Participation Chapter 2 Market Rules Issue Date: December 8, 2004

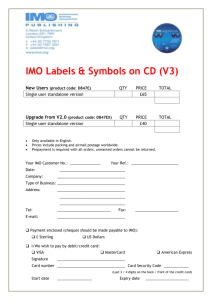

advertisement