Scheduled? Semester(s) fall Day Evening 13. Special Fees none 14. Special Student Expenses (i.e., equipment, clothing, tools, etc.): 15. Submitted by ___Helen Edwards____________________ Tel. Ext.4367 16. Submitting Division/Center Review _______________________ Date 17. Division/Center Review ________________________________ Date 18. Division/Center Review ________________________________ Date Approved by Curriculum Committee __ ACADEMIC AFFAIRS COURSE OUTLINE 1/01 3/14/03 1 Date 2/4/03 College of the Redwoods COURSE OUTLINE DATE 2/4/03 PROGRAM AND COURSE NUMBER: BUS 81B FORMER NUMBER (If previously offered) BUS 99 COURSE TITLE: Federal Corporate and Partnership Income Tax Law I. CATALOG AND OUTLINE 1. CATALOG DESCRIPTION: An introduction to the Internal Revenue Code with emphasis on income tax preparation for corporations and partnerships. Working with tax law, income determination, deductions, property transactions, capital gains and losses, and tax determination are covered. NOTE: 2. COURSE OUTLINE: Topic 1. Tax research, organization structures 2. Corporate tax liability computation 3. Other corporate tax levies 4. Corporate distributions 5. Acquisitions and reorganizations 6. Partnership formations and operation 7. Special partnership issues 8. S corporations 9. Gift and Estate taxes 10. Administrative procedures % of Classroom Hours Spent on Each 10 10 10 10 10 10 10 10 10 10 II. PREREQUISITES Prerequisite? No Yes Corequisite? No Yes Recommended Preparation? No Yes BUS 81A (course) (course) Rationale for Prerequisite, Corequisite, Recommended Preparation Student not previously taking BUS 81A or equivalent would not succeed in BUS 81B as they would not be familiar with the terminology, forms, laws, research methods, etc. ACADEMIC AFFAIRS COURSE OUTLINE 1/01 2 PROGRAM AND COURSE NUMBER BUS 81B III. OUTCOMES AND ASSESSMENTS 1. COURSE OUTCOMES/OBJECTIVES: List the primary instructional objectives of the class. Formulate some of them in terms of specific measurable student accomplishments, e.g., specific knowledge and/or skills to be attained as a result of completing this course. For degree-applicable courses, include objectives in the area of "critical thinking." Upon successful completion of this course, the students will be able to: Upon successful completion of this course, the student will be able to: • • • • • • • Identify the major types of taxes, sources of tax law and tax structure Identify and locate appropriate tax law sources Determine income types and taxability Identify and classify deductions and losses Identify and calculate capital gains and losses Apply various tax computation methods Complete required federal income tax-forms 2. COLLEGE LEVEL CRITICAL THINKING TASKS/ASSIGNMENTS: Degree applicable courses must include critical thinking tasks/assignments. This section need not be completed for non-credit courses. Describe how the course requires students to independently analyze, synthesize, explain, assess, anticipate and/or define problems, formulate and assess solutions, apply principles to new situations, etc. Individual Income Tax Law students are required to: • • • • • Analyze IRS tax code sections, Revenue Rulings, and court cases Discuss ethical dilemmas Identify important tax issues Solve real-world tax problems Demonstrate ability to complete federal income-tax forms 3. ASSESSMENT Degree applicable courses must have a minimum of one response in category A, B, or C. If category A is not checked, the department must explain why substantial writing assignments are an inappropriate basis for at least part of the grade. A. This course requires a minimum of two substantial (500 words each) written assignments which demonstrate standard English usage (grammar, punctuation, and vocabulary) and proper paragraph and essay development. In grading these assignments, instructors shall use, whenever possible, the English Department’s rubric for grading the ENGL 150 exit essay. Substantial writing assignments, including: essay exam(s) term or other paper(s) laboratory report(s) written homework reading report(s) other (specify) If the course is degree applicable, substantial writing assignments in this course are inappropriate because: The course is primarily computational in nature. The course primarily involves skill demonstrations or problem solving. Other rationale (explain) B. Computational or Non-computational problem-solving demonstrations, including: exam(s) quizzes homework problems laboratory report(s) field work other (specify) complete income tax forms ACADEMIC AFFAIRS COURSE OUTLINE 1/01 3 PROGRAM AND COURSE NUMBER BUS 81B C. Skill demonstrations, including: class performance(s) field work other (specify) performance exam(s) D. Objective examinations, including: multiple choice true/false completion other (specify) matching items E. Other (specify) NOTE: A course grade may not be based solely on attendance. IV. TEXTS AND MATERIALS APPROPRIATE TEXTS AND MATERIALS: (Indicate textbooks that may be required or recommended, including alternate texts that may be used.) Text(s) Title: Comprehensive Federal Taxation (current year) Required Edition: most current edition Alternate Author: Pope, Anderson, Kramer Recommended Publisher: Prentice Hall Date Published: latest (Additional required, alternate, or recommended texts should be listed on a separate sheet and attached.) For degree applicable courses the adopted texts have been certified to be college-level: Yes. Basis for determination: is used by two or more four-year colleges or universities (certified by the Division Dean or Center Dean) OR has been certified by the LAC as being of college level using a Readability Index Scale. No Request for Exception Attached. REQUIRED READING, WRITING, AND OTHER OUTSIDE OF CLASS ASSIGNMENTS: Over a 16-week presentation of the course, 3 hours per week are required for each unit of credit. ALL Degree Applicable Credit classes must treat subject matter with a scope and intensity, which require the student to study outside of class. Two hours of independent work done out of class are required for each hour of lecture. Lab and activity classes must also require some outside of class work. Outside of the regular class time the students in this class do the following: Study Answer questions Skill practice Required reading Problem solving activity or exercise Written work (essays/compositions/report/analysis/research) Journal (reaction and evaluation of class, done on a continuing basis throughout the semester) Observation of or participation in an activity related to course content (e.g., play, museum, concert, debate, meeting, etc.) Other (specify) ACADEMIC AFFAIRS COURSE OUTLINE 1/01 4 PROGRAM AND COURSE NUMBER BUS 81B V. TECHNICAL INFORMATION 1. Contact Hours: (Indicate "TOTAL" hours if less than semester length) Lecture: 3 TOTAL HOURS 54 Lab: 3 TOTAL HOURS 54 (Use Request for Exception sheet to justify more-thanminimum required hours.) 5. Recommended Maximum Class Size 50 6. Transferability CSU UC List two UC/CSU campuses with similar courses (include course #s) BA459; Acct 157 Articulation with UC requested Lecture Units 3 Lab Units 1 Variable Unit Range Total Units 4 7. Grading Standard Letter Grade Only CR/NC Only Grade-CR/NC Option Grade-CR/NC Option Criteria: Introductory 1st course in sequence Exploratory 2. TLUs 7.5 3. Does course fulfill a General Education requirement? For existing courses only; for new courses, use GE Application Form) Yes No 8. Is course repeatable Yes No If so, repeatable to a maximum of: Total Enrollments Total Units (Use Request for Exception sheet to justify repeatability.) If yes, in what G.E. area? AA/AS Area CSU/GE Area IGETC Area 9. SAM Classification C Course Classification I 4. Method of Instruction: Lecture Lab Lecture/Lab Independent Study ACADEMIC AFFAIRS COURSE OUTLINE 1/01 5