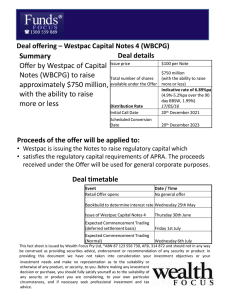

For personal use only WESTPAC CONVERTIBLE PREFERENCE

advertisement