The Brattle Group 44 Brattle Street Cambridge, MA 02138

advertisement

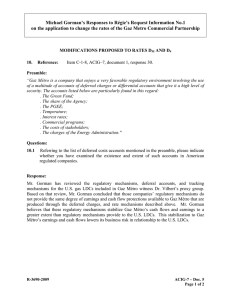

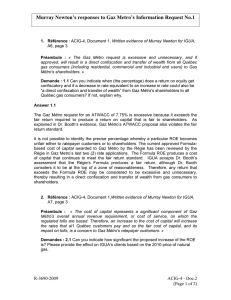

RÉGIE DE L’ÉNERGIE WRITTEN EVIDENCE OF PAUL R. CARPENTER FOR GAZ MÉTRO The Brattle Group 44 Brattle Street Cambridge, MA 02138 (617) 864-7900 May 2007 WRITTEN EVIDENCE OF PAUL R. CARPENTER TABLE OF CONTENTS I. OVERVIEW/SUMMARY ..................................................................................................1 II. INVESTMENT RISK AND TRENDS IN THE NATURAL GAS MARKET ENVIRONMENT SINCE 1999...........................................................................................4 III. EVALUATION OF GAZ MÉTRO’S BUSINESS RISK SINCE 1999 AND 2004 .........12 A. Determinants Of Business Risk And The Cost Of Capital ....................................12 B. Gaz Métro’s Business Risk Environment ..............................................................14 C. Evidence of Changes in Gaz Métro’s Business Risk Since 1999 and 2004 ..........20 1. Increases in Uncertainty in Gas Use Per Customer.................................................... 20 2. Increased Risk due to Gaz Métro’s Performance Incentive Mechanism.................... 27 D. IV. Conclusion .............................................................................................................29 GAZ MÉTRO’S BUSINESS RISK COMPARED TO OTHER LDCS IN CANADA AND THE UNITED STATES ........................................................................29 A. Gaz Métro’s Unique Business Environment..........................................................29 1. Natural Gas Penetration in Québec ............................................................................ 30 2. Competition from Electricity...................................................................................... 34 3. Gaz Métro’s Industrial Customer Load...................................................................... 37 4. Conclusion.................................................................................................................. 39 B. Gaz Métro’s Return on Equity Compared to Allowed Returns on Equity for U.S. LDCs ........................................................................................................39 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 I. OVERVIEW/SUMMARY 2 Q1. Please state your name, address and position. 3 A1. My name is Paul R. Carpenter. I am a Principal of The Brattle Group, an economic and 4 management consulting firm with offices in Cambridge, Massachusetts, Washington 5 D.C., San Francisco, California, London, England, and Brussels, Belgium. My office is 6 located at 44 Brattle Street, Cambridge, Massachusetts 02138. 7 Q2. 8 9 Will you briefly describe your educational background and professional qualifications? A2. Yes. I am an economist specializing in the fields of industrial organization, finance and 10 energy and regulatory economics. I received a Ph.D. in Applied Economics and an M.S. 11 in Management from the Massachusetts Institute of Technology, and a B.A. in 12 Economics from Stanford University. I have been involved in research and consulting on 13 the economics and regulation of the natural gas, oil and electric utility industries in North 14 America and abroad for over twenty years. I frequently have testified before federal, 15 state and Canadian regulatory commissions, in federal court and before the U.S. 16 Congress, on issues of pricing, competition and regulatory policy in these industries. 17 Outside of North America, I have advised governments and regulatory bodies on the 18 structure of their natural gas markets and the pricing of gas transmission services. These 19 assignments have included testimony before the U.K. Monopolies and Mergers 20 Commission and the Australian Competition Tribunal, and advice to the governments of, 21 and regulators in, Greece, Ireland, the Netherlands, New Zealand and Australia. 22 I have been extensively involved in the evaluation of the economics and regulation of the 23 natural gas industry in North America. In Canada, I have advised pipeline companies and 24 have previously testified before the National Energy Board (“NEB”) and the Alberta 25 Energy and Utilities Board (“EUB”) on matters relating to pipeline competition and 26 capacity expansion, including the Alliance Pipeline Ltd. certification proceeding. I gave 27 evidence on business risk previously before the NEB in the multi-pipeline cost of capital 28 case, on behalf of Foothills Pipe Lines, and in more recent NEB proceedings on behalf of 1 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 TransCanada PipeLines Limited. I provided written evidence on business risk before the 2 Ontario Energy Board (“OEB”) on behalf of Union Gas Limited as part of its 2007 rate 3 application. I provided written testimony and appeared before the OEB on behalf of 4 Enbridge Gas Distribution Inc. as part of its 2007 rate application. Further details of my 5 educational and professional background, as well as a listing of my publications, are 6 provided in my curriculum vitae, which is appended to this evidence as Attachment A. 7 Q3. What assignment were you given in this proceeding? 8 A3. I have been asked by Gaz Métro to provide evidence concerning its business and 9 regulatory risks as they affect the return on equity required by investors in Gaz Métro 10 securities, and to render an opinion as to the adequacy of the current formula return to 11 compensate investors for bearing those risks. In particular, I have been asked to evaluate 12 whether, and the extent to which, there have been changes in the business risk and 13 regulatory environment faced by Gaz Métro since 1999, when the formula approach to 14 return on equity was approved by the Régie, and since 2004, when the formula was 15 reevaluated. I have also been asked to provide evidence comparing Gaz Métro’s business 16 risk and current allowed return with the risk and allowed returns of other Canadian and 17 U.S. natural gas local distribution companies (“LDCs”). 18 Q4. Could you summarize your conclusions? 19 A4. Yes. 20 • It is important for the Régie to undertake an updated, quantitative evaluation of 21 Gaz Métro’s allowed return. Changes in natural gas markets since 1999 and 2004 22 suggest natural gas distribution investment risks have increased since the formula 23 used to determine Gaz Métro’s allowed return on equity was previously 24 evaluated. Recent increases in equity thickness for NEB-regulated pipelines and 25 Canadian distributors also suggest that investment risks have increased. And, the 26 returns anticipated for new and proposed NEB-regulated pipelines suggest that the 27 returns allowed under the NEB’s formula are too low. 2 WRITTEN EVIDENCE OF PAUL R. CARPENTER • 1 Gaz Métro’s business and regulatory risk have increased since 1999 and 2004, 2 which implies that its allowed return should be increased relative to the return 3 produced by the current operation of the ROE formula. • 4 Other comparative evidence suggests that Gaz Métro is riskier than average 5 LDCs. In particular, it is riskier than the LDCs in Professor Chrétien’s U.S. LDC 6 portfolio, and riskier than Canadian LDCs that have recently received increases in 7 their allowed returns via increases in their deemed equity thickness. Despite the 8 fact that Gaz Métro is riskier than average LDCs, its allowed return is 9 significantly lower than allowed ROEs for LDCs in the U.S. • 10 I understand that Gaz Métro is applying for a 10.19% return on equity at its 11 deemed equity thickness of 38.5%. This request is at the low end of the range of 12 required ROEs estimated by Professor Chrétien of 9.93% to 11.44%. In my 13 opinion, the ROE that Gaz Métro is requesting is conservatively low, given the 14 evidence that Gaz Métro has higher business risks and somewhat lower regulatory 15 risks than typical gas LDCs in Canada and the U.S., and given that it has higher 16 financial risks (at the 38.5% deemed equity thickness) than the LDCs in Professor 17 Chrétien’s U.S. LDC sample. Finally, I note that an increase in ROE, represented 18 by Gaz Métro’s request over the current formula result, is appropriate given the 19 increased business risks faced by equity investors in Gaz Métro since the ROE 20 formula was introduced in 1999 and reviewed in 2004. 21 Q5. How is the rest of your evidence organized? 22 A5. In Section II, I discuss standards for determining a fair return, and evidence that required 23 returns for energy infrastructure have increased due to changes in natural gas markets 24 since 1999 and 2004. In Section III, I discuss the determinants of business risk, Gaz 25 Métro’s business risk environment, and how that environment has changed since 1999 26 and 2004. Finally, in Section IV, I compare Gaz Métro’s business environment to that of 27 other LDCs in Canada and the U.S., and show how Gaz Métro’s allowed return on equity 28 compares to that of LDCs in the U.S. 3 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 2 II. INVESTMENT RISK AND TRENDS IN THE NATURAL GAS MARKET ENVIRONMENT SINCE 1999 3 Q6. What is investment risk and how does it relate to a regulator’s decision to establish 4 5 an appropriate allowed return for a natural gas utility? A6. One of the bedrock principles for establishing a fair return on equity for a regulated 6 utility that has been long recognized by economists, regulators, and the courts in Canada 7 and the U.S. is that a reasonable return should “be comparable with the return available 8 from the application of the capital to other enterprises of like risk.”1 This principle 9 implies that any evaluation of the reasonableness of a particular return should consider 10 the level of risk faced by investors in the enterprise, and how those risks and returns 11 compare with other companies with similar risks. Investment risk for a natural gas utility 12 has been defined to include financial and business risks. Financial risk involves the 13 extent to which debt is employed in the company’s capital structure. Business risk is a 14 somewhat more subjective concept and is more difficult to quantify precisely,2 but it is 15 sometimes categorized to include the supply, demand (or market), competitive, operating 16 and regulatory risks that might be faced by particular utilities.3 Both business and 17 financial risks are accounted for in the methodology employed by Professor Chrétien to 18 estimate the cost of capital for Gaz Métro. For example, as discussed in his evidence, the 19 Fama-French and Adjusted CAPM methods employed to estimate the cost of equity for a 1 National Energy Board, RH-1-70, p.7-5. See also National Energy Board, RH-2-2004, p. 17, where the NEB stated that a fair or reasonable return on capital should meet three requirements. It should: (1) “be comparable to the return available from the application of the invested capital to other enterprises of like risk (the comparable investment standard)”, (2) “enable the financial integrity of the regulated enterprise to be maintained (the financial integrity standard)”, and (3) “permit incremental capital to be attracted to the enterprise on reasonable terms and conditions (the capital attraction standard).” 2 The NEB has recognized that the assessment of business risk is an inherently qualitative exercise. See National Energy Board, RH-2-1994, p. 24: “The Board has systematically assessed the various risk factors for each of the pipelines but has not found it possible to express, in any quantitative fashion, specific scores or weights to be given to risk factors. The determination of business risk, in our view, must necessarily involve a high degree of judgment, and the analysis is best expressed qualitatively.” 3 See, for example, National Energy Board, RH-4-2001, p. 13. I understand that in past decisions the Régie has treated regulatory risk as an element separate from business risk. In this evidence I include regulatory risk as a part of business risk conceptually, but I also evaluate its implications separately for Gaz Métro’s return on equity. 4 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 “benchmark” gas LDC employ stock market data that reflect the historical business risks 2 perceived by the equity investors in Professor Chrétien’s sample portfolios. These data 3 also reflect the market-value capital structures of the companies in the sample portfolios 4 and thus their financial risks. The evidence I present compares Gaz Métro’s particular 5 business and financial risks to the risks that one would expect for a “benchmark” gas 6 LDC, and thus assists the Régie in positioning Gaz Métro’s required return on equity 7 within the benchmark results provided by Professor Chrétien in his evidence. 8 Q7. 9 10 You have mentioned the distinction between business and financial risk. How do those concepts relate to the allowed return on equity and the deemed equity ratio? A7. Return on equity and the deemed equity ratio or “thickness” (when combined with the 11 cost of debt) are the components which make up the total return on assets. It is, of 12 course, the total return (the weighted average return on debt and equity) that matters to 13 investors. But equity investors, as residual claimants on the firm’s assets behind debt 14 holders, are particularly concerned about the relationship between the equity ratio and the 15 allowed return on equity. As residual claimants, equity investors bear added financial 16 risk or “leverage” the lower the deemed equity thickness, all else equal. 17 Q8. 18 19 How have changes in business risk under a formula approach to return on equity been traditionally accounted for by Canadian regulators? A8. Ever since various Canadian regulators began to employ formulas for the determination 20 of allowed ROEs, the practice has been to adjust the deemed equity thickness for 21 perceived changes in business risk. Higher business risk would imply that greater equity 22 thickness would be required. This procedure was fine as long the resulting total return on 23 assets continued to be fair and reasonable. But because the evaluation of business risk is 24 largely subjective, this procedure is not a substitute for the more rigorous determination 25 as to whether the return on equity produced by the formula in combination with the 26 deemed equity thickness is fair and reasonable. This determination requires the kind of 27 analysis performed by Professor Chrétien in his evidence. 28 29 Q9. What has been the trend in allowed ROE under the NEB formula as compared to the formula applied by the Régie to Gaz Métro since 1999? 5 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 A9. The trend in ROE has been significantly downward under both formulas. In Figure 1 I 2 have plotted the authorized returns on equity produced by the NEB formula and those 3 produced by the formula authorized by the Régie for Gaz Métro from 1999 to the present. Figure 1 Gaz Métro's Authorized ROE vs. Authorized ROE under the NEB Formula 10.50% Gaz Métro Authorized ROE Authorized ROE 10.00% 9.50% 9.00% 8.50% NEB Authorized ROE 8.00% 1999 2000 2001 2002 2003 2004 2005 2006 2007 Source: NEB & Gaz Métro. Notes: Gaz Métro's Authorized ROE is its "base ROE," excluding incentives. The NEB Authorized ROE is effective for a calendar year. Therefore, the ROE authorized for 1999 is effective 1/1/99. Gaz Métro's ROE is effective for a fiscal year. Therefore, the ROE authorized for 1999 is effective 10/1/98. 4 5 Note that even though the formulas are slightly different in the two jurisdictions,4 the 6 trend over time in the resulting returns under the two formulas has been very similar. 7 This is due, of course, to the fact that the two formula approaches are designed to largely 8 track the trend in the yield on the Canadian Long Bond. As Figure 1 demonstrates, the 9 most significant declines in the formula returns have occurred since 2004. 4 The NEB Authorized ROE differs from Gaz Métro's Authorized ROE because the NEB and Gaz Métro adjustment formulas rely on different interest rates. The NEB adjustment formula relies on 3-months-out and 12-months-out forecasts of 10-year Government of Canada bond yields published in the November issue of Consensus Forecasts, and the spread between 10-year and 30-year Government of Canada bonds during the previous October. Gaz Métro’s adjustment formula relies on 3-months-out and 12-months-out forecasts of 10-year Government of Canada bond yields published in the August issue of Consensus Forecasts, and the spread between 10-year and 30-year Government of Canada bonds during the previous July. Both the NEB and Gaz Métro adjustment formula use a 0.75 elasticity factor. 6 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 Q10. How does Gaz Métro’s return on equity and equity thickness compare to that of 2 3 other Canadian gas distributors? A10. I present recent approved common and preferred equity ratios and returns on equity for 4 Gaz Métro and other Canadian gas distributors whose returns on equity are set using 5 formula-based methodologies in Figure 2 below. Figure 2 Approved Capital Structures for Canadian Gas Distributors Utility Pacific Northern Gas (West Division) 1 Pacific Northern Gas N.E. (Tumbler Ridge) Terasen Gas Terasen Gas (Vancouver Island) 3 4 5 Common Equity Ratio Preferred Equity Ratio 2006/2007 Return on Common Equity BCUC 40.00% 3.76% 9.02% BCUC 36.00% 0.00% 8.77% BCUC BCUC 36.00% 35.01% 0.00% 0.00% 9.02% 8.37% BCUC 40.00% 0.00% 9.07% [1] Pacific Northern Gas N.E. [1] (Ft. St. John/Dawson Creek) 2 Regulator [1] [2] 6 7 AltaGas ATCO Gas EUB EUB 41.00% 38.00% 0.00% 6.00% 8.51% 8.51% 8 9 Enbridge Gas Distribution Inc. [3] Union Gas OEB OEB 38.00% 36.00% 2.63% 3.24% 8.39% 8.54% 10 Centra Gas Manitoba PUB 33.40% 0.00% 9.26% 11 12 Gaz Métro Gazifère Régie Régie 38.50% 40.00% 7.50% 0.00% 8.73% 9.34% Source: Company annual reports, regulatory filings and decisions. Notes: [1] 2007 rates have not yet been approved by the BCUC. Reflects requested capital structure and formula-based ROE. [2] 2007 rates have not yet been approved by the EUB. Reflects requested capital structure and formula-based ROE. [3] 2007 rates have not yet been approved by the OEB. Reflects requested capital structure and formula-based ROE. 6 7 Q11. What has been the recent experience in Canada with respect to changes in equity 8 9 thickness to account for changes in business risk? A11. In Figure 3 I report the changes in deemed equity thickness that have been authorized by 10 various Canadian regulators since the formula approach to ROE was adopted in their 11 jurisdictions. 7 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 3 Changes in Deemed Equity Thickness Approved Equity Thickness Prior Equity Thickness Change in Equity Thickness Aug-06 40% 36% 4% Mar-06 35% 33% 2% Mar-06 40% 35% 5% Utility Regulator Docket / Decision Date 1 Pacific Northern Gas (West Division) BCUC G-99-06 2 Terasen Gas [1] BCUC G-14-06 3 Terasen Gas [1] (Vancouver Island) BCUC G-14-06 [2] 4 5 6 ATCO Gas ATCO Pipelines NGTL EUB EUB EUB 2004-052 2004-052 [ 2 ] 2004-052 [ 2 ] Jul-04 Jul-04 Jul-04 38% 43.0% 35% 37% 43.5% 32% 1% -0.5% 3% 7 Union Gas OEB EB-2005-0520 Jun-06 36% 35% 1% 8 9 Foothills TransCanada BC System NEB NEB TG-08-2005 TG-02-2006 Dec-05 Feb-06 30% 30% 6% 6% 10 11 12 TransCanada Mainline TransCanada Mainline TransCanada Mainline NEB NEB NEB RH-2-2004 RH-4-2001 Mar-07 Apr-05 Jun-02 36% 36% 40% [ 3 ] 36% 33% 30% 13 14 15 Westcoast [ 4 ] Westcoast [ 4 ] Westcoast [ 4 ] NEB NEB NEB TG-06-2006 TG-3-2004 RH-2-97 Aug-06 Aug-04 Aug-97 4% 3% 3% 4% (for 2006); 5% (for 2007) Notes: 36% 33% 35% (for 2006); 36% (for 2007) 31% 30% 31% 30% 35% 1% -5% [1] BCUC Decision 2004-052 also increased Terasen Gas and Terasen Gas (Vancouver Island) 's allowed formula-based ROEs. Terasen Gas' 2006 ROE increased by 0.51%, and Terasen Gas (Vancouver Island) 's 2006 ROE increased by 0.71%. [2] In Decision 2004-052, the EUB also considered AltaGas' equity thickness, and left it unchanged at 41%. [3] In March 2007, TransCanada submitted a settlement that would increase its deemed equity thickness to 40%. This settlement has not yet been approved by the NEB. [4] Results for Westcoast are for Westcoast's Zones 3 & 4. Tolls for Westcoast's Zones 1 & 2 are set differently pursuant to the NEB's Framework for Light-handed Regulation. [5] Centra Gas Manitoba's rates are set using an equity thickness that is determined by formula, instead of a deemed equity thickness. Its approved equity thickness has changed over time as follows 1 40% (1995 test year), 39.95% (1997 test year), 39.06% (1998 test year), 38.6% (2003/04 test year), 32.3% (2005/06 test year), and 33.4% (2005/06 test year). 2 Nearly all of the changes in equity thickness have been in the positive direction, and 3 nearly all were associated with determinations by the regulators that business risks had 4 increased for the utilities involved, or they were the results of settlements between the 5 utilities and their stakeholders. 6 Q12. Could you describe some of the changes in the natural gas market environment in 7 North America that have occurred since 1999 and their implications for natural gas 8 utility infrastructure investment? 9 A12. Yes. The market environment in which gas utilities operate in North America has 10 changed significantly since 1999 reflecting greater uncertainty in the supply of the gas 11 commodity and greater uncertainty in the extent and timing of growth in demand. This 12 uncertainty is partly reflected in significantly higher gas commodity price levels and 8 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 volatility. These changes have significant implications for the need for, and investment 2 risk of, gas utility infrastructure. 3 These changes have been recognized in Canada by the NEB in its summary of the 4 feedback it received in 2006 during its Energy Futures Project consultation sessions. In 5 its report on these sessions under “Key Messages,” the NEB writes: 6 1. New Energy Paradigm 7 8 9 10 11 There is consensus that the energy system in Canada has transitioned into a new paradigm characterized by tighter energy markets, high and volatile energy prices, high value currency, higher inflationary pressures, ageing infrastructure at all levels, and an uncertain demand response.5 12 Additional gas market uncertainty has also been created by the increased environmental 13 concerns associated with greenhouse gas emissions and their role in long-term climate 14 change. While some of the policy responses to these concerns, such as the pricing of 15 carbon emissions through so-called “cap-and-trade” or taxation schemes, may ultimately 16 favor natural gas relative to coal or oil, other policies may not (e.g., those that favor 17 renewable energy sources or nuclear power.) No matter what the specific policies are 18 that result from these heightened environmental concerns, it seems clear that higher and 19 more uncertain prices for natural gas are more likely than not to be experienced in a 20 carbon-constrained world. 21 Q13. What is the evidence for changes in natural gas commodity prices and price 22 23 volatility since 1999? A13. Tighter supply/demand balances for natural gas have led to substantially increased prices 24 and price volatility in North America since 1999. To show this phenomenon, in Figure 4 25 I have plotted the 12-month forward “strip” price of natural gas on the New York 26 Mercantile Exchange (NYMEX) from April 1990 to April 2007. This is a useful index to 5 National Energy Board, Energy Futures Project: Consultation Sessions Feedback, July 2006, p. 2. 9 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 reference because it reflects the broad market expectation of the level and volatility of 2 future prices in a way that is normalized somewhat for seasonal effects. Figure 4 Nymex Natural Gas 12-Month Average Future Prices (April 1990 - April 2007) 15 Pre-1999 Future Price (US$/GJ) 12 Post-1999 12-Month Average 1.89 Standard Deviation 0.29 12-Month Average 5.12 Standard Deviation 2.33 9 6 3 0 19 4/ 4/ 90 91 19 4/ 4/ 92 19 4/ 4/ 93 19 4/ 4/ 94 19 4/ 4/ 95 19 4/ 4/ 96 19 4/ 4/ 97 19 4/ 4/ 98 19 4/ 4/ 99 19 4/ 4/ 00 20 4/ 4/ 01 20 4/ 4/ 02 20 4/ 4/ 03 20 4/ 4/ 04 20 4/ 4/ 05 20 4/ 4/ 06 20 4/ 4/ 07 20 4/ 4/ Note: Null prices are omitted to adjust for market inactivity. 3 4 Prior to 1999 the average of these forward prices was US $1.89 per GJ with a standard 5 deviation of US $0.29, a very low and stable price environment. As the figure indicates, 6 since 1999 the average forward price more than doubled to US $5.12 per GJ and the 7 standard deviation of those prices ballooned to US $2.33, an eight-fold increase. The 8 same pattern can be seen for 36-month NYMEX forward prices shown in Figure 5. 10 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 5 Nymex Natural Gas 36-Month Average Future Prices (April 1997 - April 2007) 15 Future Price (US$/GJ) 12 Post-1999 Pre-1999 36-Month Average 2.18 36-Month Average 4.93 Standard Deviation 0.09 Standard Deviation 2.19 9 6 3 4/ 2/ 20 07 4/ 2/ 20 06 4/ 2/ 20 05 4/ 2/ 20 04 4/ 2/ 20 03 4/ 2/ 20 02 4/ 2/ 20 01 4/ 2/ 20 00 4/ 2/ 19 99 4/ 2/ 19 98 4/ 2/ 19 97 0 Note: Null prices are omitted to adjust for market inactivity. 1 2 While these changes in the commodity market pre and post-1999 are dramatic, even those 3 averages mask to some extent the market changes experienced in just the last 22 months, 4 as NYMEX forward prices on both a 12 and 36-month basis have risen to the US $7 to 5 $11 per GJ range. This reflects the market’s current perception that we have entered a 6 sustained period of high natural gas prices and high price volatility that has not been seen 7 before in North America. Whether or not these changes in the gas commodity market are 8 permanent or temporary is a subject of debate (the market, at least, is forecasting a 9 continuation of the pattern for at least the next three years.) One thing that we can have 10 some confidence in, however, is that there will be continued uncertainty in future prices 11 and increased price volatility, uncertainty which contributes to greater demand growth 12 and use-per-customer risk for gas utilities distributing the commodity. 13 14 Q14. Is there direct evidence that since 1999 the market has required higher returns for utility investment in Canada than the returns implied by the NEB formula? 11 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 A14. Yes, there is. Figure 6 provides the details of the returns agreed by the parties in recently 2 completed and proposed Canadian pipeline projects. According to these data, these 3 projects earn, or propose to earn, returns on equity in the range of 11.0 percent to 14.0 4 percent on equity thickness of at least 25 percent. I will return to other evidence of 5 returns for comparable risk LDC investments below. But these pipeline investments are 6 some of the best examples we have in Canada of returns required by market participants 7 making new capital investments in natural gas infrastructure outside of the NEB or 8 provincial ROE formulas. Figure 6 Most Recently Completed and Proposed Canadian Pipeline Projects Year Participants Project Capital In-Service Tolling Methodology Structure ROE 2000 Negotiated cost of service arrangement, 15 year contracts with renewal options starting at year 10, accelerated depreciation for contracts that are not renewed in year 10 70/30 11.25% 1999 ROE of 13% for Canadian portion (for first five years) and 14% for U.S. portion. Single postage stamp rates for services offered 75/25 13.00% Completed Pipelines Alliance Enbridge Fort Chicago M&NE Duke Emera ExxonMobil Proposed Pipelines Brunswick Emera 2008 Seeking approval for a confidential negotiated toll agreement with a shipper holding almost all of the project's capacity, as well as designation as a Group 2 pipeline Mackenzie Delta Imperial 2009 Negotiated cost of service agreement with ROE equal to the NEB multi-pipeline ROE plus 221 basis points for the first 10 years; after 10 years ROE will be set by negotiated settlement or by an application by the transporter to the NEB ConocoPhillips Shell 60/40 [1] 70/30 11.00% to 14.00% NEB ROE + 2.21% ExxonMobil APG Source: NEB & Company Websites. Notes: [1] 40% represents Brunswick's minimum equity component 9 10 III. 11 EVALUATION OF GAZ MÉTRO’S BUSINESS RISK SINCE 1999 AND 2004 A. DETERMINANTS OF BUSINESS RISK AND THE COST OF CAPITAL 12 Q15. How does one define business risk in the context of a company’s cost of capital? 13 A15. 14 Business risk in the context of a company’s cost of capital is the uncertainty in the income earning capability of the firm’s assets that investors in the company’s equity are 12 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 exposed to over the economic lifetime of the assets. Business risk has been traditionally 2 subdivided into market demand, supply, competitive, regulatory and operating risks.6 3 Q16. What kinds of risks matter the most in evaluating a company’s business risk from a 4 5 cost of capital perspective? A16. The risks that matter the most from an equity investor’s perspective are those that cannot 6 be diversified away through the holding of a broad portfolio of securities. Risks that are 7 hard to diversify are those that are generally correlated with the level of (and changes in) 8 general economic activity. Such risks are referred to as “systematic.” Broadly speaking, 9 systematic risks associated with the gas distribution business include uncertainties in the 10 demand for, and supply of, distribution services that are affected by changes in economic 11 activity, including incomes and prices. 12 Q17. How does the fact that a company itself may be comprised of a diversified portfolio 13 14 of businesses affect the evaluation of a company’s business risk? A17. Investors in a company that contains a diversified set of businesses will evaluate the total 15 business risk of the company based on the weighted average risk of the portfolio of assets 16 that makes up the company, where the weights are the market value shares of the 17 individual businesses in the overall company portfolio. 18 company as less risky simply because the company has chosen to own a diversified set of 19 assets. This is because investors themselves can always choose to diversify within their 20 own investment portfolios, and therefore no additional risk-reduction value is assigned to 21 a company that chooses to diversify. Investors will not view a 22 Q18. How does rate regulation affect a company’s business risk? 23 A18. On the one hand, rate regulation reduces a company’s business risk if it provides equity 24 investors some assurance that a fair return on and of capital will be earned over the 25 lifetime of the firm’s assets. On the other hand, regulation may enhance a company’s 26 business risk if investors perceive that there is uncertainty in the future regulatory 6 National Energy Board, Reasons for Decision, TransCanada Pipelines Limited, RH-4-2001, June 2002, page 13. 13 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 treatment of the firm’s businesses. That is why regulatory risk is sometimes evaluated as 2 a separate component of business risk. While the equity securities of rate regulated firms 3 are generally perceived as relatively stable, low-risk investments, the greater exposure of 4 such firms to competition from other regulated and unregulated businesses, and 5 alternative fuels, has changed that perception somewhat in recent years, particularly in 6 the energy utility sector. 7 B. GAZ MÉTRO’S BUSINESS RISK ENVIRONMENT 8 Q19. How would you characterize Gaz Métro’s assets from a business risk perspective? 9 A19. 10 11 residential, commercial and industrial customers. Q20. How does Gaz Métro’s gas distribution business subdivide in terms of customer 12 13 Gaz Métro’s assets are devoted to the provision of traditional gas distribution services to classes? A20. In fiscal year 2006, Gaz Métro served roughly 167,000 customers in five tariff classes, D1 14 (general service), DM (modular service), D3 (stable service), D4 (stable service for large 15 volumes), and D5 (interruptible service). 16 customers made up 71% of Gaz Métro’s customers and 12% of its throughput, 17 commercial customers made up 28% of customers and 33% of throughput, and industrial 18 customers made up 1% of customers and 55% of throughput. Gaz Métro is forecasting 19 total throughput of 5,878 106m3 for fiscal year 2008, which represents a 1.1% increase 20 from the prior year estimate (the fiscal year 2007 estimate) on a comparable weather- 21 normalized basis. This 1.1% increase in throughput is attributed to the increase in 22 consumption of one large industrial customer, partially offset by a decrease in the 23 consumption of small and medium load customers. In terms of customer class, residential 24 Q21. How does Gaz Métro earn income on its distribution services? 25 A21. Since 2000, Gaz Métro’s rates have been set using a Performance Incentive Mechanism. 26 Under this mechanism, Gaz Métro’s rates are set prior to the start of each fiscal year by 27 comparing its projected cost of service to a revenue cap. Gaz Métro’s projected cost is 28 computed using traditional cost of service ratemaking principles, with an allowed return 14 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 on equity set using the Régie-approved formula-based methodology at a deemed equity 2 thickness. Its revenue cap is computed by escalating the prior years’ cap based on the 3 Québec Consumer Price Index minus an X-factor. 4 account for certain exogenous factors (for example, the impact of weather on revenues 5 and the impact of changes in interest rates on Gaz Métro’s allowed return) and exclusions 6 (for example, the overall cost of energy efficiency programs and the impact of prior year 7 overearnings). If the revenue cap is greater than Gaz Métro’s projected cost of service, 8 then rates are set so that the projected productivity gain is shared between customers and 9 Gaz Métro,7 with the portion of the productivity gain retained by Gaz Métro returned to 10 customers after five years. If the revenue cap is less than Gaz Métro’s projected cost of 11 service, then rates are set to recover Gaz Métro’s projected cost of service. In this case, 12 the difference between Gaz Métro’s projected cost of service and the revenue cap must be 13 repaid to customers before Gaz Métro can share in productivity gains or collect 14 overearnings in later years. 15 At the end of each fiscal year, Gaz Métro’s actual productivity gain is compared to its 16 expected productivity gain. If its actual productivity gain is greater than the expected 17 productivity gain, then the resulting overearnings are shared between customers and Gaz 18 Métro (in the form of a contribution to an energy efficiency fund and a reduction in rates 19 in the second subsequent fiscal year). If the actual productivity gain is positive but less 20 than the expected productivity gain, then Gaz Métro retains all of the actual productivity 21 gain (since in this case customers received a full share of the expected gain prior to the 22 start of the fiscal year). If the actual productivity gain is negative, then customers and 23 Gaz Métro share the deficit (with customers’ share in the form of an increase in rates in 24 the second subsequent fiscal year). In this case, Gaz Métro must repay customers for 25 their share of the deficit with interest before Gaz Métro can share in productivity gains or 26 overearnings in later years. 7 The revenue cap is adjusted to Since 2004, Gaz Métro’s authorized incentive return has been capped at 375 basis points (after-tax) above its allowed return. Gaz Métro can only receive an authorized incentive return if certain performance indicators are met. 15 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 Q22. How has the Performance Incentive Mechanism changed since it was put in place in 2 3 2000? A22. Gaz Métro’s Performance Incentive Mechanism has been modified twice since it took 4 effect in October 2000. The first modifications was effective October 2004, and the 5 second will take effect October 2007. 6 The modifications in October 2004 involved changes to several parameters that govern 7 the Performance Incentive Mechanism. When the Performance Incentive Mechanism 8 took effect in October 2000, the X-factor was 0.3%, customers received 47.5% of 9 projected productivity gains and customers received 67% of overearnings. Starting in 10 October 2004, the X-factor was increased to 0.5%, customers’ share of projected 11 productivity gains was increased to 50%, and customers’ share of overearnings was 12 increased to 75%. 13 The modifications that will take effect in October 2007 are more fundamental. Most 14 significantly, in recognition of the fact that “Gaz Métro’s business reality has evolved 15 since the performance incentive mechanism was introduced,” and in particular because 16 “sales volumes are more volatile and per customer volumes are down, primarily because 17 of energy conservation initiatives,”8 a new exogenous factor will be introduced that 18 partially accounts for declining average use by small and medium load (SML) customers. 19 This exogenous factor will be based on revenue variation due to declines in SML 20 customer weather normalized volumes two years prior to the fiscal year. More precisely, 21 it is calculated as: 8 “Performance Incentive Mechanism Agreed in Negotiated Settlement Process (NSP) R-3599-2006,” [Translation – Not approved by Participants], April 19, 2007, page 10. 16 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 -[(ΔVt-2% + 0.86%) * 90% * VSML * Ratet-2], where 2 3 ΔVt-2% = total normalized consumption of a certain group of SML customers9 for year t-2, 4 VSML = total volume consumed by SML customers, and 5 6 Ratet-2 = rate based on rate brackets used to convert volumes into revenues for year t-2. 7 The X-factor will decrease to its original level, 0.3%. This decrease in the X-factor is 8 meant to account, in part, for the fact that there is no explicit adjustment for volume 9 variation by large load customers. 10 Several other modifications in the Performance Incentive Mechanism will take effect in 11 October 2007. The return of past productivity gains will be smoothed by basing them on 12 a five-year moving average. Changes will be made in service quality requirements in 13 order to give Gaz Métro a greater incentive to make improvements in service quality 14 indicators. If Gaz Métro achieves between 85% and 100% on specified indicators, then it 15 will retain a corresponding percentage of projected productivity gains and overearnings.10 16 The Performance Incentive Mechanism will include a target return of $4 million per year 17 for meeting a cumulative Global Energy Efficiency Plan (GEEP) volume reduction of 18 24,000,000 m3 per year.11 Finally, transmission and load-balancing revenues will be 19 treated differently in order to decrease overearnings associated with these services,12 and 9 SML customers served continuously since 1999 that have not required any sales intervention by Gaz Métro. 10 If Gaz Métro achieves less than 85% on specified service quality indicators, then it retains no projected productivity gains or overearnings. 11 This target return will be prorated if Gaz Métro only partially achieves the GEEP volume reduction. 12 Revenue from financial transactions related to transmission and load-balancing services (which are transactions such as loans of unused storage space that do not have an impact on the total volume of transmission and load-balancing tools used during a fiscal year) will be forecast at the start of a fiscal year. If actual revenues are lower than projected revenues, then the deficit will be placed in a deferral account and recovered from customers. If actual revenues are greater than projected revenues, then the difference will be shared 25%/75% between Gaz Métro and its customers, regardless of whether Gaz Métro attains an incentive award or overearnings. Operational transactions related to transmission and load-balancing services will also be forecast prior to the start of the fiscal year. At the end of the fiscal year, customers will receive 75% of earnings from operating transactions, calculated as (actual average operating (continued…) 17 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 a new exogenous factor will be introduced to adjust for the impact of changes in income 2 and capital tax rates on the cost of service. 3 Q23. Is Gaz Métro continuing to make capital investments in its distribution business? 4 A23. Yes. Gaz Métro is proposing capital expenditure of $132.1 million for fiscal year 2008. 5 This includes $44.1 million in network expansion expenditures, $35.2 million in deferred 6 charges expenditures (mainly commercial programs and IT development), and $22.5 7 million in network improvement expenditures. Gaz Métro made capital expenditures of 8 $195.4 million in fiscal year 2007, including $47 million in expenditures actually 9 incurred in 2005 and 2006 but included in rate base in 2007 associated with serving 10 TransCanada’s Bécancour cogeneration project, which is now Gaz Métro’s largest 11 customer. Gaz Métro continues to put new capital at risk. 12 Q24. Does the fact that the markets Gaz Métro serves are expected to grow mean that its 13 14 assets are likely to be exposed to less business risk? A24. No. Risk is not about expectations alone. Risk involves the uncertainty associated with 15 the expected outcomes. Some of the riskiest firms that one can evaluate from an 16 investment perspective are those that serve high growth but highly uncertain markets 17 such as telecommunications or technology. A high growth market is certainly a positive 18 factor from an equity investor’s perspective all else equal. However, that same investor 19 will demand a higher rate of return if the expected growth is more uncertain. 20 Q25. What are the principal classes of business risk to which Gaz Métro is exposed? 21 A25. Gaz Métro is exposed to market risk in its gas distribution business. Gaz Métro is also 22 exposed to regulatory risk related to its Performance Incentive Mechanism. Incentive 23 ratemaking regimes create greater expected short-term variations in earnings than does 24 traditional cost-of-service regulation, particularly where deferral accounts are used to 25 adjust for cost under- or over-recovery. I will return to this topic in more detail below. transactions price – projected average operating transactions price) * minimum [actual operating transactions volume, projected operating transactions volume]. 18 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 Q26. How does market risk manifest itself in Gaz Métro’s gas distribution business? 2 A26. The market risk to which Gaz Métro is exposed in its distribution business manifests 3 itself in uncertainty over the future utilization of its distribution assets. Because Gaz 4 Métro’s gas distribution assets are sunk investments, and cannot be redeployed easily to 5 another use should market conditions change, Gaz Métro’s future income earning 6 capability depends critically on the maximum utilization of its assets. While Gaz Métro 7 is compensated to some extent for declining volumes under its Performance Incentive 8 Mechanism, this compensation does not provide Gaz Métro with assured cost recovery 9 protection should its asset utilization differ from forecasts. In this way, Gaz Métro bears 10 some market risk that depends on asset utilization. 11 Q27. What factors could affect the utilization of Gaz Métro’s distribution assets? 12 A27. Distribution asset utilization is a function of the wholesale and retail price of the gas 13 commodity itself, of the price of competing fuels, of general economic activity in its 14 service area, and of weather deviations from normal forecast conditions. Of these risk 15 factors, the ones most important to equity investors (i.e., those that are systematic) are the 16 level of prices and economic activity. Weather deviations from normal are less important 17 to equity investors because they are not likely to be correlated with the market and hence 18 they are a diversifiable risk. Again, this is because investors themselves can cheaply 19 diversify away risks that are not correlated with movements in the general economy by 20 holding a portfolio of equities, such as broadly-based mutual funds. Moreover, Gaz 21 Métro is compensated for weather deviations via a deferral account that is included in 22 rate base and amortized over a five year period. 23 Q28. To this point you have not mentioned supply risk. Does Gaz Métro face supply risk 24 25 in its gas distribution business? A28. Not to a significant degree, in my opinion. This is partly because Gaz Métro’s gas supply 26 costs are a pass-through item in its customers’ bills. Of course, to the extent these supply 27 costs rise, the market risk to which Gaz Métro is exposed increases, as I describe below. 28 But that is not the same as supply risk in that Gaz Métro does not face a significant risk 29 that the utilization of its facilities will be reduced due to the unavailability of supply. 19 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 2 3 C. OF CHANGES IN GAZ MÉTRO’S BUSINESS RISK SINCE 1999 Q29. What changes in the business risk to which Gaz Métro is exposed since 1999 and 4 5 EVIDENCE AND 2004 2004 have you identified? A29. I have identified two areas in which there has been a measurable increase in Gaz Métro’s 6 business risk that would matter to investors in its equity securities. 7 Increases in the level and volatility of gas commodity prices and thus increased 8 uncertainty in gas use per customer; and 2) Increased uncertainty associated with Gaz 9 Métro’s earnings due to its Performance Incentive Mechanism. 10 11 1. These are: 1) Increases in Uncertainty in Gas Use Per Customer Q30. In Section II, you discussed changes in the level and volatility of gas prices since 12 1999, and particularly since 2004. 13 commodity price environment translate to Gaz Métro and its customers? 14 A30. How do these changes in the natural gas Ultimately these price level and volatility changes in the wholesale market are reflected 15 in the retail market. To see this, I have plotted Gaz Métro’s total billing rate for several 16 of its tariff classes in Figures 7 through 9. Using Gaz Métro’s rate D1 as an example, 17 Figure 7 shows that during the period October 1995 to September 1998 (“Pre-1999”) the 18 average billing rate was 27 cents/m3 with a standard deviation of 1.1 cents/m3, and that 19 this amount had increased by 14% over the period. During October 1998 to September 20 2004 (“Post-1999”), the average rate D1 monthly bill was 42 cents/m3 (a 56 percent 21 increase) while the standard deviation of those amounts increased to 7.6 cents/m3. 22 Starting in October 2004 (“Post-2004”), the average rate D1 monthly bill increased 23 further to 53 cents/m3 (an 96 percent increase over pre-1999 levels) while the standard 24 deviation of those amounts increased to 5.2 cents/m3. 20 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 7 Tariff D1 70 Monthly Total Billing Rate (¢/m³) 60 50 40 30 Rate D1 Average % Change 20 Pre-1999 Post-1999 Post-2004 10 27.02 42.37 52.89 14.26 63.60 3.72 Standard Deviation 1.14 7.63 5.20 0 Oct-95 Oct-96 Oct-97 Oct-98 Oct-99 Oct-00 Oct-01 Notes: "Pre-1999" is 10/95 - 9/98. "Post-1999" is 10/98 - 9/04. "Post-2004" is 10/04 - 9/06. 1 21 Oct-02 Oct-03 Oct-04 Oct-05 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 8 Tariff DM 60 Monthly Total Billing Rate (¢/m³) 50 40 30 Rate DM Average % Change 20 Pre-1999 Post-1999 Post-2004 18.18 32.26 41.49 19.19 81.31 4.00 Standard Deviation 1.04 7.11 5.14 10 0 Oct-95 Oct-96 Oct-97 Oct-98 Oct-99 Oct-00 Oct-01 Notes: "Pre-1999" is 10/95 - 9/98. "Post-1999" is 10/98 - 9/04. "Post-2004" is 10/04 - 9/06. 1 22 Oct-02 Oct-03 Oct-04 Oct-05 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 9 Tariff D3 60 Monthly Total Billing Rate (¢/m³) 50 40 30 Rate D3 Average % Change 20 Pre-1999 Post-1999 Post-2004 17.95 31.59 40.13 Standard Deviation 12.69 77.33 4.37 0.77 6.79 5.16 10 0 Oct-95 Oct-96 Oct-97 Oct-98 Oct-99 Oct-00 Oct-01 Oct-02 Oct-03 Oct-04 Oct-05 Notes: "Pre-1999" is 10/95 - 9/98. "Post-1999" is 10/98 - 9/04. "Post-2004" is 10/04 - 9/06. 1 2 These fundamental changes in the commodity price environment have begun to induce 3 changes in customer use of Gaz Métro’s network. This can be seen in decreases in Gaz 4 Métro’s historical and forecast usage per customer. 5 Q31. What do the usage per customer statistics show? 6 A31. The statistics show significant declines in use per customer over time. Gaz Métro has 7 provided me with data on weather normalized average use per customer for several of its 8 tariff classes.13 These data are presented in Figures 10 and 11 below. For example, for 9 tariff class D1 estimated weather normalized average use in 1999 was 13.9 103m3. By 13 In forecasting weather normalized usage, Gaz Métro considers: diminishing demand due to extreme gas prices, energy efficiency induced by Gaz Métro programs and undertaken independently by customers, relative fuel prices (oil and electricity vs. natural gas), Hydro-Québec special rates, macroeconomic indicators like Québec GDP, and decreases in 30-year average heating degree days for weather normalization. 23 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 2004, estimated weather normalized average use declines to 13.5 103m3, a 2.9% decline. 2 The weather normalized average use estimate for 2008 based on the current price 3 forecasts is 11.5 103m3, a decline of an additional 14.4%. Figure 10 Estimated Normalized Average Usage for Tariff Class D1 (Annual 10³m³ per Customer) 15.0 Normalized Average Usage (10³m³) 14.5 14.0 13.5 13.0 12.5 12.0 11.5 11.0 1996 1997 1998 1999 2000 2001 4 24 2002 2003 2004 2005 2006 2007 2008 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 11 Estimated Normalized Average Usage for Tariff Classes DM and D3 (Annual 10³m³ per Customer) 700 Normalized Average Usage (10³m³) 650 600 550 500 450 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 1 2 Q32. Do the recent changes in Gaz Métro’s Performance Incentive Mechanism, namely 3 the new exogenous factor meant to account for declining usage, compensate Gaz 4 Métro for these decreases in average normalized usage? 5 A32. No. The new exogenous factor meant to adjust for declining usage only accounts for 6 declines in usage for Gaz Métro’s SML (small and medium load) customers. Moreover, 7 it is incorporated with a two year lag. Therefore, the fiscal year 2008 revenue cap will be 8 adjusted for annual variation in 2006 SML customer usage. 9 Q33. Can you discuss how changes in natural gas prices and the prices of competing fuels 10 since 1999 and 2004 have affected Gaz Métro’s industrial (or large load) customers? 11 A33. Yes. Figure 12 below shows the relative cost of natural gas and fuel oil for large firm 12 and interruptible customers (bars lower than 100% indicate that natural gas is more 13 expensive than fuel oil). As Figure 12 indicates, the competitive position of natural gas 14 has eroded relative to fuel oil since 1999. 25 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 12 Relative Cost of Fuel Oil Vs. Natural Gas for Large Industrial Customers 120% Firm Industrial Customers; # 6 Fuel Oil, 1.5% Sulphur 100% Over 100%, gas is cheaper Interruptible Industrial Customers; # 6 Fuel Oil, 1.5% Sulphur 80% 60% 40% 20% 0% 1996-97 1997-98 1998-99 1999-2000 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 Source: Gaz Métro Analysis. 1 2 Figure 13 shows the number of customers and load for Gaz Métro’s large industrial (tariffs 3 D4 and D5) customers for selected years between 1999 and 2008. Gaz Métro has lost many 4 large industrial customers since 1999. Its large customer load has decreased significantly 5 since 1999, although this decrease has been partially offset by the addition of the 6 TransCanada Bécancour cogeneration plant in September 2006. Figure 13 Gaz Métro's Large Industrial Customer Load ( Tariff Classes D4 and D5 ) Number of Customers 7 8 9 6 3 Volume (10 m ) 1999 2004 2007 2008 388 364 296 257 3,550 2,420 2,890 2,980 Q34. What do you conclude regarding the effects of the changed gas commodity environment on the risk associated with Gaz Métro’s gas distribution business? 26 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 A34. Equity investors looking at Gaz Métro’s gas distribution business will be primarily 2 concerned with uncertainty surrounding the short and long-term utilization of Gaz 3 Métro’s distribution assets. Since 1999 and particularly since 2004 there has been a 4 fundamental change in the natural gas commodity price environment in which Gaz Métro 5 operates. This change has already begun to affect negatively the utilization of Gaz 6 Métro’s network across its rate classes, and there is substantial future uncertainty in this 7 utilization. This represents a significant change in Gaz Métro’s business risk. 8 9 10 2. Q35. How does Gaz Métro’s Performance Incentive Mechanism differ from traditional 11 12 Increased Risk due to Gaz Métro’s Performance Incentive Mechanism cost of service regulation in terms of regulatory risk? A35. In general, Gaz Métro’s Performance Incentive Mechanism exposes equity investors to 13 greater business risks than would traditional cost of service regulation. This is primarily 14 due to the productivity gains and overearnings sharing and service performance threshold 15 features of the Performance Incentive Mechanism. How much greater the risk is depends 16 on the particular form of cost of service regulation to which it is being compared. In 17 Canada, most traditional cost of service regimes employ deferral accounts to “true up” 18 the incurrence of costs with the recovery of costs in future periods. This form of cost of 19 service regulation exposes utilities to the least long-term cost recovery risk, and 20 depending on the extent to which deferral accounts are employed, may reduce short term 21 earnings volatility as well. In the U.S., most cost of service regimes do not make 22 extensive use of deferral accounts, and many do not require utilities to file frequent rate 23 cases. Under this approach the regulator is making use of “regulatory lag” (the time 24 between cost-of-service rate cases) as an incentive mechanism. I.e., to the extent the 25 utility is able to reduce costs or increase productivity between rate cases, its earned 26 returns will vary between rate cases. 27 regulation exposes utilities to somewhat greater business risks. 28 Gaz Métro’s Performance Incentive Mechanism exhibits some of the characteristics of 29 cost of service regulation with regulatory lag, but it is a riskier regime because the As a result, this approach to cost of service 27 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 revenue cap includes the effect of projected productivity gains that must be shared with 2 Gaz Métro’s customers before any gains or overearnings accrue to Gaz Métro’s 3 shareholders. 4 Q36. Previously you mentioned some of the changes that have been made to Gaz Métro’s 5 recently approved Performance Incentive Mechanism that will take effect in 6 October 2007. What is the likely effect of those changes on Gaz Métro’s business 7 risk? 8 A36. The three modifications I discussed previously that would seem to have the greatest 9 potential to affect Gaz Métro’s business risk are 1) the new exogenous factor for 10 declining average use by SML customers; 2) the smoothing of past productivity gains by 11 basing them on a five-year moving average, and 3) the modification of the service 12 performance indicators to between 85% and 100% to increase Gaz Métro’s incentives to 13 improve service quality. The first two of these changes would be expected to reduce Gaz 14 Métro’s business risk, all else equal, because they are likely to reduce Gaz Métro’s 15 exposure to short term earnings volatility. Of course, all else is not equal in this case 16 because declines in use per customer are continuing to be experienced, as I have shown, 17 and the SML exogenous factor does not fully account for these effects. There is also no 18 explicit adjustment being made for volume variation by large load customers, but the X- 19 factor has also been reduced to 0.3% to account, in part, for this fact. Finally, the 20 modification of the service performance indicators can be expected to increase Gaz 21 Métro’s business risk because it raises the hurdle which must be overcome before Gaz 22 Métro can retain the relevant percentages of any productivity gains or overearnings. 23 Q37. What do you conclude with respect to the effect of Gaz Métro’s Performance 24 25 Incentive Mechanism on its business risk? A37. On balance, Gaz Métro’s Performance Incentive Mechanism can be expected to increase 26 its business risk relative to the traditional models of cost of service regulation employed 27 for other utilities in North America. 28 expected to reduce its risks directionally, and only partially in response to the more risky 29 market environment to which Gaz Métro is now exposed. The recent changes to its Mechanism can be 28 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 D. CONCLUSION 2 Q38. What do you conclude regarding changes in Gaz Métro’s business risk since 1999 3 when the ROE formula was put in place, and since 2004, when the formula was last 4 evaluated? 5 A38. I conclude that Gaz Métro’s business risk has increased significantly since 1999, and 6 particularly since 2004. Increases in the level and volatility of natural gas prices have 7 increased the uncertainty surrounding the short-term and long-term utilization of Gaz 8 Métro’s distribution network. Recent changes in Gaz Métro’s Performance Incentive 9 Mechanism only partially reduce Gaz Métro’s exposure to these uncertainties. Moreover, 10 Gaz Métro’s Performance Incentive Mechanism, first implemented in 2000 and revised in 11 2004 and 2007, increases its business risk relative to traditional models of cost of service 12 regulation. 13 14 IV. 15 16 A. GAZ MÉTRO’S UNIQUE BUSINESS ENVIRONMENT Q39. How does Gaz Métro’s business environment compare to other LDCs in Canada 17 18 GAZ MÉTRO’S BUSINESS RISK COMPARED TO OTHER LDCS IN CANADA AND THE UNITED STATES and the U.S.? A39. Gaz Métro’s business environment is unique compared to other LDCs in Canada and the 19 U.S. in at least three respects: (1) natural gas has a significantly lower penetration rate in 20 Québec, in Gaz Métro’s service territory, than in the service territories of typical LDCs in 21 Canada and the U.S.; (2) Gaz Métro faces significantly stronger competition from 22 electricity than other LDCs in Canada and the U.S.; and (3) Gaz Métro has a large 23 industrial customer load, an industrial customer load that is larger than the LDCs in 24 Professor Chrétien’s U.S. LDC sample. 29 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 2 1. Q40. How does natural gas penetration in Québec compare to natural gas penetration in 3 4 Natural Gas Penetration in Québec other Canadian provinces? A40. Natural gas usage for home heating is significantly lower in Québec than in all Canadian 5 provinces except the Atlantic provinces. See Figure 14 below, which was compiled using 6 data from Natural Resource Canada for 2004. Natural gas represents 9% of the energy 7 used for home heating in Québec, compared to over 60% of the energy used for home 8 heating in Manitoba, British Columbia, Ontario, Saskatchewan and Alberta. Figure 14 Fuel Mix for Home Heating in Canadian Provinces in 2004 100% Other 90% Wood % of Energy Use for Heating 80% 70% 60% 50% Heating Oil 40% 30% Electricity 20% 10% 0% Natural Gas Quebec Atlantic Manitoba British Columbia and Territories Ontario Saskatchewan Alberta Source: Natural Resources Canada, "Comprehensive Energy Use Database" Notes: "Other" includes propane and coal; Atlantic Region is comprised of Newfoundland, Prince Edward Island, Nova Scotia, and New Brunswick 9 10 Total natural gas usage is also significantly lower in Québec than in all other Canadian 11 provinces except for the Atlantic provinces. Figure 15 shows primary natural gas and other 12 fuel usage for the Canadian provinces in 2003. 13 percentage of total primary fuel usage gas is significantly lower in Québec than in Ontario, 14 Manitoba, British Columbia, Saskatchewan and Alberta. 30 It shows that natural gas usage as a WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 15 Fuel Mix in Canadian Provinces in 2003 100% Primary Electricity 90% % of Energy Consumption 80% 70% 60% Petroleum 50% 40% Coal 30% 20% 10% Natural Gas 0% Quebec Atlantic Ontario Manitoba British Columbia & Territories Saskachewan Alberta Source: Statistics Canada Notes: Primary electricity is hydro and nuclear electricity. Atlantic provinces are Newfoundland, Prince Edward Island, Nova Scotia and New Brunswick. 1 2 Q41. How does natural gas penetration in Québec compare to natural gas penetration in 3 4 the U.S.? A41. Natural gas usage for home heating is significantly higher in the U.S. than in Québec. 5 See Figure 16 below, which was compiled using the most recently available survey of 6 Residential Energy Consumption compiled by the U.S. Energy Information 7 Administration, for 2001. Natural gas represents over 55% of the energy used for home 8 heating in the Northeast, South, West and Midwest census regions of the U.S. 31 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 16 Fuel Mix for Home Heating in US in 2001 100% Kerosene LPG 90% % of Energy Use for Heating 80% Heating Oil 70% 60% Electricity 50% 40% 30% Natural Gas 20% 10% 0% Northeast South West Midwest Source: EIA, "Residential Energy Consumption Survey 2001" 1 2 Total natural gas usage is also greater in the U.S. than in Québec. Figure 17 shows natural 3 gas and other fuel usage by census region in the U.S. It shows that natural gas usage as a 4 percentage of total primary fuel usage in Québec (see Figure 15) is significantly lower than 5 natural gas usage in the U.S., where natural gas usage is greater than 20% of total fuel 6 usage in every census region. 32 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 17 Fuel Mix in US Census Regions in 2003 100% Other Biomass 90% Hydro Nuclear % of Energy Consumption 80% 70% Petroleum 60% 50% 40% Coal 30% 20% Natural Gas 10% 0% Midwest Northeast South West Source: EIA Notes: Natural Gas inlcudes supplemental gaseous fuels such as propane-air, refinery gas, coke-oven gas, still gas, manufactured gas, biomass gas, or air or inerts added for Btu stabilization; "Other" includes geothermal, wind, photovoltaic, solar, thermal energy and net imports of electricity. 1 2 Q42. Have you compared Gaz Métro’s growth rate to that of other distributors in 3 4 Canada and the U.S.? A42. Yes. Gaz Métro’s penetration rate in housing starts in Québec is significantly lower than 5 the penetration rate for natural gas in new, single-family homes in the U.S. Gaz Métro 6 supplied natural gas to 9.7% of all housing starts in Québec in 2005 and 11% of all 7 housing starts in Québec in 2006, while natural gas was used to heat 58.2% of newly 8 constructed single family homes in the U.S. in 2005.14 9 penetration rate in new residential housing despite its significant spending on advertising 10 and other market initiatives. Gaz Métro spent $2.5 million in advertising expenditures in 11 2006 and employed 45 full-time sales force representatives for its three market segments 12 (its residential, commercial and industrial market segments). 14 Gaz Métro had a lower American Gas Association Energy Analysis EA 2006-07, August 17, 2006, p. 1. 33 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 Q43. What does this relatively low penetration of natural gas suggest for Gaz Métro’s 2 3 business risk? A43. It suggests that Gaz Métro is less likely than other LDCs in Canada and the U.S. to be 4 able to exploit geographic scale and scope economies to lower its average costs and 5 therefore its rates. Without the ability to exploit geographic scale and scope economies, 6 Gaz Métro’s rates are likely to be less competitive than the prices of competing fuels, 7 such as electricity for residential and commercial customers and fuel oil for industrial 8 customers. 9 10 2. Q44. Figure 14 shows significant usage of electricity for home heating in Québec. How 11 12 Competition from Electricity competitive is natural gas with electricity for home heating in Québec? A44. According to Gaz Métro’s rate cases filed with the Régie, natural gas has been more 13 expensive than electricity for home heating since 2000. Figure 18 compares the relative 14 fuel costs for natural gas and electricity in Québec (and note that natural gas costs are 15 higher than electricity costs when the bars are smaller than 100%). 34 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 18 Relative Cost of Electricity vs. Natural Gas For Residential One Family Households 140% 120% Over 100%, gas is cheaper 100% 80% 60% 40% 20% 0% 1996-97 1997-98 1998-99 1999-2000 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 Source: Gaz Métro Analysis 1 2 Q45. Why is natural gas at a competitive disadvantage to electricity for residential 3 4 customers in Québec? A45. Hydro-Québec’s electricity rates are low because Québec has abundant, inexpensive 5 hydroelectric resources. Commentators have recently argued that Hydro-Québec’s rates 6 should be raised to reflect the market value, and not the cost, of its power.15 Currently, 7 Hydro-Québec’s rates are significantly below market value, which offers a subsidy to 8 electricity users relative to users of competing fuels like natural gas.16 The relative value 9 of this surplus has risen while the Régie’s formula has been in place. According to an 10 analysis by Hydro-Québec, during the eight years from May 1, 1998 to April 1, 2006, the 15 See Marcel Boyer, “Higher Electricity Prices Can Unleash the Value of Québec’s Energy Potential,” Montreal Economic Institute, April 2007. Mr. Boyer is the Vice President and Chief Economist of the Montreal Economic Institute and holder of the Bell Canada Chair at the University of Montreal. 16 Mr. Boyer estimates that increasing Hydro-Québec’s rates to reflect the market value of its power would result in a roughly 50% increase in average annual residential electricity bills. Id., p. 3. 35 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 energy cost for a house in Québec heated with electricity rose 14.4%, while the energy 2 cost for a similar house heated with natural gas rose 58%.17 3 Natural gas is also at a competitive disadvantage to electricity for commercial and 4 industrial customers because of the structure of Hydro-Québec’s rates. Hydro-Québec 5 has a tiered rate structure for small (G), medium (M), and large (L) electricity customers 6 where the unit rate these customers pay decreases (even below Hydro-Québec’s marginal 7 cost or electricity production – the unit rate can be as low as 2.81 cents/kWh for rates M 8 and L according to Hydro-Québec’s April 1, 2007 rates chart) as they consume more 9 power.18 10 11 entirely dependent on electricity. Q46. How competitive is natural gas with electricity in other Canadian provinces and in 12 13 This rate structure encourages commercial and industrial customers to be the U.S.? A46. Electricity rates are significantly higher in most other major cities in Canada and the U.S. 14 than in Québec. Therefore, electricity has a greater competitive advantage compared to 15 natural gas in Québec than in most other major cities in Canada and the U.S. Figure 19 16 uses data from Hydro-Québec to compare residential electricity rates in major North 17 American cities as of April 2006. Figure 19 shows that only residential rates in Winnipeg 18 and Vancouver were lower than residential rates in Québec as of April 2006. The pattern 19 is similar for larger commercial and industrial customers. 17 18 Id., p. 4. Hydro-Québec recognizes that its rate structure puts it at a competitive advantage to competing fuels. Under the “Understanding the bill and rates – Small Power (G)” section of its website, it states: “In any given billing period, your average cost for both power and energy decreases as your consumption increases. And since energy prices are 50% lower in the second consumption bracket than in the first, our Small-Power Business Rate becomes even more competitive once the first kilowatt hours have been consumed.” See http://www.hydroquebec.com/business/typique/structure_tarifg.html. 36 WRITTEN EVIDENCE OF PAUL R. CARPENTER Figure 19 Average Residential Electricity Rates for Major North American Cities for Monthly Consumption of 1000 KWh (April 1, 2006) 30 25 23.8 19.2 New York, NY (Consolidated Edison) 12.4 Miami, FL (Florida Power and Light) 10.2 12.2 Charlottetown, PE (Maritime Electric) 10.1 11.2 Halifax, NS (Nova Scotia Power) 10.1 11.1 Toronto, ON (Toronto Hydro) Vancouver, BC (BC Hydro) 10.0 Regina, SK (SaskPower) Winnipeg, MB (Manitoba Hydro) 9.9 Edmonton, AB (EPCOR) 6.4 9.2 Moncton, NB (NB Power) 6.3 8.2 Ottawa, ON (Ottawa Hydro) 6.6 Montréal, QC (Hydro-Québec) 7.9 Nashville, TN (Nashville Electric Service) 10 10.4 St. John’s, NL (Newfoundland Power) ¢/kWh 15 18.8 Houston, TX (Reliant Energy) 21.1 20 13.0 1 2 Boston, MA (Boston Edison) San Francisco, CA (Pacific Gas and Electric) Detroit, MI (Detroit Edison) Chicago, IL (Commonwealth Edison) Source: "Comparison of Electricity Prices in Major North American Cities, 2006", Hydro Québec. Notes: Rates are in Canadian dollars. Q47. What does this unusual competition between gas and electricity in Québec suggest 3 4 Seattle, WA (Seattle City Light) 0 Portland, OR (Pacific Power and Light) 5 for Gaz Métro’s business risk? A47. The strong competition between natural gas and electricity increases Gaz Métro’s 5 business risk relative to other LDCs in Canada and the U.S. Electricity rates in Québec 6 are unusually low. These low electricity rates make it difficult for Gaz Métro to increase 7 its penetration of the Québec market, particularly as natural gas commodity prices 8 increase and become more volatile. 9 10 3. Q48. What portion of Gaz Métro’s load is represented by deliveries to industrial 11 12 13 Gaz Métro’s Industrial Customer Load customers? A48. In 2005, approximately 54% of Gaz Métro’s load (measured on a normalized basis) was deliveries to industrial customers (mainly deliveries to customers receiving service under 37 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 tariffs D4 and D5). In 2006, approximately 55% of Gaz Métro’s load was deliveries to 2 industrial customers. 3 Q49. How does Gaz Métro’s industrial load compare to that of other LDCs in the U.S.? 4 A49. Figure 20 below compares Gaz Métro’s industrial load in fiscal year 2005 to the 5 industrial load in calendar year 2005 of the U.S. LDCs in Professor Chrétien’s U.S. pure 6 play LDC portfolio.19 It shows that Gaz Métro’s industrial load was higher than each of 7 the U.S. LDCs except for Atmos Energy Corporation. Figure 20 Gaz Métro Industrial Load Compared to Prof. Chrétien's U.S. LDC Sample 60% 50% % of Total Throughput 40% 30% 20% 10% 0% Gaz Metro New Jersey Resources Corp. Laclede Group South Jersey Inc. Industries Inc. AGL Resources Northwest Natural Gas Co. Piedmont Southwest Gas Atmos Energy Natural Gas Co Corp. Corporation Note: Gaz Métro's Industrial Load Factor is for the 2005 fiscal year whereas the figures for US LDC s are for the 2005 calendar year. Gaz Métro's Industrial Load Factor is computed using normalized total volumes. 8 9 WGL Holdings Inc. Q50. What does Gaz Métro’s relatively large industrial load suggest for Gaz Métro’s 10 business risk? 19 Attachment B to my testimony describes the LDCs in Professor Chrétien’s pure play U.S. LDC portfolio in greater detail. 38 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 A50. Gaz Métro’s relatively large industrial load increases its business risk. Industrial 2 customers tend to have loads that are more variable and unpredictable than other 3 customer classes. They tend to have a greater ability to switch from natural gas to 4 competing fuels (particularly fuel oil) when natural gas commodity prices rise relative to 5 the prices of competing fuels. Moreover, in recent years many industrial customers have 6 decreased the size of their operations or have shut down in response to macroeconomic 7 conditions and fuel costs. 8 particularly striking when compared to load variations for residential and commercial 9 customers (SML customers). SML customers’ load varies due to changes in weather and 10 to increased energy conservation. However, these more predictable variations can be at 11 least partially addressed through weather normalization mechanisms and through 12 mechanisms like that recently incorporated into Gaz Métro’s Performance Incentive 13 Mechanism that is meant to account for declining customer usage. 14 15 4. Conclusion Q51. What do you conclude regarding Gaz Métro’s business environment compared with 16 17 This greater variability in industrial customers’ load is that of other LDCs in Canada and the U.S.? A51. Gaz Métro’s business risk tends to be greater than that of typical LDCs in Canada and the 18 U.S. due to the low penetration of natural gas in Québec, the unusual level of competition 19 between natural gas and electricity in Québec, and Gaz Métro’s relatively large industrial 20 load. 21 22 B. 23 Q52. How does Gaz Métro’s allowed ROE under the Régie-approved formula compare to 24 25 GAZ MÉTRO’S RETURN ON EQUITY COMPARED TO ALLOWED RETURNS ON EQUITY FOR U.S. LDCS allowed ROEs for U.S. LDCs? A52. Gaz Métro’s allowed ROE under the formula is significantly below the returns allowed 26 by regulators for LDCs in the U.S. I have compared Gaz Métro’s allowed ROE under the 27 Régie’s formula with allowed ROEs awarded for U.S. LDCs by state regulatory 28 commissions during the period January 1999 – October 2006. The results are shown in 39 WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 Figure 21 below. They show that during the period that the Régie-approved formula was 2 in place, allowed ROEs for U.S. LDCs have always been greater than Gaz Métro’s 3 allowed ROE. Figure 21 Gaz Metro's Authorized ROE Vs Authorized ROEs for U.S. LDCs Jan 1999-Oct 2006 14.00% 13.00% Authorized ROEs for US LDCs Authorized ROE 12.00% 11.00% 10.00% 9.00% Gaz Métro's Authorized ROE under the formula 8.00% 1/1/1999 1/1/2000 1/1/2001 1/1/2002 1/1/2003 1/1/2004 1/1/2005 1/1/2006 Source: "Regulatory Focus", Regulatory Research Associates 4 5 Q53. Are there any factors, including differences in financial risk, that would cause you 6 to believe that U.S. LDCs should have higher allowed ROEs than Gaz Métro? 7 A53. I cannot think of any reasons that are material. In the evidence above we have 8 highlighted the many reasons why Gaz Métro’s business risk should be considered 9 greater than the business risk borne by investors in U.S. LDCs (including differences in 10 regulatory risk). 11 differences in financial risk (i.e., leverage). 12 thicknesses in the range of 40 to 60 percent, implying that their equity investors face 13 lower financial risk that do equity investors in Gaz Métro. This would be a further reason 14 why Gaz Métro’s allowed ROE should be higher than that observed for U.S. LDCs. 15 These differences in allowed ROEs also cannot be explained by Q54. Does this complete your written evidence? 40 In fact, most U.S. LDCs have equity WRITTEN EVIDENCE OF PAUL R. CARPENTER 1 A54. Yes. 41