WESTPAC SUBORDINATED NOTES INFORMATION MEMORANDUM

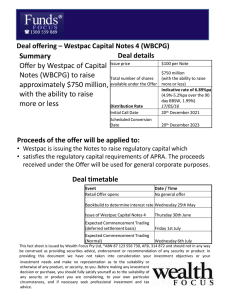

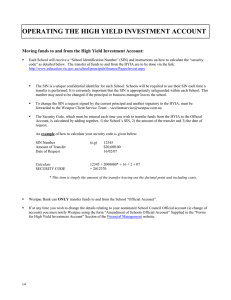

advertisement