Murray Newton’s responses to Gaz Metro’s Information Request No.1

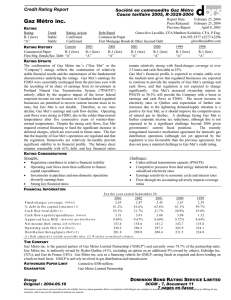

advertisement

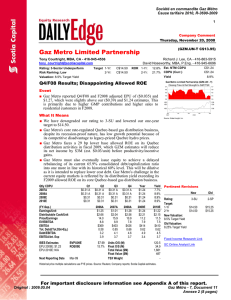

Murray Newton’s responses to Gaz Metro’s Information Request No.1 1. Référence : ACIG-4, Document 1, Written evidence of Murray Newton for IGUA, A6, page 3 Préambule : « The Gaz Métro request is excessive and unnecessary, and if approved, will result in a direct confiscation and transfer of wealth from all Québec gas consumers (including residential, commercial and industrial end users) to Gas Métro's shareholders. » Demande : 1.1 Can you indicate when (the percentage) does a return on equity get confiscatory and if a decrease in rate equivalent to an increase in rate could also be “a direct confiscation and transfer of wealth” from Gaz Métro's shareholders to all Québec gas consumers? If not, explain why. Answer 1.1 The Gaz Métro request for an ATWACC of 7.75% is excessive because it exceeds the fair return required to produce a return on capital that is fair to shareholders. As explained in Dr. Booth’s evidence, Gaz Métro’s ATWACC proposal also violates the fair return standard. It is not possible to identify the precise percentage whereby a particular ROE becomes unfair either to ratepayer customers or to shareholders. The current approved Formulabased cost of capital awarded to Gaz Métro by the Régie has been reviewed by the Régie in Gaz Metro’s last two (2) rate applications. The Formula ROE produces a cost of capital that continues to meet the fair return standard. IGUA accepts Dr. Booth’s assessment that the Régie’s Formula produces a fair return, although Dr. Booth considers it to be at the top of a zone of reasonableness. Therefore, any return that exceeds the Formula ROE may be considered to be excessive and unnecessary, thereby resulting in a direct confiscation and transfer of wealth from gas consumers to shareholders. 2. Référence : ACIG-4, Document 1,Written evidence of Murray Newton for IGUA, A7, page 3 Préambule : « The cost of capital represents a significant component of Gaz Métro's overall annual revenue requirement, or cost of service, on which the regulated tolls are based. Therefore, an increase to the cost of capital will increase the rates that al1 Québec customers pay and so the fair cost of capital, and its impact on tolls, is a concern to Gaz Métro's ratepayer customers. » Demandes : 2.1 Can you indicate how significant the proposed increase of the ROE is? Please provide the effect on IGUA’s clients based on the 2010 price of natural gas. R-3690-2009 ACIG-4 - Doc.2 (Page 1 of 2) Answer 2.1 Please also refer to the response to Gaz Metro’s information request No. 2.2 hereinafter. As explained in response to Gaz Metro’s information request No. 1.1, any increase to the ROE that exceeds the fair return standard is excessive and unnecessary. This is true regardless of the dollar impact on tolls. The proposed ATWACC of 7.75% translates into an ROE of 12.39%. This represents a massive 52% increase over the current ROE of 8.17% produced by application of the current Formula. If approved, this would increase the return on rate base by approximately 29 million dollars. Taking into account the increased corporate income tax that would be applicable to these higher earnings, we estimate Gaz Métro’s annual revenue requirement would increase by approximately 38 million dollars. Therefore, for 2009/2010, industrial end users and all other Québec gas consumers would be required to pay 38 million dollars more in tolls than necessary. 2.2 Can you indicate what percentage the cost of capital represents on the total bill for clients of the D4 tariff? Answer 2.2 The commodity price of natural gas is currently trading at low levels that have not been seen for several years. However, the regulated transport and distribution rate portion of gas users’ total delivered cost of natural gas continues to rise to the point where, for industrials, they now jointly represent approximately 30 to 40 percent of the total delivered cost of natural gas. Any unnecessary rate increase caused by an excessive ROE causes these regulated rates to be higher than necessary. Most industrial gas users have negotiated individual commercial arrangements for the gas commodity and IGUA is not privy to those arrangements. As such, IGUA understands the total delivered gas cost invoiced may vary considerably amongst industrial gas users. Therefore IGUA is unable to quantify the percentage that the cost of capital represents on the total bill for clients of the D4 tariff. HBdocs - 6861732v1 R-3690-2009 ACIG-4 - Doc.2 (Page 2 of 2)