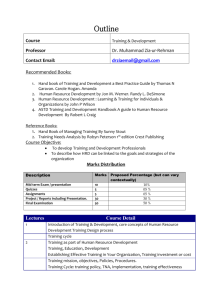

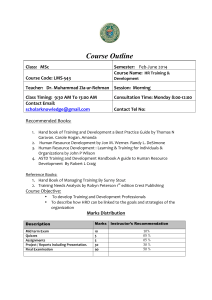

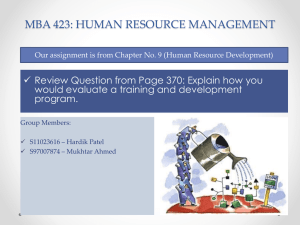

Saurashtra University

advertisement