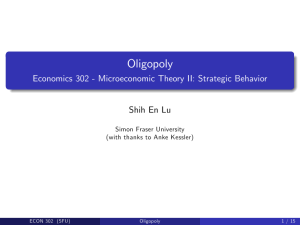

Imperfect Competition Economics 302 - Microeconomic Theory II: Strategic Behavior

advertisement

Imperfect Competition

Economics 302 - Microeconomic Theory II: Strategic Behavior

Instructor: Songzi Du

compiled by Shih En Lu

(Chapter 10 in Watson (2013))

Simon Fraser University

January 22, 2016

ECON 302 (SFU)

Lecture 4

January 22, 2016

1 / 10

Oligopoly

Armed with game theory, let’s return to the study of market.

What happens when the number of firms is small, but greater

than one?

Intuitively, we expect the firms to have some market power, but not

as much as a monopoly, so we expect an intermediate outcome.

Model #1: Firms compete by simultaneously setting their quantities

(Cournot model).

Model #2: Firms compete by simultaneously setting their prices

(Bertrand model).

Next week: Firms compete sequentially (Stackelberg model).

ECON 302 (SFU)

Lecture 4

January 22, 2016

2 / 10

Cournot Competition: Basic Model

Let’s start with the simplest case: two firms with the same constant

marginal cost c produce a homogeneous good with linear market

demand P(q) = a − b · q.

We look for a Nash equilibrium.

Actions: Firm 1 picks q1 ≥ 0, firm 2 picks q2 ≥ 0. Infinitely many

actions!

Let’s fix firm 2’s quantity q2 , and figure out firm 1’s best response.

Firm 1 maximizes:

(P − c)q1 = (a − b(q1 + q2 ) − c)q1

= −bq12 + (a − bq2 − c)q1

(This is strictly concave in q1 for any q2 . Is firm 1’s best response

ever a mixed strategy?)

ECON 302 (SFU)

Lecture 4

January 22, 2016

3 / 10

Cournot Competition: Basic Model (II)

First-order condition:

−2bq1 + a − bq2 − c = 0

a−c

q2

−

= q1

2b

2

Similarly, firm 2’s best response to firm 1 picking q1 is:

a−c

q1

−

= q2

2b

2

In a NE, firms best respond to each other, so both these

best-response functions (or reaction functions) must hold.

Thus we solve the system of equations, which gives:

q1 = q2 =

ECON 302 (SFU)

Lecture 4

a−c

3b

January 22, 2016

4 / 10

Cournot Competition: Basic Model (III)

The total market quantity is thus q1 + q2 =

2 a−c

3 b

>

1 a−c

2 b

= qm .

The price is therefore lower under a Cournot

than under a

duopoly

2

1

a

+

c;

the monopoly

monopoly. (Cournotprice is a − b 23 a−c

=

b

3

3

1 a−c

1

1

price is a − b 2 b = 2 a + 2 c).

Deadweight loss is also lower. (This conclusion changes if fixed costs

are high enough.)

You can check that the total profit under Cournot duopoly is

which is less than the monopoly profit of

1 (a−c)2

4

b .

2 (a−c)2

9

b ,

The Cournot duopoly fails to maximize the total profit: firms are not

internalizing the negative effect of their production on the other firm’s

price.

Firms could increase profit by each producing 12 qm (cooperating), but

each would have an incentive to produce more (defecting).

ECON 302 (SFU)

Lecture 4

January 22, 2016

5 / 10

Cournot Competition is a Prisoner’s Dilemma

Cooperate

Defect

Cooperate

-2, -2

-1, -5

Defect

-5, -1

-3, -3

Cournot duopoly game is dominance solvable: ISD leads to the NE

quantity (Give it a try if you want a challenge).

ECON 302 (SFU)

Lecture 4

January 22, 2016

6 / 10

Bertrand Competition

The Cournot model delivered sensible results. But do we observe

firms setting quantity or price?

Bertrand model: firms simultaneously choose price.

Let Q(p) be the demand curve.

Firm with lowest price pL sells Q(pL ) units, while firm(s) with higher

price(s) sell nothing. (Homogeneous good)

If m firms share the lowest price pL , then each sells

ECON 302 (SFU)

Lecture 4

1

m Q(pL )

units.

January 22, 2016

7 / 10

Bertrand Competition: Simplest Case

Two firms with the same constant marginal cost c (and no fixed

cost) face downward-sloping demand that crosses c at a positive

quantity.

Suppose that each firm chooses a price in cents:

{0, 0.01, 0.02, 0.03, . . .}, and c is also in cents.

We look for pure-strategy Nash equilibria.

(There sometimes exist NE that are not in pure strategies. They are

hard to find, and we will ignore them.)

ECON 302 (SFU)

Lecture 4

January 22, 2016

8 / 10

Bertrand Competition: Simplest Case (II)

Suppose firm 2 picks p2 , what is firm 1’s best response?

ECON 302 (SFU)

Lecture 4

January 22, 2016

9 / 10

Bertrand Competition: Simplest Case (II)

Suppose firm 2 picks p2 , what is firm 1’s best response?

If p2 > c + 0.01, then firm 1 always wants to undercut him. And vice

versa.

There are two NE’s: (c, c) and (c + 0.01, c + 0.01).

ECON 302 (SFU)

Lecture 4

January 22, 2016

9 / 10

Bertrand Competition: Discussion

Does the NE seem plausible?

Some explanations:

1

2

3

Product differentiation

Capacity constraints

Collusion (after quiz)

ECON 302 (SFU)

Lecture 4

January 22, 2016

10 / 10