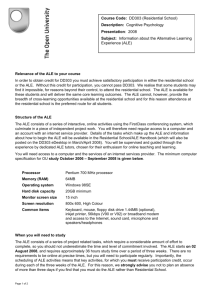

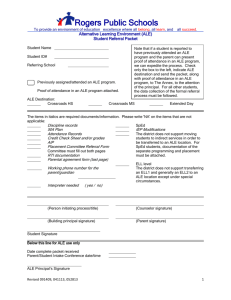

offer ALE ProPErty grouP ALE NotES 2 ProSPECtuS An offer of unsecured

advertisement