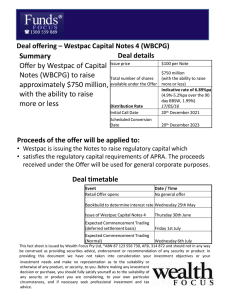

For personal use only Westpac Capital Notes 4 OFFER INFORMATION

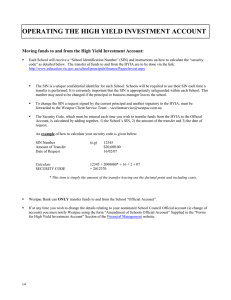

advertisement