Subaward Agreement

advertisement

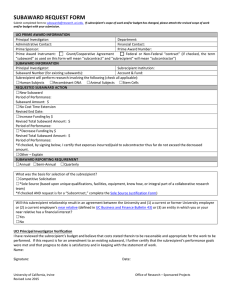

Subaward Agreement Institution/Organization ("UNIVERSITY") Name: Address: Institution/Organization ("SUBRECIPIENT") Middle Tennessee State University 1301 East Main Street Murfreesboro, TN 37132-0001 Name: Address: Prime Award No. EIN No.: Subaward No. Awarding Agency CFDA No. Subaward Period of Performance Amount Funded this Action Est. Total (if incrementally funded) Project Title Reporting Requirements [Check here if applicable: See Attachment 2] : FFATA (Attachment 3B) : ARRA funds (Attachment 2) Terms and Conditions 1) University hereby awards a cost reimbursable subaward, as described above, to Subrecipient. The statement of work and budget for this subaward are (check one): as specified in Subrecipient’s proposal dated ; or X as shown in Attachment 4 . In its performance of subaward work, Subrecipient shall be an independent entity and not an employee or agent of University. 2) University shall reimburse Subaward not more often than quarterly for allowable costs. All invoices shall be submitted using Subrecipient’s standard invoice or MTSU’s standard invoice (attachment 5) and at a minimum shall include current and cumulative costs (including cost sharing), subaward number, and certification as to truth and accuracy of invoice. Invoices that do not reference University’s subaward number shall be returned to Subrecipient. Invoices and questions concerning invoice receipt or payments should be directed to the appropriate party’s Financial Contact, as shown in Attachment 3. 3) A final statement of cumulative costs incurred, including cost sharing, marked “FINAL,” must be submitted to University’s Financial Contact NOT LATER THAN sixty (60) days after subaward end date. The final statement of costs shall constitute Subrecipient’s final financial report. 4) All payments shall be considered provisional and subject to adjustment within the total estimated cost in the event such adjustment is necessary as a result of an adverse audit finding against the Subrecipient. 5) Matters concerning the technical performance of this subaward should be directed to the appropriate party’s Project Director, as shown in Attachment 3. Technical reports are required as shown above, “Reporting Requirements.” 6) Matters concerning the request or negotiation of any changes in the terms, conditions, or amounts cited in this subaward agreement, and any changes requiring prior approval, should be directed to the appropriate party's Administrative Contact, as shown in Attachment 3. Any such changes made to this subaward agreement require the written approval of each party's Authorized Official, as shown in Attachment 3. 7) Each party shall be responsible for its negligent acts or omissions and the negligent acts or omissions of its employees, officers, or directors, to the extent allowed by law. 8) Either party may terminate this agreement with thirty days written notice to the appropriate party’s Administrative Contact, as shown in Attachment 3. University shall pay Subrecipient for termination costs as allowable under OMB Circular A-21or A-122 or 45 CFR Part 74 Appendix E, “Principles for Determining Costs applicable to Research and Development under Grants and Contracts with Hospitals”, as applicable. 9) No-cost extensions require the approval of the University. Any requests for a no-cost extension should be addressed to and received by the Administrative Contact, as shown in Attachment 3, not less than thirty days prior to the desired effective date of the requested change. 10) The Subaward is subject to the terms and conditions of the Prime Award and other special terms and conditions, as identified in Attachments 1 and 2. 11) By signing below Subrecipient makes the certifications and assurances shown in Attachments 1 and 2. By an Authorized Official of UNIVERSITY: ___________________________________ By an Authorized Official of SUBRECIPIENT: _______________ Date ______________________________________ _______________ Date November 2010 Attachment 1 Subaward Agreement By signing the Subaward Agreement, the authorized official of the SUBRECIPIENT certifies, to the best of his/her knowledge and belief, that: Certification Regarding Lobbying 1) No Federally appropriated funds have been paid or will be paid, by or on behalf of the Subrecepient to any person for influencing or attempting to influence an officer or employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress in connection with the awarding of any Federal contract, the making of any Federal grant, the making of any Federal loan, the entering into of any cooperative agreement, and the extension, continuation, renewal, amendment, or modification of any Federal contract, grant, loan, or cooperative agreement. 2) If any funds other than Federally appropriated funds have been paid or will be paid to any person for influencing or intending to influence an officer or employee of any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress in connection with this Federal contract, grant, loan, or cooperative agreement, the Subrecipient shall complete and submit Standard Form -LLL, "Disclosure Form to Report Lobbying," to the University. 3) The Subrecipeint shall require that the language of this certification be included in the award documents for all subawards at all tiers (including subcontracts, subgrants, and contracts under grants, loans, and cooperative agreements) and that all subrecipients shall certify and disclose accordingly. This certification is a material representation of fact upon which reliance was placed when this transaction was made or entered into. Submission of this certification is a prerequisite for making or entering into this transaction imposed by section 1352, title 31, U. S. Code. Any person who fails to file the required certification shall be subject to a civil penalty of not less that $10,000 and not more than $100,000 for each such failure. Debarment, Suspension, and Other Responsibility Matters Subrecipeint certifies by signing this Subaward Agreement that neither it nor its principals are presently debarred, suspended, proposed for debarment, declared ineligible, or voluntarily excluded from participation in this transaction by any federal department or agency. OMB Circular A-133 Assurance Subrecipeint assures University that it complies with A-133 and that it will notify UNIVERSITY of completion of required audits and of any adverse findings, which impact this subaward. Special Terms and Conditions 1) The Subrecipient warrants that no part of the total contract amount provided herein shall be paid directly or indirectly to any officer or employee of the state of Tennessee as wages, compensation, or gifts in exchange for acting as officer, agent, employee, sub-contractor, or consultant to the Subrecipient in connection with any work contemplated or performed relative to this Subaward. If the Subrecipient is an individual, the Subrecipient warrants that within the past six months he/she has not been and during the term of this contract will not become an employee of the State of Tennessee. 2) This Subaward may be terminated by either party by giving written notice to the other, at least _30__ days before the effective date of termination. 3) This Subaward may be modified only by written amendment executed by all parties hereto. 4) The books, records, and documents of the Subrecipient, insofar as they relate to work performed or money received under this Subaward, shall be maintained for a period of three full years from the date of the final payment, and shall be subject to audit, at any reasonable time and upon notice, by the University or the Comptroller of the Treasury, or their duly appointed representatives. 5) The Subrecipient shall not assign this Subaward or enter into sub-contracts for any of the work described herein without obtaining the prior written approval of the University. 6) By acceptance of this Subaward the Subrecipient is attesting that the Subrecipient will not knowingly utilize the services of illegal immigrants and will not knowingly utilize the services of any subcontractor that does so in delivery of the services under this agreement. If the Subrecipient is discovered to have breached this attestation, the Subrecipient shall be prohibited from supplying services to any TBR institution/state for a period of one (1) year from the date of discovery of the breach. Subrecipient may appeal the (1) year by utilizing an appeals process in the “Rules of Finance and Administration, 0602.” November 2010 ATTACHMENT 2 SUBAWARD AGREEMENT Reporting Requirements November 2010 Attachment 3 Subaward Agreement University Contacts Subrecipient Contacts Administrative Contact Administrative Contact Name: Address: Name: Telephone: Fax: Email: Dr. Myra Norman 1301 East Main Street, Box 124 Murfreesboro, TN 37132-0001 615-898-5010 615-898-5028 mnorman@mtsu.edu Address: Telephone: Fax: Email: Principal Investigator Project Director Name: Address: Name: Address: Telephone: Fax: Email: 130 East Main Street, Box Murfreesboro, TN 37132-0001 615615@mtsu.edu Telephone: Fax: Email: Financial Contact Financial Contact Name: Address: Name: Telephone: Fax: Email: Tammy Wiseman 1301 East Main Street, CAB 105 Murfreesboro, TN 37132-0001 615-494-7675 615-8985799 twiseman@mtsu.edu Address: Telephone: Fax: Email: Authorized Official Authorized Official Name: Address: Name: Telephone: Fax: Email: John Cothern 1301 East Main Street Murfreesboro, TN 37132-0001 Address: 615-898-2852 jcothern@mtsu.edu Telephone: Fax: Email: November 2010 ATTACHMENT 4 SUBAWARD AGREEMENT Statement/Scope of Work (SOW) & Budget November 2010 ATTACHMENT 5 SUBAWARD AGREEMENT MTSU Standard Financial Invoice INVOICE FOR REIMBURSEMENT NAME AND ADDRESS OF CONTRACTOR: INVOICE NUMBER: INVOICE ENDING DATE: CONTRACTING AGENCY: CONTRACT PERIOD BANNER FUND: COST CONTRACT CATEGORIES BUDGET CUMMULATIVE QUARTERLY EXPENDITURES EXPENDITURES A. SALARIES $ $ $ B. FRINGE $ $ $ C. EQUIPMENT $ $ $ D. TRAVEL $ $ $ E. PARTICIPANT SUPPORT $ $ $ F. OTHER DIRECT COSTS $ $ $ G. INDIRECT COSTS $ $ $ $ $ $ TOTALS 1. Total Cumulative Accrued Expenditures $ 2. Estimated Disbursement for the Next Quarter (Advance Only) $ 3. Total Estimated Cash Needs (Line 1 + 2) $ 4. Less Payment Received to Date $ 5. Amount Receivable/REFUNDABLE with this Invoice $ I certify to the best of my knowledge and belief that the data above is Allotment Code: correct and that all expenditures were made in accordance with the Cost Center: contract conditions and that payment is due and has not been previously requested. CONTRACTOR'S AUTHORIZED SIGNATURE Signature TITLE _______________________________ DATE Signature TITLE _______________________________ DATE November 2010 Attachment 6 Audit Certification and Financial Questionnaire Middle Tennessee State University – Office of Research Services Organization/Company Name: _______________________________________________________ Sub-award # _______________________________ Title of Project: __________________________________________________________________________ This is an audit certification for your organization's/company's most recently completed fiscal year (Respond to A or B, below, as applicable): A. My organization is subject to the requirements of OMB Circular A-133 and an external independent audit of my organization/company has been completed for Fiscal Year 20______ . ____No material instances of non-compliance, material weakness and/or reportable conditions were found related to any sub-award(s) from MTSU. A true, complete and correct copy of the audit report is attached or available at the following website ____________________________________________. ____Material instances of non-compliance, material weakness and/or reportable conditions were found related to sub-awards (s) from MTSU and enclosed is a copy of the audit report with corrective action responses or it can be found at the following website: _________________________________________________________________. OR _________B. My organization/company is not subject to the requirements of OMB Circular A-133 because (_____we are a for-profit organization, ____we are a foreign (non-US) entity, _____we expend less than $500,000 a year in federal funds, or _____ other (_________________________________________). We _____ have/ ____ have not been audited by a U.S. Government audit agency or by an independent CPA firm for the most recently completed Fiscal Year : from MM/DD/YYYY:______________ to MM/DD/YYYY:______________). *If you have had a recent annual audit conducted, please, provide a copy of the audited financial statement for the most current fiscal year or a link to the website: _________________________________________. Signature of Authorized Official: Signature _______________Date Name (printed) __ Title Organization/Company EIN # _______ Address Phone ______ ______ _________ ___ __ DUNS #__________________________ ___________________ _ Fax ________ ___Email November 2010

![[Date] Tolif Hunt Grants and Contracts Administrator](http://s2.studylib.net/store/data/010776578_1-d1d361bf891a4262d8230dfa37d005e7-300x300.png)