Gazifere Fair Return and Capital Structure Professor Laurence Booth

advertisement

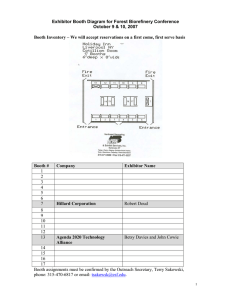

Gazifere Fair Return and Capital Structure Professor Laurence Booth CIT Chair in Structured Finance Rotman School of Management BOOTH Gazifere 2010 Key Issues before the Regie Has Gazifere’s business risk increased since its last hearing in1998? Is the 75% ROE adjustment to forecast changes in the long Canada bond yield still appropriate? What is a fair and reasonable ROE for Gazifere and what is a reasonable range for the estimate? BOOTH Gazifere 2010 Gazifere’s Business Risk McShane and Booth agreement that risk has a short and long run dimension Short run: return on capital – McShane: ability to earn a “compensatory return” – Booth not earning the allowed ROE – Whether the allowed ROE is fair and reasonable or “compensatory” is regulatory risk not business risk – Quantitative assessment Long run: return of capital – The ability to recover the investment in rate base – Viability of the natural gas market in Quebec – Qualitative assessment BOOTH Gazifere 2010 Gazifere ROE Performance GI-31 Doc 1.1 & GI32 Doc 1.5 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Allowed BOOTH Gazifere 2010 Actual Short Run Risk Gazifere has over earned its ROE by an average of 0.96% per year since 1998 (GI-31); No trend in over-earning “Gazifere has not gone back.... to establish the drivers for deviations from the allowed return” (GI-31) – Clearly Gazifere thinks its short run risk is not material? 2005 deviation due to bad debt expense form two large industrial customers (Booth IR#11) 2007-9 uptick due to performance based regulation: PBR is not a risk as company simply earns more than the allowed ROE BOOTH Gazifere 2010 Gaz Metro Allowed vs Actual ROE 15 14 13 12 11 10 9 8 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Allowed Incentive Actual Gaz Metro has sometimes failed to earn its full PBR but still over earned its allowed ROE BOOTH Gazifere 2010 Gazifere Revenue Composition 1999 2003 2006 2009 19,748 22,633 28,438 32,077 2,539 2,562 2,818 2,968 14 14 13 12 Residential Commercial Industrial Gazifere Revenue Composition GI-3- Doc 1 0.60 0.50 0.40 0.30 0.20 0.10 0.00 1999 2000 2001 2002 2003 RES BOOTH Gazifere 2010 2004 COMM 2005 IND 2006 2007 2008 2009 Natural Gas Competitiveness Development of natural gas from shale has created a disconnect from the price of oil – 1999 price advantage was 24% for residential and a disadvantage of 8% for commercial – 2009 residential advantage increased to 50% and commercial 53% Quebec has abundant electricity – 1999 price advantage of natural gas was 24% for residential and 57% for commercial – 2009 this advantage had dropped to 15-27% for residential and 33% for commercial BOOTH Gazifere 2010 Business Risk Summary Demonstrated ability to earn allowed ROE Protective regulatory environment where PBR has increased over-earning Large increase in customer base as natural gas has a competitive advantage over both oil and electricity for residential and commercial consumers Drop off in industrial customers, particularly interruptible reduces forecast risk and possibility of bad debt losses similar to 2005 Overall no sign of any increase in business risk, more likely a reduction BOOTH Gazifere 2010 Regie Gaz Metro Decision BOOTH Gazifere 2010 Financial US emerging from a brutal recession, Canada from a mild recession Cause was the failure of the US financial system that spread contagion around the world Catalyst: Failure of Lehman Brothers September 14, 2008 – Domino effect around the world as banks focused on survival Hoarded cash Reduced lending Sold off securities to bolster capital Reduced principal trading in debt markets: reduced liquidity in secondary markets BOOTH Gazifere 2010 Stock Market Collapse Index or Exchange United States Composite (US Dollar) Japan Composite (US Dollar) United Kingdom Composite (US Dollar) Canada Composite (US Dollar) Germany Composite (US Dollar) Hong Kong Composite (US Dollar) Spain Composite (US Dollar) Switzerland Composite (US Dollar) Last Trade Date 213.40 10/24/2008 82.39 10/24/2008 149.79 10/24/2008 278.25 10/24/2008 218.89 10/24/2008 186.44 10/24/2008 388.93 10/24/2008 374.65 10/24/2008 1Day Change -7.52 1 Day % -3.40% 1 Month % -27.53% 6 Month % -37.17% YTD % -2.74 -3.21% -22.00% -32.07% -35.54% -11.63 -7.21% -35.44% -48.66% -52.51% 3,441 -4.74 -1.67% -40.46% -48.15% -49.61% 1,636 -14.62 -6.26% -39.40% -51.88% -56.28% 1,426 -10.10 -5.14% -31.80% -51.39% -57.97% 1,361 -26.01 -6.27% -34.22% -50.24% -51.93% 1,146 -10.44 -2.71% -22.21% -32.06% -34.35% 1,111 -40.46% 2006 $b Value 18,039 4,422 Real Economy can not flourish if the financial system is broken: 1) Credit crunch 2) Real economy stops spending 3) Sharp recession started 2008Q4 in Canada BOOTH Gazifere 2010 BOOTH Gazifere 2010 CP BA Money market now back to normal in Canada 3/4/2010 1/4/2010 11/4/2009 9/4/2009 7/4/2009 5/4/2009 3/4/2009 1/4/2009 11/4/2008 9/4/2008 7/4/2008 5/4/2008 3/4/2008 1/4/2008 11/4/2007 9/4/2007 7/4/2007 5/4/2007 3/4/2007 1/4/2007 11/4/2006 9/4/2006 7/4/2006 5/4/2006 3/4/2006 1/4/2006 Short Term Credit Spreads Money Market Spreads (CansimV121812,V121778,V121796) 300 250 200 150 100 50 0 Overnight Rate (cansim V39079) 10 9 8 7 6 5 4 3 2 1 12/1/2009 12/1/2008 12/1/2007 12/1/2006 12/1/2005 12/1/2004 12/1/2003 12/1/2002 12/1/2001 12/1/2000 12/1/1999 12/1/1998 12/1/1997 12/1/1996 12/1/1995 12/1/1994 12/1/1993 12/1/1992 0 Bank of Canada has increased the overnight rate twice since May to remove some of the stimulus as economy has regained most of the jobs lost during the recession BOOTH Gazifere 2010 Yields since January 2008 9 Gaz Metro hearing August 2009 8 7 6 5 4 BBB A AA 8/1/2010 7/1/2010 6/1/2010 5/1/2010 4/1/2010 3/1/2010 2/1/2010 1/1/2010 12/1/2009 11/1/2009 9/1/2009 10/1/2009 8/1/2009 7/1/2009 6/1/2009 5/1/2009 4/1/2009 3/1/2009 2/1/2009 1/1/2009 12/1/2008 11/1/2008 10/1/2008 9/1/2008 8/1/2008 7/1/2008 6/1/2008 5/1/2008 4/1/2008 3/1/2008 2/1/2008 3 Canada LTC Yields fell, Corporate debt yields increased but now back to precrisis levels McShane recommends a 50% adjustment to Corporate bond yields, This means about the same allowed ROE as start of 2008 Recently both Corporates and Canada yields have fallen unlike in the financial crisis BOOTH Gazifere 2010 Default Spreads Since Dec 1979 500 450 400 350 300 250 200 150 100 50 AA A BBB Spreads still high relative to where we are in the recovery, perhaps 0.50% too high or long Canada’s 0.50% too low BOOTH Gazifere 2010 12/31/2009 12/31/2007 12/31/2005 12/31/2003 12/31/2001 12/31/1999 12/31/1997 12/31/1995 12/31/1993 12/31/1991 12/31/1989 12/31/1987 12/31/1985 12/31/1983 12/31/1981 12/31/1979 0 Conclusion LTC Yields remain the only long term opportunity cost or fair rate of return in the capital market LTC yields expected to increase to 4.5% for 2011, – 3.93% at time of testimony – 3.53% currently – More risk of lower LTC yields than higher for 2011 Corporate yields have followed long Canada yields down the last five months, AA spreads constant, A spreads minor pick up. Market is still “jittery” BOOTH Gazifere 2010 Risk Premium Models Explicit Risk premium model – CAPM – Primary reliance by NEB (RH-1-2008) – Primary reliance by Regie K R F MRP * Time Value of Money BOOTH Gazifere 2010 Market Risk Premium * “beta” BOOTH Gazifere 2010 Annual Rate of Return Estimates 1926-2009 U.S. CANADA S&P Long US Excess Equities Treasury Return AM 11.80 5.77 6.03 GM 9.77 5.40 OLS 11.09 5.11 Volatility1 20.48 9.15 TSE Equities Long Excess Canadas Return 11.39 6.43 4.96 4.37 9.69 6.08 3.61 5.98 10.42 5.80 4.62 18.96 8.87 Arithmetic is simple average; geometric is compound and OLS is the least squares estimate. Approximately Geometric Mean = Arithmetic Mean - .5*variance For example, US variance is about 4%, so AM and GM diverge by about 2% BOOTH Gazifere 2010 Fernandez Survey May 2009 1) MRP higher in Canada than US 2) Median Canadian MRP is 5.1% BOOTH Gazifere 2010 If the Regie randomly asked a Canadian finance professor what the MRP is, the answer would almost certainly be 5.0% or 6.0% BOOTH Gazifere 2010 BOOTH Gazifere 2010 -0.100 BOOTH Gazifere 2010 Utility beta Utility (No TAU) Jan-09 Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 Jan-90 Jan-89 Jan-88 Jan-87 Jan-86 Jan-85 Relative Risk (BETA) Average Utility Betas 0.600 0.500 0.400 0.300 0.200 0.100 0.000 Stock Performance over Last Year: Emera BOOTH Gazifere 2010 Stock Performance over Last Year: Fortis BOOTH Gazifere 2010 Stock Performance over Last Year: GMLP BOOTH Gazifere 2010 Fair ROE LTC Yield: Market Risk Premium: Beta: Issue costs: Recommended Benchmark ROE: 7.75% Financial Crisis adjustment: Gazifere addition: Recommended ROE: 4.50% 5.0-6.0% 0.45-0.55 0.50% 0.50% 0.25% 8.50% Since June LTC Yields have dropped but spreads have widened BOOTH Gazifere 2010 2009 Reviews AUC November 2009 OEB (August 2009) BOOTH Gazifere 2010 Analyst Views Matt Aikman McQuarrie May 2008 to CAMPUT BOOTH Gazifere 2010 ROE Formula Reviews OEB 2003 (2004 Decision) AUC (AEUB) 2003 for 2004 BCUC 2007 changes (100% adjustment to Canada yields changed to 75%) NEB 2001 confirmation in TCPL Mainline declined to hear ROE evidence in 2004 Regie 2007 Gaz Metro decision Ms. McShane recommended a 75% ROE adjustment to long Canada yield changes as late as 2007 in an Ontario Power Generation hearing BOOTH Gazifere 2010 New ROE formula proposals McShane – assume NEB correct in 1994 – adjusts for 50% of long term Canada (LTC) and “spread” in A bond yield changes – collapses to change by 50% of the change in A bond yields ROE 12 . 25 % 0 . 50 * ( LTC 9 . 25 %) 0 . 50 * ( Spread 0 . 71 %) Booth – assume NEB correct in 2000 – adjusts for 75% of change in LTC yields – adjusts for 50% of the change in A spreads ROE 9 . 90 . 75 * ( LTC 6 . 12 %) 0 . 50 * ( Spread 0 . 94 %) BOOTH Gazifere 2010 ROE Adjustment Formula ROE Formula 13 12.5 12 11.5 11 10.5 10 9.5 9 8.5 8 1995 1996 1997 1998 1999 2000 NEB 2001 2002 McShane 2003 2004 Booth1 2005 2006 2007 2008 2009 Booth2 McShane assumes NEB got it right for 199f and wrong from thereafter Booth 1 &2 assumes NEB got it right in 2001 or 2004 and uses spread change to capture the “crisis” premium BOOTH Gazifere 2010 2010 Gazifere Assume Regie got it right in 1998 – adjust by 75% of LTC change – adjust by 50% of spread change ROE 10 . 0 % 0 . 75 * ( LTC 5 . 70 %) 0 . 50 * ( spread 0 . 99 %) For 2011 – LTC is 4.50% – Utility spread 1.30% LTC causes 0.75*1.2% or -0.90% Spread causes 0.50* 0.30 or +0.15 Overall 9.25% Update – LTC forecast yields lower (-0.15%) – spreads wider (+0.10%) BOOTH Gazifere 2010 US Data Moody’s – – – – 25% regulation 25% ability to earn the allowed ROE 10% diversification 40% financials: the numbers “Moody’s views the regulatory risk of US utilities as being higher in most cases than that of utilities located in some other developed countries, including Japan, Australia and Canada. The difference in risk reflects our view that individual state regulation is less predictable than national regulation; a highly fragmented market in the US results in stronger competition in wholesale power markets; US fuel and power markets are more volatile; there is a low likelihood of extraordinary political action to support a failing company in the US; holding company structures limit regulatory oversight; and overlapping and unclear regulatory jurisdictions characterize the US market. As a result no US utilities, except for transmission companies subject to federal regulation, score higher than a single A in this factor.” “as is characteristic of the US, the ability to recover costs and earn returns is less certain and subject to public and sometimes political scrutiny.” BOOTH Gazifere 2010 US Utility Bond Ratings Description is of business risk rating for each rating class BOOTH Gazifere 2010 Newfoundland Power Decision BOOTH Gazifere 2010 BCUC Decision BOOTH Gazifere 2010 Ms McShane’s Use of Analyst Growth Forecasts BOOTH Gazifere 2010 Optimism Bias Analyst are over optimistic and gradually zero in on the right numbers as they get guidance from companies Academic research that analysts are biased McKinsey (consultants) – S&P500earnings growth has been 100% too optimistic: 10-12% vs 6% Ms McShane’s US sample – – – – Historic & forecast GDP growth Historic dividend growth: Historic earnings growth: Forecast analyst growth: BOOTH Gazifere 2010 5.0% 2.5% 4.0% 5.9% Ms McShane’s Risk Assessment for Gazifere She assumes Gazifere would be a BBB utility and estiamtes the risk premium for US BBB’s relative to her low risk US utilities US utilities are large risky utilities Gazifere is a small low risk utility BOOTH Gazifere 2010 Fair ROE LTC Yield: Market Risk Premium: Beta: Issue costs: Recommended Benchmark ROE: 7.75% Financial Crisis adjustment: Gazifere addition: Recommended ROE: Suggested New ROE Formula: 4.50% 5.0-6.0% 0.45-0.55 0.50% 0.50% 0.25% 8.50% 9.25% Since June LTC Yields have dropped but spreads have widened BOOTH Gazifere 2010