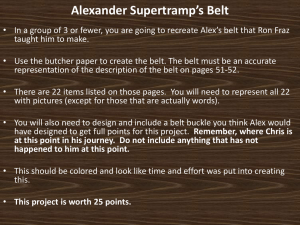

Making Sense of the Manufacturing Belt:

advertisement