] Deferral Mechanisms and Other Risk Mitigating Mechanisms Sales and Weather Normalization Features

advertisement

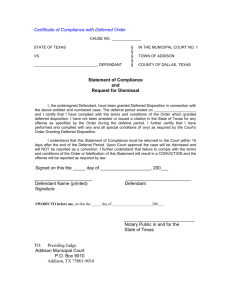

![] Deferral Mechanisms and Other Risk Mitigating Mechanisms Sales and Weather Normalization Features](http://s2.studylib.net/store/data/012211240_1-7a4d4a8a75ddc54f644a9577ff400e14-768x994.png)

] BENCHMARK SAMPLE OF U.S. GAS AND ELECTRIC UTILITIES Company States Served Deferral Mechanisms and Other Risk Mitigating Mechanisms Sales and Weather Normalization Features Straight fixed variable rate design, customer pays 1/12 of annual fixed charges and a predetermined percent of demand day annual capacity charges each month Georgia (Atlanta Gas Light) Weather Normalization Adjustment with Regulatory assets/liabilities recoverable through New Jersey rate adjustements made at end of heating rate riders or base rates for unrecovered (Pivotal Utilities Holdings season; revenue decoupling mechanism formerly Elizabethtown Gas) regulatory infrastructure program costs, unrecovered environmental remediation costs, unrecovered postretirment benefit costs. In NJ recover unrealized losses or gain on financial instrument derivatives as well as lost and unaccounted for gas (LUAF); in other regions LUAF in base rates AGL Resources Consolidated Edison New Jersey Resources NICOR Northwest Nat. Gas Original: 2010-05-27 proposed Commodity Cost Recovery Assurance Does not sell gas in Georgia Shares equally with ratepayers difference between monthly market benchmark and actual cost of gas Tennessee (Chattanooga Gas) Performance based rate plan (PBR) provides for company to be exempt from audits of its Weather Normalization Adjustment Rider gas procurement activities if costs are with adjustments made each meter‐reading within 1% of benchmark level; Incentive cycle mechanisms related to gas procurement, capacity release and off‐system sales. Virginia (Virginia Natural Gas) Purchase Gas Adjustment (PGA) clause Weather Normalization Adjustment rider ‐ separate factors for each customer class; provides quarterly rate changes to reflect fluctuations in gas costs; annual decoupling mechanism designed to mitigate reconciliation with total billed vs actual gas the impact on revenues of residential costs ‐ difference is deferred and customer participation in energy conservation programs. recovered/refunded in following year New York New Jersey Deferral of certain expenses (stray voltage costs, property taxes, interest on variable rate debt, asbestos litigation costs) so long as deferrals don't cause earnings to fall below a particular ROE level; Financial statements includes a complete listing of the companies regulatory assets and liabilities including unrecognized pension and OPEB, environmental remediation expenses, deferred derivative losses (long‐term) gas rate plan deferral, World Trade restoration costs ‐ collected through rates/riders; Lost and unaccounted for gas mechanism as not in base rates Electric: Revenue Decoupling Gas: Weather Normalization Electric: market power adjustment clause (MAC) or commodity adjustment clause (CAC) ‐ changes in clause are recognized in each customer bill (monthly, bi‐monthly etc) Gas: Fuel adjustment clause for annual reconcilation of recoverabe gas costs; excess/deficiency is deferred and recovered or refunded annually in following year 2006 ‐ decoupling; Conservation Incentive Regulatory riders for recovery of state‐mandated Program allows for recovery of margin Gas cost recoveries subject to an annual programs, remediation adjustment and energy deficiency associated with non‐weather true‐up; large commercial and industrial efficiency costs calculated on a per‐therm basis; related changes in customer usage limited customer on basic gas supply suervice are Lost and unaccounted for mechanism as not in subject to monthly price changes to the level of Basic Gas Supply Service base rates Charge savings achieved Illinois Purchased Gas Adjustment (PGA) ‐ Energy Efficiency Plan rider allows for recovery, SFV rate design that recovers 80% of Rate 1 automatically adjusted monthly on fully‐ outside of a rate case, of expenses associated customers' fixed delivery service costs forecasts gas costs for prospective base with energy efficiency programs; can recover through monthly customer charge (Mar period. Unamortized amounts earn interest costs associated with advanced metering based on the Commission‐established 2009) programs; rider for bad debt expense; customer deposit rate, reviewed annually Oregon Automatic adjustment clause to flow back taxes reflected in rates that differ by at least $0.1 million from amount actually paid (fed'l, state & local); System Integrity Program to recover Decoupling for conservation plus weather‐ Purchased Gas Adjustment clause contain through PGA costs related to base steel, pipeline adjusted rate mechanism (WARM) in place sharing provisions with respect to changes integrity and other pipeline safety programs for residential and commercial customers in gas commodity costs either 80/20 or subject to soft cap of $12 million annually with (customers can opt out of WARM) 90/10 (selected by the utility annually) expenses above that subject to commission approval; lost and unaccounted for gas mechanism as not in base rates GI‐30 Document 1.15 Page 1 de 5 Requête 3724‐2010 ] Company NSTAR States Served Massachusetts North Carolina Piedmont Natural Gas South Jersey South Carolina Commodity Cost Recovery Assurance Pension and post‐retirement benefits, Electric: Transmission cost recovery mechanisms, recovery of low‐income discounts rates, Electric utilities not at risk for fluctuation in employee costs, bad debt. During transition to market prices; full decoupling (2009‐2012), recover lost base Cost of gas adjustments are determined All companies to have operational revenues decoupling plans in place by year‐end 2012. semi‐annually, amounts put in deferred gas Gas: during transition to full decoupling (2009‐ cost account recovered through CGA factor 2012), recovery of energy‐efficiency‐related lost including carrying costs base revenue through adjustment clause; lost and unaccounted for gas mechanism as not in base rates LDC may recover expenses for additional Purchased gas adjustment ‐ annual Customer Utililization Tracker which interstate pipeline capacity and storage added prudence review; commodity and prior to a general rate case subject to annual true‐ decouples the recovery of authorized up; demand and storage costs are allocated to all margins from sales for all reasons including transportation rates adjusted through the PGA conservation and weather customer classes incl. transportation on volumetric basis Weather normalization clauses apply to Non‐automatic purchased gas adjustment residential and small commercial customers clause reviewed annually during winter months Tennessee (Piedmont Gas) Incentive mechanisms related to gas procurement. Also capacity release and off‐ system sales where net benefits/costs are allocated to ratepayers and shareholders on 75%/25% basis. Plan reviewed every 3 years Weather normalization clause; Jan 2010 regulator rejected request to Automatic gas commodity recovery clause implement revenue decoupling mechanism and energy efficiency programs. New Jersey (South Jersey Gas) Trackers for capital investment recovery and energy efficency (ended 2009) 2006 ‐ decoupling; Conservation Incentive Program allows for recovery of margin deficiency associated with non‐weather related changes in customer usage limited to the level of Basic Gas Supply Service Charge savings achieved Maryland Trackers for pension and OPEB expenses; D.C. Increases in pension and OPEB expenses are recovered through a surcharge; effect on net income of any changes in delivered volumes and prices to interruptible customers limited by margin‐sharing arrangements in rates; Lost and unaccounted for gas tracker as not in base rates WGL Holdings Inc. Virginia Original: 2010-05-27 Deferral Mechanisms and Other Risk Mitigating Mechanisms Sales and Weather Normalization Features Gas cost recoveries subject to an annual true‐up; large commercial and industrial customer on basic gas supply service are subject to monthly price changes Purchased gas charge includes the cost of the natural gas commodity and cost of Revenue Normalization Adjustment (RNA) transporting gas; recover of carrying costs on storage gas balances and hexane stabilizes level of net revenues collected from customers by eliminating the effect of infection costs through surcharge; Retains a portion of margins associated with off‐ deviations in customer usage caused by system sales, interruptible sales, and variations in weather from normal levels interruptible transportation activities. and other factors e.g., conservation Margins beyond this level are allocated 85% to ratepayers and 15% to the company. Gas hedging program for gas storage (benefits flowed through PGC); an application for a revenue normalization adjustment designed to decouple non‐gas revenue from actual volumes delivered and mitigate weather and conservation impacts was filed by WGL with PUC on December 21, 2009 Purchased Gas Charge reconciled annually; carrying costs on storage balances and over/undercollected gas costs recovered through surchage; hexane injection costs also to be recovered through PGA starting 2011 Purchase Gas Adjustment (PGA) clause Weather Normalization Adjustment rider ‐ Permitted to recover carrying charges on storage separate factors for each customer class; provides quarterly rate changes to reflect fluctuations in gas costs; annual gas balances, over/under‐collected gas costs, decoupling mechanism designed to mitigate the impact on revenues of residential reconciliation with total billed vs actual gas hexane costs and commodity‐related customer participation in energy costs, difference is deferred and uncollectibles expense conservation programs. recovered/refunded in following year GI‐30 Document 1.15 Page 2 de 5 Requête 3724‐2010 Company Commission Gazifere Régie AltaGas EUB AltaLink EUB ATCO Electric EUB DEFERRAL ACCOUNTS FOR CANADIAN UTILITIES Source for Account info Deferral Accounts Compte de stabilisation de la température Compte de gaz perdu Compte d'auto‐assurance Compte ajustement du coût du gaz Novoclimat Document from Gazifere Charges réglementaires PGEÉ Écarts volumétriques du PGEÉ (CÉV PGEÉ) : Quote‐part versée à l’AEÉ Fonds vert Deferred Cost of Gas 2008 report on operating stats. Deferred CEO/CFO Certification Costs Schedule 9 Deferred Regulatory Costs (Hearing) Deferred Regulatory Costs (Non‐Hearing) Direct Assigned Capital Deferral Canada Revenue Agency Deferral Long Term Debt Deferral Property Tax Deferral Annual Tower Payment Deferral 2008 report on operating stats. No Cost Capital: Schedule 9 Hearing Cost Reserve Reserve for Injuries and Damages (SIR) Future Income Tax Pension Liability Rainbow‐type Expense Reserve 2008 report on operating stats. Schedule 9 ATCO Gas EUB 2008 report on operating stats. Schedule 9 Enbridge Gas Distribution OEB Response in 2005 TGI Case EPCOR EUB Foothills Pipe Lines (Yukon) NEB FortisAlberta EUB FortisBC BCUC Original: 2010-05-27 2008 report on operating stats. Schedule 9 In Rate Base x x x x Out of Rate Base x x x x x x x x x x x x x x x x x x x x x Deferred Pension and Supplemental Pension Reserve for Injuries and Damages Future Income Tax Deferred Supplemental Pension Deferred Post Employment Benefits Deferred Hearing Costs Deferred Bad Debt Expense (net of penalty revenue) Deferred Consumer Advocate Costs Adoption of Financial Instruments Production Abandonment Costs Variable Pay Program Transmission Charges Weather deferral Account Load Balancing Deferral Account Reserve for Injuries and Damages Commodity Cost Reconciliation Account Midstream Cost Reconciliation Account Long Term Debt Issue and Expense Deferred Interest on Commodity Cost and/or Midstream Cost Commercial Commodity Unbundling Program DSM Gas Cost Variance Account Transmission Charge Deferral Account (DX only) Hearing Costs Uniform Set of Accounts Tariff Bill Code AESO Charges Deferral Account Contributed Asset Self Insurance Reserve Accumulated Depreciation Refund Property, Business & Linear Tax Deferral Account Contribution Reserve for Projects x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x Foothills Pipe Lines Ltd. is regulated on a cost of service basis and over or under‐collections are adjusted in tolls annually. Reserve for Self Insurance x Hearing Cost Reserve x Schedule of Pension Liability x 2008 report on operating stats. Deferred Financing Cost x Schedule 9 Future Income Tax x Deferred Revenues x Reserve for Injuries and Damages x Other Deferred Credits x Demand Side Management x Deferred Regulatory Expense x Prelim. 2009 Revenue Preliminary and Investigative Charges x Requirements and Appendix A of G Advanced Metering Infrastructure x 193‐08 Negotiation Cost of PPA x (Negotiated Settlement BC Hydro Rate Increase x Agreement) Other Deferred Charge and Credits x Deferred Debt Issue Costs x Surveillance Report GI‐30 Document 1.15 Page 3 de 5 Requête 3724‐2010 Company Gaz Metro Commission Regie DEFERRAL ACCOUNTS FOR CANADIAN UTILITIES Source for Account info Gaz Metro‐6, Document 1 R‐3580‐ 2008 Hydro One Transmission OEB 2009 MD&A Maritime Electric IRAC 2010/11 Rates Application Nova Scotia Power NSUARB 2009 GRA Applicaton Ontario Electricity Distributors OEB Hydro One Networks 2009 Application see electronic page 211 Ontario Power Generation Pacific Northern Gas Terasen Gas Original: 2010-05-27 OEB BCUC BCUC 2009 Audited Financial Statements and Dec 2009 Accounting Order Tab‐2 PNG‐West 2009 Rate Application page 10 2010‐2011 Revenue Requirements App. Table C‐8‐4 and Negotiated Settlement 11/09 Deferral Accounts In Rate Base x x x x x x x x x x x x x x Frais reliés a la dette Frais reliés a l'expansion Prog. Comm. Axé sur financement (PCAF) Programmes commerciaux Développement des systèmes informatiques Frais reliés au coût du gaz Cotisation d'impôts Indémnites de départ Frais des intervenants Brevets Redevances à la Régie PGEÉ ‐ Dépenses et subvention 2006 PGEÉ ‐ Pertes de revenue 2006 Frais reportés ‐ Provision auto‐assurance Trop‐perçu 2006 x Créances majeures 2006 x Récupération nivellement gaz perdu Récupération des cptes de stabilisation tarifaire x Out of Rate Base x Rural and Remote Rate Protection Variance Acct. Smart Meters Deferred Pension External Revenue Variance Account Regulatory Asset Recovery Account I ‐ Rider 1 Regulatory Asset Recovery Account II ‐ Rider 2 Regulatory Liability Refund Account ‐ Rider 3 Revenue Recovery Account (RRA) ‐ Rider 4 Export & Wheeling Fee (factored into rates for 4 years ‐ ending 2010) Energy Cost Adjustment Mechanism Defeasance & Finance Charges Section 21 and 2005 Q1 Taxes Prepaid Pension Asset Fuel and DSM Deferred Asset Asset Retirement Obligations RSVA RARA and other Revenues Deferred Smart Meter Costs Deferred Revenue Accrued not Received Regulatory Asset ‐ OEB Costs deferred Future Income Tax Ancillary Services Net Revenue Variance Account ‐ Nuclear Bruce Lease Net Revenues Variance Account Pickering A Return to Service Deferral Account Tax Loss Variance Account Nuclear Liability Deferral Account Nuclear Gx Development Costs ‐ Capacity Refurb. x x x x x x x x x x x x x x x x x x x x x x x x x x x x x Nuclear Gx Dev. Costs ‐ New Nuclear Development Hydro electric Water Conditions Variance Nuclear Deferral and Variance Over/Under Recovery Variance Account (effec. 1/1/2010) RSAM Line Break Costs Extraordinary Plant loss Stress Corrosion Cracking Lost Margin from certain industrial customers In line inspection GCVA Deactivated Facilities Other interest Bearing Deferrals Methanex Termination Payment Deferral Commodity Cost Reconciliation Account (CCRA) Midstream Cost Reconcilation Account (MCRA) RSAM Interest on CCRA/MCRA/RSAM Revelstoke Propane Cost Deferral Account SCP Mitigation Revenues Variance Account Energy Efficiency & Conservation (EEC) NGV Conversion Grants Property Tax Deferral Insurance Variance Pension & OPEB Variance BCUC Levies Variance Interest Variance Olympics Security Costs Deferral IFRS Conversion Costs 2009 ROE & COC Application Pension & OPEB Funding SCP Tax Reassessment Deferred Service Line Installation Fee Earnings Sharing Mechanism x x x x x x x x x x x x x x x x x x x x Interest Variance calculation on gas in storage inventory Costs of Application (CCE, ROE & RRA) IFRS Transitional Deferral Account Gains & Losses on Asset Dispostion CCE CPCN Costs LILO Reassessment New Energy Solutions Deferral Account x x x x x x x x x x x x x x x x x GI‐30 Document 1.15 Page 4 de 5 Requête 3724‐2010 x Company Commission DEFERRAL ACCOUNTS FOR CANADIAN UTILITIES Source for Account info Terasen Gas Vancouver Island BCUC 2010-2011 RR Application C-8-4 Terasen Gas (Whistler) BCUC 2010-2011 RR Application Table 7-3 TransCanada PipeLines NEB TCPL Canadian Mainline ‐ NEB 2009Q4 Surveillance Report Trans Quebec & Maritimes Pipeline Union Gas Westcoast Energy Original: 2010-05-27 NEB OEB NEB NEB 2009 Q4 Surveillance Report EB‐2007‐0606 Settlement Agreement Appendix B Deferral Accounts continuing during IR term NEB 2009 Q4 Surveillance Report Deferral Accounts Rate Stabilization Deferral Account RDDA 2009 Revenue Surplus Account Gas Cost Variance Account (GCVA) Energy Efficiency & Conservation (EEC) NGV Conversion Grants Olympics Security Costs Deferral IFRS Conversion Costs Costs of Application (CCE, ROE & RRA) CCE CPCN Costs 2009 Rate Design Application PCEC Start Up Costs IFRS Transitional Deferral Account PENSION & OPEB Funding Compressor Fired Hours Financing Costs LNG Storage Facility Development Costs VIGP Preliminary Survey & Investigation Costs BC Capital Tax Assessment & Appeal Cost Gas Cost Reconciliation Account (GCRA) Sales Margin Differential (SMDA) Natural Gas Pipeline Development Costs Decommissioning of Propane Assets Capital Gain on Sale of Propane Land Property Tax ‐ Propane Plant Capital Contribution to TGVI Appliance Conversion Planning Costs Direct Appliance Conversion Costs Conversion Income Tax Deferral Account Interest Rate Differential Property Tax Differential IFRS Implementation Costs 2010 Olympic Games Security Costs IFRS Transitional Adjustments Costs of Applcation (ROE, COC & RR) CCE CPCN Applicatons Deferred ROE Variance (2005‐2009) Transmission By Others (TBO) Costs Storage Operating Costs Pipeline Integrity and Insurance Deductible NEB Cost Recovery Return on Rate Base Income Taxes Depreciation Expense Gas Related and Electric Costs Municipal and Other Tax Performance Incentive Envelope Compressor Repair & Overhaul FX (Gain)/Loss on Redemption Gain on Sale of Linepack Firm Service (revenue) Discretionary (revenue) Non‐Discretionary (revenue) Interest Rate Management Program 2008 Revenue Deficiency Variance Insurance Variance SCC Costs Compressor Fuel Storage Revenue Municipal and other taxes Regulatory costs 2008 Transition Revenue NEB Cost Recovery Income Tax TCPL Tolls and Fuel North Purchase Gas Variance Account South Purchase Gas Variance Account Spot Gas Variance Account Unabsorbed Demand Cost Variance Account Investory Revaluation Account Short Term Storage & Exchange Balancing Long Term Peak Storage Deferred Customer Rebates/Chartes Lost Revenue Adjustment Mechanism Intra Period WACOG Changes Unbundled Servies Unauthorized Storage Overrun DSM Variance Account Gas Distribution Access Rule (GDAR) Costs Late Payment Penalty Litigation Shared Savings Mechanism Variance Carbon Dioxide Offset Credits Deferral Account New Account ‐ Customer Usage Variance Account Deferred Income Taxes (only one for Field Services) Discretionary Revenues Contract Demand Volumes Pipeline Integrity Costs ‐ O&M Pipeline Integrity Costs ‐ Capital Property Taxes NEB Cost Recovery Expense Debt SRED Charges T South Cost Recovery IFRS Cost Recovery Enpower LMCI Costs Customer Service Incentive T North Expansion In Rate Base Out of Rate Base x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x x GI‐30 Document 1.15 Page 5 de 5 Requête 3724‐2010