Document 12358576

advertisement

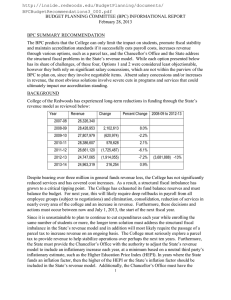

http://inside.redwoods.edu/BudgetPlanning/documents/ BPCBudgetRecommendations3.pdf REDWOODS COMMUNITY COLLEGE DISTRICT BOARD OF TRUSTEES MEETING March 16, 2013 Agenda Item # SUBJECT: BUDGET PLANNING COMMITTEE INFORMATIONAL REPORT RECOMMENDATION For Information Only. The President/Superintendent presents a summary of the Budget Planning Committee’s (BPC) recommendations for closing the budget gap. BPC SUMMARY RECOMMENDATION The BPC predicts that the College can only limit the impact on students, promote fiscal stability and maintain accreditation standards if it successfully cuts payroll costs, increases revenue through various options, such as a parcel tax, and the Chancellor’s Office and the State address the structural fiscal problems in the State’s revenue model. While each option presented below has its share of challenges, of these four, Options 1 and 2 were considered least objectionable, however they both rely on significant salary concessions, which are not within the purview of the BPC to plan on, since they involve negotiable items. Absent salary concessions and/or increases in revenue, the most obvious solutions involve severe cuts in programs and services that could ultimately impact our accreditation standing. BACKGROUND College of the Redwoods has experienced long-term reductions in funding through the State’s revenue model as reviewed below: Year Revenue Change Percent Change 2007-08 26,326,340 2008-09 28,428,953 2,102,613 8.0% 2009-10 27,807,979 (620,974) -2.2% 2010-11 28,386,607 578,628 2.1% 2011-12 26,661,120 (1,725,487) -6.1% 2012-13 24,747,065 (1,914,055) -7.2% 2013-14 24,963,319 216,254 0.9% 2008-09 to 2012-13 (3,681,888) -13% Despite bearing over three million in general funds revenue loss, the College has not significantly reduced services and has covered cost increases. As a result, a structural fiscal imbalance has grown to a critical tipping point. The College has exhausted its fund balance reserves and must balance the budget. For next year, this will likely require deep rollbacks in payroll from all employee groups and elimination, consolidation, reduction of services in nearly every area of the 1 college and an increase in revenue. Furthermore, these decisions and actions must occur between now and July 1, 2013, the start of the next fiscal year. Since it is unsustainable to plan to continue to cut expenditures each year while enrolling the same number of students or more, the longer term solution must address the structural fiscal imbalance in the State’s revenue model and in addition will most likely require the passage of a parcel tax to increase revenue on an ongoing basis. The College must seriously explore a parcel tax to provide revenue to help stabilize operations over perhaps the next ten years. Furthermore, the State must provide the Chancellor’s Office with the authority to adjust the State’s revenue model to include an inflationary increase each year, at a minimum based on a neutral third party’s inflationary estimate, such as the Higher Education Price Index (HEPI). In years where the State funds an inflation factor, then the higher of the HEPI or the State’s inflation factor should be included in the State’s revenue model. Additionally, the Chancellor’s Office must have the authority to pro-rata adjust enrollment targets down to balance the State’s revenue model, instead of reducing funding per student. The Chancellor’s A fundamental key to fiscal stability Office must also be provided the authority to adjust enrollment targets down further should the revenue is that in no case should the model become unbalanced during the year, unless the model’s funding per student ever State backfills its deficit. A fundamental key to fiscal be reduced. stability is that in no case should the model’s funding per student ever be reduced. The Budget Planning Committee (BPC) met on Wednesday, February 20, 2013, then met again at a special budget workshop on Friday, February 22, 2013. The BPC reviewed and refined four options for closing the $1.7 to $2.1 million budget gap. The BPC used a simple, but important rubric in reviewing the budget savings options, as follows: BPC Rubric: Maintain accreditation standards by focusing on student success and fiscal stability. The four options presented below were reviewed by the BPC as possible scenarios, recognizing that other solutions might exist, including some combination of the four scenarios and/or other budget savings options. Following is a briefing on the BPC’s four options for closing the budget gap: OPTION 1: This option relies heavily on payroll concessions from all employees. The $1.4 million or 5.6% salary and benefit rollback might be negotiated in any number of ways. However, to illustrate the magnitude of such concessions, all employee groups would need to, for example: Rollback the 2012-13 Step, Column and COLA and the 2013-14 Step and Column. Reduce medical, dental and vision coverage to lower cost policies offered by our JPA plus each employee would need to contribute a monthly payment towards that insurance coverage. Also, the College would need to implement the following: 2 Restore auxiliary support to the general fund back up to the $300,000/year level. Note that Housing and Dining have serious deferred maintenance and cannot continue this level of transfer for much longer. Generate $80,000 to $100,000 in net lease revenue to support the general fund. Reallocate about $600,000 of Measure Q bond funds to support, for example, a solar project to cut utility costs by $30,000 to $40,000. There may be other State project funds available to partially offset the measure Q allocation. The current measure Q allocations would need to be rebalanced to include such a project. Reduce the $700,000 in faculty release time by $300,000. Layoff employees or eliminate vacant positions for a round 2 reorganization/RIF, program discontinuance, close centers/sites of $300,000. BPC decided to lump together these cost savings strategies as all involve the cutback of services to students in one way or another. It should also be noted that if any of the above savings were not fully realized, then the reorganization/RIF, program cuts, and campus closings would need to grow to make up the shortfall. Depending on the timing, furloughs or other one-time savings measures might be needed in the interim, until permanent reorganization, program, and campus closing savings could be realized. Furthermore, to balance the 2014-15 and 2015-16 budgets, this option relies heavily on the College successfully passing a parcel tax to generate $600,000 to $800,000 per year. A discussion at the BPC centered around the need to state the magnitude of state reductions experienced by the College and to ask taxpayers in Humboldt County to support the main campus, for taxpayers in our Mendocino service area to support the Mendocino center and for taxpayers in Del Norte to support the Del Norte Center. Finally, the BPC recommends the selling of the Garberville site. BPC members expressed concern that while this site is not a significant drain on the general fund today, there will be ongoing pressure to expand services at the site. BPC members felt that the site cannot generate significant revenue in the next few years, if ever, and that the College is in no financial position to cover start-up costs for a new site for several years. About $1.5 million has been invested in the site to date, and funds from a sale could be used for campus facility upgrades and to address deferred maintenance needs district wide. OPTION 2: This option relies on a medium level of employee concessions. Most employee concessions would require negotiations, so the actual concessions could be different. However, for illustration of the magnitude of an $839,000 or 3.4% concession might include: Rollback the 2013-14 Step and Column. Reduce medical, dental and vision coverage to less expensive policies offered by our JPA plus each employee would need to contribute a monthly payment towards that insurance coverage. Also, the College would need to implement the following: Restore auxiliary support to the general fund back up to the $300,000/year level. Note that Housing and Dining have serious deferred maintenance and cannot continue this level of transfer. Generate $80,000 to $100,000 in net lease revenue to support the general fund. 3 Reallocate about $600,000 of Measure Q bond funds to support, for example, a solar project to cut utility costs by $30,000 to $40,000. Reduce the $700,000 in faculty release time by $300,000. Eliminate the $20,000 high school concurrent fee waiver. Layoff employees or eliminate vacant positions for a round 2 reorganization/RIF, program discontinuance, close centers/sites of $700,000. Reduce starting salaries of new hires for $15,000 in savings. Close Garberville site. To balance the 2014-15 and 2015-16 budgets, this option also relies heavily on the College successfully passing a parcel tax to generate $600,000 to $800,000 per year. OPTION 3: This option is similar to option 1 in that it relies heavily on employee payroll concessions in 2013-14. This option differs from option 1 in that it assumes no parcel tax is passed. As a result, the following must occur in 2013-14, 2014-15 and 2015-16: Essentially all of the savings items already identified in Option 1 for 2013-14, except the use of Measure Q funds to save utility costs. Payroll concessions of a magnitude similar to not providing any Steps, Columns in 201415 and 2015-16. Increase the transfer from auxiliaries to $350,000 in 2014-15 and 2015-16. It was planned to stop the auxiliary transfer for several years to pay for much needed repairs in Housing and Dining. This would mean that the repairs would occur at a slower pace. Layoff employees or eliminate vacant positions for a round 2 reorganization/RIF, program discontinuance, close centers/sites of $350,000 in 2013-14. Layoff employees or eliminate vacant positions for a round 3 reorganization/RIF, program discontinuance, close centers/sites of $175,000 in 2015-16. Close Garberville site. OPTION 4: This option assumes smaller payroll concessions than options 1, 2, or 3. The payroll concessions included in this scenario might equate to reducing the medical, dental and vision plans to less expensive options, but no other payroll concessions. As a result, the College would need to implement a reorganization/RIF, program discontinuance, close centers/sites of $1.3 million, which could impact our accreditation standing. SUMMARY OF BPC OPTIONS: BPC members believe that Option 1 best met the rubric, while option 2 was next best. Members thought that option 3 was either not viable or at best only minimally viable as it does not provide a reasonable solution for 2014-15 and 2015-16. BPC member believe that option 4 is not a viable option as RIFs and program cuts of $1.3 million over and above the round 1 reorganization would likely lead to serious deficiencies and ultimately a loss of accreditation. DISCUSSION OF BUDGET SAVINGS IDEAS AND SUGGESTIONS: BPC members expressed concern that the list of suggestions has grown and that some of the suggestions deserve to be pursued while other suggestions probably are not very viable. More details for each idea are included on a separate worksheet, so the ideas are summarized below. 4 The list below is presented in no particular order. BPC believes the following are viable: 5 Revenue Generators: Student Technology Fee (requires BOT support) Parcel Tax (requires voter approval) CO Deficit Factor Policy Change (requires legislation, CO support) CO Deficit Factor Hold Harmless (requires legislation, CO support) CO HEPI inflation Factor Policy Change (requires legislation, CO support) High demand or high cost program fee (requires legislation, CO support) Close and lease remote campuses and unused buildings Increase class size limits* Sell surplus goods on ebay Qualified administrators teach a course* Use bond funds to install solar or wind generator Offer an employee focused non-credit development course Lease space for highway billboards, allow advertising on campus property Non-credit enrollments* Sell or Lease Property Develop a Foundation alumni program Control/Reduce Expenditures: Purchasing card Require direct deposit for all payroll Use Google for campus email Make the campus smoke free (Some BPC members noted that this might result in more smoking across campus since smoking tents would be removed) Move student course evaluations to an online form Reduce starting salaries for new hires* Close most campus services on Fridays Merge with another college (This would be a long term idea needing ACCJC, CO and Legislative approval) Various payroll concessions* Layoffs, Reorganization, RIF* Furlough* Eliminate temporary staff Suspend Overtime Eliminate High School Concurrent Enrollment Fee Waiver Campus Shut Down Reorganize Deans, division chairs, area coordinators, etc* Hold Open Vacant Positions Planned to be Filled Program Discontinuance* Reorganize confidential staff Suspend Board of Trustees Stipends Centralize AOA staff Eliminate printing of all catalogs and schedules Reduce Software Costs Use More Web-Based Services One-time draw from Employee Benefit Trust 6 *Potential savings that may require negotiations After a review and discussion, the BPC believes the following are not viable options and should not be pursued (in no particular order): Mandatory meal plan for all students (Probably not allowed by Ed Code) Eliminate general fund support to other funds & categoricals Reduce General Fund Support to DSPS to Minimum Required Contract Out Graphics, IT, Custodial, Groundskeeping, Warehouse, Payroll, Security, or other department Associated Students Fund Clerical Support (ASCR already provides other support to CR) Reduce Travel & Supplies Costs (Budgets already cut) Reduce Faculty Overload Assignments Reduce Campus Public Safety to less than 24/7 coverage Use ASCR Student Cards or Higher One Card for Student ID (Small, rural college cannot get business sponsors) BUDGET IMPLICATIONS N/A. 7