Western Carolina University Program Assessment Plan —Finance, Financial Planning BSBA

advertisement

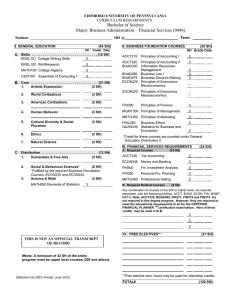

Western Carolina University Program Assessment Plan BSBA—Finance, Financial Planning College of Business Assessment Plan for 2006-7 Primary Contact Name/Info: Roger Lirely, Department Head 215A Forsyth 227-3491 lirely@wcu.edu Department Mission Statement: The goal of the faculty in financial planning is to prepare students for careers in the private and/or public sector. Through teaching, our primary responsibility, we strive to create a learning environment of excellence with a personal touch. We encourage the development of critical thinking and decision-making abilities and provide our students with the skills associated with a professional career in financial planning. We maintain a qualified and motivated faculty by engaging primarily in applied and instructional development research and through service to our campus, professional, and regional constituencies. Statement on Alignment of Program Mission w/ University and College Mission Consistent with the university and college missions, the financial planning mission emphasizes quality teaching, and the dissemination of applied and pedagogical research. Through service and teaching, embers of the faculty are encouraged to develop relationships with regional employers and businesses. Students have an opportunity to meet and work with these regional constituents and graduate with the requisite skills to pursue professional financial planning careers in western North Carolina and beyond. Mission Goals Our graduates will be: The goal of the faculty in financial planning is to prepare students for careers in the private and/or public sector. Through teaching, our primary responsibility, we strive to create a learning environment of excellence with a personal touch. We encourage the development of critical thinking and decisionmaking abilities and provide our students with the skills associated with a professional career in financial planning. We maintain a qualified and motivated faculty by engaging primarily in applied and instructional development research and through service to our campus, professional, and regional constituencies. 1.0 Capable of preparing a financial plan that incorporates economic, financial, tax and ethical considerations in helping clients reach life goals 2.0 Effective communicators. 3.0 Knowledgeable Western Carolina University Program Assessment Plan BSBA—Finance, Financial Planning College of Business Assessment Plan for 2006-7 Objectives Outcome Assessment Assessment Our graduates will be able to: Delivery Location Methodology Location 1.1 Demonstrate an ability to identify a client's needs in risk management, investments, college planning, retirement planning, tax planning and estate planning. FIN 310, 335, 406, 410, 496 ACCT 355, BSBA Foundation of Knowledge FIN 496 Primary trait analysis embedded in case studies 1.2 Demonstrate an ability to analyze a client's needs in order to provide a plan that will enable the client to reach life goals. 1.3 Demonstrate an understanding of the qualities necessary to build strong relationships between the planner and client. 1.4 Demonstrate an appreciation for the importance of ethical behavior in the financial planning profession. 2.1 Exhibit effective written communication skills. FIN 310, 410, 496 FIN 496 ACCT 310, 410, 496, FIN 496 Primary trait analysis embedded in case studies Primary trait analysis embedded in case studies ACCT 310, 410, 496, LAW 230 FIN 496 ENG 101, 102, FIN 310, 410, 496 FIN 496 2.2 Exhibit effective oral communication skills Liberal studies FIN 496 2.3 Employ electronic communication technology CIS 251, ACCT 355 ACCT 355 3.1 Demonstrate an ability to ACCT 275, FIN 496 Primary trait analysis embedded in case studies Primary trait analysis embedded in case studies Primary trait analysis embedded in case studies Primary trait analysis embedded in MSSP and online communications ETS Major Field Mission Goals Our graduates will be: in the use of specific financial planning content areas 4.0 Aware of the cultural competencies expected of financial planning professionals in business environments 2.1 2.2 2.3 Western Carolina University Program Assessment Plan BSBA—Finance, Financial Planning College of Business Assessment Plan for 2006-7 Objectives Outcome Assessment Assessment Our graduates will be able to: Delivery Location Methodology Location interpret financial statements and analyze the information therein. FIN 310, 406, 410, 496 Test or Paraplanner exam 3.2 Demonstrate an ability to solve major types of time value of money problems. 3.3 Demonstrate an ability to manage an equity portfolio. FIN 305, 310, 410, 496 FIN 496 FIN 406 FIN 406 4.1 Show that they have been successfully involved in professional organizations through employment, internships, mentoring, student organization activities or other approved professional involvements. Internships, concurrent employment, student organizations, New York trip, case competition, service learning Exit interview ETS Major Field Test or Paraplanner exam ETS Major Field Test or Paraplanner exam Survey Direct measurement data collected during fall 2006 and spring 2007 but inaccessible at time of report due to COB move. See 2.1 See 2.2 Indirect: Only 1/3 of the graduating seniors in spring 2007 had secured employment—each in banking. None had professional certifications. Students found the faculty to be helpful but aging and the curriculum interesting but fast-paced. All felt they were well-prepared but were neutral as to their ability to solve structured and unstructured finance problems.