Diploma pre-sessional Macroeconomics Laura Sochat 29/09-01/10

advertisement

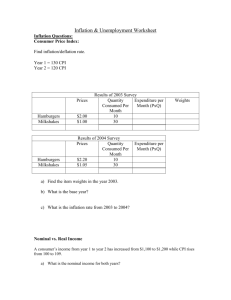

Diploma pre-sessional Macroeconomics Laura Sochat 29/09-01/10 Based on EC108 lecture notes Laura Sochat EC201 classes every Thursday at 17.00 in S0.13. Email: Laura.Sochat@warwick.ac.uk Office hours (S0.86): Monday: 15.00-16.00 Thursday: 11.00-12.00 Check my webpage regularly, as I will announce changes on there, if any. Gross Domestic Product Market value of all final goods and services produced within an economy in a given period of time. How do you compute GDP? Can either be seen as total income, or total expenditure. Why must those be equal? Suppose economy produces three goods- X, Y, and Z. 𝐺𝐺𝐺 = (𝑃𝑥 × 𝑄𝑥 ) + (𝑃𝑦 × 𝑄𝑦 ) + (𝑃𝑧 × 𝑄𝑧 ) Treatment of inventories, used good and intermediate goods and services. Class exercise: using value added to compute GDP Weat = 1£ Flour = 3£ Bread = 6£ GDP (continued) Nominal vs. Real GDP Nominal GDP: Value at current prices. If prices increase-> Nominal GDP increases. If quantity increase-> Nominal GDP increases Real GDP: Value at a ‘base-year’ prices. Value of real GDP changes only when quantity changes. What is included in GDP Y = I + C + G + NX I is investment, C is consumption, G is Government Spending, and NX is net exports (Exports-Imports) What is the difference between GNP and GDP? Cost of living – Consumer Price Index Measures the level of prices. Computed by collecting the price of thousands of goods and services. Suppose a typical consumer consumes 8 units of good X and 5 units of good Y each month. Different weights attributed to different goods and services depending on their relative importance in the basket of the typical consumer. How would you computer the CPI? Look back.. To what could we compare the CPI to? GDP deflator vs. CPI GDP deflator CPI Includes all goods and services (incl. goods bought by firms and government) Measures the prices of goods and services in the basket of a typical consumer Imported goods are not part of GDP, and therefore not included in the GDP deflator measure. Goods produced elsewhere but consumed domestically are included in the CPI measure The basket of goods and services changes every year. CPI looks at a fixed basket of goods and services over the years. Population Employed Unemployed Not employed but looking for a job Labour force Working in a paid job Available labour to produce goods and services (includes both employed and unemployed persons) Not in the labour force Not employed, and not looking for a job The unemployment rate represents the percentage of the labour force that is unemployed. 𝑁𝑁𝑁𝑁𝑁𝑁 𝑜𝑜 𝑢𝑢𝑢𝑢𝑢𝑢𝑢𝑢𝑢𝑢 𝑈𝑈𝑈𝑈𝑈𝑈𝑈𝑈𝑈𝑈𝑈𝑈 𝑟𝑟𝑟𝑟 = × 100 𝑙𝑙𝑙𝑙𝑙𝑙 𝑓𝑓𝑓𝑓𝑓 The labour force participation rate represents the fraction of the adult population which participates in the labour force. 𝑙𝑙𝑙𝑙𝑙𝑙 𝑓𝑓𝑓𝑓𝑓 𝑙𝑙𝑙𝑙𝑙𝑙 𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝 𝑟𝑟𝑟𝑟 = × 100 𝑎𝑎𝑎𝑎𝑎 𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝 Very quickly: A Closed Economy, market clearing model. Supply side Factors of production and the production function Factors of production are the ‘tools’ used to produce goods and services in the economy Labour, 𝐿 = 𝐿� � Capital, 𝐾 = 𝐾 Output produced using a given amount of capital and labour represents the available technology – This is represented through the production function: 𝑌 = 𝐹 𝐾, 𝐿 Where F is usually assumed to have constant returns to scale. What does this mean? Demand for the factors of production How is the demand for the factors of production determined? A firm will demand each factor of production up until the point where its cost= its benefit Cost = Wages and rent paid to the factors of production Benefits = extra output from an using extra unit of that factor of production (marginal product) Diminishing marginal returns As a factor input is increased, its marginal product falls. Why is that? Demand side Aggregate demand Consumption : Consumer’s demand for goods and services 𝐶 =𝐶 𝑌−𝑇 As disposable income increases, consumption increases. Investment : Demand for investment goods 𝐼 = 𝐼 (𝑟) As r increases, Investment decreases. Why? r represents the cost of borrowing, it is the opportunity cost of using own funds. Government Spending : Government demand for goods and services We assume government spending to be exogenous 𝒀=𝑪 𝒀−𝑻 +𝑰 𝒓 +𝑮 Equilibrium Aggregate demand- 𝑌 = 𝐶 𝑌 − 𝑇 + 𝐼 𝑟 + 𝐺 Aggregate supply- 𝑌 = 𝐹 𝐾, 𝐿 Equilibrium where Demand = Supply 𝐶 𝑌 − 𝑇 + 𝐼 𝑟 + 𝐺 = 𝐹 𝐾, 𝐿 Y, T, G, K and L are given in this model. The real interest rate adjusts to equate demand and supply. We can therefore rewrite this equation such as: � , 𝐿�) 𝐶 𝑌� − 𝑇� + 𝐼 𝑟 + 𝐺̅ = 𝐹(𝐾 Money and Inflation The functions of money Store of value Unit of account It is a way to transfer purchasing power from the present to the future. Prices, debt, are quoted and recorded in term of money. Medium of exchange We use money to buy goods and services Quantity of money: Control and measures Symbol Assets included M1 Checkable deposits + currency in circulation M2 M1 + retail money market mutual fund balances, saving deposits, small time deposits Controlled through monetary policy In many countries today, monetary policy is delegated to independent central banks. Open market operations, discount rate, reserve requirements. Money multiplier (multiplied effect of monetary base on money supply). Quantity Equation How is the quantity of money related to income and prices? 𝑀×𝑉 =𝑃×𝑌 Y represents output, proxy for transactions (T) - the higher the output, the higher the number of transactions will be. P represents the price of one unit of output. PY is therefore the dollar value of output (nominal GDP, remember earlier). V is the income velocity of money, that is the number of times the average pound bill changes hands in a given time period. M represents the quantity of money. Quantity Theory of Money Assuming constant and exogenous velocity, we can look at the effect of a change in the money supply 𝑀 × 𝑉� = 𝑃 × 𝑌 A change in the money supply implies a proportional change in nominal GDP. How is the overall price level determined? Nominal GDP is determined by the money supply (see above), and Y is determined by the factors of production (and the production function) Therefore? Inflation Start by rewriting the quantity theory of money in terms of growth rates: ∆𝑉 =0 𝑉 ∆𝑃 =𝜋 𝑃 ∆𝑀 ∆𝑉 ∆𝑃 ∆𝑌 + = + 𝑀 𝑉 𝑃 𝑌 We can therefore rewrite the quantity theory of money such as: ∆𝑀 ∆𝑌 − =𝜋 𝑌 𝑀 What can you conclude? Inflation and interest rates Denote the nominal interest rate i, the real interest rate r, and inflation, as before, π. 𝑟 =𝑖−𝜋 This is the fisher equation. We saw that the real interest rate adjusts for equilibrium (S=I) An increase in the money supply leads to an increase in inflation An increase in the inflation rate causes a one-to-one increase in the nominal interest rateThis is the fisher effect. The role of expectations- Two real interest rates When making investment decisions, people do not know what inflation will be in the future. They therefore make their decision using their expectations of inflation: 𝑟 = 𝑖 − 𝜋𝑒 Money demand depends on Y, but also on i The nominal interest rate is the opportunity cost of holding money. Given 𝑟, 𝜋 𝑒 and Y, a change in M leads to a change in P of the same percentage. What happens if inflation expectations change? Look at a money demand equation 𝑀 𝑑 = 𝐿(𝑖, 𝑌) 𝑃 Building the IS-LM model Keynesian cross and the IS curve Income is determined by the spending plan of households If people want to spend Firms can sell more The more firms sell, the more they produce The more workers they hire Planned expenditure versus Actual expenditure Why would they differ? Firms may sell more or less than what they have produced Unplanned inventory investment For simplicity, assume that G, T and I are given and constant: 𝑃𝑃 = 𝐶 𝑌 − 𝑇� + 𝐼 ̅ + 𝐺̅ Planned expenditure as a function of Income The Keynesian Cross Equilibrium in the Keynesian cross Suppose you start at point 𝑌𝐴 Actual expenditure > Planned expenditure. Firms are producing more than they are selling Workers get laid off Production decreases until Y is back at its equilibrium level. Multiplier effects: What would be the effect of an increase in G? Of an increase in T? Now let’s look at what happens to income when the interest rate changes… The IS curve The theory of liquidity preference Denote 𝑀 𝑠 to 𝑃 be the supply of real money balances and is assumed to be exogenous, and therefore does not depend on the interest rate. As we saw before, this is not true for the demand for money, more particularly, 𝑀 𝑑 = 𝐿(𝑟, 𝑌) 𝑃 The interest rate adjusts to ensure equilibrium in the market for the most liquid asset- Money. Now let’s look at what happens to the interest rate when income increases… Market for real money balances and the LM curve Short run Equilibrium