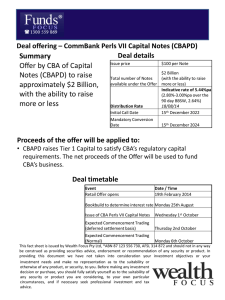

COMMBANK CAPITAL NOTES PERLS VIII Prospectus and PERLS III Reinvestment Offer Information

advertisement