Oligopoly Economics 302 - Microeconomic Theory II: Strategic Behavior Shih En Lu

advertisement

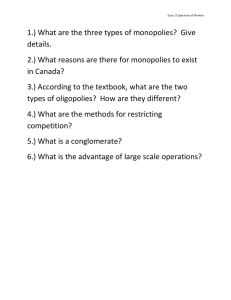

Oligopoly Economics 302 - Microeconomic Theory II: Strategic Behavior Shih En Lu Simon Fraser University (with thanks to Anke Kessler) ECON 302 (SFU) Oligopoly 1 / 15 Topics 1 Quick review of game theory basics 2 Cournot competition 3 Bertrand competition ECON 302 (SFU) Oligopoly 2 / 15 Most Important Things to Learn 1 Solidify understanding of normal-form games: de…nitions, …nding NE, relation between ISD and NE 2 Find best-response functions in Cournot game 3 Determine the Cournot outcome in an oligopolistic market 4 Determine the Bertrand outcome(s) in an oligopolistic market 5 Be able to explain how to rule out other outcomes in the Bertrand game ECON 302 (SFU) Oligopoly 3 / 15 Some Review Questions What’s the di¤erence between a strategy, an outcome and a Nash equilibrium? Does it ever make sense to compare di¤erent players’payo¤s? When you’re doing ISD, do comparisons between player 2’s payo¤s help determine whether you should delete a row? Why can a NE, whether or not it is in pure strategies, only involve strategies that survive ISD? If a game is dominance solvable, what can you say about its NE? If you need to …nd the NE of a game that’s bigger than 2x2, what could you do …rst to reduce your workload? ECON 302 (SFU) Oligopoly 4 / 15 Oligopoly Armed with game theory, let’s return to the study of market power. What happens when the number of sellers is small, but greater than one? Intuitively, we expect the …rms to have some market power, but not as much as a monopoly, so we expect an intermediate outcome. First: Assume …rms simultaneously pick quantities (Cournot model) Then: Assume …rms simultaneously pick prices (Bertrand model) Later this semester: Firms make decisions sequentially ECON 302 (SFU) Oligopoly 5 / 15 Cournot Competition: Basic Model Let’s start with the simplest case: two …rms with the same constant marginal cost c produce a homogeneous good with linear market demand P = a bQ. We look for a Nash equilibrium. Actions: Firm 1 picks q1 actions! 0, …rm 2 picks q2 0. In…nitely many Let’s …x …rm 2’s quantity q2 , and …gure out …rm 1’s best response. Firm 1 maximizes: (P c ) q1 = ( a = b ( q1 + q2 ) bq12 + (a bq2 c ) q1 c ) q1 (This is strictly concave in q1 for any q2 . Is …rm 1’s best response ever a mixed strategy?) ECON 302 (SFU) Oligopoly 6 / 15 Cournot Competition: Basic Model (II) First-order condition: 2bq1 + a a = 0 bq2 c q2 c 2b 2 = q1 Similarly, …rm 2’s best response to …rm 1 picking q1 is: a c 2b q1 = q2 2 In a NE, …rms best respond to each other, so both these best-response functions (or reaction functions) must hold. Thus we solve the system of equations, which gives: q1 = q2 = ECON 302 (SFU) Oligopoly a c 3b 7 / 15 Cournot Competition: Basic Model (III) The total market quantity is thus Q = q1 + q2 = 23 a b c > 12 a b c = qm . The price is therefore lower under a Cournot duopoly than under a monopoly. Deadweight loss is also lower, but this conclusion changes if …xed costs are high enough. You can check that the total pro…t is monopoly pro…t of 2 1 (a c ) . 4 b 2 2 (a c ) , 9 b which is less than the The Cournot duopoly fails to maximize pro…t: …rms are not internalizing the negative e¤ect of their production on the other …rm’s price. Firms could increase pro…t by each producing 21 qm (cooperating), but each would have an incentive to produce more (defect). ECON 302 (SFU) Oligopoly 8 / 15 Exercise Same setup (constant MC = c, demand P = a …rms. bQ), but now n Solve for the Cournot quantities. What happens as n ! ∞? ECON 302 (SFU) Oligopoly 9 / 15 Additional Topics (Time Permitting) Graphical representation Merging …rms with increasing marginal cost (you will see this on the problem set) ECON 302 (SFU) Oligopoly 10 / 15 Cournot Summary Firms simultaneously pick quantity. Look for Nash equilibria: where the best response functions intersect. With linear demand (and typically), a …rm wants to produce less when others produce more (quantities are strategic substitutes). Total quantity and price are between monopoly and perfect competition cases. Sellers fail to maximize joint pro…t. Outcome converges to perfect competition outcome when the number of …rms ! ∞. ECON 302 (SFU) Oligopoly 11 / 15 Bertrand Competition The Cournot model delivered sensible results. But do we observe …rms setting quantity or price? Bertrand model: …rms simultaneously choose price. Let Qd (.) be the demand curve. Firm with lowest price pL sells Qd (pL ) units, while …rm(s) with higher price(s) sell nothing. (Homogeneous good) The following is often, but not always, assumed: if n …rms share the lowest price pL , then each sells n1 Qd (pL ) units. ECON 302 (SFU) Oligopoly 12 / 15 Bertrand Competition: Simplest Case Two …rms with the same constant marginal cost c (and no …xed cost) face downward-sloping demand that crosses c at a positive quantity. We look for pure-strategy Nash equilibria. (There sometimes exist NE that are not in pure strategies. They are hard to …nd, and we will ignore them.) For simplicity, we assume that any real number can be a price (not just multiples of 0.01). ECON 302 (SFU) Oligopoly 13 / 15 Bertrand Competition: Simplest Case (II) In a NE, can a …rm pick a price below c? In a NE, can both …rms pick prices strictly above c? In a NE, can one …rm choose c and the other …rm choose a price strictly above c? What case is left? Is that a NE? Graphical representation ECON 302 (SFU) Oligopoly 14 / 15 Bertrand Competition: Discussion Does the NE seem plausible? Some explanations: 1 2 3 Product di¤erentiation Capacity constraints Collusion (later this semester) Even though in the examined case, the Bertrand model seems easier to solve than the Cournot model, it gets very messy very fast when some simplifying assumptions are omitted! See problem set for examples. ECON 302 (SFU) Oligopoly 15 / 15