C A N A D A RÉGIE DE L’ÉNERGIE N : R-3630-2007

advertisement

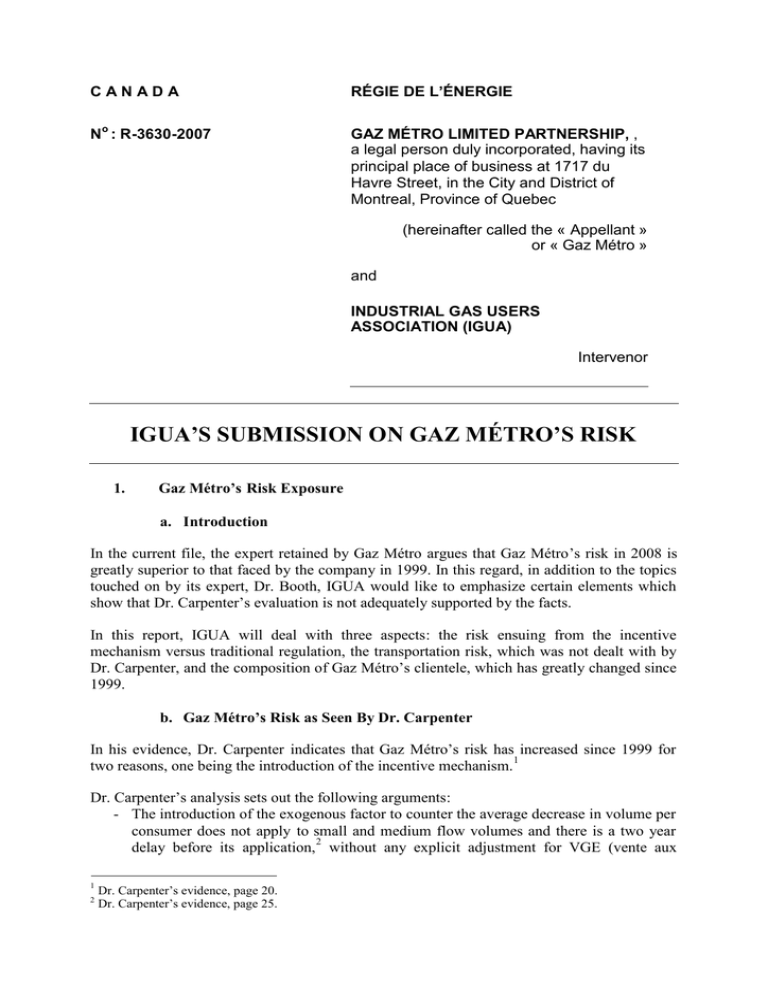

CANADA RÉGIE DE L’ÉNERGIE No : R-3630-2007 GAZ MÉTRO LIMITED PARTNERSHIP, , a legal person duly incorporated, having its principal place of business at 1717 du Havre Street, in the City and District of Montreal, Province of Quebec (hereinafter called the « Appellant » or « Gaz Métro » and INDUSTRIAL GAS USERS ASSOCIATION (IGUA) Intervenor IGUA’S SUBMISSION ON GAZ MÉTRO’S RISK 1. Gaz Métro’s Risk Exposure a. Introduction In the current file, the expert retained by Gaz Métro argues that Gaz Métro’s risk in 2008 is greatly superior to that faced by the company in 1999. In this regard, in addition to the topics touched on by its expert, Dr. Booth, IGUA would like to emphasize certain elements which show that Dr. Carpenter’s evaluation is not adequately supported by the facts. In this report, IGUA will deal with three aspects: the risk ensuing from the incentive mechanism versus traditional regulation, the transportation risk, which was not dealt with by Dr. Carpenter, and the composition of Gaz Métro’s clientele, which has greatly changed since 1999. b. Gaz Métro’s Risk as Seen By Dr. Carpenter In his evidence, Dr. Carpenter indicates that Gaz Métro’s risk has increased since 1999 for two reasons, one being the introduction of the incentive mechanism. 1 Dr. Carpenter’s analysis sets out the following arguments: - The introduction of the exogenous factor to counter the average decrease in volume per consumer does not apply to small and medium flow volumes and there is a two year delay before its application, 2 without any explicit adjustment for VGE (vente aux 1 2 Dr. Carpenter’s evidence, page 20. Dr. Carpenter’s evidence, page 25. IGUA’s submission on Gaz Métro’s risk Page 2 - - - - grandes enterprises, sales to major companies) except for a reduction of the factor from 0.5% to 0.3%, which accounts only partly for that fact.3 He discusses the consumption reduction in the industrial sector between 1999 and 2008, noting the contribution of TCE in 2008 which brings volumes pretty well back to their 1999 level (also noting the unfavourable situation of natural gas with respect to oil); 4 Gaz Métro’s incentive mechanism has cost of service characteristics with regulatory lag. However, this kind of regulation is riskier because the revenue cap includes the effects of projected productivity gains which must be shared with consumers before any gains or over earnings accrue to Gaz Métro’s shareholders;5 Modification (from 85% to 100%) of the performance indicators can be seen as an additional obstacle for attaining an additional return for shareholders; 6 The incentive mechanism, set up in 2000 and revised in 2004 and 2007, increases the company’s risk in comparison to traditional cost of service regulation. 7 In addition, Dr. Carpenter indicates that the incentives create a greater short-term variation in revenues in comparison to traditional cost of service regulation, particularly when deferral accounts are in place to compensate for the effect of certain revenue or cost fluctuations (both increases and decreases). 8 c. The Risk Ensuing from the Incentive Mechanism In general, Dr. Carpenter seems to submit that setting up an incentive mechanism is riskier than traditional cost of service cost regulation. This idea could be true theoretically depending on the kind of mechanism, the duration for which rates are fixed, the various components going into the formula, etc. However, Gaz Métro’s specific case does not seem to us at all to be made up of the characteristics which would so increase the risk to shareholders, except for one element which we will deal with below. On the contrary, the incentive mechanism only has the risk of allowing higher levels of earnings than those available under traditional cost of service regulation. Furthermore, it appears to us that the incentive potential is much superior to that in place prior to 1999. i. Forecast Mode 1. Traditional Cost of Service Regulatory Mode applicable to Gaz Métro before 2000 Under the traditional Cost of Service regulatory mode, the regulated company makes an update of elements of the rate case on a yearly basis. At that point, the company budgets its expenses and volumes for the test year. Rates are then established by dividing budgeted expenses (which include the allowed return on the rate base) by projected volumes. In this regulatory mode, any variance at the start of the year, therefore in forecast mode, is borne entirely by the customers. For example, all else being equal, the following situations would appear: 3 Dr. Carpenter’s evidence, page 28. Dr. Carpenter’s evidence, page 26. 5 Dr. Carpenter’s evidence, pages 27-28. 6 Dr. Carpenter’s evidence, page 28. 7 Dr. Carpenter’s evidence, page 29. 8 Dr. Carpenter’s evidence, page 18. 4 2 IGUA’s submission on Gaz Métro’s risk Page 3 RATE CASE MODIFICATION Increased costs Decreased costs Increased volumes Decreased volumes EFFECT ON RATES Rate increase Rate reduction Rate reduction Rate increase We can therefore conclude that there is almost no risk to the distributor in forecast mode. This statement assumes that the regulator accepts the regulated company’s proposal, as presented. The regulator could however decide not to accept certain of the distributor’s proposals which could, ultimately, affect its ability to earn its expected return. In short, in traditional service cost regulation mode, the distributor is assured, in forecast mode and excluding the potential impact of the regulator, of earning back its entire cost of service, including its return. However, taking Gaz Métro’s example before the setting up of the incentive mechanism in 2000, the distributor could benefit from only a small reward over and above its allowed return insofar as 50% of all surplus earnings then had to be reimbursed to the users. 2. Gaz Métro’s Incentive Mechanism It must be noted right off that the incentive mechanism in place since 2000 is the result of a proposal presented by the distributor itself, as opposed to a mechanism imposed by the regulator or instituted at the request of stakeholders such as the consumers. In this context, it is difficult to conceive that the distributor would propose or accept in the course of negotiations a mechanism increasing the company’s risk or reducing its profitability in comparison to the traditional regulatory mode. That being said, Gaz Métro’s incentive mechanism does in fact allow a 50% reward on productivity gains in forecast mode, which is not possible under the traditional regulatory mode. In addition, if the distributor manages to maintain these productivity gains over time, it will be possible for him to continue to profit from this same reward for a period of 5 years. Furthermore, what would happen if Gaz Métro is unable to propose, in forecast mode, a required income below the revenue cap (thus a situation of economic loss)? According to Gaz Métro’s incentive mechanism, the revenue required by the Distributor would be applied. Thus, if Gaz Métro is unable to create productivity gains and to improve its return, it would find itself in the same situation as under traditional regulation, with rates allowing the company to recover projected costs, including its allowed return. When compared to the traditional regulatory mode, we therefore see that the only effect which Gaz Métro’s incentive mechanism in forecast mode has on the Distributor’s risk is to offer a possible reward over and above the allowed return. However, Gaz Métro must have its expenses approved each year, just as under a traditional regulatory mode. Even though this is done as part of a lighter process, the regulator has as much power as under the traditional mode to reduce the requests of Gaz Métro. The Distributor thus has the same risk as in a traditional regime. On the other hand, the regulator has less interest in not recognizing the revenue level required by Gaz Métro insofar as the 3 IGUA’s submission on Gaz Métro’s risk Page 4 mechanism is supposed to offer sufficient incentive to the Distributor to itself achieve its productivity gains, which is not recognized under the traditional regulation model. In short, in forecast mode, Gaz Métro’s situation is in no way riskier under the incentive regulation than under traditional regulation. ii. Year End 1. The Traditional Cost of Service Regulatory Mode of before 2000 At year end in 1999 and in previous years, Gaz Métro had to file for the statutory closing of its books. At this point, if it turned out that surplus earnings over the allowed return had been collected, Gaz Métro could keep a 50% reward over its allowed return. The rest was returned to its customers. On the other hand, if there proved to be a shortfall, i.e. costs greater than actual revenues, the shareholders then suffered a loss on their return. This is notably what happened in 1995. 2. Gaz Métro’s Incentive Mechanism According to the incentive mechanism, Gaz Métro will be able to keep 25% of surplus earnings at the end of the year. Furthermore, if there is a shortfall at the end of the year, the shareholders will then suffer a loss, either of their incentive or of the allowed return, depending on the situation at the start of the year. However, this loss will be lower than under the traditional regulatory mode, as explained below. Furthermore, contrary to the traditional regulatory mode, Gaz Métro will be able to keep 50% of the surplus earnings received for the next five years if it can convert this unforeseen gain into a long-term gain. Under the traditional regulatory mode, if the gain is a long-term one, it must be incorporated into the budget of the next rate case, thus making all possible future reward on this productivity gain disappear. Thus, even though the end of year reward is less in the framework of the incentive mechanism in the short term, there is no additional risk of not reaching the allowed return whether we are under the regulatory mode or under the incentive mechanism. Furthermore, if we are talking of permanent productivity gains, the incentive mechanism offers a greater likelihood of keeping part of the gains up to 50% of them over the next five years. iii. Deferral Accounts Exclusions9 and Different Exogenous Factors and The objective of setting up the deferral accounts used at Gaz Métro and the exogenous factors and exclusions integrated to the incentive mechanism is much the same, i.e.: to protect and compensate Gaz Métro from the effects of short and long term revenue and cost fluctuations. In this respect, Gaz Métro is protected against temperature variations, costs of the PGEÉ (Plan global d’efficacité énergétique, overall energy efficiency plan), interest rate variations, 9 Mécanisme incitatif, pages 14-18. Incentive Mechanism, pages 14-18. 4 IGUA’s submission on Gaz Métro’s risk Page 5 intervener costs, 90% of the variation in PMD customer volumes, the 53rd pay period, etc.10 Certain elements are under its control and dealt with through exclusions (PGEÉ, etc.), while elements beyond the company’s control (interest rates, etc.) are treated as exogenous factors. When comparing the two methods of regulation, it does not seem to us that Gaz Métro’s risk has been increased in the least through the implementation of the incentive mechanism. Obviously, there is an annual “true-up” phenomenon in the framework of a traditional regulation based on actual data while, in the incentive mechanism, there is a part that is established on the basis of a mathematical formula. We note that the parameters have evolved since 2000 in order to allow the incentive mechanism to remain effective. This efficacy implies the certainty of obtaining, on the part of the Distributor, the addition of a reward to the shareholders’ allowed return in exchange for productivity gains. The addition of wind and temperature warming as factors over the last years demonstrates the mechanism’s capacity to adapt to Gaz Métro’s situation. We consider that these examples demonstrate that using parameters adds no additional risk to Gaz Métro. Furthermore, there is not a single year to date in which the required income has been greater than the revenue cap and in any case, as explained previously, in the worst of cases it would be the required income which would be used to fix the rates generating the revenues. This ensures, in any event, that the Distributor should at the least earn its allowed return, excluding the short term variations within a year. iv. The Effect of Variations of Volumes within the year Prior to 1999 in comparison to 2008 Gaz Métro has always been at risk during the year of not meeting its budgets. It is therefore at risk on its volume forecasts and its costs. Thus, whether it be under the traditional regime or the incentive mechanism, Gaz Métro has always had to make do with its forecast risk, except that it has been reduced in different ways over time. The first element is the setting up of a deferral account for temperature normalization, which has protected Gaz Métro from the volume fluctuations caused by temperature. The other element is the nature of Gaz Métro’s clientele. This element will be covered below, but at this stage we would like to say that the structure of Gaz Métro’s clientele will make it possible, as of 2008, to have a lower risk than that of 1999 with respect to volume variations, having reduced the industrial portion thereof. In short, the situation has changed little since 1999 and it has even improved with regard to the composition of Gaz Métro’s clientele. Furthermore, an important additional protection is now part of the incentive mechanism. Indeed, one can read in section 3.2.3 of the incentive mechanism dealing with surplus earnings and revenue shortfalls: “At year end … In case of a shortfall, this will be calculated comparing the actual return (as today) with that due to the methodology retained by the Régie replacing the fixed rate of return formula (prior to any incentive). 10 D-99-11, page 32. 5 IGUA’s submission on Gaz Métro’s risk Page 6 Were a shortfall to be noted in the annual report, 50% of said shortfall will be recovered by customers in the rates of the following year and treated as an exclusion.” Thus, contrary to the traditional regulatory mode, Gaz Métro can now recover 50% of any shortfall against its allowed return. We consider that this element considerably reduces Gaz Métro’s risk in 2008 compared to that it faced in 1999 under the traditional regime. v. Compensation of Volume Variations for the Duration of the Mechanism Dr. Carpenter seems to indicate that Gaz Métro’s incentive regime is riskier than a traditional regime because the latter does not take into account all of the volume fluctuations over time. In fact, we agree with Dr. Carpenter that the effect of volume is not totally taken into account with respect to the PMD. Indeed, he is correct to state that only 90% of the variation in volume is taken into account with a two year delay. It is important, however, to note that this is true both ways. Thus, if there is an increase of volume for this clientele, the effect is to reduce the revenue cap by only 90%, thus leaving a supplementary productivity gain of 10% to Gaz Métro. The compensation is thus not one-directional. In this respect, it is interesting to note that this year the situation is one of an increase in volumes.11 Thus, since the implementation of this adjustment through an automatic formula, it does not seem to us that Gaz Métro has an additional risk in comparison to its situation under the traditional regulatory mode. Furthermore, Dr. Carpenter indicates that only part of the volume variation of VGE customers is taken into account by the reduction of the X factor by 0.2%. This is not our understanding. According to IGUA, the reduction of the X factor by 0.2% is applied completely to take into account the reduction in volumes of VGE customers. A quick calculation leads us to conclude that this compensation is more than sufficient, representing close to 75% of distribution revenue generated by rate 4 and 5 users from 2008 over five years. 12 Furthermore, excluding TCE’s share in distribution revenues generated by class 4 and 5 customers, this represents a compensation of close to 90% of all other industrial consumers. Thus, even if we retain Dr. Carpenter’s affirmation that only part of the compensation of 0.2% would be for the volume variation of the VGE, e.g. 0.1% instead of 0.2%, this would mean that Gaz Métro would be compensated over the next five years for losses of 45% of the volumes of the VGE, excluding TCE (TransCanada Energy Limited).13 11 Voir R-3630-2007, Gaz Métro-8, document 5, page 3. See R-3630-2007, Gaz Métro-8, Document 5, page 3. 0,2 % * 5 * 459,191 M$ = 45,191 M$ versus des revenus de distribution pour les tarifs 4 et 5 en 2008 de 60,5 M$ (Gaz Métro-13, document 6) 0.2 % X 5 X $459.191 million = $45.191 million versus distribution revenues in 2008 for rates 4 and 5 of $60.5 million (Gaz Métro-13, Document 6) 13 Nous discuterons plus loin de la différence de TCE versus les autres types de clients industriels. Pour l’instant, limitons nous pour mentionner que le risque de perdre les revenus de TCE est très faible comparativement aux autres clients industriels. We will discuss below the difference of TCE versus other types of industrial customers. For now, let us simply mention that the risk of losing TCE revenues is very low compared to other industrial customers. 12 6 IGUA’s submission on Gaz Métro’s risk Page 7 Furthermore, this compensation for VGE volume variations is directly included in the calculation formula of the revenue cap and is therefore not linked to actual evolution. Thus, if industrial consumers who currently use oil instead of natural gas were to return, this compensation will still be present. The compensation would then represent an effortless productivity gain for Gaz Métro. All of this does not seem to us to represent a greater risk, but rather an advantage of the incentive mechanism over the traditional regulatory mode. Moreover, the current situation in which the volumes of the least captive customers have already left and in which everything is coming together for the consumption of less polluting energies brings us to conclude that the sales situation for the VGE will only improve over the next few years (for example the green tax, an eventual carbon tax, etc.) Finally, and as for all other aspects, if it turned out that the reduction in volumes were more rapid than the compensations included in the calculation formula of the revenue cap, there would then be application of the required income, which would not in any way affect Gaz Métro’s ability to earn its allowed return before any reward. vi. The Only Potential Risk to Gaz Métro under the Incentive Regulatory Mode Compared to the Traditional Regulatory Mode All of this discussion brings us to conclude that Gaz Métro has no additional risk under the incentive regime as opposed to the traditional regime under which it was regulated before 2000. Quite the contrary, it appears to us that the risk is lower than it was in 2000, notably through the protection against revenue shortfalls. In fact, only one element of risk is truly present according to us, though we consider it to be more on a theoretical level. This element would be the case in which the mechanism would come to an end and there would be revenue shortfalls or surplus earnings which would not have been reimbursed to the customers. Section 3.2.4 of the mechanism indicates: “If the required revenue presented by Gaz Métro in the rate case were to exceed the revenue ceiling, the rates would be adjusted to the level of the required revenue, with the following reservations: All subsequent productivity gain (required revenue less than the revenue ceiling) would first be used to reduce the rates (before any sharing) until the overpayments have been compensated for; All subsequent over earnings would first be used to reduce the rates (before all sharing) until the overpayments have been compensated for; If the mechanism were to end, Gaz Métro would have to reimburse customers, through rates and over a three year period, with interest weighted on capital costs, 50% of accumulated overpayments up to 0.75% of the rate base. The portion of the shortfall recovered from the customers would be reimbursed to the customers, with interest, if the subsequent productivity gains and over earnings make this possible. If the incentive mechanism were to come to an end, the outstanding balance would be cancelled.” 7 IGUA’s submission on Gaz Métro’s risk Page 8 We therefore note that Gaz Métro could have a shortfall at the end of the incentive mechanism in a situation in which the revenue shortfalls had not been completely reimbursed. We consider this to be a very minor and mostly unlikely risk. d. The Transportation Risk In his evidence, Dr. Carpenter does not deal with the transportation element in Gaz Métro’s risk. According to IGUA, this element creates less risk today than in 1999 for the following reasons: - In 1999 : - Long term contract with TCPL;14 - Less liquid secondary market; - Rates that have not been unbundled, no consumer (save exception) owning their own transport. - In 2008 : - Contractual quantities with TCPL are, for the most part, revised annually. Gaz Métro can easily get rid of its transportation surpluses at this time;15 - The secondary market is more active and more liquid, thus further ensuring the possibility of recovering stranded transportation costs ; - A portion of transportation needs are now directly managed by customers, thus reducing the extent of Gaz Métro’s potential stranded costs (biogas and customer-held transportation represent, for 2008, 8.27% of peak transportation needs).16 Despite these changes, VGE customers still have rate conditions which motivate customers to make agreements for long periods (five or three years with continuous renewal). IGUA has even shown, as part of its 2006 dissenting position, that if a customer decides to no longer consume natural gas in order to change to another energy source, Gaz Métro would find itself in a position in which it would make greater transportation revenues than what it would have made had the customer continued to consume gas (this was for a customer not holding his own transport, as is the case for all rate D5 customers). 17 All of these elements bring us to conclude that Gaz Métro today bears a lesser transportation risk, on the short term in comparison to the situation that prevailed in 1999. e. Composition of Gaz Métro’s Clientele The composition of Gaz Métro’s clientele has greatly evolved between 1999 and 2008. The changes can be rapidly summarized by three phenomena: - A marked increase in residential and commercial clientele; - A marked reduction in traditional VGE clientele; and 14 Voir R-3484-2002, SCGM-6, document 1 et 1.6. See R-3484-2002, SCGM-6, Documents 1 and 1.6. Voir R-3630-2007, Gaz Métro – 3, document 1, page 14. See R-3630-2007, Gaz Métro – 3, Document 1, page 14. 16 Voir R-3630-2007, Gaz Métro – 4, document 6, page 1. See R-3630-2007, Gaz Métro – 4, Document 6, page 1. 17 Voir Dissidence de l’ACIG, cause tarifaire 2007, R-3596-2006, phase II, pièce C-1-11. See IGUA Dissenting Reasons, rate case 2007, R-3596-2006, Phase II, exhibit C-1-11. 15 8 IGUA’s submission on Gaz Métro’s risk Page 9 - The arrival of a major player VGE consumer (TCE representing 15% of Gaz Métro’s volumes) with a very minimal risk profile. We can see from the table below that the VGE only represent approximately 50% of Gaz Métro’s volumes in 2008, compared to 57% in 1999. Furthermore, if TCE is excluded in 2008, VGE customers only represent 36% of total volumes. Similarly, VGE revenues have gone from 31% in 1999 to 19% in 2008 (17.5% if TCE is excluded). Thus, this demonstrates that the weight of the industrial sector is in strong decline both with respect to volumes and revenues from 1999 to 2008. This reduction in the weight of the industrial clientele represents, according to IGUA, a reduction in Gaz Métro’s business risk. With respect to TCE, this client does not represent the same risk level as an a conventional industrial customer. Indeed, this customer signed a 20 year contract with Gaz Métro, linked to the nature of its production, being an electricity supply contract of 20 years with HydroQuébec Distribution.18 Thus, this client is not a risk to the economic growth of its sector of activity, as a pulp and paper factory or a steel plant would be, for example (no unforeseeable variations in production linked to the economy). Nombre de clients, volume et revenus moyens par classe de tarif Données projetées 1998-99 Nombre moyen de clients par classe de tarif Tarifs D1 148 092 1999-2000 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2007-2008 avec TCE continu (DM) 149 594 150 130 151 496 150 600 153 248 156 300 163 152 169 276 173 885 173 886 947 119 1 181 116 1 306 116 1 424 118 1 585 113 1 490 110 1 593 105 1 772 95 1 788 90 1 744 1 745 269 149 427 259 151 150 257 151 809 239 153 277 242 152 540 254 155 102 234 158 232 216 165 235 206 171 360 84 173 175 886 83 173 175 887 99,11% 98,97% 98,89% 98,84% 98,73% 98,80% 98,78% 98,74% 98,78% 98,86% 98,86% Tarif D 4 0,63% 0,08% 0,78% 0,08% 0,86% 0,08% 0,93% 0,08% 1,04% 0,07% 0,96% 0,07% 1,01% 0,07% 1,07% 0,06% 1,04% 0,05% 0,99% 0,05% 0,99% 0,05% Interruptible (tarif D5) 0,18% 0,17% 0,17% 0,16% 0,16% 0,16% 0,15% 0,13% 0,12% 0,10% 0,10% Tarifs DM et D 3 Tarif D 4 Interruptible (tarif D5) Total Tarifs D1 Tarifs DM et D 3 Volume moyen par classe de tarif (millier de m³, @ 37,89 MJ/m³) Tarif D 1 2 062 597 2 148 027 2 197 424 2 022 470 2 060 007 2 066 583 2 077 506 2 064 043 2 003 626 1 991 162 1 991 163 565 929 631 190 724 962 764 296 758 073 777 016 833 433 913 213 918 489 908 687 1 818 874 1 946 923 1 827 567 1 885 024 1 667 890 1 559 555 1 646 103 1 905 182 1 975 463 2 314 086 2 331 921 1 421 734 1 601 342 6 176 791 1 291 942 5 898 726 1 339 011 6 146 421 798 970 5 253 626 810 167 5 187 802 771 969 5 261 671 745 189 5 561 310 694 528 5 647 247 575 694 5 811 895 646 263 5 878 033 646 263 5 878 034 Tarif D 1 33,39% 36,42% 35,75% 38,50% 39,71% 39,28% 37,36% 36,55% 34,47% 33,87% 33,87% Tarifs DM et D 3 9,16% 10,70% 11,79% 14,55% 14,61% 14,77% 14,99% 16,17% 15,80% 15,46% 30,94% Tarif D 4 Interruptible (tarif D5) 31,52% 30,98% 30,67% 31,75% 30,06% 31,28% 34,26% 34,98% 39,82% 39,67% 24,19% 25,93% 21,90% 21,79% 15,21% 15,62% 14,67% 13,40% 12,30% 9,91% 10,99% 10,99% Tarifs DM et D 3 Tarif D 4 Interruptible (tarif D5) Total Revenu moyen par classe de tarif (millier de $) Tarifs D1 420 845 433 562 458 865 459 145 480 008 497 119 498 227 478 629 493 030 502 356 502 356 63 398 68 428 82 723 92 696 92 462 98 518 103 313 105 015 109 441 112 032 121 925 123 556 109 175 118 014 125 776 114 367 115 318 135 586 116 794 102 740 105 461 95 569 83 837 691 636 58 941 670 106 67 191 726 793 63 574 741 191 56 658 743 495 51 404 762 359 52 749 789 875 47 250 747 688 37 488 742 699 37 505 757 354 37 505 757 355 Tarifs DM et D 3 60,85% 9,17% 64,70% 10,21% 63,14% 11,38% 61,95% 12,51% 64,56% 12,44% 65,21% 12,92% 63,08% 13,08% 64,01% 14,05% 66,38% 14,74% 66,33% 14,79% 66,33% 16,10% Tarif D 4 17,86% 16,29% 16,24% 16,97% 15,38% 15,13% 17,17% 15,62% 13,83% 13,92% 12,62% Interruptible (tarif D5) 12,12% 8,80% 9,24% 8,58% 7,62% 6,74% 6,68% 6,32% 5,05% 4,95% 4,95% SCGM-17 Doc 2A R-3397-98 SCGM-10 Doc 9 A R-3426-99 SCGM-11 Doc 2 R-3444-2000 SCGM-11 Doc 7 R-3463-2001 SCGM-14 Doc 7 R-3484-2002 SCGM-12 Doc 7 R-3510-2003 SCGM-12 Doc 8 R-3529-2004 SCGM-12 Doc 8, p1 R-3559-2005 SCGM-13 Doc 8, p1 R-3596-2006 Tarifs DM et D 3 Tarif D 4 Interruptible (tarif D5) Total Tarifs D1 Sources Gaz Métro - 8 et Gaz Métro - 13 Doc 10 Doc 6 R-3630-2007 R-3630-2007 IGUA considers that when the weight of industrial customers is evaluated in Gaz Métro’s franchise with respect to the company’s risk, the weight of TCE must be withdrawn from this 18 D-2004-197, pages 5 and 7. 9 IGUA’s submission on Gaz Métro’s risk Page 10 calculation. Thus, we can see that Gaz Métro’s business risk has been greatly reduced between 1999 to 2008. f. Conclusion It does not appear to IGUA that the business risk has increased between 1999 and 2008 as submitted by Dr. Carpenter on the elements dealt with above. The incentive mechanism has not added risk. On the contrary, we have demonstrated that the mechanism provides additional protection against eventual revenue shortfalls and the only risk Gaz Métro must bear with respect to other elements is the adding of an additional reward to its allowed return. The management of transportation is less risky today, the contracts more flexible, the market being more liquid with a portion of the risk now being borne directly by the customers. Finally, Gaz Métro’s clientele is much less based today on the industrial clientele than it was in 1999, thus reducing this aspect of its business risk. All of these facts together thus indicate that Gaz Métro’s business risk in 2008 is largely inferior than that for 1999. THE WHOLE RESPECTFULLY SUBMITTED. MONTREAL, July 6, 2007 HEENAN BLAIKIE LLP Attorneys for IGUA 10