REDWOODS COMMUNITY COLLEGE DISTRICT September 10, 2012 Agenda Item #3.2

advertisement

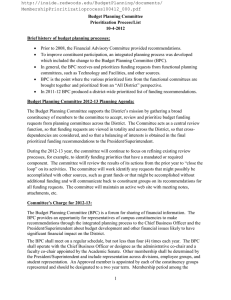

http://www.redwoods.edu/district/board/documents/September102012packet.pdf REDWOODS COMMUNITY COLLEGE DISTRICT BOARD OF TRUSTEES MEETING September 10, 2012 Agenda Item #3.2 SUBJECT: APPROVE 2012-13 FINAL BUDGET RECOMMENDATION Action is required. The President/Superintendent recommends that the Board of Trustees approve the Final Budget for all funds pursuant to BP 6200. BACKGROUND The 2012-13 Final Budget Report for all funds will be a handout at the meeting. Attached to this report is the 2012-13 unrestricted general fund budget. Unrestricted general fund revenue reflects the Chancellor’s Office estimate for state apportionment assuming that the proposed ballot measure does not pass. Should the ballot measure pass, the District may be able to capture increased revenue by increasing enrollments. For expenditures, the tentative budget presented in June 2012 included budget savings recommended by the Budget Planning Committee (BPC) that required successful negotiations to implement. For the 2012-13 Final Budget, only those savings that have already been implemented have been included in the budget. The chart below shows the budget gap that was reviewed by the BPC and the BPC’s proposed adjustments to close the budget gap. Most of these budget cuts have been implemented. However, certain items requiring negotiations have not yet been successfully implemented. Budget Planning Committee (BPC) February 2012 Recommendations Revised Estimate 3,311,639 Budget Shortfall - Worst Case (Tax measures fail) 101 Corridor Sites (Lease + operating costs) Transfer Auxiliary Support (Bookstore, Dining, Housing, Parking) TLUs (Course Section Funding) Reduce operating expenditures Revenue increase Retirement Holds, Reductions, Reorganization Estimates: Administration, Management Faculty (Negotiations) Staff (Negotiations) Payroll Concessions (Negotiations) Accreditation Budget TLUs growth FTES (Over the 6-30-2011 budget) BPC Recommendations (275,000) (300,000) (275,000) (200,000) (80,000) (435,000) (800,000) (650,000) (471,639) 100,000 75,000 (3,311,639) (523,000) (808,000) (232,000) - Shortfall if all BPC recommendations fully implemented Despite implementing most of the BPC recommendations above, the 2012-13 final budget Board of Trustees - September 10, 2012 191 remains out-of-balance. About $1.1 million of the gap is comprised of an additional cut in state funding enacted by the Legislature over the summer and savings proposed by the BPC that require negotiations, which have not yet materialized. The BPC recently reviewed and made additional recommendations for closing this new budget cut target. In addition to the $1.1 million gap, $50,000 has been added for ongoing annual write downs to bad debts and $300,000 in costs related to Special Trustee Recovery and Accreditation. The budget for ongoing write downs is needed as the District expects some level of bad debts each year, despite best efforts at collection. Based on last year’s actual results at year-end, adjustments were also made to the TLU expenditure budget and the other revenue budget. An estimated $500,000 in temporary savings was removed, so that only budget savings that have been implemented are included in this budget. These budget adjustments increase the total gap to $2 million. The beginning fund balance includes a $790,000 write down to the allowance for doubtful accounts/bad debts. After an annual review of student accounts receivable balances, this entry was made to adjust the net student accounts receivable to a conservative amount that can reasonably be expected to be collected. This write down mostly relates to prior years, but nonethe-less reduces the District’s fund balance. To recover from this budget deficit, a comprehensive list of budget cut options for consideration is attached. This list includes the most recent BPC recommendations as well as additional items reviewed at a recent BPC meeting to create and present to the Board a comprehensive list of budget savings options for discussion. Some items on the list do not include a savings estimate, either because the savings depends on the level of the budget cut or additional research is needed to develop a savings estimate. BUDGET IMPLICATIONS Although the District has taken significant actions to close the budget gap, additional savings need to be implemented during 2012-13. If $2 million of budget savings can be realized during this fiscal year through successful negotiations and other actions, then the fund balance would end at about 2.28%. With continued budget savings, the District can return to a 5.00% fund balance by 2013-14 or 2014-15. Note: Title V requires the adoption of a final budget that provides a positive ending fund balance. Therefore, a transfer (loan) of funds will be made from the Employee Benefit Trust Fund in the amount necessary to eliminate the deficit Unrestricted General Fund Ending Balance. These funds must be transferred back to the Employee Benefit Trust Fund as soon as sufficient Unrestricted General Fund Balance exists. To address the deficit in future years, the District must realize an increase in revenue and a reduction in expenditures. LL/lw Board of Trustees - September 10, 2012 192