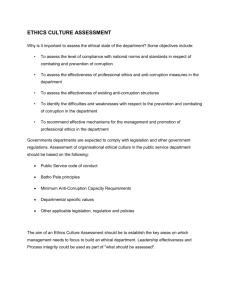

Center for Corporate Ethics and Governance

advertisement