WORKING PAPER SERIES

advertisement

July 2015

No.237

The Political Economy of Risk and Ideology

Matthew Dimick and Daniel Stegmueller

WORKING PAPER SERIES

Centre for Competitive Advantage in the Global Economy

Department of Economics

THE POLITICAL ECONOMY

OF

RISK

AND I DEOLOGY

Matthew Dimick∗

Daniel Stegmueller†

ABSTRACT

This paper argues for the central role of risk aversion in shaping political ideology.

We develop a political economy model to establish this link and provide empirical

evidence in support of our argument. Our model distinguishes the effects of risk

aversion from unemployment risk and our evidence sheds light on debates over explanations for the welfare state. We show that risk aversion is an important determinant

of political-economic attitudes and is at least as important as, if not more so, an

individual’s position in the income distribution.

∗

†

SUNY Buffalo Law School, mdimick@buffalo.edu

University of Mannheim, mail@daniel-stegmueller.com

I. INTRODUCTION

A growing political science literature posits more and more possible links between

basic individual characteristics, such as personality traits, and political ideology and

behavior (see, e.g., Mondak and Halperin 2008; Vecchione and Caprara 2009; Gerber

et al. 2010; Mondak et al. 2010; Morton, Tyran, and Wengstrom 2011). Critics of

this research enterprise point towards its reliance on correlations between personality

measures and political outcomes (Verhulst, Eaves, and Hatemi 2012). What is missing

are clear theoretical frameworks linking basic individual characteristics to political

ideology (Feldman 2012: 186). In this paper we focus on the role of risk aversion

and provide one possible theoretical (formal) mechanism linking it to ideology. We

argue that risk aversion is linked to political ideology via an “economic” channel. An

individual’s level of risk aversion shapes how individuals translate labor market risks,

such as income losses due to unemployment, into demand for social protection.3 To

test the predictions from our theoretical model we use survey data on individuals’

ideological position combined with experimentally validated risk aversion measures.

This allows us to test the importance of risk aversion with a large representative

sample. We develop an explicit measure of risk aversion, which takes into account

that survey-based risk aversion measures are imperfect and noisy, and include it in a

model of individuals’ ideology. Our results show that risk aversion is an important

determinant of political attitudes and is at least as important as, if not more so, an

individual’s position in the income distribution.

To the best of our knowledge, we are the first to provide theory and evidence of the

ideology effects of risk aversion in the political economy literature.4 Risk aversion plays

a fundamental role in this research program. For instance, Moene and Wallerstein

(2001) argue that a decrease in inequality can increase support for redistribution as

3

This channel need not be exclusive. In both our theoretical and empirical models we allow for

non-economic motivations. However, we do report evidence that social spending preferences

are related to political ideology in the way our model assumes. We also find that income has a

significant and substantive effect on ideology, in an identical way that is has on social spending

or redistribution preferences. All of this gives us confidence that the “economic” channel linking

risk aversion and political ideology is an important one. We furthermore note that whether risk

aversion is endogenous to other factors, such as culture (Douglas and Wildavsky 1983; Wildavsky

1987), is a question that remains outside of the scope of this present study.

4

For a recent analysis of the effects of risk aversion on political participation outside of the political

economy literature, see Kam (2012).

2

long as individuals are sufficiently risk averse. In particular, they assume a degree of

risk aversion that implies that demand for social insurance will increase as income

goes up. Consistent with this view, we find that greater risk aversion does indeed

make a person more ideologically left-leaning. However, in contrast to their argument,

we find that the effect of income on ideology is negative even when controlling for risk

aversion. Nevertheless, we also do find some limited evidence that this negative effect

weakens as individuals become more risk averse, which is consistent with our, as well

as Moene and Wallerstein’s (2001), underlying behavioral model. These results do

not challenge the role of risk aversion in individual (i.e., micro-level) social policy

preferences, but they do question the macro-level argument that lower inequality can

lead to more redistribution via risk preferences.

Risk aversion also plays a critical role in Iversen and Soskice (2001). In that paper,

individuals with more specific skills demand more social spending. In particular, their

theory predicts that skill specificity, holding income constant, would have no effect

on social policy preferences if individuals were not averse to risk, i.e., if they were

risk neutral. Risk aversion is therefore essential to their asset theory of social policy

preferences. While fully exploring the relationship between risk aversion and skill

specificity is beyond the scope of this article, we find, in line with Iversen and Soskice,

that risk aversion does indeed influence ideological commitments that align with

more social spending.

Our political economy model also allows us to distinguish and relate our argument

to a now growing literature on the role of economic risks in shaping support for social

policies. For instance, Cusack, Iversen, and Rehm (2006); Rehm (2009, 2011a); and

Rehm, Hacker, and Schlesinger (2012) have established convincing evidence that

occupational unemployment risk is a critical factor shaping social policy preferences.

We agree that this research demonstrates that unemployment risk is related to the

demand for social policy. However, as our political economy model makes clear, the

effect of risk aversion is quite distinct from unemployment risk.

To see why this is the case, we provide a simple example. Consider two individuals,

neither of whom faces any unemployment risk. Suppose individual A earns $40,000

per year, while B earns $30,000. All else equal, extensive theory and data would

predict that B would prefer more redistribution than A, because she is poorer. Now

consider individual C, who also makes $40,000 but is subject to a 25% chance of

3

becoming unemployed, in which case she earns nothing. The expected income of C is

0.75 × $40, 000 = $30, 000. C would also prefer more redistribution than A, but in

this case, because her expected income is lower. This is the effect that Cusack, Iversen,

and Rehm (2006) and Rehm (2009, 2011b) identify.

Let us now introduce the idea of risk aversion. We can capture this idea formally

with any concave utility function. To take a simple example, suppose a person values

p

a dollar of income according to the following function: u($) = $. In this case, B

p

values her expected income of $30,000 at 30, 000 = 173.20. In contrast, C values

p

her identical expected income at 0.75 × 40, 000 = 150. Even though both B and C

have identical expected income, B’s utility is higher than C’s. Notice that if C were

making a bet, she would take the $30,000 with certainty, and forgo the three-quarters

chance of getting $40,000 even though the expected value of the two bets is equal.

Indeed, C’s refusal to accept a “fair bet,” can help us understand the demand

for social insurance. Suppose that C is employed and pays an insurance company

$4,000—or that the government taxes C’s income at a 10% rate—in exchange for the

right to receive $4,000 if she becomes unemployed. This makes her expected utility

p

p

0.75 × 36, 000 + 0.25 × 4, 000 = 158.11. Having insurance improves C’s utility

over that without any insurance. But note that her expected income with insurance is

now lower: 0.75 × $36, 000 + 0.25 × $4, 000 = $28, 000 < $30, 000. This underscores

the importance of the concavity of the utility function: an individual values a dollar

less when employed than when unemployed. She would therefore prefer to pay to

have more income when unemployed.

These examples illustrate the distinct behavioral assumptions that differentiate the

effects of unemployment risk from risk aversion on social policy preferences. This

distinction is important because it is linked with very different explanations for the

development of the welfare state. One potential theory explains the welfare state as a

mechanism to redistribute income from rich to poor. Another views the welfare state

as a vehicle for providing insurance to protect against social risks. Unemployment risk

is therefore a redistributive motive: it increases the demand for social policy because it

reduces expected income. In contrast, risk aversion is inherently an insurance motive:

it increases demand for social policy because increases the volatility of the expected

stream of income. Moreover, without risk aversion, the reason that B and C in the

examples above prefer more social spending is behaviorally equivalent: they are both

4

poorer than A. In contrast, with risk aversion, C prefers more social spending than B,

even though they have identical expected income.

The paper proceeds in the following order. In section II, we develop a formal model,

with which we derive explicit hypotheses on the effects of risk aversion, income, and

unemployment risk on social spending preferences and political ideology. In section

III we translate our theoretical model into empirically testable language. In section IV

we discuss our data and in section V specify our statistical models for risk aversion

and ideology. Finally, we discuss our results in section VI.

II. MODEL

In this section we develop a formal model of the labor market, government policy,

and political ideology. From this model, we then derive testable implications for how

risk aversion, income, and unemployment risk influence individuals’ social policy

preferences.

Consider a continuum of individuals of size one, distinguished by two characteristics:

their productivity (or wage rate if the labor market is perfectly competitive), w, and

their degree of risk aversion, σ. We assume that w ∈ W = R+ and σ ∈ Σ = R+

respectively have cumulative distribution G(w) and H(σ), positive probability density

g(w) and h(σ), have finite expectation, and are i.i.d. Further, let s ∈ S = W × Σ. A

type-s worker thus has characteristics (w, σ).

Each individual has a utility function over a set of policies, i ∈ N , N = {1, 2, . . . , n},

which we refer to as an individual’s ideology.5 In this conception, ideology is explicitly

multidimensional. However, in many cases, individuals must make single-dimensional

choices, such as choosing between a left versus a right politician in an election or, as in

our dependent variable, a self-placement on a left-right ideological scale. Therefore,

the utility, Vs , of an individual with characteristics s over the n-dimensional policy

space takes the form:

Vs (x 1 , x 2 , . . . , x n ) =

n

X

−(x i − x̄ i,s )2

(1)

i=1

5

Our definition of ideology collapses the distinction between that term and an individual’s policy

preferences. Without altering results, we could retain this nuance by using a model proposed by

Hinich and Munger (1992) or Hinich and Munger (1996).

5

where x i is the value for policy i and x̄ i,s is an individual’s ideal point for that policy.

We highlight two features. First, we say that an individual is further left, on a left-right

∗

ideological scale, if the value for policy i that maximizes an individual’s utility, x i,s

,

∗

is larger than some other policy value, x i,s

> x i . Clearly, the value for policy i that

maximizes each individual’s utility is the one that equals her ideal point. Although

this function assumes that the effect of one policy choice on utility is independent of

the other policy choices, this is a stronger assumption than necessary. All we require

is that a shift of policy preferences on a single dimension have straightforward and

discernible effects on an individual’s overall ideological position.

An individual’s ideal point for social spending is an endogenous variable in our

model. We posit that this point has at least some important connection to that person’s

economic situation. To capture this, we assume that each individual also has a von

Neumann-Morgenstern utility function u(c) over final consumption. The function u

is twice continuously differentiable, strictly increasing, and concave. We employ a

standard functional form for analyzing risk aversion, termed constant relative risk

aversion:

c 1−σ

(2)

1−σ

The label for this functional form comes from the fact that the coefficient of risk

u(c) =

aversion is constant relative to consumption: σ = −cu00 (c)/u0 (c). Thus, this form

straightforwardly parameterizes the level of risk aversion, with a larger σ signifying a

greater degree of risk aversion.

Workers can be employed or unemployed. A worker with characteristics s is employed with probability qs ≡ q(w, σ) ∈ [0, 1] and unemployed with probability 1 − qs .6

When employed, their consumption is denoted c E and cN when unemployed. They

can also receive transfers from the government, denoted b, that also may depend on

their employment status. Fiscal policy is characterized by two parameters: first, the

government raises revenue by taxing income, y, at a flat-rate, τ ∈ [0, 1]. Second,

following Moene and Wallerstein (2001), χ ∈ [0, 1] determines the share of revenue

6

The (un)employment rate varies with a worker’s type, but is otherwise exogenous in our model. For

a way to make it endogenous in a political economy model, see Dimick and Stegmueller (n.d.).

We could also produce a dynamic model with exogenous entry and exit rates into and out of

employment, as in Moene and Wallerstein (2001), but doing so would add notational complexity

without adding any additional insight to our current model.

6

spent on transfers to employed workers. The parameter χ clarifies the importance of

policy design in shaping social spending preferences, especially when individuals are

risk averse and desire insurance. In particular, when transfers are targeted only to

employed workers (χ = 1), fiscal policy to an important extent is purely redistributive.7 On the other hand, when transfers are targeted specifically to the unemployed

(χ = 0), government transfers come in the form of social insurance. The government

is subject to a balanced budget constraint:

b = τz̄.

(3)

where z̄ represents the mean income of income-earning (i.e., employed) workers:

z̄ =

Z Z

σ

q(w, σ) y(w)dG(w)dH(σ).

w

Letting b E be the size of the transfer going to employed workers, q̄ ≡

R R

σ

w

qs dG(w)dH(σ)

the average employment rate, bN the size of the transfer going to unemployed workers,

and 1 − q̄ the average unemployment rate, we can decompose the budget constraint

(3) into its separate components:

q̄b E + (1 − q̄)bN = χτz̄ + (1 − χ)τz̄

Since by definition q̄b E = χτz̄ and (1 − q̄)bN = (1 − χ)τz̄ we can solve for the transfer

to each group:

bE =

χτz̄

q̄

bN =

and

(1 − χ)τz̄

1 − q̄

(4)

Thus, all revenue goes to employed workers when χ = 1, but goes to all unemployed

workers when χ = 0. In contrast to these two scenarios, transfers are universal when

χ = q̄.

When employed, workers earn income, y, by supplying labor, l ∈ [0, ∞). Specifically, y = wl. However, supplying labor is also costly. The cost of supplying labor is

C(l), with the cost of labor measured in units of the consumption good and where C(·)

7

Not to an unconditional extent, insofar as unemployment is an important determinant of economic

inequality.

7

is an increasing and strictly convex function, with C(0) = 0 and liml→∞ C 0 (l) = ∞.

Taking all of this together, the consumption of an employed worker is:

c E = (1 − τ)wl + b E − C(l)

(5)

while the consumption of an unemployed worker is:

cN = bN

(6)

Putting all of this together, we assume that individuals’ expected consumption utility

takes the form of:

U(w, σ) ≡ qs u(c E ) + (1 − qs )u(cN )

(7)

To summarize the model, the timing of events is as follows:

Pn

1. Individuals choose their policy positions, i=1 x i,s , to maximize their utility Vs ,

Pn

given their ideal points, i=1 x̄ i,s .

2. An individual’s social spending ideal point, x̄ i,s = τ∗s , is determined by choosing

a tax rate, τ, to maximize her expected consumption utility, U(w, σ), subject to

a balanced-budget constraint, which allocates the revenue to employed workers,

b E , and unemployed workers, bN , according to the share χ.

3. When employed, workers choose how much labor to supply, l, to maximize

their utility u(c E ).

A. Equilibrium

An equilibrium of the model is characterized by workers’ optimal choices of l, τ,

and their policy preferences x i . For each individual, it is straightforward to show that

these choices exist and are unique. We do this in Proposition 2 in the Appendix, but

offer the intuition here.

By backward induction, we start with workers’ choice of labor supply. Labor supply

is increasing in workers’ productivity, so more productive workers supply more labor

and earn higher incomes. Also, labor supply is decreasing in the tax rate. This fact

creates a disincentive effect which ensures that no individual chooses a tax rate larger

than one. This choice of the tax rate captures workers’ social spending preferences.

8

Finally, identifying workers’ social spending ideal points helps locate individuals in

a left-right ideological space. Since social spending constitutes one dimension of a

person’s ideology, ideology and social spending preferences are linked. Say policy i

represents social spending, then x̄ i,s (τ∗s ) = τ∗s . Using the ideology equation in (1), we

then can say that anything that increases (decreases) an individual s’s social spending

∗

preferences moves her ideologically to the left (right): ∂ x i,s

/∂ τ∗s = 1 > 0.

B. Comparative Statics

We now turn to the comparative statics of the model. Specifically, this section analyzes implications of risk aversion, income, and unemployment for political ideology.

Proposition 1. (Political ideology). The effect of risk aversion (σ), income ( y), and

unemployment rate (1 − q) on individuals’ left-right ideological location (x ∗ ) are as

follows:

1. (Risk aversion). Holding income and unemployment risk constant, a greater

degree of risk aversion (larger σ) makes a person more left-leaning (larger x ∗ ) for

all χ < 1.

2. (Income). Holding risk aversion and unemployment risk constant,

a) (Transfers targeted to unemployed, χ = 0). There exists a value of σ = σ0

such that if σ < σ0 , then an increase in income (larger y) makes an individual

less left-leaning (smaller x ∗ ). If σ ≥ σ0 , then an increase in income makes

an individual more left-leaning (larger x ∗ ).

b) (Universal transfers, χ = q̄). There exists a value of σ = σ00 > σ0 such

that if σ < σ00 , then an increase in income (larger y) makes an individual

less left-leaning (smaller x ∗ ). If σ ≥ σ00 , then an increase in income makes

an individual more left-leaning (larger x ∗ ).

c) (Transfers targeted to employed, χ = 1). For any level of risk aversion, σ,

an increase in income (larger y) makes an individual less left-leaning.

3. (Unemployment). Holding risk aversion and income constant, an increase in an

individual’s unemployment rate (larger 1 − q) makes her more left-leaning (larger

x ∗ ) for all χ < 1.

9

Proof. See Appendix A.2

This proposition establishes the testable predictions of the model. Part 1 of the

proposition is our main prediction. It says that the more risk averse a person is, holding

her income and unemployment risk constant, the more left-leaning she becomes. The

reason for this follows from the concavity of a person’s utility function. More risk

aversion means a more concave utility function. More concavity in the utility function

means that a person puts less value on having an additional dollar if employed, and

more value on an additional dollar if unemployed. Therefore, a more risk averse

person prefers more social insurance than a less risk averse person. The final link we

make is that greater preferences for social spending are more aligned with ideologically

left, rather than right, positions.

Part 2 is the model’s predictions about the relationship between income and political

ideology. Again, a preference for greater social spending is aligned with a more leftleaning political position. But the relationship between income and social spending

preferences is more ambiguous, and depends on an interaction with the individual’s

level of risk aversion. In either the targeted-to-unemployed or universal case, an

increase in income may increase a person’s preferences for social spending if her

aversion to risk is large enough. Intuitively, a highly risk-averse person wants more

insurance to protect against the chance of a larger fall in income. The difference

between the two scenarios is that targeted transfers are “pure” insurance, while

universal transfers have an inherently redistributive element to them. Thus, in the

universal case, the degree of risk aversion required to make increasing income have a

positive effect on social spending preferences is larger. In contrast, when transfers are

targeted to the employed, transfers have no insurance element and social spending

preferences are strictly decreasing in income.

To anticipate our empirical analysis, we focus mainly on the pure income effect in

order to compare our results to the effects of risk aversion, as well as other research.

However, the interaction effect between income and risk aversion is also substantively

interesting and important. For example, Moene and Wallerstein (2001) assume that

all individuals are sufficiently risk averse so that preferences for social insurance

will be increasing in income. This assumption is critical for their (macro-level)

political economy argument that a reduction in inequality can lead to an increase

10

in redistribution. We therefore also examine this interaction effect in a subsequent

section of the empirical analysis.

Part 3 serves primarily to distinguish our focus on risk aversion from an analysis

based on occupational unemployment risk. Our model predicts that an increase in

unemployment risk makes a person more left-leaning through her social spending

preferences. Regardless of how transfers are targeted, the fundamental mechanism is

the same: higher risk of unemployment reduces expected income. A higher risk of

unemployment makes expected income closer to the individual’s unemployed income,

which is lower than her income when employed. Thus, when the expectation of

unemployment increases, it is not risk aversion, but expectations of lower income

that induce an increased demand for social spending.

III. TESTING THE MODEL

In this section, we translate our theoretical results into a statistical model. Using

the first-order condition of an individual’s utility in equation (7), we implicitly obtain

a function for a person’s location in ideological space, x s∗ (σ, y), via her ideal social

spending policy preferences (τ∗ ), as a function of her level of risk aversion, σ, and

her income, y. The first-order Taylor expansion of x s∗ (σ, y) is:

x s∗

where

P

=α+

∂ x s∗

∂σ

σ+

∂ x s∗

∂y

y+

X ∂ x∗

s

∂r

r

(8)

r is a list of some additional implications (based on previous research) that

we control for. Thus, our regression equation takes the form:

zi = γψi + δ yi +

X

βi ri ,

(9)

where zi is an individual’s ideological position. Our empirical individual-level measure

of risk aversion is denoted by ψi , and its coefficient corresponds with our central

theoretically-derived hypotheses of Proposition 1: γ = ∂ x s∗ /∂ σ, δ = ∂ x s∗ /∂ y. Hence,

if γ is larger than zero, both statistically and substantively, we obtain support for the

expectation that ∂ x s∗ /∂ σ > 0 from Part 1 of Proposition 1. Likewise, if δ is less than

zero, our expectation is confirmed that ∂ x s∗ /∂ y < 0 from Part 2.

11

Our dependent variable is an individual’s ideology, i.e., his or her position on a

left-right dimension. We assume that more left positions imply a stronger preference

for welfare spending and redistribution. Our argument has general implications for

welfare and spending preferences. Thus we opt for using a broad explanandum instead

of the more commonly used more specific question on redistribution preferences

(which focuses narrowly on the rich-poor income gap). Indeed, a question about

redistribution and inequality may not capture a risk view of social policy preferences,

which has a fundamentally different behavioral foundation, as we have argued.8

IV. DATA

We use data from the German Socio-Economic Panel (SOEP), an ongoing longitudinal survey of German households. It is carefully constructed to be representative of

the German adult population. Information on households and every adult individual

living in that household is obtained through face-to-face interviews held annually

(mainly between January and May). SOEP provides high-quality data on individuals’

labor market activities, such as income, work experience, and unemployment spells.9

What makes this study ideal for our purpose, is that in 2009 it includes a detailed

measurement instrument of risk aversion. It consists of a set of items assessing the

extent to which individuals engage in risky behaviors in different contexts. Using

risk measures as part of a large-scale panel study allows us to study the effect of risk

aversion in a proper random sample allowing inference to the total population.10

However, compared to a laboratory experiment, our measure of risk aversion might

be both less reliable and less valid. The latter concern is alleviated by an explicit

8

Our ideal question would be one about social spending, since it would be broad enough to capture

both redistributive and insurance motives. In the absence of that, we believe our ideology measure

to be the next best alternative.

9

For more information on the SOEP contents and structure see Haisken-DeNew and Frick (2005) and

Wagner, Frick, and Schupp (2007).

10

Furthermore, an advantage of using a survey measurement instrument is that it allows us to derive

individual risk preferences without having to recover behavioral parameters using (arbitrary)

identifying assumptions. The downside of our survey-based measures of risk is that they are not

incentive compatible, a problem that is overcome by laboratory experiments where real money

is at stake (for a discussion see e.g., Camerer and Hogarth 1999; Holt and Laury 2002). We

alleviate this concern by using a behaviorally validated survey instrument combined with an explicit

measurement model.

12

validation study, which tested the survey measures using a field experiment. The

former is explicitly addressed in our model. We construct a covariate measurement

error model (Wansbeek and Meijer 2000), which takes into account the limited

reliability of survey based measures of risk aversion.

We select our sample as follows. Starting from the full sample in 2009, we use all

SOEP samples (A to H) except an oversample of high-income earners (sample G).

This yields a sample of 18,996 individuals. We focus on working-age individuals and

exclude those still in full-time education. This provides us with a sample of 13,948

individuals. After deleting cases with missing covariates, we obtain a final sample

size of 13,464 respondents.

Risk aversion measures and experimental validation.

In order to test our model we

require a measure of risk aversion that fully captures individual differences. We

construct our measure using a set of risk items included in SOEP wave 2009 where

individuals are asked to what extent they take risks in various contexts of daily life

(Weber, Blais, and Betz 2002). These include taking risks while driving, in leisure time,

doing sports, in financial matters, as well as an individual’s general willingness to

take risk. All responses are given on an 11-point scale, where 0 represents “unwilling

to take risks”, while 11 represents “fully prepared to take risks”.11 In our empirical

application below we reverse this scale, such that higher values indicate more aversion

to taking risks.

In order to test the behavioral validity of these survey questions, Dohmen et al.

(2005) carry out a large scale field experiment based on a representative sample

of 450 individuals.12 Participants of the experiment completed parts of the SOEP

questionnaire (including our general risk item), and then took part in a lottery

experiment (cf. Holt and Laury 2002). Results show that survey items used to measure

general risk predict actual risky choices rather well (Dohmen et al. 2005). Thus, they

are “uniquely valid instruments” (Dohmen et al. 2005: 18) capturing individual

heterogeneity in risk preferences (and actual risk-taking).

11

The exact question wording is “How would you assess your preparedness to take risks in the following

areas...?”

12

The field experimental sample was obtained using the random walk method, using face-to-face

interviews with CAPI between June and July 2005.

13

Ideology.

Our dependent variable is the standard measure of ideology, similar to the

one used in ANES. It asks individuals to place themselves on an 11-point scale with

labeled endpoints, ranging from “far left” (0) to “far right” (10).13 We reverse this

scale so that higher values represent left positions.14

Individual characteristics

We do not include a huge number of “control variables” in

our models, to avoid Achen’s (2005) garbage can regression problem arising from too

many (endogenous) covariates. However, we include basic individual characteristics,

to capture heterogeneity between individuals: age and gender are obvious candidates.

Education is captured by years of schooling. We also include an indicator variable

for growing up in the former GDR to capture possibly lasting effects of communism

(Alesina and Fuchs-Schündeln 2007). Finally, a respondent’s income is measured by

his or her gross income from labor in the previous calendar year. In more extended

specifications, we include further individual and household characteristics. These

include indicator variables for being unemployed, self-employment, a union member,

and/or of non-German nationality. We also include the number of hours worked,

the duration of one’s experience of unemployment in the previous calendar year (in

months), as well as a variable capturing household size.15 Descriptive statistics of all

variables are available in appendix A.3.

V. STATISTICAL SPECIFICATION

Our statistical model consists of a simple linear model relating ideology to risk

aversion. However, our proxy measures of risk aversion are imperfect and simply

including them on the right-hand side of our model introduces a clear errors-in-

13

The actual question text is: “In politics, people often talk about “left” and “right” when describing

different political views. When you think about your own political view, how would you rate them

on the scale below?”.

14

We validate that the left-right variable used here does have significant economic content. We use

2,519 cases from the German portion of the European Social survey, which includes both a left-right

measure similar to the one used in this paper as well as a measure of redistribution preferences

widely used in politico-economic research. Using a scaled ordered logit model (Anderson 1984) we

relate redistribution preferences to the left-right scale. The relationship between left-right position

and redistribution preferences is highly significant. The estimated effect of left-right position on

redistribution preferences is 0.485 with a standard error of 0.084.

15

Union membership was not assessed in the panel wave used in our analysis. Therefore, we matched

this information from an earlier interview (two waves prior).

14

variables problem (Chesher 1991). We solve this by adjoining a measurement system

(Fuller 1987: ch.4) to our linear model. This allows us to generate reliable measure

of risk aversion and to properly include the uncertainty arising from our imperfect

proxies (cf. Skrondal and Rabe-Hesketh 2004).

A. Measuring risk aversion

For each respondent i (i = 1, . . . , N ) we have several measures of risk aversion

x i1 . . . x iJ . Based on our theoretical model (and in line with its usual conceptualization

in economics) we argue that each individual can be assigned a scalar value of risk aversion, denoted ψi . Thus, observed risk aversion measures x i j are results of unobserved,

or latent, levels of ψi . By modeling how this latent variable generates observed risk

measures we can generate estimates of ψi , which is what we are ultimately interested

in (Jackman 2009: ch.9).

We stack available risk measures for each individual into a length-J vector x i =

(x i1 , . . . , x iJ )0 and model x i as a function of ψi via the following linear system:

x i = µ + λψi + εi .

(10)

Here µ is a vector of means (or intercepts), while λ is a length J vector of coefficients

relating changes in ψi to changes in x i . Finally, εi is a vector of regression residuals.16

The measurement system is completed by assigning a distribution to the latent variable

or random coefficient, ψ = (ψ1 , . . . , ψN )0 . Following established convention we use a

normal distribution centered at zero: ψ ∼ N (0, ω).17

To identify the model both scale and orientation of ψ need to be set (Anderson and

Rubin 1956; Wansbeek and Meijer 2000: 208). This can be achieved by fixing the

variance, ω, and putting inequality constraints on one of the elements of λ, which is

the strategy used in most ideal-point models (e.g., Quinn 2004). Alternatively, if we

put a scalar restriction on one of the elements of λ, we identify both the orientation

and the scale of our latent risk measure (which is then on the same scale as our

We assume that C ov(εi j , εik )∀ j, k, i.e., the standard assumption that, conditional on the latent

variable, measurements are independent (Jackman 2008).

17

See Skrondal and Rabe-Hesketh (2004) for a general discussion of random coefficient/factor models.

16

15

measures).18 We follow the latter strategy and fix λ1 = 1. Thus, a higher value of ψi

implies that an individual is less prepared to take risk in several areas of life, in other

words, she is more risk averse.

Before proceeding to our model for ideology, we address an objection to our measurement strategy. A critical reader might argue that assuming a normal distribution

for latent risk aversion is an arbitrary choice. While there is research arguing for

this choice on the grounds of its robustness against misspecification (Bartholomew

1988; Wedel and Kamakura 2001), note that this assumption is not necessary for

our model. Jettisoning the normal distribution assumption, we also estimate f (ψ)

semi-parametrically by approximating it using a finite mixture of normals (Ferguson

1983):

f (ψ) =

K

X

πk φ(ψ|µk , σ2 )

k=1

Here φ(·) is the normal density, and π is discrete with mass at (µk , σ2 ). To insure

P

identification k πk = 1. Even with very few mass points (K being as little as two)

finite normal mixtures are flexible enough to approximate a wide number of densities.

See Rossi (2014: ch.1) and Skrondal and Rabe-Hesketh (2004: ch.6) for an extended

discussion. In our empirical application we set K = 3 to produce a non-parametric

estimate of f (ψ) in addition to the one based on the normal distribution described

above. With these ψi estimates in hand we can proceed to estimate the relationship

between risk aversion and ideology.

B. Ideology

For each individual i we have a scalar measure of ideology, yi , her income, w i , and

a vector of social characteristics, zi . We model the relationship between risk aversion,

ψi , and ideology using the following specification:

yi = zi0 β + γψi + δw i + υi .

18

(11)

To be more precise, we can identify the model from covariances alone. We have J(J − 1)/2 = 10

covariances, from which we want to identify: 5 elements in λ, 5 elements in ε and ω. Clearly, the

model is not identified without restrictions. Fixing one element of λ identifies the model.

16

Here γ is the regression coefficient associated with the risk aversion effect, ∂ x s∗ /∂ σ,

and δ corresponds to the income effect ∂ x s∗ /∂ w. Systematic differences in social

characteristics of individuals are captured by coefficient vector β. Finally, υi are white

noise residuals distributed N (0, σ2 ).

C. Estimation

We implement the model in a fully Bayesian framework (Gill 2014; Jackman 2009),

which allows for straightforward estimation of all ψi and fully takes into account the

uncertainty arising from our measurement of risk aversion. We estimate our system of

measurement equations in (10) jointly with equation (11). Our Bayesian specification

is completed by assigning prior distributions to all free model parameters. We choose

vague or “uniformative” prior values for all model parameters so that our results do

not depend on prior information (see appendix A.4 for details). The joint model can

be estimated via Gibbs sampling. We ran two chains for 40,000 iterations discarding

the first 10,000 as transient phase of the Gibbs sampler.19 All results reported below

are based on the remaining 30,000 posterior samples.

VI. RESULTS

A. Risk aversion

We start by discussing results from our measurement of risk aversion. Table 1

shows parameter estimates (posterior means) together with an interval measure of

uncertainty – 90% highest posterior density regions – in brackets.20 The first two

columns, labeled ψ(P) show estimates based on our parametric model with an assumed

normal distribution on latent risk aversion, while the last remaining two columns,

labeled ψ(N P) , display non-parametric estimates.

We find strong evidence that latent levels of risk aversion drive observed (or, more

precisely, reported) levels of risk aversion. Estimates in columns λ j , which show the

19

Standard diagnostics did not indicate any convergence issues and Monte Carlo standard errors (i.e.,

simulation noise) was an order of magnitude smaller than our estimates.

20

A region R is a 100(1 − α) percent HPD region for parameter θ if (1) P(θ ∈ R) = 1 − α and

(2) P(θ1 ) ≥ P(θ2 ) for all θ1 ∈ R and θ2 ∈

/ R, i.e., it yields an interval estimate with the added

requirement that each value in the interval is larger than those outside of it (Gill 2014: 46).

17

Table 1: Parameter estimates I: risk aversion equations. Willingness to take risks

as function of latent risk aversion. Parametric [ψ(P) ] and nonparametric [ψ(N P) ]

distribution estimates.

ψ(P)

ψ(N P)

µj

λj

µj

λj

Driving

6.799

[6.761,6.836]

1.000

[1.000,1.000]

3.939

[3.834,4.053]

1.000

[1.000,1.000]

Financial

8.023

[7.992,8.052]

0.738

[0.718,0.758]

5.923

[5.830,6.012]

0.734

[0.716,0.755]

Leisure, Sports

6.606

[6.570,6.643]

1.080

[1.055,1.105]

3.481

[3.363,3.601]

1.093

[1.067,1.117]

Occupation

6.564

[6.526,6.603]

1.045

[1.019,1.071]

3.564

[3.447,3.678]

1.050

[1.024,1.075]

General

6.125

[6.094,6.155]

0.862

[0.841,0.883]

3.718

[3.623,3.812]

0.842

[0.822,0.862]

Risk behavior

Notes: Based on 30,000 MCMC samples. Nonparametric estimate of f (ψ) based on K=3.

strength of the relationship between ψi and risk measures x i j , are substantial. For

example, a unit increase in latent risk aversion induces a decrease in willingness to

take risk in financial matters by 0.74 ± 0.01 points. The relationship between ψ and

other measures is of similar magnitude, with small confidence intervals, indicating that

their relationship is highly statistically significant. Estimates from our non-parametric

model are slightly smaller, but still highly significant (both in the substantive and

statistical sense).

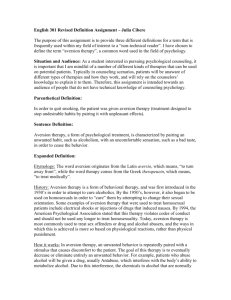

The distribution of estimated risk aversion for all individuals is displayed in Figure 1. We calculate posterior means for each ψi and estimate their distribution via

Gaussian kernel density estimation on a 200-point grid. Figure 1 reveals substantial

heterogeneity in levels of risk aversion between individuals. Even our parametric

model yields a posterior distribution of risk aversion with quite heavy tails. This

phenomenon is even more marked when using our non-parametric estimates. They

show some evidence of bi-modality, with a substantive part of the population being

averse to taking risks.

18

0.25

ψ(P)

ψ(NP)

0.20

f(ψ)

0.15

0.10

0.05

0.00

−4

−2

0

ψ

2

4

Figure 1: Distribution of risk aversion. Parametric and non-parametric estimates.

Kernel density plots (Gaussian kernel with bandwidth 0.6 evaluated on 200-point

grid).

B. Ideology

Estimates

The role risk aversion plays in shaping ideology is demonstrated in Ta-

ble 2. It shows parameter estimates for equation (11) together with their 90% HPD

regions for a range of model specifications.21 Our baseline model (1) simply includes

a respondents income as distance from the country mean. In line with recent political

economy research on micro-level preferences, higher income distance is associated

with a more conservative political outlook (and once more underscores the strong

economic content of our dependent variable). Model (2) proceeds to a test of our

argument, by including our (parametric) estimates of individuals’ risk aversion. Holding income distance constant, we find a positive effect of risk aversion, indicating that

more risk averse individuals are more left-leaning. We will explore the substantive

magnitude of this below; for now we note that the relationship clearly is statistically

different from zero, as indicated by the HPD region bound away from zero. When

using a non-parametric estimate of risk aversion in model (3) we reach a strikingly

21

Note that we split the presentation of estimates into two tables for reasons of exposition. The model

was estimated jointly carrying through all uncertainty from the risk aversion estimation stage.

19

Table 2: Parameter estimates II: ideology equation. Ideology as function of (parametric and nonparametric) risk aversion.

Income

(1)

(2)

(3)

(4)

−0.043

[−0.056,−0.031]

−0.039

[−0.052,−0.026]

−0.039

[−0.052,−0.026]

−0.029

[−0.047,−0.010]

ψ(P)

0.051

[0.036,0.067]

ψ(N P)

Controls

Basica

Extendedb

N

Deviance

0.050

[0.032,0.066]

0.055

[0.039,0.070]

yes

no

yes

no

yes

no

yes

yes

13464

307336

13464

307302

13464

307264

11065

251520

Notes: Based on 30,000 MCMC samples. a Basic covariate set includes age, gender, years of education, and an indicator variable for growing up in East Germany. b Extended covariate set includes indicators for unemployment and self-employment, union membership,

non-German nationality, and household size.

similar conclusion, indicating that our core result does not depend on the assumption

of normally distributed latent risk aversion.

Our previous three models included controls for basic individual differences, such

as age, gender, education, and growing up in the former GDR. We obtain the same

result for the role of risk aversion when excluding all covariates. Moving towards the

other extreme, model (4) includes an extended set of covariates, which have been

found to influence ideology, including indicator variables of current unemployment,

being member of a trade union, or self-employed, being of non-German nationality,

hours worked, previous experience of unemployment, and household size. While their

inclusion clearly increases endogeneity issues, we argue that even after conditioning

on these characteristics individuals are still highly heterogeneous with respect to their

level of risk aversion. Accordingly, model (4) shows a remarkably similar estimate for

risk aversion, with a slightly increased uncertainty, as evidenced by the wider HPD

region.

Before examining the substantive size of the risk aversion effect vis-à-vis income,

we perform another strict test of our central hypotheses, formulated in Proposition 1.

Table 3 shows Bayesian p-values, which represent directional (one-sided) tests of our

20

Table 3: Bayesian tests of central hypotheses

Hypothesis (H1 )

Income effect

Risk aversion effect

Prob(H0 )

∂ x s∗ /∂ w < 0

∂ x s∗ /∂ σ > 0

0.000

0.000

Note: Calculated from 30,000 MCMC samples from Model 2.

income and risk aversion hypotheses. It strongly confirms our results from Table 2:

our predictions regarding risk aversion are strongly supported by the current evidence.

Substantive magnitude

In order to assess the substantive magnitude of the influence

of risk aversion on ideology we compare its effect to that of income. In Figure 2

we calculate marginal effects at each decile of the respective distribution of income

and risk aversion (based on estimates of model 2). Our results show the expected

marked negative effect of income, which is especially apparent at higher deciles of the

income distribution. However, and perhaps surprisingly for a variable far less tangible

than income, risk aversion matters just as much. As Figure 2 shows, increasing risk

aversion leads to more leftist ideological positions. The magnitude of this effect rivals

that of income.

C. Risk-dependent income effect

In addition to the test of our core prediction of the role of risk aversion, we examine

a further implication of our model concerning the effect of income on preferences.

The vast majority of political-economic models of preference formation treat the effect

of income on preferences or ideology as homogeneous over individuals (as did we in

the previous section). However, from Proposition 1 we derived the expectation of an

income effect heterogeneous in risk aversion. More precisely, we predict that the effect

of income on ideology decreases in absolute value monotonously with increasing risk

aversion. To study this prediction we replace the income term, δw i in our ideology

equation in (11) with the interaction specification δ(w i + w i ψi ). The second element

of vector δ captures how the effect of income on ideology depends on an individuals’

level of risk aversion. In order to interpret results more intuitively, Figure 3 plots

21

min

Income distance

1

2

3

4

5

6

7

8

9

max

Risk aversion

0.2

Marginal effects

0.1

0.0

−0.1

−0.2

−0.3

min

1

2

3

4

5

6

7

8

9

max

Deciles

Figure 2: Effects of risk aversion (panel A) and income distance (panel B). Posterior

means and 90% credible intervals of marginal effects evaluated at deciles of each

variable.

marginal income effects at different levels of risk aversion with their associated 90%

HPD regions.

While there is considerable uncertainty around the marginal effect estimates, Figure 3 still illustrates that the income effect is heterogeneous in risk aversion. In line

with the prediction from our model, as risk aversion increases, the effect of income on

ideology weakens. For individuals with low levels of risk aversion (say one standard

deviation below the population mean, ψi < −1.6) we find a strong negative marginal

effect of income, while for highly averse individuals (ψi > 1.6) the income effect

is reduced considerably. In fact, for individuals with extreme levels of risk aversion

(ψi > 2) the effect of income on ideology is not statistically distinguishable from zero.

This finding has wider implications for existing political economic models invoking

risk aversion. Remember that our results are based on a large-scale population sample,

which is arguably better suited to detect high levels of risk aversion (than, say, a

lab experiment involving students). Still, we do not find that individuals are so risk

averse that an increase in income can increase support for social spending or induce a

22

0.05

Income effect

0.00

−0.05

−0.10

●

●

●

●

●

●

●

●

●

●

●

●

●

●

−0.15

−2

−1

0

1

2

Risk aversion

Figure 3: Marginal income effect at different levels of risk aversion

leftward shift in ideology, as hypothesized by Moene and Wallerstein in their seminal

paper (Moene and Wallerstein 2001).

D. Robustness tests

To study the robustness of our results we conducted several additional analyses.

Occupational risk

So far we have developed our analysis focusing on the central role

of risk aversion controlling for a number of covariates. One factor receiving considerable attention in the recent literature is occupation-specific risk of unemployment

(Rehm 2009; Cusack, Iversen, and Rehm 2006), which we have not included in our

analysis. In Part 3 of Proposition 1 we show that risk aversion emerges as a distinct

factor shaping preferences. In other words, we should find a substantively strong

effect of risk aversion even when accounting for occupational unemployment risk.

This is borne out empirically. Studying the distribution of risk aversion in occupational

groups (not shown here), we do indeed find that at each level of occupational unemployment individuals are still highly heterogeneous in their levels of risk aversion. For

a stricter statistical test, we include a direct measure of occupational unemployment

23

risk (Rehm 2009; Cusack, Iversen, and Rehm 2006).22 Our results show that, while

occupational unemployment risk emerges as a significant factor shaping ideology, risk

aversion remains highly relevant. Our estimate of risk aversion is 0.050±0.011.

Second dimension issues

We have developed our analytical model explicitly allowing

for the fact that an individual’s ideology is possibly shaped by many considerations.

One of these are spending preferences, whose dependency on risk aversion we have

modeled systematically. As long as an increase in spending preferences yields a (left)

shift in ideology we can analyze the effect of risk aversion. However, one might argue

that an important conflicting element of ideology are values and moral considerations.

While we do not have direct measures of these, we include religion as proxy to

capture non-economic aspects of an individual’s ideological position.23 To the extent

that religion is related to moral or value-based ideological considerations, we can

capture this effect. Our results show that (as expected) religion does have an effect

on ideology, but even after its inclusion risk aversion still emerges as highly relevant.

Our estimated effect of risk aversion is 0.049±0.011.

Wealth

In our previous analyses we only included an individuals current income, thus

ignoring the role of wealth. Both positive and negative wealth shape an individual’s

economic security and thus have straightforward effect on (economic) ideology. The

question is how their inclusion alters our estimate of risk aversion. We include a

respondent’s net wealth in 2007 (for details on its calculation see appendix A.3) in

our ideology equation. We find the effect of risk aversion slightly reduced, estimated

as 0.048 with an HPD region from 0.031 to 0.065.

VII. CONCLUSION

In this paper we establish the importance of risk aversion in shaping political

ideology. We provide an explicit formal, political economy model that links the

22

We measure occupational unemployment risk following Rehm (2009) by calculating occupational

risk of unemployment from Labor force survey data. For each 2-digit occupation (ISCO) groups,

we estimate the proportion of unemployed individuals. Our estimation takes into account survey

sample inclusion probabilities.

23

We measure religion using an individual’s denominational self-categorization, i.e., if she considers

herself either Catholic, Protestant, member of another faith, or no faith at all.

24

two ends of this relationship through an “economic” channel. Our argument is that

more risk averse individuals demand more social spending to address risks, such as

unemployment risk in the labor market. A greater demand for social spending in turn

shifts individuals’ ideological location to the left in the political spectrum.

We provide evidence to support this argument. Our results support the conclusion

that risk aversion is strongly related, both substantively and statistically, to individuals’

political-ideological position on a left-right scale. This effect is robust to a variety

of controls and specifications. The magnitude of the effect of risk aversion is approximately as strong as a person’s income on political ideology. We also uncover

some more limited evidence that the negative effect of income weakens as individuals

become more risk averse, which is consistent with what our formal model predicts.

These findings, and the consistent relationship between redistribution preferences

and ideology, give us some confidence that the “economic” mechanism we specify in

our formal model is a plausible one.

Some important implications follow from our findings. Most importantly, our

results examine the essential, but hitherto untested, assumption of risk aversion in

core models of political economy. For instance, risk aversion is a critical ingredient

in social insurance and skill specificity arguments for redistribution in respectively

Moene and Wallerstein (2001) and Iversen and Soskice (2001). Our results support

the assumption of risk aversion in both models. But we do not find (empirically) the

extreme levels of risk aversion necessary to change the sign of an individual’s income

effect as hypothesized in Moene and Wallerstein (2001).

Finally, another virtue of our formal model is that we are able to distinguish precisely

the effects of risk aversion from those of unemployment risk. This later variable is

the focus of much recent research . We do not wish to challenge the importance of

unemployment risk this research uncovers (Cusack, Iversen, and Rehm 2006; Rehm

2009, 2011b; Rehm, Hacker, and Schlesinger 2012). But we do think risk aversion

better captures the behavioral elements underlying the “insurance” theory of the

welfare state than does unemployment risk. This is because, as our model illustrates,

risk neutral individuals will have no desire for social insurance, but may prefer more

social spending for purely redistributive reasons if they are subject to greater risk of

unemployment.

25

REFERENCES

Achen, C. 2005. “Let’s Put Garbage-Can Regressions and Garbage-Can Probits Where

They Belong.” Conflict Management and Peace Science 22 (4): 327–339.

Alesina, A., and N. Fuchs-Schündeln. 2007. “Good-Bye Lenin (or Not?): The Effect

of Communism on People’s Preferences.” American Economic Review 97 (4): 1507–

1528.

Anderson, J. A. 1984. “Regression and Ordered Categorical Variables.” Journal of the

Royal Statistical Society B 46 (1): 1–30.

Anderson, T. W., and H. Rubin. 1956. “Statistical inference in factor analysis.” In

Proceedings of the third Berkeley symposium on mathematical statistics and probability,

ed. J. Neyman. Vol. 5, Berkeley pp. 111–150.

Bartholomew, D. 1988. “The sensitivity of latent trait analysis to choice of prior

distribution.” British Journal of Mathematical and Statistical Psychology 41 (1):

101–107.

Camerer, C. F., and R. M. Hogarth. 1999. “The effects of financial incentives in

experiments: A review and capital-labor-production framework.” Journal of Risk

and Uncertainty 19 (1-3): 7–42.

Chesher, A. 1991. “The effect of measurement error.” Biometrika 78 (3): 451–462.

Cusack, T., T. Iversen, and P. Rehm. 2006. “Risks At Work: The Demand And Supply

Sides Of Government Redistribution.” Oxford Review Of Economic Policy 22 (3):

365–389.

Dohmen, T. J., A. Falk, D. Huffman, U. Sunde, J. Schupp, and G. G. Wagner. 2005.

“Individual risk attitudes: New evidence from a large, representative, experimentallyvalidated survey.” IZA Discussion paper.

Douglas, M., and A. Wildavsky. 1983. Risk and culture: An essay on the selection of

technological and environmental dangers. Univ of California Press.

Feldman, S. 2012. “Review of Personality and the Foundations of Political Behavior.”

Perspectives on Politics 10 (1): 186–187.

Ferguson, T. S. 1983. “Bayesian density estimation by mixtures of normal distributions.”

In Recent Advances in Statistics, ed. M. Rizvi, J. Rustagi, and D. Siegmund. Number

1983 New York: Academic Press.

26

Frick, J. R., M. M. Grabka, and J. Marcus. 2007. “Editing and Multiple Imputation

of Item-Non-Response in the 2002 Wealth Module of the German Socio-Economic

Panel (SOEP).” SOEP Survey Papers, No. 148.

Fuller, W. A. 1987. Measurement error models. New York: John Wiley & Sons.

Gerber, A. S., G. a. Huber, D. Doherty, C. M. Dowling, and S. E. Ha. 2010. “Personality

and Political Attitudes: Relationships across Issue Domains and Political Contexts.”

American Political Science Review 104 (01): 111.

Gill, J. 2014. Bayesian Methods. A Social and Behavioral Sciences Approach. 3rd Edition.

Boca Raton: Chapman & Hall.

Haisken-DeNew, J. P., and J. R. Frick. 2005. Desktop Companion to the German

Socio-Economic Panel (SOEP). Technical report.

Hinich, M. J., and M. C. Munger. 1992. “A spatial theory of ideology.” Journal of

Theoretical Politics 4 (1): 5–30.

Hinich, M. J., and M. C. Munger. 1996. Ideology and the theory of political choice.

University of Michigan Press.

Holt, C. A., and S. K. Laury. 2002. “Risk aversion and incentive effects.” American

Economic Review 92 (5): 1644–1655.

Iversen, T., and D. Soskice. 2001. “An Asset Theory of Social Policy Preferences.”

American Political Science Review 95 (4): 875–893.

Jackman, S. 2008. “Measurement.” In Oxford Handbook of Political Methodology, ed.

J. M. Box-steffensmeier, H. E. Brady, and D. Collier. Oxford: Oxford University

Press.

Jackman, S. D. 2009. Bayesian Analysis for the Social Sciences. New York: Wiley.

Kam, C. D. 2012. “Risk attitudes and political participation.” American Journal of

Political Science 56 (4): 817–836.

Moene, K. O., and M. Wallerstein. 2001. “Inequality, Social Insurance and Redistribution.” American Political Science Review 95 (4): 859–874.

Mondak, J. J., and K. D. Halperin. 2008. “A framework for the study of personality

and political behaviour.” British Journal of Political Science 38 (02): 335–362.

27

Mondak, J. J., M. V. Hibbing, D. Canache, M. A. Seligson, and M. R. Anderson. 2010.

“Personality and civic engagement: An integrative framework for the study of trait

effects on political behavior.” American Political Science Review 104 (01): 85–110.

Morton, R., J.-R. Tyran, and E. Wengstrom. 2011. “Income and Ideology: How Personality Traits, Cognitive Abilities, and Education Shape Political Attitudes.” Discussion

Papers. Department of Economics, University of Copenhagen.

Quinn, K. M. 2004. “Bayesian Factor Analysis for Mixed Ordinal and Continuous

Responses.” Political Analysis 12: 338–353.

Rehm, P. 2009. “Risks and Redistribution: An Individual-Level Analysis.” Comparative

Political Studies 42 (7): 855–881.

Rehm, P. 2011a. “Risk Inequality and the Polarized American Electorate.” British

Journal of Political Science 41 (2): 363–387.

Rehm, P. 2011b. “Social policy by popular demand.” World Politics 63 (02): 271–299.

Rehm, P., J. S. Hacker, and M. Schlesinger. 2012. “Insecure alliances: Risk, inequality,

and support for the welfare state.” American Political Science Review 106 (02):

386–406.

Rossi, P. 2014. Bayesian Non-and Semi-parametric Methods and Applications. Princeton:

Princeton University Press.

Skrondal, A., and S. Rabe-Hesketh. 2004. Generalized latent variable modeling: Multilevel, longitudinal and structural equation models. Boca Raton: Chapman & Hall.

Vecchione, M., and G. V. Caprara. 2009. “Personality determinants of political participation: The contribution of traits and self-efficacy beliefs.” Personality and Individual

Differences 46 (4): 487–492.

Verhulst, B., L. J. Eaves, and P. K. Hatemi. 2012. “Correlation not causation: The

relationship between personality traits and political ideologies.” American Journal

of Political Science 56 (1): 34–51.

Wagner, G. G., J. R. Frick, and J. Schupp. 2007. “The German Socio-Economic Panel

Study (SOEP)–Scope, Evolution and Enhancements.” Schmollers Jahrbuch 127 (1):

139–169.

Wansbeek, T., and E. Meijer. 2000. Measurement Error and Latent Variables in Econometrics. Amsterdam: North Holland.

28

Weber, E. U., A.-R. Blais, and N. E. Betz. 2002. “A domain-specific risk-attitude scale:

Measuring risk perceptions and risk behaviors.” Journal of Behavioral Decision

Making 15: 263–290.

Wedel, M., and W. A. Kamakura. 2001. “Factor analysis with (mixed) observed and

latent variables in the exponential family.” Psychometrika 66 (4): 515–530.

Wildavsky, A. 1987. “Choosing preferences by constructing institutions: A cultural

theory of preference formation.” American Political Science Review 81 (01): 3–21.

29

A. APPENDIX

A.1. Equilibrium Uniqueness and Existence

∗

Proposition 2. An equilibrium is a triple, {ls∗ , τ∗s , x i,s

}. For each s, an equilibrium exists

and is unique.

We begin at the final stage of the model. Only employed workers supply labor, so

each employed worker chooses l to maximize utility u(c E ) subject to her consumption

(5), and taking taxes and transfers as given. Taking the derivative of this equation

and setting it equal to zero, leads to the unique equilibrium value of labor supply for

each type:

l w∗ = Cl−1 [(1 − τ)w]

(12)

Existence and uniqueness is ensured by the convexity of C(·). Convexity of C(·) also

implies that l w∗ is increasing in l, decreasing in τ. Also note that l w∗ does not depend

on σ. Hence, we subscript with w rather than s. For the same reason we will write

income as yw = wl w∗ . Finally we will assume that Cl−1 (·) is a weakly concave function,

which will ensure that the second-order conditions are straightforwardly met.

We turn now to workers’ social spending preferences. The program is:

max qs u(c E ) + (1 − qs )u(cN )

τ

(13)

subject to the consumption constraints (5) and (6) and the government budget

constraint (4). Applying the envelope theorem, this gives the first-order condition for

τ as

1−χ

χ

0

qs u (c E )

(z̄ + τz̄τ ) − yw + (1 − qs )u (cN )

(z̄ + τz̄τ ) = 0.

q̄

1 − q̄

0

(14)

Two implications should be clear from this first-order condition. First, z̄ > 0 represents

the marginal benefit of the transfer and τz̄τ < 0 represents the marginal cost. Second,

since − yw < 0, satisfing the first-order condition requires (z̄ + τz̄τ ) − yw ≤ 0 and

(z̄ + τz̄τ ) ≥ 0. These implications will be important for the proofs that follow.

To give the first-order condition some intuition, let ξ(z̄, τ) ≡ z̄τ (τ/z̄) < 0 be the

elasticity of public funds with respect to the tax rate. Then when social spending is

targeted to the unemployed (χ = 0), after rearranging (14) the optimal level of social

30

spending τ∗s is given by:

qs

1−

1 − qs

u0 (c E )

u0 (cN )

yw

+ (1 − q̄)ξ(z̄, τ) = 0

z̄

(15)

When transfers are universal (χ = q̄), the first-order condition can be rearranged to

give:

qs

1−

1 − qs

i

u0 (c E ) h yw

− (1 + ξ(z̄, τ)) + ξ(z̄, τ) = 0.

z̄

u0 (cN )

(16)

Finally, when transfers are targeted to employed workers (χ = 1), the first-order

condition is:

yw

+ ξ(z̄, τ) = 0

(17)

z̄

These formulations of the first-order condition are convenient, since they capture

1−

the three critical effects of Proposition 1. The term qs /(1 − qs ) captures the effect

of unemployment risk. The u0 (c E )/u0 (cN ) term is the marginal rate of substitution

between employed and unemployed consumption, and captures the effect of risk aversion. The yw /z̄ term is the ratio between individual income and average government

revenues, which captures the (pure) income effect.

It is easily checked that the second-order condition is satisfied. From the concavity

of Cl−1 (·), differentiating equation (14) once again with respect to τ yields a strictly

negative expression. This condition ensures the existence and uniqueness of an

individually-optimal choice of social spending, τ∗s .

Finally, we derive the effect of social spending preferences on an individuals ideological location. Let policy i represent social spending, then x̄ i,s (τ∗s ) = τ∗s . Then, choosing

∗

x i to maximize in equation (1), it is clear that the solution is x i,s

= x̄ i,s = τ∗s . we

then can say that anything that increases (decreases) an individual s’s social spending

∗

preferences moves her ideologically to the left (right): ∂ x i,s

/∂ τ∗s = 1 > 0.

A.2. Proof of Proposition 1

Since the second-order conditions are satisfied, by the implicit function theorem

the sign of ∂ τ∗s /∂ m for any parameter m is the sign of dm. Further, by applying the

31

Chain Rule, it then follows that a change in any parameter has an effect with identical

∗

/∂ τ∗s · ∂ τ∗s /∂ m) = sign(∂ τ∗s /∂ m).

sign, that is, sign(∂ x i,s

Beginning with the effects of risk aversion, differentiate equation (14) with respect

to σ to get:

χ

− qs u (c E ) ln(c E )

(z̄ + τz̄τ ) − yw

q̄

0

1−χ

(z̄ + τz̄τ ) (18)

− (1 − qs )u (cN ) ln(cN )

1 − q̄

0

This equation is identical to (14) except the ln(·) terms and the possible changes in

sign. Therefore, since c E ≥ cN is always true and implies ln(c E ) ≥ ln(cN ), the entire

expression is always positive.24 Note that in the case χ = 1, equation (18) becomes

1

−qs u (c E ) ln(c E )

(z̄ + τz̄τ ) − yw ,

q̄

0

which from the first-order condition in that case, (1/q̄)(z̄ + τz̄τ ) − yw = 0, must be

zero. Intuitively, risk aversion plays no role in social-policy preferences when transfers

have no insurance element to them. Thus, except in this limiting case, an increase in

risk aversion always increases social spending preferences: ∂ τ∗s /∂ σ > 0.

Turning to income, differentiate equation (14) with respect to yw and write:

u0 (c E )(σµ − 1)

(19)

using the fact that σ = −cu00 (c)/u0 (c) and where,

µ=

[ yw − (χ/q̄)(z̄ + τz̄τ )](1 − τ)

.

[(1 − τ) yw + (χ/q̄)τz̄ − C(l)]

(20)

Moene and Wallerstein (2001) call µ the elasticity of consumption when working

with respect to 1 − τ. Start with the case χ = 0, which makes µ in equation (20),

24

Note in particular that the term on the left of (18) is positive for all c E ≥ 1 and larger in absolute value

than the term on the right, which is nonpositive for all cN ≥ 1. For all c E ≥ 1 and all 0 ≤ cN < 1,

the whole expression is positive. Finally, for all 0 ≤ c E < 1 and all 0 ≤ cN < 1 the term on the left is

negative and smaller in absolute value than the term on the right, which is positive, which again

makes the entire expression positive.

32

denoted µ0 = (1 − τ) yw /[(1 − τ) yw − C(l)] > 1. Let σ0 be the value of σ that gives

σ0 µ0 − 1 = 0. Then equation (19) is nonnegative for all σ ≥ σ0 and negative for all

σ < σ0 . Thus, in the case χ = 0, ∂ τ∗s /∂ yw ≥ 0 for all σ ≥ σ0 and ∂ τ∗s /∂ yw < 0 for

all σ < σ0 .

An analogous argument holds for the case χ = q̄. Let µ00 be the value of (20) when

χ = q̄. For any value of τ, we have yw − (z̄ + τz̄τ ) < yw and (1 − τ) yw + τz̄ − C(l) >

(1 − τ) yw − C(l). Therefore, it is clear that [ yw − (z̄ + τz̄τ )](1 − τ)/[(1 − τ) yw + τz̄ −

C(l)] = µ00 < µ0 . This implies that σ00 > σ0 , where σ00 is the value of σ for which (19)

equals zero when χ = q̄. Thus, in the case χ = q̄, ∂ τ∗s /∂ yw ≥ 0 for all σ ≥ σ00 and

∂ τ∗s /∂ yw < 0 for all σ < σ00 .

Finally, for χ = 1, this value of χ implies from the first-order condition that

(1/q̄)(z̄ + τz̄τ ) − yw = 0. Hence, (19) is negative for χ = 1 and ∂ τ∗s /∂ yw < 0 for all

σ.

Finally, we examine the effects of employment and unemployment. Differentiating

equation (14) with respect to qs we obtain:

χ

1−χ

0

u (c E )

(z̄ + τz̄τ ) − yw − u (cN )

(z̄ + τz̄τ ) ≤ 0

q̄

1 − q̄

0

(21)

which is negative by the first-order condition. Note that for χ = 1, this expression

is equal to zero, so some universality is again essential for unemployment risk to

influence social spending preferences. Thus, s’s ideal tax rate is decreasing in her

employment rate, and therefore increasing in her unemployment rate: ∂ τ∗s /∂ (1−qs ) ≥

0 for all χ < 1.

33

A.3. Data details

Table A.1 shows descriptive statistics of all variables.

Descriptive statistics

Table A.1: Descriptive statistics of estimation sample

Mean

Risks while driving

Financial risks

Risks in leisure, sports

Risks in occupation

General risk taking

Ideology (right–left)

Age

Education

Income distance (in 1000 Euro)

Household size

Unemployment experience

Hours worked

Female

East

Unemployed

Self-employed

Foreigner

Union member

Calculation of wealth

SD

6.78

2.57

8.02

2.14

6.60

2.57

6.54

2.65

6.12

2.16

5.33

1.63

44.45 11.86

12.38

2.60

0.00

2.00

2.80

1.24

1.17

2.51

27.84 20.36

52%

27%

8%

7%

6%

14%

Obtaining information on wealth on the individual level is

notoriously difficult. In 2007 SOEP includes a comprehensive wealth module with a

detailed set of wealth related items similar to the British Household Panel Study. An

individuals net wealth is captured by several components displayed in Table A.2.

Missing responses are particularly problematic when trying to assess an individuals

wealth (especially if nonresponse is systematically related to certain wealth components). SOEP provides imputation (accounting for selection effects) of all wealth

components using detailed respondent information. For an extensive documentation

see Frick, Grabka, and Marcus (2007). Here we use a simple aggregate of all imputed

values.

Figure A.1 plots the kernel density estimate of wealth in our sample.

34

Table A.2: Wealth components

property ownership

+ owner-occupied property

+ financial & assets

+ business assets

+ tangible assets

+ private pensions (incl. life insurance)

= Gross wealth

– debt owner-occupied property

– other property debt

– consumer debt

= Net wealth

0.015

0.010

0.000

0.005

Density

0.020

0.025

Note: Property values are evaluated at market prices

0

50

100

150

200

250

300

Wealth [in 1000s]

Figure A.1: Density of wealth in sample

A.4. Prior parameter distributions and values

Table A.3 shows prior distributions and prior values for our model in the main

text. Columns ‘Prior test’ 1 and 2 display alternative parametrizations to check

for the robustness of our analysis agains changes in prior values. Test 1 specifies

35

a priori variances 10 times larger as in our main model. Test 2 uses a different

parametrization of the inverse gamma prior for all variances in the model. Under both

prior checks we obtain virtually indistinguishable parameter estimates for our central

model parameters. For example, after rounding to two significant digits, under both

test 1 and 2 we estimate γ as 0.05 with a posterior SD of 0.01.

36

37

b

a

N (m0 , v0 )

N (m0 , v0 )

G −1 (a0 , b0 )

G −1 (a0 , b0 )

N (m0 , v0 )

N (m0 , v0 )

G −1 (a0 , b0 )

λj,

µj,

εj,

ω

βk ,

γ

υ

m0 = 0, v0 = 100

m0 = 0, v0 = 100

a0 = 0.001, b0 = 0.001

a0 = 0.001, b0 = 0.001

m0 = 0, v0 = 100

m0 = 0, v0 = 100

a0 = 0.001, b0 = 0.001

Main model

m0 = 0, v0 = 1000

m0 = 0, v0 = 1000

a0 = 0.001, b0 = 0.001

a0 = 0.001, b0 = 0.001

m0 = 0, v0 = 1000

m0 = 0, v0 = 1000

a0 = 0.001, b0 = 0.001

Prior test 1

Largest observed absolute parameter estimate difference (prior test 1 and 2 compared to main model)

K = ncol(X )

k = 1, . . . , K b

j = 2, . . . , J

j = 1, . . . , J

j = 1, . . . , J

Prior distribution

Parameter

Prior values

Table A.3: Prior parameter distributions and values.

m0 = 0, v0 = 100

m0 = 0, v0 = 100

a0 = 1, b0 = 0.005

a0 = 1, b0 = 0.005

m0 = 0, v0 = 100

m0 = 0, v0 = 100

a0 = 1, b0 = 0.005

Prior test 2

0.0003

0.0001

0.0001

0.0002

0.0004

0.0000

0.0001

∆a