How to read these

advertisement

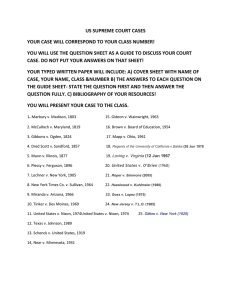

How to read these tables: This guide is produced to provide investors in existing CPPI/Threshold Managed Capital Protected Products with an at a glance overview of whether they are participating in the initial allocation to equities. Where possible, we have estimated the most recent break costs for an investment loan. These projections are for investors with a variable rate loan. Investors with no loan are likely to be better off switching than illustrated. Investors with a fixed rate loan are likely to be worse off than illustrated. Investors should request an individual illustration from their provider before cashing in their investment. Red = Redemption is likely to be beneficial At a Glance Guide to CPPI Redemption Amber = Redemption is likely to be beneficial, greater care needed Green = Stay with product likely to be more beneficial CPPI/Threshold Managed Investments g Last updated: 28th February 2010 Overall gain/loss at maturity^ Investment Loan 100% Switch to Switch to Participation alternative alternative Protection ‐ Current Overall rate in Equivalent variable term term gain/loss on Remain in Switch to underlying return to interest deposit current alternative deposit early managed Redeem or rate investment (zero tax) (46.5% tax) break even fund redemption fund Stay Break costs of variable Maturity Unit Unit prices, as date price of ... loan* HFA Series Octane Fund (Series 1)† Octane Fund Series 2† Octane Asia Octane Asia Octane Global Fund ‐ Asia Octane Global Fund ‐ US Octane Global Fund ‐ Europe Octane 5 Fund ANZ Discovery Asia Fund 0% 0% 5% 58% 58% 58% 93% 0% Stay Stay Stay Stay Stay Stay Stay Redeem ‐31% ‐33% ‐29% 29% ‐31% ‐36% ‐36% ‐20% ‐27% 0% 0% 0% 18% 11% 11% 68% 0% ‐10% ‐7% 6% 12% 5% 5% 42% 28% ‐14% ‐12% ‐1% 1% 5% ‐1% ‐2% 32% 19% ‐22% ‐23% ‐15% 15% ‐13% ‐19% ‐19% 5% ‐5% 10.8% 10.1% 5 5.8% 8% N/A N/A N/A N/A 5.0% 7.655% f 7.835% f 8 45% f 8.45% f 9.05% f 9.05% f 9.05% f 11.45% f 5.65% 3.7% 2.3% 6 0% 6.0% 10.2% 10.2% 10.2% 15.9% 0.0% Dec‐12 0.73 Sep‐13 0.69 30/11/2009 J 14 Jun‐14 0 0.77 77 30/11/2009 Jul‐15 0.79 30/11/2009 Jul‐15 0.75 30/11/2009 Jul‐15 0.75 30/11/2009 Jul‐16 0.96 30/11/2009 Jul‐16 0.73 31/12/2009 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem ‐17% ‐18% ‐18% ‐16% ‐16% ‐16% ‐17% ‐16% ‐14% ‐16% ‐16% ‐15% ‐15% 5% 4% 4% 4% 4% 4% 2% 4% 6% 4% 4% 5% 5% 21% 20% 20% 23% 23% 23% 21% 23% 26% 23% 23% 24% 24% 14% 13% 13% 16% 16% 16% 14% 16% 19% 16% 16% 17% 17% ‐1% ‐2% ‐2% 0% 0% 0% ‐1% 0% 2% 0% 0% 1% 1% 4.3% 4.6% 4.6% 4.0% 4.0% 4.0% 4.3% 4.0% 3.5% 4.0% 4.0% 3.8% 3.8% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% May‐14 0.86 31/12/2009 May‐14 0.85 31/12/2009 May‐14 y 0.85 31/12/2009 / / May‐14 0.85 31/12/2009 May‐14 0.85 31/12/2009 May‐14 0.85 31/12/2009 May‐14 0.84 31/12/2009 May‐14 0.85 31/12/2009 May‐14 0.87 31/12/2009 May‐14 0.85 31/12/2009 May‐14 0.85 31/12/2009 May‐14 0.86 31/12/2009 May‐14 y 0.86 31/12/2009 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem ‐19% ‐18% ‐19% ‐21% ‐20% ‐19% ‐19% ‐25% ‐18% 18% ‐19% 4% 5% 4% 2% 3% 4% 4% ‐3% 5% 4% 29% 30% 29% 25% 27% 29% 29% 19% 30% 29% 21% 23% 21% 18% 20% 21% 21% 12% 23% 21% 1% 2% 1% ‐1% 0% 1% 1% ‐6% 2% 1% 4.0% 3.7% 4.0% 4.5% 4.2% 4.0% 4.0% 5.5% 3 7% 3.7% 4.0% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9 30% 9.30% 9.30% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0 8% 0.8% 0.8% Apr‐15 0.82 31/12/2009 Apr‐15 0.83 31/12/2009 Apr‐15 0.82 31/12/2009 Apr‐15 0.80 31/12/2009 Apr‐15 0.81 31/12/2009 Apr‐15 0.82 31/12/2009 Apr‐15 0.82 31/12/2009 Apr‐15 0.76 31/12/2009 A 15 Apr‐15 0 0.83 83 31/12/2009 Apr‐15 0.82 31/12/2009 87% 54% 0% 0% 36% 0% 0% 75% 0% 0% 0% 0% 0% 62% 100% 100% 70% 0% 0% 0% Stay Redeem Redeem Redeem Redeem Redeem Redeem Stay Redeem Redeem Redeem Redeem Redeem Stay Stay Stay Stayy Redeem Redeem Stay ‐4% ‐12% ‐23% ‐26% ‐18% ‐25% ‐26% ‐12% ‐24% ‐26% ‐32% ‐26% ‐26% ‐14% 4% 31% ‐11% ‐26% ‐24% ‐32% 51% 29% 0% 0% 15% 0% 0% 35% 0% 0% ‐12% 0% 0% 28% 67% 111% 35% 0% 0% 0% 53% 40% 23% 18% 31% 19% 18% 40% 21% 18% 8% 18% 18% 37% 66% 109% 42% 18% 21% 8% 44% 32% 16% 11% 23% 13% 11% 32% 14% 11% 2% 11% 11% 29% 56% 97% 34% 11% 14% 2% 20% 10% ‐4% ‐8% 2% ‐7% ‐8% 10% ‐5% ‐8% ‐15% ‐8% ‐8% 7% 30% 63% 11% ‐8% ‐5% ‐15% 0.8% 2.4% 5.0% 5.7% 3.7% 5.5% 5.7% 2.4% 5.2% 5.7% 7.4% 5.7% 5.7% 2.8% N/A N/A 2.2% 5.7% 5.2% 7.4% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% May‐15 0.97 31/12/2009 May‐15 0.89 31/12/2009 May‐15 0.78 31/12/2009 May‐15 0.75 31/12/2009 May‐15 0.83 31/12/2009 May‐15 0.76 31/12/2009 May‐15 y 0.75 31/12/2009 / / May‐15 0.89 31/12/2009 May‐15 0.77 31/12/2009 May‐15 0.75 31/12/2009 May‐15 0.69 31/12/2009 May‐15 0.75 31/12/2009 May‐15 0.75 31/12/2009 May‐15 0.87 31/12/2009 May‐15 1.05 31/12/2009 May‐15 1.32 31/12/2009 May‐15 y 0.90 31/12/2009 / / May‐15 0.75 31/12/2009 May‐15 0.77 31/12/2009 May‐15 0.69 31/12/2009 83% 80% 82% 82% 76% 62% 92% Stay Stay Stay Stay Stayy Stay Stay 3% 2% ‐1% 4% 4% 0% 2% 48% 46% 42% 49% 48% 38% 49% 51% 49% 45% 52% 52% 46% 49% 42% 41% 36% 43% 43% 38% 41% 23% 21% 18% 24% 24% 19% 21% N/A N/A N/A N/A N/A / N/A N/A 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 9.30% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% May‐14 1.04 31/12/2009 May‐14 1.03 31/12/2009 May‐14 1.00 31/12/2009 May‐14 1.05 31/12/2009 May‐14 y 1.05 31/12/2009 / / May‐14 1.01 31/12/2009 May‐14 1.03 31/12/2009 30/11/2009 Perpetual Protected Investments Series 1 Ausbil Australian Active Equity Fund Ausbil Australian Emerging Leaders Fund AXA Wholesale Global Equity Value Fund q y BlackRock Global Allocation Fund (Aus.) Class D Colonial First State W'sale Global Resources Macquarie Int. Infrastructure Securities Fund Perennial Global Property Trust Perennial Growth Australian Shares Trust Perpetual Wholesale Australian Fund Perpetual Wholesale International Share Fund PM CAPITAL Absolute Performance Fund T. Rowe Price Global Equity Fund UBS Australian Share Fund Perpetual Protected Investments Series 2 Aberdeen Asian Opportunities Fund Ausbil Australian Active Equity Fund Ausbil Australian Emerging Leaders Fund AXA Wholesale Global Equity Value Fund Colonial First State W'sale Global Resources GVI Global Industrial Share Fund Macquarie Int. Infrastructure Securities Fund Perennial Global Property Trust Perpetual Wholesale Australian Fund Perpetual Wholesale Australian Fund Schroder Wholesale Australian Equity Fund Perpetual Protected Investments Series 3 Aberdeen Asian Opportunities Fund Ausbil Australian Active Equity Fund** Ausbil Australian Emerging Leaders Fund AXA Wholesale Global Equity Value Fund BlackRock Global Allocation Fund Class D Units Challenger Wholesale Australian Share Fund Colonial First State W'sale Global Resources DWS Global Equity Thematic Fund GVI Global Industrial Share Fund Macquarie Int. Infrastructure Securities Fund Perennial Global Property Trust Perpetual Wholesale Australian Fund Perpetual Wholesale Ethical SRI Fund Perpetual Wholesale International Fund Platinum Asia Fund 1 Premium China Fund 1 Schroders Wholesale Australian Equity Fund q y T Rowe Price Global Equity Fund Vanguard Australian Share Index Fund Vanguard International Share Index Fund Series 1 & 2 Fund Participation Offer Perpetual Protected Investments Series 1 Ausbil Australian Active Equity Fund Ausbil Australian Emerging Leaders Fund AXA Wholesale Global Equity Value Fund Colonial First State W'sale Global Resources Macquarie Int. Infrastructure Securities Fund q Perennial Global Property Wholesale Trust Perennial W'sale Growth Aus. Shares Trust Red = Redemption is likely to be beneficial At a Glance Guide to CPPI Redemption Amber = Redemption is likely to be beneficial, greater care needed Green = Stay with product likely to be more beneficial CPPI/Threshold Managed Investments Last updated: 28th February 2010 Overall gain/loss at maturity^ Investment Loan Participation Switch to Switch to 100% rate in alternative alternative Protection ‐ Current Overall underlying term term Equivalent variable gain/loss on Remain in Switch to managed Redeem managed Redeem or or early early current current alternative deposit alternative deposit deposit deposit return to interest return to interest fund Stay redemption fund investment (zero tax) (46.5% tax) break even rate Break costs of variable Maturity variable Maturity Unit Unit Unit prices, as Unit prices as date price of ... loan* Series 1 & 2 Fund Participation Offer Perpetual Protected Investments Series 1 100% 62% 90% Stay Stay Stay 6% ‐5% 4% 57% 32% 51% 55% 39% 52% 46% 31% 43% 26% 13% 24% N/A N/A N/A 9.30% 9.30% 9.30% 1.1% 1.1% 1.1% May‐14 1.07 31/12/2009 May‐14 0.96 31/12/2009 May‐14 1.05 31/12/2009 85% 85% 85% 100% 100% Stay Stay SStay Stay Stay ‐1% ‐5% 0% ‐1% 4% 54% 48% 55% 58% 66% 57% 51% 59% 57% 65% 48% 42% 50% 48% 56% 23% 18% 25% 23% 30% N/A N/A N/A / N/A N/A 9.30% 9.30% 9.30% 9.30% 9.30% 0.8% 0.8% 0.8% 0.8% 0.8% Apr‐15 1.00 31/12/2009 Apr‐15 0.96 31/12/2009 Apr‐15 1.01 31/12/2009 Apr‐15 1.00 31/12/2009 Apr‐15 1.05 31/12/2009 Jun‐09 Ausbil Australian Emerging Leaders Fund BT Wholesale Core Australian Share Fund Colonial First State W'sale Global Resources GVI Global Industrial Share Fund Perennial Value Shares Trust Macquarie Int. Infrastructure Securities Fund Perpetual's Wholesale Australian Fund Platinum Asia Fund Platinum International Fund Premium China Fund Vanguard Australian Shares Index Fund Vanguard Int. Shares Index Fund (Hedged) Walter Scott Global Equity Fund Winton Global Alpha Fund Zurich Inv's Global Thematic Share Fund 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Stay Stay Stay Stay Stayy Stay Stay Stay Stay Stay Stay Stay Stay Stay Stayy 33% 27% 30% 15% 28% 17% 26% 7% 10% 14% 27% 23% 8% 0% 5% 105% 96% 100% 77% 98% 80% 94% 66% 69% 76% 96% 90% 66% 54% 62% 103% 94% 98% 75% 96% 78% 92% 64% 68% 74% 95% 89% 64% 52% 60% 92% 84% 87% 66% 85% 68% 82% 55% 58% 64% 84% 78% 55% 44% 51% 62% 55% 58% 40% 57% 42% 54% 31% 34% 39% 56% 51% 31% 22% 28% N/A N/A N/A N/A N/A / N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 8.70% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% 1.1% Nov‐14 1.34 29/12/2009 Nov‐14 1.28 30/12/2009 Nov‐14 1.31 29/12/2009 Nov‐14 1.16 29/12/2009 Nov‐14 1.29 30/12/2009 / / Nov‐14 1.18 29/12/2009 Nov‐14 1.27 29/12/2009 Nov‐14 1.08 30/12/2009 Nov‐14 1.11 30/12/2009 Nov‐14 1.15 24/12/2009 Nov‐14 1.29 29/12/2009 Nov‐14 1.25 29/12/2009 Nov‐14 1.09 28/12/2009 Nov‐14 1.01 24/12/2009 Nov‐14 1.06 29/12/2009 Nov‐08 Ausbil Australian Active Equity Fund Ausbil Australian Emerging Leaders Fund BT Wholesale Core Australian Share Fund Colonial First State W'sale Global Resources DWS Global Equity Agribusiness Fund Perpetual's Wholesale Australian Fund Platinum Asia Fund Platinum International Fund Premium China Fund Premium China Fund Vanguard Australian Shares Index Fund Vanguard Int. Shares Index Fund (Hedged) Vanguard Property Securities Index Fund Walter Scott Global Equity Fund 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 27% 78% Stay Stay Stay Stay Stay Stay Stay Stay Stay Stay Stay Redeem Stay 41% 57% 38% 59% 68% 42% 42% 19% 44% 32% 15% ‐17% ‐2% 117% 141% 113% 144% 158% 118% 119% 83% 122% 104% 77% 12% 46% 116% 139% 111% 142% 156% 116% 117% 81% 120% 102% 75% 27% 50% 104% 126% 99% 129% 142% 104% 105% 71% 108% 91% 65% 20% 42% 72% 91% 69% 94% 105% 73% 73% 45% 76% 62% 40% 2% 20% N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 9.90% 9.90% 9.90% 9.90% 9.90% 9.90% 9.90% 9.90% 9 90% 9.90% 9.90% 9.90% 9.90% 9.90% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1 2% 1.2% 1.2% 1.2% 1.2% 1.2% Nov‐14 1.42 29/12/2009 Nov‐14 1.58 29/12/2009 Nov‐14 1.39 30/12/2009 Nov‐14 1.60 29/12/2009 Nov‐14 1.69 29/12/2009 Nov‐14 1.43 29/12/2009 Nov‐14 1.43 30/12/2009 Nov‐14 1.20 30/12/2009 Nov 14 Nov‐14 1 46 1.46 24/12/2009 Nov‐14 1.34 29/12/2009 Nov‐14 1.16 29/12/2009 Nov‐14 0.84 29/12/2009 Nov‐14 1.00 28/12/2009 61% 12% 7% 5% 16% 12% 5% 27% 5% 4% 13% 5% 21% 15% 6% 20% 78% 100% 100% 21% 15% 20% 6% 4% 60% Stay Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Stay Redeem Redeem Redeem Redeem Stay Stay Stay Redeem Redeem Redeem Redeem Redeem Stay ‐1% ‐15% ‐16% ‐16% ‐15% ‐16% ‐17% ‐12% ‐19% ‐17% ‐15% ‐27% ‐13% ‐15% ‐16% ‐14% 4% 26% 23% ‐13% ‐15% ‐14% ‐17% ‐17% 0% 28% 3% 1% 0% 4% 2% 0% 9% 0% 0% 2% 0% 6% 3% 1% 5% 38% 72% 68% 6% 3% 6% 0% 0% 30% 34% 15% 13% 13% 15% 13% 12% 19% 9% 13% 14% ‐1% 17% 15% 14% 16% 41% 70% 66% 17% 15% 17% 13% 12% 35% 26% 9% 7% 7% 9% 7% 6% 13% 3% 7% 8% ‐7% 11% 8% 7% 10% 33% 61% 57% 11% 8% 10% 7% 5% 28% 13% ‐3% ‐4% ‐4% ‐3% ‐4% ‐6% 1% ‐8% ‐5% ‐3% ‐17% ‐1% ‐3% ‐4% ‐2% 19% 44% 40% ‐1% ‐3% ‐1% ‐5% ‐6% 14% N/A 4.7% 5.2% 5.2% 4.7% 5.1% 5.6% 3.6% 6.3% 5.3% 4.9% 9.4% 4.1% 4.8% 5.1% 4.4% N/A N/A N/A 4.2% 4.8% 4.3% 5.3% 5.6% N/A 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 10.10% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% Jun‐13 1.00 28/12/2009 Jun‐13 0.87 29/12/2009 Jun‐13 0.85 29/12/2009 Jun‐13 0.85 29/12/2009 Jun‐13 0.86 30/12/2009 Jun‐13 0.85 30/12/2009 Jun‐13 0.84 29/12/2009 Jun‐13 0.90 29/12/2009 Jun‐13 0.82 29/12/2009 Jun‐13 0.85 30/12/2009 Jun‐13 0.86 29/12/2009 Jun‐13 0.74 29/12/2009 Jun‐13 0.88 28/12/2009 Jun‐13 0.86 29/12/2009 Jun‐13 0.85 24/12/2009 Jun‐13 0.87 29/12/2009 Jun‐13 1.06 30/12/2009 Jun‐13 1.27 30/12/2009 Jun‐13 1.24 24/12/2009 Jun‐13 0.88 29/12/2009 Jun‐13 0.86 24/12/2009 Jun‐13 0.88 29/12/2009 Jun‐13 0.85 29/12/2009 Jun‐13 0.84 29/12/2009 Jun‐13 1.01 28/12/2009 Perpetual Wholesale Australian Share Fund PM Capital Absolute Performance Fund UBS Australian Share Fund Perpetual Protected Investments Series 2 Ausbil Australian Emerging Leaders Fund AXA Wholesale Global Equity Value Fund Colonial First State W'sale Global Resources l i l i ' l l b l GVI Global Industrial Share Fund Perpetual Wholesale Australian Fund Macquarie Fusion Funds Jun‐08 Aberdeen Asian Opportunities Fund Ausbil Australian Active Equity Fund Ausbil Australian Emerging Leaders Fund Axa's Wholesale Global Equity Value Fund BT Wholesale Core Australian Share Fund Challenger Wholesale Australian Share Fund Colonial First State W'sale Global Resources DWS Global Equity Thematic Fund DWS Global Equity Agribusiness Fund Eley Griffiths Group Small Companies Fund GVI Global Industrial Share Fund Perennial Global Property Trust Macquarie‐Globalis BRIC Ad'ge Fund (Hedged) Macquarie Int. Infrastructure Securities Fund BlackRock (Merrill Lynch) Global Allocation Perpetual's Wholesale Australian Fund Platinum Asia Fund Platinum International Fund Premium China Fund Russell Emerging Markets Fund Van Eyk Blueprint Australian Shares Fund Vanguard Australian Shares Index Fund Vanguard Int. Shares Index Fund (Hedged) Vanguard Property Securities Index Fund Walter Scott Global Equity Fund Red = Redemption is likely to be beneficial At a Glance Guide to CPPI Redemption Amber = Redemption is likely to be beneficial, greater care needed Green = Stay with product likely to be more beneficial CPPI/Threshold Managed Investments Last updated: 28th February 2010 Overall gain/loss at maturity^ Investment Loan 100% Switch to Switch to Participation alternative alternative Protection ‐ Current Overall rate in Equivalent variable term term gain/loss on Remain in Switch to underlying return to interest deposit current alternative deposit early managed Redeem or rate investment (zero tax) (46.5% tax) break even fund redemption fund Stay Break costs of variable Maturity Unit Unit prices, as date price of ... loan* Macquarie Fusion Funds Nov‐07 Aberdeen Asian Opportunities Fund Ausbil Australian Active Equity Fund Ausbil Australian Emerging Leaders Fund Axa's Wholesale Global Equity Value Fund Challenger Wholesale Australian Share Fund DWS Global Equity Thematic Fund Eley Griffiths Group Small Companies Fund Fidelity Australian Equities Fund GVI Global Industrial Share Fund Perennial Global Property Trust Macquarie Int. Infrastructure Securities Fund BlackRock (Merrill Lynch) Global Allocation Macquarie Asian Alpha Fund** Perpetual's Wholesale Australian Fund Premium China Fund UBS Property Securities Fund Van Eyk Blueprint Australian Shares Fund Van Eyk Blueprint International Shares Fund Vanguard Australian Shares Index Fund Vanguard Int. Shares Index Fund (Hedged) Walter Scott Global Equity Fund 5% 5% 5% 4% 4% 4% 5% 5% 4% 3% 4% 5% 47% 15% 16% 2% 5% 4% 5% 6% 27% Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem ‐16% ‐16% ‐16% ‐17% ‐17% ‐16% ‐17% ‐17% ‐16% ‐21% ‐17% ‐16% ‐7% ‐15% ‐15% ‐18% ‐18% ‐17% ‐17% ‐18% ‐11% 1% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 1% 18% 3% 4% 0% 0% 0% 0% 0% 10% 14% 13% 13% 12% 13% 13% 12% 13% 13% 7% 12% 14% 25% 14% 16% 11% 10% 13% 13% 11% 21% 8% 7% 7% 6% 7% 7% 6% 7% 7% 1% 6% 7% 18% 8% 9% 4% 4% 6% 6% 5% 14% ‐4% ‐5% ‐5% ‐5% ‐5% ‐5% ‐5% ‐5% ‐5% ‐10% ‐5% ‐4% 6% ‐3% ‐2% ‐7% ‐7% ‐5% ‐5% ‐6% 2% 5.0% 5.3% 5.3% 5.5% 5.3% 5.3% 5.5% 5.3% 5.3% 6.9% 5.5% 5.1% N/A 4.9% 4.6% 5.9% 5.9% 5.3% 5.4% 5.8% N/A 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% 1.3% Jun‐13 0.85 28/12/2009 Jun‐13 0.85 29/12/2009 Jun‐13 0.85 29/12/2009 Jun‐13 0.84 29/12/2009 Jun‐13 0.85 30/12/2009 Jun‐13 0.85 29/12/2009 Jun‐13 0.84 30/12/2009 Jun‐13 0.85 30/12/2009 Jun‐13 0.85 29/12/2009 Jun‐13 0.80 29/12/2009 Jun‐13 0.84 29/12/2009 Jun‐13 0.85 24/12/2009 Jun‐13 0.94 30/11/2009 Jun‐13 0.86 29/12/2009 Jun‐13 0.87 24/12/2009 Jun‐13 0.83 29/12/2009 Jun‐13 0.83 24/12/2009 Jun‐13 0.85 24/12/2009 Jun‐13 0.85 29/12/2009 Jun‐13 0.83 29/12/2009 Jun‐13 0.91 28/12/2009 Jun‐07 Aberdeen Asian Opportunities Fund Ausbil Australian Active Equity Fund Ausbil Australian Emerging Leaders Fund Axa's Wholesale Global Equity Value Fund Challenger Wholesale Australian Share Fund Colonial First State W'sale Colonial First State W sale Global Resources Global Resources DWS Global Equity Thematic Fund Deutsche Strategic Value Fund Eley Griffiths Group Small Companies Fund GVI Global Industrial Share Fund Perennial Global Property Trust Perennial Value Shares Trust Macquarie Global Private Equity Securities Macquarie Int. Infrastructure Securities Fund Macquarie Property Income Fund BlackRock (Merrill Lynch) Global Allocation BlackRock (Merrill Lynch) Global Allocation Macquarie Asian Alpha Fund Perpetual's Wholesale Australian Fund PM Capital Absolute Performance Fund Premium China Fund Russell Global Opportunities Fund UBS Property Securities Fund Van Eyk Blueprint Australian Shares Fund Van Eyk Blueprint International Shares Fund Walter Scott Global Equity Fund Zurich Inv'ss Global Thematic Share Fund Zurich Inv Global Thematic Share Fund 13% 5% 5% 3% 4% 3% 4% 25% 4% 4% 3% 16% 2% 4% 0.4% 12% 36% 12% 4% 26% 4% 2% 5% 4% 26% 20% Redeem Redeem Redeem Redeem Redeem Redeem Redeem Stay Redeem Redeem Redeem Redeem Redeem Redeem Stay Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem ‐10% ‐11% ‐11% ‐12% ‐12% ‐12% ‐12% ‐21% ‐12% ‐11% ‐14% ‐9% ‐12% ‐11% ‐16% ‐10% ‐3% ‐10% ‐12% ‐7% ‐11% ‐13% ‐11% ‐11% ‐7% ‐8% 4% 2% 1% 0% 0% 0% 1% 0% 0% 1% 0% 4% 0% 2% 0% 3% 14% 3% 1% 8% 2% 0% 2% 2% 9% 7% 12% 11% 10% 9% 9% 9% 10% ‐2% 9% 10% 7% 12% 9% 11% 4% 11% 20% 12% 10% 15% 11% 8% 11% 11% 16% 14% 7% 6% 5% 4% 4% 4% 4% ‐7% 4% 5% 2% 7% 4% 5% ‐1% 6% 14% 6% 4% 9% 5% 3% 6% 5% 10% 9% ‐1% ‐2% ‐3% ‐4% ‐4% ‐4% ‐3% ‐14% ‐3% ‐3% ‐5% ‐1% ‐4% ‐2% ‐8% ‐2% 6% ‐2% ‐3% 1% ‐2% ‐5% ‐2% ‐2% 2% 1% 4.1% 4.6% 4.9% 5.2% 5.3% 5 4% 5.4% 5.1% N/A 5.2% 5.0% 6.0% 4.0% 5.4% 4.7% 7.3% 4 4% 4.4% N/A 4.4% 5.0% N/A 4.7% 5.7% 4.6% 4.7% N/A 3.3% 9.15% 9.15% 9.15% 9.15% 9.15% 9 15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9 15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 9.15% 1.2% 1.2% 1.2% 1.2% 1.2% 1 2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1 2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% Jun‐12 0.92 28/12/2009 Jun‐12 0.91 29/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.89 29/12/2009 Jun‐12 0.89 30/12/2009 Jun‐12 0 89 0.89 29/12/2009 Jun‐12 0.89 29/12/2009 Jun‐12 0.80 30/11/2009 Jun‐12 0.89 30/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.88 29/12/2009 Jun‐12 0.92 30/12/2009 Jun‐12 0.89 24/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.85 22/12/2009 Jun‐12 0 91 0.91 24/12/2009 Jun‐12 0.98 30/11/2009 Jun‐12 0.91 29/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.94 24/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.88 29/12/2009 Jun‐12 0.91 24/12/2009 Jun‐12 0.90 24/12/2009 Jun‐12 0.94 28/12/2009 Jun‐12 0 93 0.93 29/12/2009 Nov‐06 Ausbil Australian Emerging Leaders Fund Axa's Wholesale Global Equity Value Fund Colonial First State W'sale Geared Share Fund Perennial Global Property Trust Macquarie Int. Infrastructure Securities Fund BlackRock (Merrill Lynch) Global Allocation Macquarie Asian Alpha Fund Perpetual's Wholesale Australian Fund** PM Capital Absolute Performance Fund UBS Australian Share Fund Walter Scott Global Equity Fund Zurich Inv's Global Thematic Share Fund 13% 3% 4% 2% 4% 5% 100% 20% 3% 13% 21% 20% Redeem Redeem Redeem Redeem Redeem Redeem Stay Redeem Redeem Redeem Redeem Redeem ‐10% ‐12% ‐12% ‐12% ‐11% ‐11% 19% ‐8% ‐11% ‐10% ‐8% ‐8% 4% 1% 1% 0% 1% 2% 49% 6% 1% 3% 7% 7% 12% 10% 10% 9% 10% 11% 47% 14% 10% 12% 14% 14% 6% 4% 5% 4% 5% 6% 40% 9% 5% 6% 9% 9% ‐1% ‐3% ‐3% ‐3% ‐3% ‐2% 30% 1% ‐3% ‐1% 1% 1% 4.3% 5.0% 5.0% 5.1% 4.9% 4.6% N/A 3.4% 4.9% 4.3% 3.4% 3.3% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% Jun‐12 0.91 29/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.89 29/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.91 24/12/2009 Jun‐12 1.20 30/11/2009 Jun‐12 0.93 29/12/2009 Jun‐12 0.90 29/12/2009 Jun‐12 0.91 29/12/2009 Jun‐12 0.93 28/12/2009 Jun‐12 0.93 29/12/2009 21% 6% 3% 3% 4% 59% 13% Redeem Redeem Redeem Redeem Redeem Stay Redeem ‐2% ‐5% ‐7% ‐6% ‐5% 5% ‐8% ‐5% 8% 3% 1% 2% 3% 3% 4% 12% 8% 6% 7% 8% 4% 8% 8% 4% 2% 3% 4% 0% 5% 4% 0% ‐2% ‐1% ‐1% 1% ‐4% 0% N/A 3.6% 4.8% 4.1% 3.8% N/A 3.3% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% Jun‐11 1.00 28/12/2009 Jun‐11 0.96 29/12/2009 Jun‐11 0.94 29/12/2009 Jun‐11 0.95 29/12/2009 Jun‐11 0.96 29/12/2009 Jun‐11 0.93 30/10/2009 Jun‐11 0.96 30/12/2009 Jun‐06 Aberdeen Asian Opportunities Fund** Ausbil Australian Emerging Leaders Fund Axa's Wholesale Global Equity Value Fund Challenger Orion Australian Share Fund Aberdeen Actively Hedged Int. Equities Fund HFA Diversified Investments Fund Perennial Value Shares Trust Red = Redemption is likely to be beneficial At a Glance Guide to CPPI Redemption Amber = Redemption is likely to be beneficial, greater care needed Green = Stay with product likely to be more beneficial CPPI/Threshold Managed Investments Last updated: 28th February 2010 Overall gain/loss at maturity^ Investment Loan 100% Switch to Switch to Participation alternative alternative Protection ‐ Current Overall rate in Equivalent variable term term gain/loss on Remain in Switch to underlying return to interest deposit current alternative deposit early managed Redeem or rate investment (zero tax) (46.5% tax) break even fund redemption fund Stay Break costs of variable Maturity Unit Unit prices, as date price of ... loan* Macquarie Fusion Funds Jun‐06 Macquarie Int. Infrastructure Securities Fund Property Securities Portfolio Perpetual's Wholesale Australian Fund Perpetual's Wholesale International Fund PM Capital Absolute Performance Fund UBS Australian Share Fund Van Eyk Blueprint Australian Shares Fund Van Eyk Blueprint International Shares Fund Walter Scott Global Equity Fund 5% 3% 12% 4% 3% 12% 3% 4% 16% Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem Redeem ‐6% ‐7% ‐5% ‐6% ‐6% ‐5% ‐5% ‐6% ‐3% 2% 1% 4% 2% 3% 4% 3% 2% 6% 7% 6% 8% 7% 7% 8% 8% 7% 10% 3% 2% 5% 4% 4% 5% 4% 3% 6% ‐1% ‐2% 0% ‐1% ‐1% 0% ‐1% ‐1% 2% 4.1% 5.0% 3.3% 3.9% 3.9% 3.3% 3.8% 4.2% 2.1% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 9.20% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% Jun‐11 0.95 29/12/2009 Jun‐11 0.94 29/12/2009 Jun‐11 0.96 29/12/2009 Jun‐11 0.96 29/12/2009 Jun‐11 0.96 29/12/2009 Jun‐11 0.96 29/12/2009 Jun‐11 0.96 24/12/2009 Jun‐11 0.95 24/12/2009 Jun‐11 0.98 28/12/2009 Dec‐05 Axa's Wholesale Global Equity Value Fund Challenger Orion Australian Share Fund Aberdeen Actively Hedged Int. Equities Fund HFA Diversified Investments Fund Perennial Value Shares Trust** Perpetual's Wholesale Australian Fund** Perpetual's Wholesale International Fund PM Capital Absolute Performance Fund PM Capital Absolute Performance Fund UBS Australian Share Fund 3% 4% 4% 59% 36% 27% 16% 3% 20% Redeem Redeem Redeem Stay Redeem Redeem Redeem Redeem Redeem ‐7% ‐5% ‐6% ‐6% 2% ‐1% ‐4% ‐6% ‐2% 1% 3% 3% 6% 13% 9% 5% 2% 7% 6% 8% 8% 7% 16% 13% 9% 7% 11% 2% 4% 4% 3% 12% 9% 6% 3% 7% ‐2% ‐1% ‐1% ‐1% 7% 4% 1% ‐1% 3% 4.8% 3.8% 3.9% N/A N/A N/A 1.8% 3 1% 3.1% 0.8% 9.70% 9.70% 9.70% 9.70% 9.70% 9.70% 9.70% 9 70% 9.70% 9.70% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1.2% 1 2% 1.2% 1.2% Jun‐11 0.94 29/12/2009 Jun‐11 0.96 29/12/2009 Jun‐11 0.96 29/12/2009 Jun‐11 0.95 30/10/2009 Jun‐11 1.03 30/12/2009 Jun‐11 1.00 29/12/2009 Jun‐11 0.97 29/12/2009 Jun 11 Jun‐11 0 95 0.95 29/12/2009 Jun‐11 0.99 29/12/2009 100% 84% Stay Stay 21% 15% 111% 93% 111% 101% 97% 87% 57% 50% N/A N/A 6.65% 6.65% Jun‐16 1.16 31/12/2009 Jun‐16 1.10 31/12/2009 9% 61% 17% 0% 0% 0% 0% Redeem Redeem Redeem Redeem Redeem Redeem Redeem ‐15% 10% ‐12% ‐13% ‐21% ‐18% ‐16% 12% 63% 18% 11% 2% 5% 8% 37% 77% 42% 39% 28% 32% 36% 29% 66% 33% 31% 20% 24% 28% 7% 38% 10% 9% 0% 3% 6% N/A N/A N/A 2.6% 4.3% 3.6% 3.1% 6.40% 6.40% 6.40% 5.65% 7.95% 6.40% 5.65% Jun‐15 0.89 31/12/2009 Jun‐15 1.14 31/12/2009 Jun‐15 0.92 31/12/2009 Jun‐15 0.82 31/12/2009 Jun‐15 0.81 31/12/2009 Jun‐15 0.86 31/12/2009 Jun‐15 0.80 31/12/2009 0% 0% 0% 0% 0% 0% Redeem Redeem Redeem Redeem Redeem Redeem ‐17% ‐14% ‐16% ‐14% ‐17% ‐15% 5% 8% 5% 8% 3% 6% 28% 33% 29% 33% 27% 31% 22% 26% 22% 26% 20% 24% 2% 6% 3% 6% 1% 4% 3.7% 3.0% 3.6% 3.0% 3 9% 3.9% 3.3% 5.75% 5.75% 5.75% 5.35% 7 05% 7.05% 5.35% Dec‐14 0.82 31/12/2009 Dec‐14 0.85 31/12/2009 Dec‐14 0.83 31/12/2009 Dec‐14 0.85 31/12/2009 Dec 14 Dec‐14 0 88 0.88 31/12/2009 Dec‐14 0.83 31/12/2009 38% 18% 0% 0% 0% Redeem Redeem Redeem Redeem Redeem 2% ‐7% ‐13% ‐12% ‐25% 35% 18% 7% 8% 0% 51% 37% 28% 30% 10% 42% 29% 21% 22% 4% 22% 11% 4% 5% ‐10% N/A N/A 3.1% 2.9% 6.6% 6.05% 6.05% 6.75% 5.40% 8.45% Jun‐14 0.96 31/12/2009 Jun‐14 0.87 31/12/2009 Jun‐14 0.89 31/12/2009 Jun‐14 0.84 31/12/2009 Jun‐14 0.77 31/12/2009 41% 0% Redeem Redeem 8% ‐9% 34% 7% 46% 23% 38% 17% 23% 4% N/A 2.7% 5 50% 5.50% 5.10% Jun‐13 0 99 0.99 31/12/2009 Jun‐13 0.89 31/12/2009 0% 100% Redeem Stay ‐6% 56% 5% 94% 17% 94% 11% 85% 3% 71% 2.5% N/A 6.85% 6.85% Jun‐12 1.12 31/12/2009 Jun‐12 1.75 31/12/2009 Macquarie Reflexion Trusts Jun‐09 BRIC and Emerging Markets Trust China Trust Jun‐08 Asia Property Trust BRIC and Emerging Markets Trust** China Trust Commodity Trust Japan Focus Trust Middle East Trust Renewable Energy Trust Dec‐07 Asia Property Trust BRIC and Emerging Markets Trust China Trust Commodity Trust Japan Focus Trust Japan Focus Trust Renewable Energy Trust Jun‐07 BRIC and Emerging Markets Trust** China Trust Japan Focus Trust Renewable Energy Trust Japan Focus Trust Variation Jun‐06 China Trust** China Trust** Emerging Markets Trust Jun‐05 Asia Trust 2005 (USD) China Trust 2005 (USD) Disclaimer: This CPPI overview is a summary only of our initial in‐house view when considering the suitability of current investments versus alternatives in the market. Each individual's circumstances and tax status should be seriously considered before cashing in or transferring to an alternative investment product. This table should not in any way be construed as providing securities advice or an endorsement or recommendation. Wealth Focus has not taken into consideration your investment objectives or your investment needs and make no representation as to the suitability or otherwise of any product, or security, to you. Before making any investment decision or purchase, you should fully satisfy yourself as to the suitability of any security or product you are considering, to your own particular circumstances, read the PDS, and if necessary seek professional investment and tax advice. We recommend that you read our Fi Financial Services Guide. Whilst Wealth Focus makes every effort to ensure that the information is correct at the time of publishing, Wealth Focus takes no responsibility for the accuracy of the information supplied. i lS i G id Whil W l h F k ff h h i f i i h i f bli hi W l hF k ibili f h f h i f i li d ^In producing this table, we have made certain assumptions to assist in projecting likely outcomes: Assumed equity growth rate = 9%pa, CPPI product cash growth rate = 4.6% (overall average). "Switch to term deposit" rates assumed as market leading rates sourced www.moneymarket.com.au 03/02/10 adjusted by ‐0.25%. Fusion & HFA break costs have assumed a $100,000 investment. CPPI maturity values shown assume equity participation does not increase for remainder of term. Loan interest rate on alternative investment assumed to be equal to current rate. If new rate is lower transfer is likely to be more beneficial and if new rate is higher will be less beneficial than illustrated. f = Only fixed rate loans were available with this product * Break costs calculated as follows: HFA Octane Asia, Global & Octane 5 = estimated difference in swap rates + 0.6%pa + $500, Fusion = 0.2% + 1 mth interest +$220, PPI Series 2 = 1mth interest, all other PPI Series = 0.3% plus 1mth interest. Participation rates are quoted directly from product provider updates. In‐house view to Redeem is based on obtaining greater than 2%pa in an alternative investment ‐ (red) >2% pa and term deposit (zero tax) projection is greater than remaining in current fund, (amber) >2%pa but term deposit (zero tax) is not greater than zero (greater care needed) ** Adviser discretion applied to provide (amber) status. †Redemptions are currently suspended on this fund. Reproduction of this document is permitted with hyperlink source to www.fundsfocus.com.au