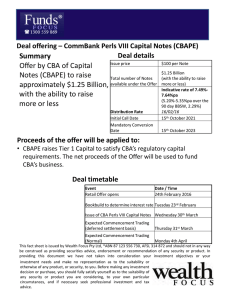

For personal use only COMMBANK CAPITAL NOTES

advertisement