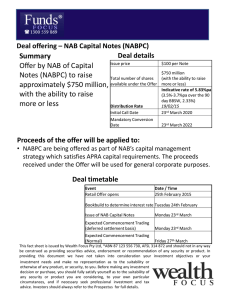

NAB Subordinated Notes

advertisement