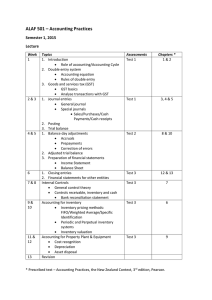

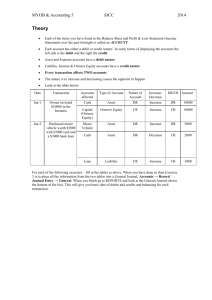

MYOB Subordinated Notes Prospectus

advertisement