Document 12300144

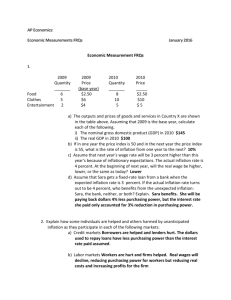

advertisement

Table of Contents

The applicability of the IS-PC-MR model on the UK economy during the crisis by

Jia Wei Mark Choo ........................................................................................................................... 7

On target: an analysis of Abenomics by Chen Yue Lok ..................................................... 16

The Value of Theoretical Models for Real-World Market Analysis by Maryam Khan. 24

A Dynamic, Hierarchical, Bayesian approach to Forecasting the 2014 US Senate

Elections by Roberto Cerina ...................................................................................................... 30

Arming Women With Credit: Why Lending to Women Makes Economic Sense by

Victoria Monro ............................................................................................................................... 46

Effect of the appreciation of the Swiss franc on the Ticinian Job Market by Guido

Tubaldi .............................................................................................................................................. 54

Localised complementary currencies: the new tool for policymakers? The Sardex

exchange system............................................................................................................................... 66

Savings-Linked, Saving Lives: The Role of Conditional Cash Transfers in Financial

Inclusion by Isaac Lim ................................................................................................................. 80

Breaking up Germany: A review of the drivers of social mobility by Dennis

Dinkelmeyer ................................................................................................................................... 92

The effects of television viewing on income aspirations and happiness by Emma

Claydon .......................................................................................................................................... 104

Bringing the Vanguard to the Rearguard: A transformative development model

for Brazil’s backlands By James B Theuerkauf * ............................................................. 116

Addressing the Exchange Rate Puzzle: Forecasting with a Taylor rule inspired

model by Amy Louise Curry.................................................................................................... 131

Poster presentations................................................................................................................. 144

Acknowledgements ................................................................................................................... 144

3

Session 1: Exploring the value of

economic models

5

The applicability of the IS-PC-MR model on the UK economy during

the crisis by Jia Wei Mark Choo

2nd year, UCL Economics

Introduction

Since the 2008 great recession, it has been a very interesting time for macroeconomics. There has

been a movement to revamp how economics is taught, challenging the ability of models and

mathematical equations to map agents’ behaviour and the economy. This debate has inspired my

interest on the applicability of economic theories. It is argued that oversimplification and

generalization of assumptions make models too abstract and impractical, yet, at various points in time,

models have been relatively successful in mapping out general movements in economies. As logical

beings, we are constantly seeking coherence in daily occurrences and given all its drawbacks,

economic models might still currently be the best solution to understanding reality. A core model of

macroeconomics is the IS-PC-MR model (3EM), and having just spent a good portion of time

learning the closed economy 3EM, I thought it was apt to examine if this model accurately reflects

reality and its ability to analyse shocks of such magnitude.

The paper will firstly set up the 3EM, following that, it will apply the model onto the UK closed

economy over 2008. This is done by analysing the Bank of England (BoE) inflation report, drawing

out relevant information specific to the UK domestic economy and applying it to the model. This

paper uses those reports as they are a reliable source of information and they provide the necessary

data for the analysis. I will be picking up key phrases from the BoE report overview in every period

and use it to explain the intuition behind the movements of the curves in the analysis and map out

developments in the economy. After that, I will compare and review the proximity between the

model’s prediction and what actually happened, followed by drawing conclusions about the

applicability of models.

IS-PC-LM Model

The 3EM is a macroeconomic model which incorporates the demand and the supply side of the

economy, and the (CB) Bank’s Monetary Rule at any given period.

IS

The IS curve reflects the demand side of the economy and in the closed economy and it is given as

Consumption + Investment + Government Spending. The components of Consumption and

Investment are negatively related to real interest rate set by the CB. Government Spending is

autonomous.

PC

The Phillips Curve (PC) reflects the supply side of economy. It is generated from the wage- and pricesetting (WS/PS) behaviour of the economy. As workers bargain for real wages and firms setting

prices, the PC is the relation between inflation and output in the economy, where it is a feasible set of

inflation and output pairs for a given rate of expected inflation p .

e

7

MR

The Monetary Rule (MR) curve reflects the best-response behavior of the inflation-targeting central

bank and it is the optimum combinations of output and inflation that the CB will choose subject to the

PC it faces. The Bank of England aims to deliver price stability, growth and employment, i.e. keeping

inflation constant at its target rate of πT and output at its max potential ye in the medium run

equilibrium (MRE). The MR generates the real interest rate (Bank Rate) the CB needs to set to guide

the demand side of the economy towards its target.

3EM analysis against BoE reports

Before I begin, I shall lay out the scope of my analysis. Firstly, I assumed that the UK economy is a

closed economy and assumed away trade, exchange rate and the forex market. This was done not

because the UK economy resembles a closed economy, but for a simplification reason. The aim of the

paper was to observe the newly learnt closed-economy model in practice and thus, the UK was simply

assumed to be purely domestic.

This paper analyses the UK economy specifically in 2008 because it was when the great recession

was unfolding and changing interest rates was still the main tool the Bank of England (BoE) used.

Other tools such as Quantitative Easing started in 2009 and thus, periods after 2008 were left out of

the analysis.

The length of each period of analysis depends on “stickiness” of wages. It will be assumed that the

wage-setting period has a length of three months, in line with the BoE quarterly inflation reports.

Key Quotes from BoE Inflation Report

February 2008

Central projection

“output growth to slow markedly this year and

gradually start to recover” (pg 5)

“pay growth was steady” (ibid)

“some measures of inflation expectations rose” (ibid)

“Higher energy, food and import prices push

inflation up sharply in the near term” (ibid)

“consumer spending growth appeared to soften and

the climate for investment deteriorated” (ibid)

“business surveys and reports from the Bank’s

regional Agents point to a further modest

deceleration in activity in early 2008” (pg 6)

“the extent to which consumer prices increase will

depend on whether businesses and retailers can pass

on higher input costs.” (pg 7)

“Survey measures of businesses intend to pass on

cost increases. But there are indications that retailers

have been accepting lower profit margins in order to

maintain sales volumes” (ibid)

8

Going into period 1, “CPI inflation remained close to the 2% target in December” (BoE, Feb 2008: 5)

at 2.1% and “output growth moderated to around its long-term historical average rate” (ibid). It will

be assumed that the economy is at MRE point z, where central bank is on its target with inflation at

2% and output at ye.

Assuming the great recession only started in the beginning of 2008, the UK economy is hit by a

negative demand shock in period 1. IS curve shifts from IS to IS' and given the current bank rate of

5.50%, The economy moves from point z to point A, with output below ye at y1'.

However, the economy is also experiencing an oil/commodity price rise. CB is away from its bliss

point and forecasts next period’s PC to be at PC(πe=π1’), at a higher inflation rate. Faced with this PC,

CB would like to be on point B on its MR curve with output at y1 and inflation at π1. In order to

achieve this, CB sets r such that when corresponding to IS’, it will result in a lower bank rate than the

current rate. As the fall in domestic demand is forecast to be “modest” and with inflation expectations

rising, the CB has to “balance conflicting risks” and reduced Bank Rate only slightly. This is reflected

in its policy rate falling from 5.50% to 5.25% in its February 2008 Inflation Report.

The oil/energy price increase is analysed as a PC inflation shock instead of modeled by the change in

markup, µ, of the Price-Setting curve because of BoE’s believe that “inflation [will ease] back to a

little above the 2% target in the medium term, as the near-term rise in energy prices drops out of the

twelve-month rate” (ibid: 7). If this shock is interpreted as a supply side disturbance, ye will change

and bank's mandate (ie the MR curve) will change as well. However, this is not the case as the BoE

projects the medium term output to be back to its original level.

Key Quotes from BoE Inflation Report

May 2008

Central projection

“output growth slows markedly through 2008, opening up

a margin of spare capacity. Sluggish income growth and

tighter credit supply dampen consumer spending, while

weaker demand outlook and lower property prices also

weigh on business and residential investment.” (pg 7)

“CPI inflation was 2.5% in March” (pg 5)

“higher energy and import prices push inflation up sharply

in the near term” (ibid)

“Pay growth remained muted” (ibid)

“measures of short-term household inflation expectations

rose again, broadly in line with the recent and prospective

movements in consumer price inflation.” (pg 7)

“The outlook is somewhat weaker than in the February

Report for the first part of the projection” (ibid)

“There were particular uncertainties relating to the

severity of the slowdown and the future path of inflation

expectations.” (pg 8)

In period 2, the forecasted PC(πe=π1’) curve actually happens. This is reflected by an increase in

inflation despite a fall in output as predicted in Feb's report, given bank rate of 5.25%. Economy is

now at point B as predicted.

9

The analysis of the oil/commodity price increase as a PC inflation shock instead of a supply side

shock in period 1 is in accordance with the economic data reflected in the May Report and is justified.

The BoE backs this up by continuing to project that “declining contribution from energy and import

prices, then bring inflation back to around the 2% target in the medium term” (BoE, May 2008: 5).

The negative demand shock continues to persist and demand continues to fall in period 2. The IS

curve shifts leftwards from IS' to IS'' and given the bank rate of 5.25%, there would be a fall in output

from y1 to y2'. This corresponds to point C'.

The high oil and energy prices continue to rise sharply and this leads to the inflation shock to continue

in the next period. CB forecasts next period's PC to be PC(πe=π2’) and faced with this PC, CB would

like to be on point C with output y2 and inflation rate at point π2. This leads to the BoE setting bank

rate to be 5.00%.

Key Quotes from BoE Inflation Report

August 2008

Central projection

“output to be broadly flat over the next year or so, after

which growth gradually recovers”

“Higher energy, food and import prices push inflation

substantially higher over the next few months” (pg 5)

“considerable uncertainty surrounds this outlook”

(ibid)

“output growth eased in the second quarter and surveys

pointed to further slowing in the third” (ibid)

“consumer spending appeared to decelerate as

households’ real incomes were squeezed” and “outlook

for investment deteriorated” (ibid)

“Subsequent data … suggested that growth in Q2 may

have been weaker than provisionally estimated” (pg

6)

“CPI inflation increased to 3.8% in June, reflecting

sharp increases in food and petrol prices” (pg 7)

“companies will over time have to pass the burden of

higher non-labour costs on to households. That will

occur through some combination of lower nominal

wage growth, higher prices and lower employment

growth, implying a reduction in the purchasing power

of households’ incomes.” (ibid)

“CPI inflation is expected to pick up sharply over the

next few months” (ibid)

“Rise in near-term inflation expectations is consistent

with households expecting the rise in inflation to be

temporary” (ibid)

10

In period 3, the forecasted PC(πe=π2’) actually happens. Economy is indeed on point C with output

falling to y2 in previous period and CPI inflation up to 3.8%. Again, the modeling of the oil/energy

price hike via PC inflation shock is justified as in period 2. This is backed up again by the BoE’s

expectation that food and energy prices will fall back in the medium term.

The negative demand shock is a persistent one and continues in period 3. IS curve continues to shift

leftward from IS'' to IS''' and given bank rate at 5.00%, output falls from y2 to y3, from point C to

point D.

Oil/energy prices continue to rise sharply, exacerbating the inflation shock. PC continues to rise to

PC(πe=π3’). Faced with this PC, CB's best response is to be on point D where output is at y3 and

inflation at π3. Given the high levels of inflation, despite the fall in output, CB decides to leave bank

rate unchanged as its best response, guiding the economy to point D.

Key Quotes from BoE Inflation Report

November 2008

Central projection

“Output to continue to fall in the early part of the

forecast, followed by a gradual recovery”

“inflation slows sharply in the near term, as the

contributions from energy and food prices decline”

(pg 5)

Due to fall in outlook for inflation, “committee

judged that a significant reduction in Bank Rate

was necessary in order to meet the 2% target in the

medium term” (pg 8)

“CPI inflation rose to 5.2% in September” (pg 5)

“Near-term outlook for inflation improved

significantly in the wake of sharp falls in

commodity prices” (pg 5)

“Measures of household inflation expectations fell

back and earnings growth remained contained”

(ibid)

“The outlook for domestic demand deteriorated

markedly” and “prospects for investment

worsened” (pg 6)

“key drivers are a sharp tightening in the supply of

money and credit, subdued growth in incomes and

past falls in asset prices” (pg 7)

“The prospects for economic growth and inflation

are judged to be unusually uncertain, reflecting

the exceptional economic and financial factors

affecting the outlook.” (pg 8)

11

In period 4, the forecasted PC(πe=π3’) actually happens as inflation spiked up to 5.2% and output

continued to fall as predicted in Aug report. Economy is on point D. Negative demand shock

continues to persist with IS shifting leftward from IS''' to IS''''. Given rate of 5.00%, this corresponds

to a fall in output to y4' on point E'.

Oil/energy prices have fallen and similar to the previous periods, it will be interpreted with a fall in

inflation expectations. PC shifts down to PC(πe=π4’). As inflation expectations have eased, CB is able

to pursue higher output without compromising its inflation aims. CB reduced bank rate strongly by 2

percentage points to 3.00%, aiming to increase output to y4 and a lower inflation rate to π4.

However, looking at the February 2009 inflation report, the UK economy did not behave as the 3EM

predicted. Though “CPI inflation fell to 3.1% in December” (BoE, February 2009: 5), as rightly

predicted from the fall in PC, “GDP contracted sharply in the fourth quarter of 2008” (ibid), despite a

lowering of the bank rate. This deviation could possibly be explained by the UK economy

experiencing “a substantially larger (GDP) decline than envisaged at the time of the November

Report” (ibid: 6). The IS curve shifted leftward more than the BoE expected and the ‘actual’ IS curve

is at IS’’’’a instead of IS’’’’. At bank rate of 3%, the economy is on point Ea rather than E, with output

falling to y4a and inflation falling to π4a. This is now more consistent with the data of Q4 2008 as

reported in the February 2009 report.

Analysis results compared against reality

As we can see, especially in the first 3 periods, the 3EM correctly modeled the general directions of

inflation, output and Bank Rate and the results were somewhat congruent with the data from the BOE

reports. This gives us a good intuition behind the interaction between the IS, PC and MR curves.

However, complication started in period 4, especially when the crisis was reaching its zenith. In the

November 2008 report, the BoE expected “output to continue to fall”, yet my analysis via the models

did not accurately account for this fall, but even predicted a rise in output. With extra data from

February 2009 report, I attempted to correct my analysis and was slightly more successful in

representing the data.

Possible reasons for differences

Some of the possible reasons for the deviation of my analysis of the 3EM and the information of the

UK economy from the BoE statements will be address below.

Bank of England’s uncertainties

Firstly, the BoE itself is unsure of the situation of the economy. There are lags and measurement

uncertainties in collecting economic data, especially for GDP. In order to project inflation, output and

accordingly set the bank rate in the next period, it is ideal that the CB has perfect information about

the current situation of the economy and future developments. The model assumes that the CB is an

omniscient agent, however, this is far from the case in reality. Though the BoE has rightly predicted a

slowdown, they were unable to predict the extent of the slowdown. Also, there was uncertainty over

the permanency of the negative demand shock. This uncertainty is clearly evident in BoE’s method of

projecting the future of the UK economy via fan diagrams.

The BoE also cannot truly interpret all the economic information and data they have gathered. Given

the complexity of the economy and the limited ability of the Monetary Policy Committee, shocks

cannot be accurately identified and explained. This is clear in the case of the energy prices shock that

accompanied the negative demand shock. The BoE was unsure if firms were going to pass on the

increase in import costs to higher prices, lowering wages or retrenching workers. This makes mapping

12

the energy price shock, as a simple inflation shock, or a supply side shock, or a combination of both,

extremely difficult.

Problems with the 3EM

Firstly, some of the assumptions embedded in the 3EM are not representative of reality. (1) The 3EM

assumes that agents in the demand and supply side of the economy are homogenous. However, this is

not the case as every agent has different preferences and behaviours. (2) The PC is assumed to have

adaptive expectations, while in reality, it tends to be a mix between rational and adaptive

expectations. (3) In order for the CB to be able to have an impact on the economy, it has to be

credible for the demand and supply side of the economy to react to its actions. The BoE is simply

assumed to be credible.

Secondly, the 3EM fails to account for the financial sector, which played an instrumental role in 2008

great recession. The 3EM ignores “characteristics of the financial system that can create vulnerability

to a financial crisis, with implications for fiscal balance” (Carlin and Soskice, 2015: xii). In order to

better understand the global economy, the financial system has to be integrated into macroeconomic

models. Some of such models are proposed in the textbook Macroeconomics: Institutions, Instability,

and the Financial System by Wendy Carlin and David Soskice.

Thirdly, monetary policy in practice is far more complex than the CB setting real interest rates as the

driving force to guide the economy. In practice, other factors such as asset prices, expectations and

confidence, and exchange rates affect Monetary Policy (Carlin and Soskice, 2015: 479). The 3EM

also assumes the Bank Rate is the only method of affecting output, but there are classical mechanisms

or market clearing mechanisms that will put pressure on output. These pressures affect the economy

naturally when output is in disequilibrium. In the 3EM, this is assumed away.

Another possible reason for the deviation between the projection of the BoE and reality attributable to

the model is the assumption that the real rate set by the CB is the rate of credit of the economy.

However, this is not the case as BoE Bank Rate and actual lending rates, such as LIBOR, were not

identical. Even the BoE reports acknowledge this drawback and projects its view on output and

inflation “assuming the bank rate follows market yields”.

When using the 3EM, the economy is viewed as static period blocks. Economic data in every period

is analysed as changes in absolute value and block shifting of IS and/or PC curves. In reality, this is

hardly the case as fluid movements and constant gradual shifting is a better representation of the

behaviour of the economy.

Another setback of the 3EM is that it can only analyse single shocks at a time. When multiple shocks

hit the economy in reality, the 3EM cannot accurately analyse changes to inflation and output.

Multiple shocks tend to come hand in hand and when these shocks affect economic variables in

opposite direction, the simple 3EM is unable to discern which shock outweighs which or generate

accurately the final outcome.

Limitations to my methodology

Another possible explanation for the difference between the model analysis and reality is the

existence of limitations in the process of my analysis.

Firstly, I assumed that the UK economy is a closed economy. However, the UK is extremely open and

globalised, it is not good representation of a closed economy. Factors such as trade, exchange rates

and the forex market are needed to be accountable in order to have a more accurate interpretation of

the UK economy.

13

Secondly, I assumed that the UK economy initially started at equilibrium output ye and that it has

reached its max potential, ie that it is not growing anymore. Thus, I treated the slowing of output

growth in the BoE statements as comparable to a fall in output. This poses 2 problems. (1) I have

inaccurately used the model right from the beginning. Instead of modeling a growing economy with

intrinsically non-static IS, PC and MR curves, I assumed that the economy is static at MRE for

simplification. (2) The UK economy might not have been at ye at the start of 2008. The issue of

deciding what exactly is “equilibrium output” limits the accuracy of my analysis.

Thirdly, when analysing the economic data from the reports onto the model, I was neither pedantic

nor technical in taking into account the exact change in output, inflation and bank rate. Economic

information were merely modeled as direction shifting on the 3 curves and not meticulously drawn to

scale. This lack of accuracy on my part possibly allowed for a substantial margin of error for my

model analysis.

Fourthly, as this paper is analysing past events, there is a possibility of hindsight bias in my modeling.

I was presented with an ‘end point’ to work towards and that might have blinded my analysis. Instead

of simulating present time economic data analysis, I might have fallen into the trap of forcing the

model to fit the data.

Fifthly, there are many ways to interpret the same economic data and therefore my interpretation is

neither the only nor the ‘right’ interpretation. Even the Monetary Policy Committee themselves are

using a variation of the 3EM as a tool! An example is mapping the oil/energy price shock as a fullfledged PC inflation shock. As pointed out under the section of BoE’s uncertainty, I do not know the

extent of the shock as a temporary PC inflation shock or having deeper supply side repercussions.

Others might interpret such data differently and will ultimately get very different results.

Strengths and limitations of modeling

After observing a core macroeconomic model in practice, we can now look at the strengths and

limitations of modeling in economics.

Strengths

It is argued that economic models can help us understand the mechanisms of economics and in the

case of the 3EM, macroeconomics. The 3EM assists us in understanding the effects of individual

policies of the CB for the next periods given the best information we have on what has occurred in

practice. As such, models help us analyse a very complex world by breaking down data into sections

and add clarity to that understanding.

Limitations

On the other hand, it is argued that as the global economy is extremely complex and with economic

models being extremely simple in comparison, results from modeling is inaccurate and unreliable.

The unrepresentative assumptions and oversimplifications possibly make models impractical and

obsolete. Many shocks and developments were bombarding the economy during the great recession

and the 3EM might be too simplified to handle such developments.

Mathematics, the tenet of economic models, tends to create general equations, unnecessarily

standardising economic agents and their behaviour. In such equations, parameters and variables are

given values within models. However, the true values of such parameters are unknown and possible

constantly changing! It is argued that economics should not be treated this way as the generalisations

destroy details which are pertinent to social sciences. This is because in reality, there exists so many

14

different actors with multiple fast-moving developments happening at the same time, it is impossible

to trace out what exactly is happening in the economy.

From this paper’s analysis, we can see a glimpse of the workability of models. A model is analogous

to a ‘machine’, churning out information based on the ‘settings’ input. Though it is obvious that it

cannot exactly predict the outcome of reality per se, based on the information that is put into the

machine of the model, it does however reflect quite accurately what happens and/or what can happen.

Models are effective in mapping predictions BUT NOT PREDICT. This is evident in the analysis of

period 4 where after the addition of the data from the February 2009 report, the model produced a

closer match to reality.

Conclusion

“Essentially, all models are wrong, but some are useful” (Box, 1987: 424). Though models might be

an unrepresentative reflection of reality with all its illogical assumptions and oversimplifications,

models do indeed help us map out our thoughts and give structure to our analysis of economics. The

key understanding of modeling, given its extreme nature of its benefits and limitations, is to be able to

have balance, and to use models sensibly and wisely. We have to discern for ourselves which

variables are important and prudently apply them in modeling. The fact that everyone has their own

interpretation of models and parameters, the onus is on economists to explain their intuition behind

their interpretations when modeling. And in turn, it is up to readers to use their own intuition to

critique or accept the intuition. As according to Lars Peter Hansen (2014), “models are not exact

replications to reality, (and at the) end of day, it is only some type of approximation. They are

simplifications and they are not perfect. Instead of dismissing imperfect models…[he prefers] to use

them in sensible ways.” After all, models might be all that we have.

Bibliography

Bank of England, 2008, Inflation Report: February 2008,

http://www.bankofengland.co.uk/publications/Documents/inflationreport/ir08feb.pdf, last assessed 2nd

Mar 2015

Bank of England, 2008, Inflation Report: May 2008,

http://www.bankofengland.co.uk/publications/Documents/inflationreport/ir08may.pdf, last assessed

2nd Mar 2015

Bank of England, 2008, Inflation Report: August 2008,

http://www.bankofengland.co.uk/publications/Documents/inflationreport/ir08aug.pdf, last assessed

2nd Mar 2015

Bank of England, 2008, Inflation Report: November 2008,

http://www.bankofengland.co.uk/publications/Documents/inflationreport/ir08nov.pdf, last assessed

2nd Mar 2015

Bank of England, 2009, Inflation Report: February 2009,

http://www.bankofengland.co.uk/publications/Documents/inflationreport/ir09feb.pdf, last assessed 2nd

Mar 2015

Box, G. E. P and Draper, N. R., 1987, Empirical Model-Building and Response Surfaces, United

Kingdom: Wiley

Carlin, W., and Soskice, D., 2015, Macroeconomics: Institutions, Instability, and the Financial

System, United Kingdom: Oxford University Press

Hansen, L. P., 4th Dec 2014, The Consequences of Uncertainty, speech, Sheikh Zayed Lecture

Theatre, New Academic Building, London School of Economics and Political Science, United

Kingdom

15

On target: an analysis of Abenomics by Chen Yue Lok

2nd year, UCL Economics

Introduction

What can one do when the economy has been experiencing stagnation and falling prices for two

decades? Japan’s Prime Minister Shinzo Abe hopes that his response, the three-pronged Abenomics

is the correct answer that can pull Japan out of the “Lost Decades”. Japan and the world are looking

at this economic experiment with much intent, and this paper aims to answer the question on

everyone’s mind: “Is it working?” This paper attempts to do this by providing a preliminary

assessment of these policies.

Japanese economic policy is an issue worth looking into for several reasons. Firstly, Japan’s

macroeconomic environment is an unprecedentedly challenging one; stagnation for over two decades,

a deflationary period longer than that of the Great Depression of 1873 (Metzler, 2013), and a

pessimistic corporate outlook. All this is further exacerbated by a diminishing demographic dividend.

Previous policy responses have been criticized as being insufficiently aggressive in tackling Japan’s

economic woes. This is where Abenomics comes in; three massive stimulus packages, aggressive

monetary easing neither the US Federal Reserve nor the European Central Bank has dared attempt,

and structural reforms to address underlying long term issues in the Japanese economy. If Abenomics

works out, it will be credited with one of the most spectacular economic comebacks in history.

But Abenomics also has implications beyond the Japanese archipelago. Developed countries are

fearing that they themselves will experience their own lost decade in the aftermath of the recession of

2007. Policymakers in economies such as the United States and the European Union have crafted

policies which share similarities with Shinzo Abe’s package. Should Abe’s project fail, doubt will

settle on their own policy responses as well. Will Abenomics success lead to its emulation in other

countries? Or will it end up being a precautionary tale of macroeconomic folly? This is the question

this essay tries to answer.

The “Three Arrows”

i.

Monetary Policy Regime Shift

The first arrow of Abenomics brings about a shift in the monetary policy regime. A few major

changes have been done here. Firstly, Abe has instructed the Bank of Japan to set an inflation target

of 2% - a level that has rarely been hit since the early 1990s. This is a shift away from previous Bank

of Japan policy, where the Bank has vigorously resisted any calls for higher inflation (Hausman and

Wieland, 2014).

Secondly, a new bank governor has been appointed. Haruhiko Kuroda has been an aggressive critic

of the previously passive policy of the bank. He is an avid supporter of Abenomics’ aim of reflation,

and has expressed willingness to spearhead “all-out efforts to utilize every possible resource” in order

to overcome deflation (Bank of Japan, 2013).

Thirdly, the policy instrument has shifted away from the overnight policy rate to the monetary base.

The new governor has described the tools as “Quantitative and Qualitative Easing (QQE)”. The

Bank’s quantitative easing program would be the largest that has been attempted in economic history,

16

and qualitative easing in the form of expectation management aims to support the efforts to combat

deflation.

ii.

Fiscal Stimulus

The second arrow consists of massive government spending packages, in an attempt to stimulate

aggregate demand. While using fiscal policy to boost the economy is not a new idea, what sets it

apart is its sheer size. There have been three stimulus packages so far; an initial package of of ¥10.3

trillion, followed by another round worth ¥5.5 trillion in April 2014. More recently, an emergency

package worth ¥3.5 trillion was passed in December 2014, as fears of recession and deflation remerge

(The Economist, 2014). How much firepower is left in this arrow is an open question however, as the

burden of the government’s debt (around 240% of GDP) means that future fiscal stimulus will be

constrained.

iii.

Structural Reforms

Reforms to the supply side of the economy will constitute the third arrow of Abenomics. Japan’s

economic problems are closely related to rigidities in key sectors such as energy and healthcare,

relatively high costs of business and the country’s diminishing workforce due to low participation

rates from women and an aging population. As to date, progress in this area has been relatively slow,

and most of the spotlight has been on monetary policy and fiscal stimulus.

Abenomics and the IS-PC-MR model.

In order to explain the rationale and outcomes of Abenomics, this paper will use the New Keynesian

IS-PC-MR model (Carlin and Soskice, 2005). We first use the standard model to explain Japan’s

economic situation, then make some adjustments to account for the changes Abenomics has brought

about. We then use the adjusted model to check the theoretical rationale for Abenomics. For

pragmatic purposes, we will limit the modelling to a closed economy.

We start the typical case to describe Japan’s situation with a large negative demand shock (reflecting

the abrupt stop of Japan’s economic rise in 1990). The large shock leaves output below equilibrium,

and inflation below target. The central bank then forecasts the lower Phillips curve for the next

period, and attempts to set a new interest rate based on the IS curve.

Here is where conventional monetary policy in Japan is rendered ineffective. The central bank has hit

the zero lower bound on interest rates, and is unable to pick the desired interest rate to generate its

best response output gap. This suboptimal response means that output is unable to increase much, and

inflation remains low. This feeds into inflation expectations for the next period (modelled by the

further lowering of the Phillips Curve), and we can see that inflation continues to spiral downwards

for the following periods. This is the liquidity trap Japan has found itself stuck with for the previous

two decades.

In order to analyze Abenomics using the model, a few adjustments need to be made to reflect Japan’s

situation.

a. The zero lower bound will be removed from the model, giving the central bank the ability to

lower real interest rates as much as they want. This is reflected by the shift in policy

instrument from the overnight policy rate to quantitative easing, which aims to influence the

borrowing-relevant interest rate directly, rather than indirectly via the overnight rate.

b. We will start the medium-run equilibrium at a negative inflation rate, as this reflects the

“deflationary equilibrium” that Japan has been experiencing. This is also a reflection of the

Bank of Japan’s monetary policy, which has a vaguely define goal of price stability.

17

We will account for the first two arrows of Abenomics in the following ways;

a.

b.

c.

d.

The fiscal stimulus will be modelled via an upward shift in the IS curve.

The new inflation target will be reflected in a shift of the MR curve.

The usage of quantitative easing is reflected in the removal of the zero lower bound.

Supply-side policies cause an exogenous shift in the equilibrium level out output.

We start the modelling by simultaneous shifts in both the IS and MR curves, reflecting fiscal stimulus

and a new inflation target respectively. This causes current output and inflation to be lower than the

new medium run equilibrium, and the central bank forecasts the Phillips curve based on the new

medium run equilibrium and lowers interest rates in order to increase both output and inflation. As

the policy instrument is now quantitative easing, it can be said that the zero lower bound no longer

constrains the policy maker. The next period sees the economy move to a point of higher output and

inflation, and the central bank subsequently increases real interest rate gradually in following periods

until inflation is at target.

Figure 1: The IS-PC-MR model explaining Abenomics

Judging Abenomics

1. Output and Growth

Both the first and second arrows aim to revive Japan’s economic growth, and a rise in output would

definitely be welcome news. Since Abe’s introduction of his economic policies, there has been an

upward motion in both nominal and real GDP. Although the wide gap between the two underlines the

18

worries over stubbornly low inflation, Abenomics is reasonably successful in boosting Japan’s output.

This can be seen especially in nominal GDP, which is trending towards pre-crisis levels.

Figure 2: Real and Nominal GDP of Japan (Federal Reserve of St Louis, 2015)

In addition to large fiscal stimuli and quantitative easing, a few tailwinds are helping output figures as

well. A depreciating yen as well as low commodity prices may help facilitate an export-led recovery.

Private consumption and investment are also rising, albeit slowly, which is a welcome sign for the

economy. However, headwinds threaten the progress of Abenomics. A consumption tax hike in 2014

may harm prospects, although indications so far suggest that the effects will not be as devastating as a

previous hike in 1997. Secondly, a potential rebound of oil prices as a result of downwards

overshooting may negate some of the positive effects low oil prices would have brought. Global

demand still remains relatively weak, limiting the role of exports in driving the economic recovery

(International Monetary Fund, 2015).

It is difficult to mention how much of that growth is attributed to Abenomics, rather than growth that

would have happened even without the fiscal stimulus or quantitative easing. Most notably, some

have argued that the growth rates are a result of the post Fukushima disaster recovery (Hayashi,

2014). That being said, forecasting agencies including the IMF have revised their growth forecasts for

2013 upwards, citing a stronger than expected effect that Abenomics has had on Japan’s economy

(International Monetary Fund, 2013).

Other forecasters have similarly revised their forecasts

upwards, and this can be taken as an indicative sign that Abenomics can rightfully claim to have

contributed to this growth.

2. Inflation and Inflation Expectations

Deflation in Japan has not been sudden shocks, but has been rather mild, yet persistent. This has led

to arguments that Japan has now entered a new deflationary equilibrium due to secular decline in

potential growth (Nakaso, 2014). The “Conquest of Deflation” is a key aim of Abenomics, with an

inflation target of 2% to be met by 2015. The question we now ask is “Is it working?”

Looking at the data, there has been an unmistakable upward trend in inflation, and the first arrow can

claim credit in contributing to this. However, much of the inflation since 2014 has also to do with a

recent hike in consumption tax. Discount those effects, and inflation for 2014 was at a low 0.5%

according to the Bank of Japan’s own estimates. As a response to this, the bank has further expanded

its quantitative easing program in late 2014 as it races against time to meet its self-imposed deadline

of 2015 to hit their inflation target. However, falling oil prices have all but dispelled any illusion, and

19

the Bank of Japan has now revised their inflation forecast downwards, and are talking about meeting

the inflation target in 2016 instead.

Figure 3: Inflation in Japan (International Monetary Fund, 2014) The yellow line denotes the start of

Abenomics, and the green line represents estimates by the IMF.

But looking at inflation alone does not tell the whole picture; expectations of inflation are just as

important to Abenomics’ success. Our IS-PC-MR model relies on consumers adapting their

expectations (modeled by a shift in the PC curve) for the whole chain of events to work. What has

happened in Japan, however, is that inflation expectations have been stubbornly low, inhibiting the

effectiveness of previous monetary policy. A possible cause for this is the bank’s credibility has been

stained by its previous record, where policy measures to encourage inflation have been adopted halfheartedly, or rolled back prematurely (Kuttner and Posen, 2001; Ugai, 2007).

This is where

qualitative easing (as opposed to quantitative easing) by the Bank comes in, where the policymaker

acts to influence consumer expectations on inflation directly by forward guidance.

Figure 4: Inflation Expectations by Enterprises (Bank of Japan, 2014)

Looking at the Bank data from conducting surveys with companies, it does seem that the bank’s

efforts in anchoring expectations have worked. On average, Japanese firms surveyed have an outlook

20

for modest positive inflation in the short and medium run. Other measures of expected inflation such

as the inflation swap rates have also gone up after the announcement of Abenomics. This gives the

transmission mechanism for QQE much needed support (Hausman and Wieland, 2014). However,

the latest survey in December 2014 returned a marginally lower rate of expected inflation. Surely

enough, the eventually reported inflation rate was too low for the government’s comfort.

I thus infer that the Bank is unlikely to hit its self-imposed deadline for meeting 2% inflation.

However, Abe and Kuroda can take comfort in the fact that inflation expectations are relatively

favourable, and that lower oil prices may have positive effects on the economy in the medium term

despite causing deflationary pressures now.

3. Stock Market Indices

We now turn to the behavior of the Japanese stock market, namely the Nikkei index in reaction to

Abenomics. The stock market is usually seen as an indicative gauge of success of the government’s

economic policy, and we can look at the index as an expression of whether the markets are confident

in Abenomics.

Some readers may be hesitant to accept the usage of stock market indices as a reliable indicator of

economic health, as a soaring index may be camouflaging shoddy fundamentals. In particular, stock

markets primarily react to expected earnings rather than the real economy, and this may cause the

stock market to be overly volatile to be any sort of reliable indicator. However, there are a few

reasons to consider the index’s indications.

Firstly, the stock market is a relatively reliable proxy to represent investor sentiment. Should

investors feel confident in a country’s economic prospects, their reaction will reflect in a rising stock

market. By extension, this applies to confidence in a country’s economic policy as well (Cliff and

Brown, 2004).

Secondly, the stock market can influence consumption and investment via the wealth effect.

Favorable stock market conditions can increase the stockholders wealth, and consequently increase

consumption and investment (Porteba, 2000). A high stock market index may hence herald future

growth in consumption, and thus economic growth.

Nikkei 225 Index

45000.00

40000.00

35000.00

30000.00

25000.00

20000.00

15000.00

10000.00

5000.00

2015-01-04

2014-01-04

2013-01-04

2012-01-04

2011-01-04

2010-01-04

2009-01-04

2008-01-04

2007-01-04

2006-01-04

2005-01-04

2004-01-04

2003-01-04

2002-01-04

2001-01-04

2000-01-04

1999-01-04

1998-01-04

1997-01-04

1996-01-04

1995-01-04

1994-01-04

1993-01-04

1992-01-04

1991-01-04

1990-01-04

0.00

Figure 5: Nikkei Index (Federal Reserve of St Louis, 2015) The start of Abenomics is denoted by a

red line.

21

The data shows a generally upward trend of the Nikkei index since the announcement of Abenomics

in early 2013. This can be linked to Abenomics in several ways. Firstly, investors are confident in

the government’s aggressiveness to tackle economic problems, and this is reflected in bullish

sentiment in the stock market. Secondly, the depreciation of the yen due to the Bank of Japan’s

quantitative easing program is helping Japanese companies improve their export sales, thus leading to

higher profit margins. This is a good sign in the long run, as higher profits allow Japanese firms to

undertake much-needed investment that may boost the long-run capacity of the economy. Shinzo

Abe thus has good reason to feel pleased with the stock market movements as a vindication of his

namesake policy.

A note on Structural Reforms

As structural reforms are relatively long term measures, it is premature to have any comprehensive

discussion on them as of yet. However, it is clear that if Abenomics is to overcome Japan’s economic

malaise convincingly, the third arrow is arguably the most important one in Abe’s quiver.

Some structural reforms are already beginning to surface. For example, the government is attempting

to encourage more women into the workforce, thus working against a cultural background which is

disadvantageous for women who wish to start a family. Closing the gender gap can lead to substantial

economic gains, and Abe is hoping to pluck what seems to be a low-hanging fruit (Sekiguchi, 2014).

Structural reforms are also aimed at improving business conditions in Japan. Japan aims to enter the

top 3 for the ease of doing business amongst OECD countries from its current position of 15. There is

much scope for improving these conditions, such as reducing the time required to register a business,

rationalizing the registration process and reducing corporate taxes amongst other measures. It is

hoped that both domestic and foreign businesses will get a boost from these measures (Haidar and

Hoshi, 2014).

Like any reform, resistance towards Abe’s third arrow likely comes from within his own party’s

ranks. This is where Abe the politician needs to shine, to ensure that his party and the electorate are

on board with the reforms he has in mind. Any gains from the first two arrows will be rendered

meaningless if Japan’s underlying issues are not resolved.

Conclusion

To conclude, we look back at the question we first set out to answer: “Is Abenomics working?” GDP

has been on an upward trend since Abe took office, although a recent hike in consumption tax has

impeded progress. Inflation is unlikely to hit the target of 2% in the coming year, although the

government can take comfort in the fact that expectations of inflation have improved markedly. The

stock markets have also largely reacted favourably to Abenomics. The answer thus seems to be a

qualified yes, although we are arguably still in too early a stage to tell. This is especially true for the

vital third arrow of structural reforms. Nonetheless, the data so far suggests that the answer may be

“So far, so good.”

References

Brown, G. and Cliff, M. (2004). Investor sentiment and the near-term stock market. Journal of

Empirical Finance, 11(1), pp.1-27.

Carlin, W. and Soskice, D. (2005). The 3-Equation New Keynesian Model --- A Graphical

Exposition.Contributions in Macroeconomics, 5(1).

22

Haidar, J. and Hoshi, T. (n.d.). Implementing Structural Reforms in Abenomics: How to Reduce the

Cost of Doing Business in Japan. SSRN Journal.

Hausman, J. and Wieland, J. (2014). Abenomics: Preliminary Analysis and Outlook. Brookings

Papers on Economic Activity, 2014(1), pp.1-63.

Hayashi, T. (2014). Is it Abenomics or Post-Disaster Recovery?

Analysis.International Advances in Economic Research, 20(1), pp.23-31.

A

Counterfactual

International Monetary Fund, (2013). World Economic Outlook. International Monetary Fund.

International Monetary Fund, (2015). World Economic Outlook. International Monetary Fund.

Kuroda, H. (2013). Quantitative and Qualitative Monetary Easing.

Kuttner, K. and Posen, A. (2001). The Great Recession: Lessons for Macroeconomic Policy from

Japan. Brookings Papers on Economic Activity, 2001(2), pp.93-185.

Metzler, M. (2013). Introduction: Japan at an infection point. In: W. Fletcher III and P. Von Staden,

ed.,Japan's 'Lost Decade': Causes, Legacies and Issues of Transformative Change, 1st ed. Oxford:

Routledge.

Nakaso, H. (2014). The Conquest of Japanese Deflation: Interim Report.

Poterba, J. (2000). Stock Market Wealth and Consumption. Journal of Economic Perspectives, 14(2),

pp.99-118.

Pump

priming.

(2015). The

Economist.

[online]

Available

http://www.economist.com/news/finance-and-economics/21637410-shinzo-abe-unleashes-smallstimulus-package-pump-priming [Accessed 24 Feb. 2015].

at:

Sekiguchi, T. (2014). Abe Wants to Get Japan's Women Working. The Wall Street Journal. [online]

Available at: http://www.wsj.com/articles/abes-goal-for-more-women-in-japans-workforce-promptsdebate-1410446737 [Accessed 24 Feb. 2015].

Ugai, H. (2006). Effects of the Quantitative Easing Policy: A Survey of Empirical Analyses. Bank of

Japan

Working

Paper

Series.

23

The Value of Theoretical Models for Real-World Market Analysis

by Maryam Khan

Final year, UCL Economics

An analysis of whether the original Cournot and Bertrand models of oligopoly competition provide a

satisfactory basis for assessing the extent to which real-world markets are effectively competitive.

Introduction

The real-world value of economic models is a topic that is frequently disputed. The traditional

Cournot and Bertrand models of oligopoly competition attempt to explain the organization of an

economy. Yet how can their conclusions, which are based on an unrealistic world where there is

perfect information, symmetric costs, homogenous products and no strategic behavior, have any realworld significance? Many argue that models such as these should be left to textbooks as they have

little value in real-world analysis. Models are designed to explain complex observed processes and are

therefore subjective approximations of reality. They can never be perfect but using them in economics

is imperative even though it has led to the “assume we have a can opener” catchphrase1 to mock

economists and other professionals who base their conclusions on unrealistic or unlikely assumptions.

On the one hand, if we are to disregard theories because they rely on unrealistic assumptions then

economics (and other professions) won’t be left with much. Furthermore, what defines an unrealistic

assumption from a realistic assumption? On the other hand, the very process of constructing models,

and then testing and revising them forces economists and policymakers to tighten their views about

how an economy works. After all, Milton Friedman argued that theories with accurate predictions are

of great value even though their assumptions may be extremely “unrealistic.” This paper analyses the

traditional Cournot and Bertrand models in order to assess their direct applicability in market analysis,

therefore determining their subsequent value. It is important to note that “value” in itself is a

subjective term and is by no means limited to how well a model can be applied to the real world.

Whilst the Cournot and Bertrand models may have limited real-world applicability, their value arises

from the knowledge they have given economists and regulators about industrial organization and

market power in an oligopoly.

An oligopoly market lies in the middle of the extremes of a monopoly and perfect competition. We

know that the outcome of perfect competition is price equal to marginal cost and the outcome of a

monopoly is marginal revenue equal to marginal cost. The main difference of the oligopoly market is

that firms are assumed to take into account interdependencies, which means that their decisions have

taken into account what their rivals might do. Moreover we assume that there are many consumers

(none large relative to the size of the market), few firms and barriers to entry. At the most basic level

(the traditional models of Cournot and Bertrand), decisions are made simultaneously and the product

is assumed to be homogeneous. The outcome of an oligopoly market depends upon the strategy,

which in turn depends upon the model we are looking at or “the game” that firms are playing when

they are competing. Cournot and Bertrand models of oligopoly competition are examples of two

1

The story is as follows: A physicist, chemist, and an economist are stranded on a desert island with no implements and a can of food. The

physicist and the chemist each devised an ingenious mechanism for getting the can open; the economist merely said, "Assume we have a can

opener"! (Boulding, 1970)

24

different games firms could be playing as the former focuses on quantity competition and the latter

price competition.

Competition authorities recognise the limitations surrounding these models but use their predictions

as a basis for theories of harm in competition investigations. Specifically competition authorities rely

on oligopoly models to look at the impact of competition between a few firms when there are barriers

to entry. For example regulators may map the structure of the market under question to the model

assumptions to identify which model is the “best fit”. From this, they consider under which

circumstances the model would predict a welfare concern. They are also used in merger analysis, to

see whether a proposed merger poses a competition concern. Moreover the traditional Cournot and

Bertrand models provide a useful “rule of thumb” and help to set a benchmark for analysis, explaining

what can happen in different types of markets.

Once we can establish what happens in the simple Cournot and Bertrand world, we can move on and

tweak the assumptions to develop more complex models, which then help to get a closer perspective

of reality. Hence, although Cournot and Bertrand themselves may not be very good at explaining the

real world, they should not be ignored when it comes to learning about oligopoly competition as they

provide a foundation for more in-depth analysis.

The Cournot model

The Cournot model or Cournot duopoly is named after Antoine Augustin Cournot (1801-1877) who

was inspired by observing competition in a spring water duopoly (Varian, 2006). It refers to the game

whereby there are two firms producing a homogenous product. Each firm faces identical/symmetric

costs and there is no co-operation and no entry. These two firms compete simultaneously by choosing

output. As they take interdependencies into account, these two firms have reaction functions whereby

they make optimal, profit-maximising quantity decisions based on what the other firm is doing. A

point on the firm’s reaction function is the best response for that firm, given what the other firm is

doing. As each firm has a reaction function, the outcome of this model is a Nash equilibrium where

each player in the game has selected the best response (or one of the best responses) with regard to the

other players' strategies (Nash, 1950).

Algebraically, we can solve the general case to show the outcome of a Cournot model. If we begin by

supposing there are N firms. Price is the same across these N firms and is determined by market

demand (Q), where Q =∑𝑖=1…𝑁 𝑞𝑖 .

P = a-bQ = a-b∑𝑖=1…𝑁 𝑞𝑖 where a and b are constants.

We assume symmetric costs for both firms: C(𝑞𝑖 ) = c𝑞𝑖 .

From this we can work out total revenue and individual firm profit by incorporating the residual

demand, which is the market demand that is not met by other firms in the industry. In particular,

quantities are “strategic substitutes”; if one firm increases output, another firm has lower residual

demand for that price.

𝜋i = TR-TC = P𝑞𝑖 − c𝑞𝑖 = (a-b∑𝑖=1…𝑁 𝑞𝑖 )𝑞𝑖 − c𝑞𝑖 = (a-c) 𝑞𝑖 - b𝑞𝑖 2 - b𝑞𝑖 ∑𝑖≠𝑗 𝑞𝑗

As firms are said to be profit maximising, we can differentiate the equation above and set it equal to

zero:

𝜕𝑞𝑗

𝜕𝜋i

= (𝑎 − 𝑐) − 2𝑏𝑞𝑖 − 𝑏 ∑ 𝑞𝑗 − 𝑏𝑞𝑖 ∑ (

)

𝜕𝑞𝑖

𝜕𝑞𝑖

𝑗≠𝑖

25

𝑗≠𝑖

We assume that

𝜕𝑞𝑗

𝜕𝑞𝑖

= 0 by the zero conjectural variation, which says that if a firm (for example firm

A) makes an output decision, we can hold output choices of other firm’s (firm B) constant. In other

words, firm B won’t change it’s output choice upon hearing A’s output choice.

Therefore :

𝜕𝜋i

= (𝑎 − 𝑐) − 2𝑏𝑞𝑖 − 𝑏 ∑ 𝑞𝑗 = 0

𝜕𝑞𝑖

𝑗≠𝑖

This rearranges to give:

2𝑏𝑞𝑖 = (𝑎 − 𝑐) − 𝑏 ∑ 𝑞𝑗

𝑗≠𝑖

𝑞𝑖 =

(𝑎 − 𝑐) − 𝑏 ∑𝑗≠𝑖 𝑞𝑗

2𝑏

This is firm i’s reaction function. As we can see it depends upon firm j’s output choice.

If we assume there are two firms (A and B) we can draw the reaction functions of each and the

intersection is where the equilibrium outcome is.

Moreover if we assume symmetry, then each firm produces the same:

q1=q2=….qN

Then we get:

2b𝑞𝑖 = (𝑎 − 𝑐) − 𝑏(𝑁 − 1)𝑞𝑖

𝑞𝑖 =

(𝑎−𝑐)

𝑏(𝑁+1)

This is the outcome decision for individual firms.

As Q is the total output of the economy and we have assumed symmetry, therefore 𝑄 = 𝑁𝑞𝑖 :

𝑄 = 𝑁𝑞𝑖 =

𝑁(𝑎 − 𝑐)

𝑏(𝑁 + 1)

This is aggregate output of the oligopoly market.

To find price we can substitute this into P = a-bQ to get:

26

𝑃 = (𝑎 − 𝑏𝑄) = 𝑎 − [

𝑏𝑁(𝑎 − 𝑐)

𝑁(𝑎 − 𝑐)

𝑎 + 𝑁𝑐

]= 𝑎−[

]=

(𝑁 + 1)

𝑏(𝑁 + 1)

𝑁+1

We arrive at the same outcome if we were to simplify P=a-bQ to P = a-Q (i.e. b=1):

𝑃 = (𝑎 − 𝑄) = 𝑎 −

𝑁(𝑎 − 𝑐)

𝑎𝑁(𝑏 − 1) + 𝑎𝑏 + 𝑁𝑐

=

𝑏(𝑁 + 1)

𝑏(𝑁 + 1)

If b = 1 this simplifies further to P =

𝑎+𝑁𝑐

𝑁+1

The result of this model is therefore one equilibrium point where firms have no incentive to deviate

from; each firm produces the same quantity and charges the same price. It can be shown that the

Cournot outcome lies in between the perfect competition and monopoly outcomes. This is useful for

competition authorities as it allows them to compare this case to perfect competition and monopoly

outcomes and to see the effect on welfare (by calculating the deadweight loss). By changing the

number of firms, the effect on welfare and market power can be scrutinised. For instance, further

analysis highlights how increasing the number of firms (N), causes the market to perfect competition.

This can be useful for competition authorities when they are assessing the effect of, say, a merger.

The main limitation of this model is the naiive conjectural variation assumption which states that

𝜕𝑞𝑗

𝜕𝑞𝑖

= 0, or in other words that firm i won’t change it’s output choice upon hearing firm j’s output choice.

Realistically, a rival may very well change output upon learning about the output decision of another

firm. In addition, in the real world, firms do not face symmetric marginal costs and they do not

compete simultaneously. There may be certain markets where this may arise, but in general this isn’t

the case for most marekts. The Cournot model also ignores the fact that firms might co-operate and

collude with each other to reach a more profit maximising outcome. Therefore the Nash equilibrium

identified above, won’t be true when applied to the real world.

However, out of these concerns, more complex models have been born, such as the Stackelberg game

which features sequential moves (a leader and a follower). The outcome of this game is that the leader

produces more than the Cournot equilibrium and the follower produces less than the Cournot

equilibrium. In addition, we have looked at N firms, an even more basic Cournot model only

considers two firms. Therefore there is vast scope for advancing the Cournot model (as mentioned

later) to better explain the real world.

The Bertrand model

The Bertrand model, named after Joseph Louis Francois Bertrand (1822-1900), describes a game

where firms set prices and it is the consumers that choose quantities at the prices set. Bertrand

formulated this model in a review of the Cournot model and found that when firms set prices, the

optimal outcome is similar to that of a perfectly competitive world (price equal to marginal cost).

Once again this model relies on strict assumptions: homogeneous products; no collusion;

simultaneous decision-making and symmetric costs. Similar to the Cournot conjecture, the Bertrand

conjecture states that in equilibrium, other firms won’t want to change their price choice in response

to Firm i’s price decision (Edgeworth, 1925).

In order to see the outcome of this game, we assume there are two firms (firm A and firm B).

Although we know that they move simultaneously, in order to arrive at a price decision, each firm

thinks sequentially. For instance, firm A thinks about making a profit-maximising price decision,

taking into account what firm B will respond with. If firm A sets a high price (above marginal cost),

firm B will react by charging a slightly lower price (undercutting) and capturing all of the market. As

27

goods are homogeneous, consumers buy from the lowest cost firm. Thus, firm A will then react by

undercutting B and this will continue until both arrive at price equal to marginal cost. As they have

set the same price, demand is split evenly between them and they each capture half of the market.

Therefore this Bertrand-Nash equilibrium is where Pa=Pb=MC and qa=qb=Q/2. The logic is that if A

or B charged a price above marginal cost, no one will buy from them and neither would set a price

below marginal cost as it would incur a loss (they would rather shut-down and leave the market).

This model is useful because price competition is observed more often than quantity competition.

However, this outcome isn’t very applicable to a real-world market, as it is based upon unrealistic

assumptions that don’t arise in most markets. Namely, the zero conjectural variation as seen with the

Cournot model, which states that firms won’t change their price upon hearing their rival’s price.

There are many pricing strategies firms may employ that might result in the Bertrand conjecture not

holding, such as predatory pricing (where firms deliberately price below their marginal cost, thereby

incurring a loss in order to drive rivals out of the market). Furthermore, this model also relies on the

assumption that the consumer will always buy from the cheapest firm. Behavioural economists can

name a wide variety of reasons as to why this may not be the case; for instance, the quality may be

perceived to be greater with a higher price. Another reason could be that consumers are not fully

informed and may not necessarily know that there are cheaper options elsewhere.

Do these models hold any value?

Although these models may not be very effective at describing the real world, they do provide a

useful benchmark for competition authorities to assess the market with. These traditional oligopoly

models, when compared to perfect competition and monopoly cases allow economists to establish a

“rule of thumb” which aids competition investigations. For instance, more firms are better (as we get

closer to perfect competition) and price competition is a good thing (seen by Bertrand model giving

the perfectly competitive outcome of price equal to marginal cost).

The assumptions of perfect information, simultaneous moves and homogenous products limit the

applicability of both Cournot and Bertrand models in real-world market analysis. These traditional

models have been extended to include asymmetric information as well as sequential moves and

product differentiation. Each underlying assumption of the traditional oligopoly models can be

changed and the resultant model gets closer to the real world. For instance, Kreps and Scheinkman

(1983) brought the two models together to provide a middle ground whereby firms can compete on

both quantity and price by choosing a capacity constraint in the first period and a price in the second

period. The result is, surprisingly, a Cournot outcome. Hence in this case, it is very important to learn

about the Cournot model, as more complex cases may revert back to the Cournot outcome as seen

above. Additionally, Cournot and Bertrand can be modified to deal with heterogeneous costs or

exogenous product differentiation. The Stackelberg game deals with sequential moves and models

also deal with endogenous product differentiation (such as representative consumer models of

monopolistic competition and locational models). These more advanced models deal with the

limitations of the traditional Cournot and Bertrand models by removing one main assumption and

analysing the effect on the outcome. They get closer at explaining the real world, but as they still

involve assumptions, their direct applicability is still somewhat limiting. Whether this makes them

more valuable and useful than the traditional Cournot and Bertrand models is limited by our definition

of “value”. If we are referring to how well these models describe the real world, then sceptics may be

justified in their criticisms; perhaps they should be resigned to textbooks. However if value

incorporates the usefulness to market analysts, the predictive nature of these models, as well as how

they’ve been enhanced to explain more complex economic phenomenon, then their stringent

assumptions are their only drawback.

28

Competition authorities face a trade off when analysing the market, as they want to carry out in-depth

analysis in order to arrive at justifiable recommendations but have limited time and resources.

Including private information about costs can make the analysis very cumbersome for competition

authorities. For the purpose of establishing theories of harm, the traditional Cournot and Bertrand

models overcome the trade off competition authorities face with having limited time and resources to

analyse the market and arrive at justifiable recommendations.

Although the Cournot model doesn’t necessarily give a realistic view of the world due to its limiting

assumptions, it does give competition authorities an idea of whether there might be a competition

concern, by allowing them to compare outcomes to a monopoly and perfect competition. Therefore it

helps them form theories of harm when beginning the investigation procedure, allowing them to

concentrate their analysis on these specific concerns. This makes the investigation process more

efficient and less time-consuming as competition authorities are only investigating cases where there

is an initial concern.

Conclusion

To conclude, I agree that Cournot and Bertrand offer a biased explanation of the real world, as each

are constrained by rigid assumptions which limit their application to reality. However, learning about

them is vital as they allow us to develop more complex models, and more importantly they aid

competition authorities in assessing whether there are competition concerns that need to be

investigated. Although neither traditional models of Cournot or Bertrand have significant direct

practical applicability to the majority of real-world markets, these theorems and the outcome they

arrive at do have real-world market value as they provide a useful benchmark from which to look at

the market. Competition authorities use them to establish theories of harm when carrying out

investigations. It is highly unlikely that we’ll ever arrive at a model that will fully explain and help us

manipulate our complex world. However the value of these traditional economic models and theories,

as Friedman set out in his ‘Methodology of Positive Economics’, lies in the accuracy of their

predictions. He maintains that the realism of a theory's assumptions is irrelevant to its predictive

value. It does not matter whether the assumptions that firms maximize profits or move simultaneously

are realistic. Theories and models should be appraised exclusively in terms of the accuracy of their

predictions. The accuracy of each model depends on how well it imitates the industry in question;

Bertrand will be better if capacity and output can be easily changed (firms are competing on price)

whilst Cournot is generally better if output and capacity are difficult to adjust (and firms are

competing on quantity). Thus their value comes from the fact that they form the foundations of our

knowledge into how firms behave in oligopoly markets. Moreover it is from the traditional Cournot

and Bertrand models that more complex models have been developed; therefore in order to learn and

understand the complicated real world, one must be able to understand what happens in a simplified

world.

References

Boulding, K. E. (1970). Economics as a Science.

Edgeworth, F. (1925). The pure theory of monopoly. Collected Papers relating to Political Economy.

Nash, J. (1950). Equilibrium points in n-person games. Retrieved 2014, from Proceedings of the

National Academy of Sciences of the United States of America:

Varian, H. (2006). Intermediate microeconomics: a modern approach (7 ed.). W. W. Norton &

Company

29

A Dynamic, Hierarchical, Bayesian approach to Forecasting the 2014

US Senate Elections by Roberto Cerina2

3rd year, UCL Economics & Statistics

Introduction

This paper sets out to accomplish 2 objectives:

1.

2.

to accurately predict the 2014 Senate election-day Republican vote share;

to grasp the lessons from the earliness/accuracy trade-off.

I will show that the 2014 Senate election was uncertain up to the very end, and Republicans’ fortunes

turned in the last few weeks. A bias in the polls favoured the Democratic party and led to unexpected

uncertainty over the results. This uncertainty was gone by the final week of polling and a Republican

takeover of the Senate was close to unquestionable. The extent to which the Republican wave

demonstrated itself was, however, unexpected.

In 2012, Drew A. Linzer presented a dynamic hierarchical Bayesian state level forecasting model to

predict the US Presidential election. The model performed remarkably in predicting the election

results, but also had the unique feature of providing estimates for voter behaviour throughout the

campaign.

Here I present an adaptation of Linzer’s model. My model’s peculiarity is that it focusses on state

level structural fundamentals for its historical forecast, as opposed to national factors, and adopts a

full-Bayesian specification to propagate the uncertainty that exists on these structural variables onto

my final predictions. The model combines historical trends with increasingly precise polls.

At the end of every week during the election campaign, I take a summary of published polls and fit

the model to calculate the distribution of voter preferences for every week in the campaign, up to

election-day. Initially, the predictions are as good as the historical forecast, but they get closer to the

actual election results as more and more polls are encoded. Simulation techniques are then used to

calculate the probability that Republicans take over the Senate.

Methodology

The Bayesian approach to statistics is philosophically different to the more main-stream “frequentist”

paradigm. A full Bayesian model allows me to integrate multiple datasets in a single model; estimate

regression coefficients in a Bayesian fashion, enabling me to encode prior knowledge in each; and

propagate the corresponding uncertainty all the way to the posterior distribution of the Republican

vote share.

Frequentist approaches to prediction using polls are available, however they pose problems in

interpretation (the p-value doesn’t quite match a Bayesian probability) and unsatisfactory in

dynamics, since they do not easily allow us to estimate voter behaviour on every day of the campaign.

For the remainder of this section, I will outline the full Bayesian model. I make extensive use of the

2012 paper from Drew Linzer [14], which served as inspiration for this piece of work.

2

Project Supervisor: Dr. Gianluca Baio

30

1. Distribution of the “trial heat" polls

My first task is to model the trial heat polls. Let 𝑖 be the state index defined over: 𝑖 = 1, . . . ,33 and let

𝑗 be the time index, representing the last 22 weeks of the election campaign: 𝑗 = 1, . . . ,22. Let 𝑛𝑖,𝑡,𝑘

be the sample size of trial heat poll 𝑘, in state 𝑖, on day 𝑡 of the campaign; let 𝑦𝑖,𝑡,𝑘 be the number of

respondents who declared they would vote for the Republican candidate, in state 𝑖, for poll 𝑘, on day 𝑡

of the campaign. Then 𝑌𝑖,𝑗 is the sum of preferences 𝑦 over all polls 𝑘 in week 𝑗 and 𝑁𝑖,𝑗 is the sum of

sample sizes, over that same week: 𝑁𝑖,𝑗 = ∑𝑘 𝑛𝑖,𝑡,𝑘 and 𝑌𝑖,𝑗 = ∑𝑘 𝑦𝑖,𝑡,𝑘 . This allows us to present our

distribution for the data:

𝑌𝑖,𝑗 ∼ Bin(𝑝𝑖,𝑗 , 𝑁𝑖,𝑗 ).

(1)

The parameter 𝑝𝑖,𝑗 is the one we are trying to estimate and it represents the probability that a citizen to

vote for the incumbent senator, for any state, at any given week of the campaign.

2. Prior distributions

I define the Republican vote share as follows:

𝑝𝑖,𝑗 = logit −1 (𝜐𝑖,𝑗 + 𝜛𝑗 ).

(2)

I adopt a hierarchical specification to explain the distribution of the vote share, where 𝜐𝑖,𝑗 represents

the state specific effect on any day of the campaign, whilst 𝜛𝑗 represents the common trend amongst

Republican candidates at the national level. I call this the Republican campaign effect.