Whitefield Resettable Preference Shares (WHFPB) 6 July 2012

advertisement

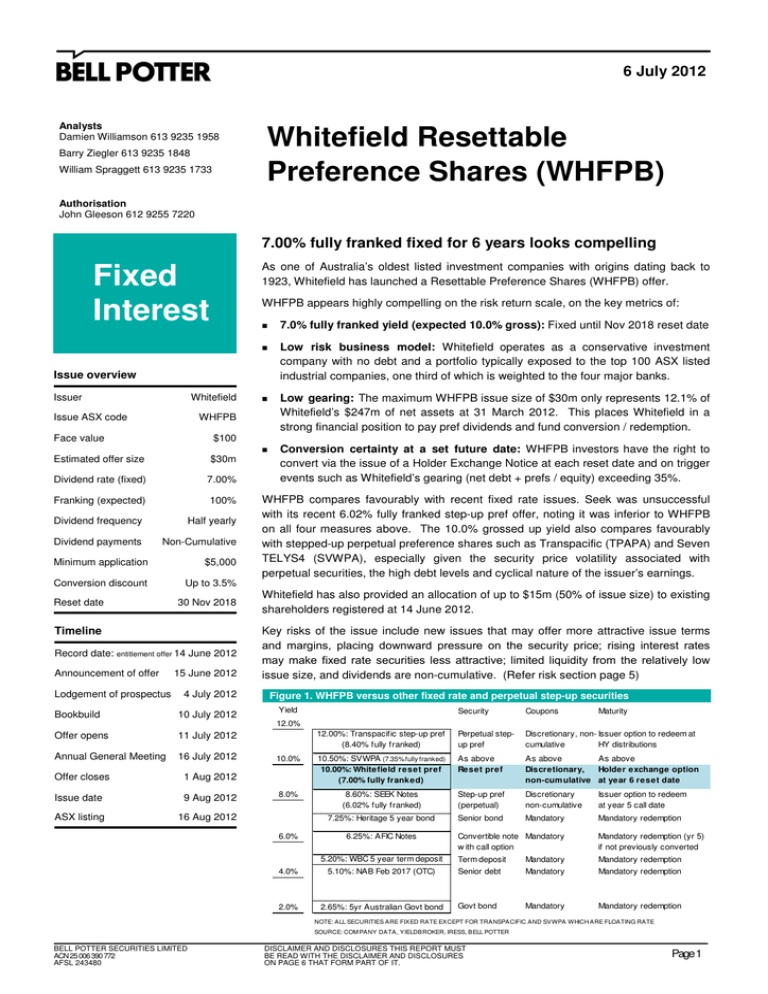

6 July 2012 Analysts Damien Williamson 613 9235 1958 Barry Ziegler 613 9235 1848 William Spraggett 613 9235 1733 Whitefield Resettable Preference Shares (WHFPB) Authorisation John Gleeson 612 9255 7220 7.00% fully franked fixed for 6 years looks compelling As one of Australia’s oldest listed investment companies with origins dating back to 1923, Whitefield has launched a Resettable Preference Shares (WHFPB) offer. Fixed Interest WHFPB appears highly compelling on the risk return scale, on the key metrics of: 7.0% fully franked yield (expected 10.0% gross): Fixed until Nov 2018 reset date Low risk business model: Whitefield operates as a conservative investment company with no debt and a portfolio typically exposed to the top 100 ASX listed industrial companies, one third of which is weighted to the four major banks. Low gearing: The maximum WHFPB issue size of $30m only represents 12.1% of Whitefield’s $247m of net assets at 31 March 2012. This places Whitefield in a strong financial position to pay pref dividends and fund conversion / redemption. Conversion certainty at a set future date: WHFPB investors have the right to convert via the issue of a Holder Exchange Notice at each reset date and on trigger events such as Whitefield’s gearing (net debt + prefs / equity) exceeding 35%. Issue overview Issuer Whitefield Issue ASX code WHFPB Face value $100 Estimated offer size $30m Dividend rate (fixed) 7.00% Franking (expected) 100% Dividend frequency Half yearly Dividend payments Non-Cumulative Minimum application $5,000 Conversion discount Up to 3.5% WHFPB compares favourably with recent fixed rate issues. Seek was unsuccessful with its recent 6.02% fully franked step-up pref offer, noting it was inferior to WHFPB on all four measures above. The 10.0% grossed up yield also compares favourably with stepped-up perpetual preference shares such as Transpacific (TPAPA) and Seven TELYS4 (SVWPA), especially given the security price volatility associated with perpetual securities, the high debt levels and cyclical nature of the issuer’s earnings. 30 Nov 2018 Whitefield has also provided an allocation of up to $15m (50% of issue size) to existing shareholders registered at 14 June 2012. Record date: entitlement offer 14 June 2012 Key risks of the issue include new issues that may offer more attractive issue terms and margins, placing downward pressure on the security price; rising interest rates may make fixed rate securities less attractive; limited liquidity from the relatively low issue size, and dividends are non-cumulative. (Refer risk section page 5) Reset date Timeline Announcement of offer Lodgement of prospectus 15 June 2012 4 July 2012 Bookbuild 10 July 2012 Offer opens 11 July 2012 Annual General Meeting 16 July 2012 Offer closes 1 Aug 2012 Issue date 9 Aug 2012 ASX listing 16 Aug 2012 Figure 1. WHFPB versus other fixed rate and perpetual step-up securities Yield Security Coupons Maturity 12.00%: Transpacific step-up pref (8.40% fully franked) Perpetual stepup pref Discretionary, non- Issuer option to redeem at cumulative HY distributions 10.0% 10.50%: SVWPA (7.35% fully franked) 10.00%: Whitefield reset pref (7.00% fully franked) As above Reset pref As above As above Discretionary, Holder exchange option non-cum ulative at year 6 reset date 8.0% 8.60%: SEEK Notes (6.02% fully franked) Step-up pref (perpetual) Discretionary non-cumulative Issuer option to redeem at year 5 call date 7.25%: Heritage 5 year bond Senior bond Mandatory Mandatory redemption 12.0% 6.0% 6.25%: AFIC Notes 5.20%: WBC 5 year term deposit 4.0% 2.0% Convertible note Mandatory w ith call option Mandatory redemption (yr 5) if not previously converted Term deposit Mandatory Mandatory redemption 5.10%: NAB Feb 2017 (OTC) Senior debt Mandatory Mandatory redemption 2.65%: 5yr Australian Govt bond Govt bond Mandatory Mandatory redemption NOTE: ALL SECURITIES ARE FIXED RATE EXCEPT FOR TRANSPACIFIC AND SVWPA WHICH ARE FLOATING RATE SOURCE: COM PANY DATA , YIELDBROKER, IRESS, BELL POTTER BELL POTTER SECURITIES LIMITED ACN 25 006 390 772 AFSL 243480 DISCLAIMER AND DISCLOSURES THIS REPORT MUST BE READ WITH THE DISCLAIMER AND DISCLOSURES ON PAGE 6 THAT FORM PART OF IT. Page 1 Whitefield Convertible Resettable Preference Shares 6 July 2012 Whitefield Resettable Preference Shares (WHFPB) Key security features WHFPB has some issue terms which vary slightly from a standard issue. include: These 7.00% Fully Franked Fixed until 30 November 2018: WHFPB holders will be entitled to a non-cumulative fixed rate dividend of 7.00% per annum, which is expected to be fully franked. Half yearly dividend periods end 31 May and 30 November. First reset date 30 November 2018: At the first reset date, if Whitefield wishes to amend the WHFPB terms, it needs to provide holders with details of the new terms at least 50 business days prior to the reset date. Whitefield may also elect to convert or redeem WHFPB at the reset date. The reset date also provides WHFPB holders the option to elect for Holder Exchange, where Whitefield has the option to convert WHFPB into shares or redeem for cash. All future reset dates post 2018 will occur at three year intervals. Dividends are subject to Whitefield’s solvency: The Whitefield Directors have the discretion not to declare a WHFPB dividend if they determine payment of this dividend would result in Whitefield becoming, or being likely to become insolvent. Under this scenario, WHFPB dividends are non-cumulative and Whitefield has no liability to make this payment. WHFPB holders have no claim in respect of the nonpayment of dividends. Overall we find it difficult to foresee a scenario where this would apply. Non payment of WHFPB dividends to result in holder exchange and dividend stopper on ordinary shares: Under the scenario that Whitefield does not pay a scheduled dividend while solvent and there is no legislation preventing the payment, the Holder Trigger Event provides investors the right to request Holder Exchange. In addition, Whitefield is restricted from paying any dividends on ordinary shares. Holder Conversion allowed under a Holder Trigger Event: While holders have the capacity to request conversion under events such as a takeover, non payment of a declared dividend (above) or suspension of trading of Whitefield shares for 20 consecutive days, WHFPB holders may also request conversion if Whitefield’s gearing (net debt + prefs / equity) exceeds 35%. Whitefield also has a conversion right under a Gearing Event if Whitefield’s gearing exceeds 25%. Under an extreme stress test such as the market decline witnessed between 30 September 2007 to 31 March 2009, assuming the WHFPB issue was undertaken in September 2007, Whitefield’s gearing as outlined in Figure 2 would have increased from 12.1% to 23.8%. Figure 2: Gearing sensitivity to GFC impact on Whitefield’s NTA 30-Sep-07 31-Mar-09 31-Mar-12 Pref issue (12.1% of Sep 2007 NTA) $0.65 $0.65 $0.65 Post-Tax NTA (Net Tangible Assets) $5.37 $2.73 $3.28 -49.2% -38.9% Change vs 30 Sep 2007 Gearing 12.1% 23.8% 19.8% S&P/ASX 200 Industrials Index 7,156 2,649 3,793 -63.0% -47.0% Change vs 30 Sep 2007 SOURCE: COMPANY DATA, IRESS, BELL POTTER Page 2 Whitefield Convertible Resettable Preference Shares 6 July 2012 Whitefield Resettable Preference Shares (WHFPB) Issue specific terms WHFPB has some issue terms which vary slightly from standard issue terms. These include: No cash top up if WHFPB dividend franking is below 100%: This risk appears very low given Whitefield had a franking credit balance of $21.19m at 31 March 2012, enabling it to pay fully franked dividends of $49.44m or $0.65 per ordinary share. Given the ordinary annual dividend is $0.17 fully franked, this surplus franking balance equates to almost four years of dividends under the highly unlikely scenario that no franking credits are received. We note the annual WHFPB dividend payment will be a maximum of $2.1m. WHFPB issue is conditional shareholder approval at the 16 July 2012 AGM: Whitefield is seeking shareholder approval for the WHFPB issue, in order that Whitefield has additional capacity to issue further shares under without shareholder approval under the 15% threshold in Listing Rule 7.1. Conversion may be into a new share class: If WHFPB conversion occurs during the middle of a Whitefield ordinary dividend period, Whitefield may issue a new class of ordinary shares to reduce the next ordinary dividend on a pro-rata basis. This is to reflect the number of days the new security is on issue for the dividend period. Once the new security goes ex dividend, the new security will be reissued as the existing ordinary shares. Conversion discount of up to 3.5%: In order to minimise the dilution upon conversion, Whitefield will not apply a conversion discount if Whitefield’s VWAP (volume weighted average price) on the 10 business days before conversion is below 90% of Whitefield’s Net Asset Backing (NAB). If the VWAP is above 90% of NAB, a conversion discount of up to 3.5% will apply, with the lowest conversion price set at 90% of NAB. As Figure 3 highlights, Whitefield has continuously traded at greater than a 10% discount to pre-tax NTA over the past 18 months. Figure 3: Share price and NTA returns versus trading premium / discount over 10 years $200 30% Prem/Disc (RHS) Pre-Tax NTA (LHS) Share Price (LHS) $175 20% $150 10% $125 $100 0% $75 -10% $50 -20% $25 $0 May-02 May-03 May-04 May-05 May-06 May-07 May-08 May-09 May-10 May-11 -30% May-12 SOURCE: COMPANY DATA, IRESS, BELL POTTER Page 3 Whitefield Convertible Resettable Preference Shares 6 July 2012 Whitefield Resettable Preference Shares (WHFPB) One of Australia’s oldest listed investment companies With a history dating back to 1923, Whitefield is one of Australia’s oldest LICs. The assets of the company consist exclusively of ASX listed industrial securities, which targets to generate an investment return over the long term that exceeds the All Industrials Accumulation Index. $232m investment portfolio at 31 March 2012 Whitefield’s $231.6m investment portfolio at 31 March 2012 comprised $3.2m cash and $228.4m of ASX listed securities across 63 industrial companies. Of the portfolio, 32.7% if comprised of the four major banks. Figure 4: Whitefield Investment Portfolio at 31 March 2012 Company $m %Portfolio 1 Commonwealth Bank 22.79 9.84% 2 Westpac 19.24 8.30% 3 ANZ Bank 17.93 7.74% 4 National Australia Bank 15.84 6.84% 5 Telstra 9.75 4.21% 6 Woolworths 9.03 3.90% 7 Wesfarmers 8.97 3.87% 8 QBE 8.42 3.64% 9 Macquarie Group 8.02 3.46% 10 CSL 7.78 3.36% 11 AMP 7.50 3.24% 12 Seven Group Holdings 6.96 3.00% 13 Crown 5.23 2.26% 14 Asciano 4.85 2.09% 15 Brambles 3.31 1.43% 16 Toll 3.19 1.38% 17 News Corp 3.17 1.37% 18 Westfield Group 3.13 1.35% 19 UGL 2.98 1.29% 20 InvoCare Other (~43 ASX listed companies) Cash 2.95 1.27% 57.46 24.80% 3.17 1.37% Total Investment Portfolio & Cash 231.64 100.00% SOURCE: COMPANY DATA, BELL POTTER WHFPB to rank above ordinary equity With respect to the payment of dividends and in the event of a company wind up, WFHPB will rank in priority to ordinary shares, but will rank behind the 8% Preference Shares, of which $23,790 are on issue. Figure 5: Whitefield Investment Portfolio at 31 March 2012 Ranking Higher Ranking Secured Debt Existing Instruments Senior Unsecured Debt None Unsecured Subordinated Debt None 8% Preference Shares Lower Ranking Amount None Preferred equity 7% Reset Preference Shares Ordinary Equity Ordinary Shares $0.02m $30.00m $247.79m SOURCE: COMPANY DATA, BELL POTTER Page 4 Whitefield Convertible Resettable Preference Shares 6 July 2012 Whitefield Resettable Preference Shares (WHFPB) Investment risks Key investment risks to consider include: • Decreases in market value and earnings of Whitefield’s investment portfolio may reduce the ability of Whitefield to pay scheduled dividends and redeem WHFPB, especially if this is associated with a material increase in gearing; • Dividends are non-cumulative and may not be paid in circumstances such as the risk of becoming insolvent; • Whitefield does not propose to provide a cash top up to dividends if it has insufficient franking credits; • Adverse movement in credit spreads as a result of a tightening in the availability and cost of credit; • Rising interest rates will generally make fixed rate securities less attractive; • New issues may offer more attractive issue terms and margins, placing downward pressure on the security price; • Low liquidity, increasing the potential adverse movements in the security price if large volumes are traded; and • Adverse changes to Government legislation, including the ability of Whitefield to distribute franking credits. Page 5 Whitefield Convertible Resettable Preference Shares 6 July 2012 Research Team Fixed Income Bell Potter Securities Limited ACN 25 006 390 772 Level 38, Aurora Place 88 Phillip Street, Sydney 2000 Telephone +61 2 9255 7200 www.bellpotter.com.au Staff Member Title/Sector Phone @bellpotter.com.au John Gleeson Research Manager 612 9255 7220 jgleeson Sam Haddad Emerging Growth 612 8224 2819 shaddad John O’Shea Emerging Growth 613 9235 1633 joshea Jonathan Snape Emerging Growth 613 9235 1601 jsnape Toby Molineaux Emerging Growth 612 8224 2813 tmolineaux Bryson Calwell Emerging Growth Associate 613 9235 1896 bcalwell Stuart Roberts Healthcare/Biotech 612 8224 2871 sroberts Tanushree Jain Healthcare/Biotech Associate 612 8224 2849 tnjain TS Lim Banks/Regionals 612 8224 2810 tslim Lafitani Sotiriou Diversified 613 9235 1668 lsotiriou Stuart Howe Bulks & Copper 613 9235 1782 showe Fred Truong Bulks & Copper 613 9235 1629 ftruong Trent Allen Emerging Growth 612 8224 2868 tcallen Michael Lovesey Emerging Growth 612 8224 2847 mlovesey Johan Hedstrom Energy 612 8224 2859 jhedstrom Stephen Thomas Gold & Nickel 618 9326 7647 sthomas Quantitative & System 612 8224 2833 jtai Damien Williamson Fixed Income 613 9235 1958 dwilliamson Barry Ziegler Fixed Income 613 9235 1848 bziegler Industrials Financials Resources Quantitative Janice Tai Fixed Income The following may affect your legal rights. Important Disclaimer: This document is a private communication to clients and is not intended for public circulation or for the use of any third party, without the prior approval of Bell Potter Securities Limited. In the USA and the UK this research is only for institutional investors. It is not for release, publication or distribution in whole or in part to any persons in the two specified countries. This is general investment advice only and does not constitute personal advice to any person. Because this document has been prepared without consideration of any specific client’s financial situation, particular needs and investment objectives (‘relevant personal circumstances’), a Bell Potter Securities Limited investment adviser (or the financial services licensee, or the representative of such licensee, who has provided you with this report by arraignment with Bell Potter Securities Limited) should be made aware of your relevant personal circumstances and consulted before any investment decision is made on the basis of this document. While this document is based on information from sources which are considered reliable, Bell Potter Securities Limited has not verified independently the information contained in the document and Bell Potter Securities Limited and its directors, employees and consultants do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or accurate. Nor does Bell Potter Securities Limited accept any responsibility for updating any advice, views opinions, or recommendations contained in this document or for correcting any error or omission which may become apparent after the document has been issued. Except insofar as liability under any statute cannot be excluded. Bell Potter Limited and its directors, employees and consultants do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this document or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this document or any other person. Disclosure of interest: Bell Potter Limited, its employees, consultants and its associates within the meaning of Chapter 7 of the Corporations Law may receive commissions, underwriting and management fees from transactions involving securities referred to in this document (which its representatives may directly share) and may from time to time hold interests in the securities referred to in this document. Page 6