A FROM 18-K SECURITIES AND EXCHANGE COMMISSION

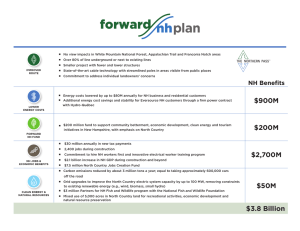

advertisement