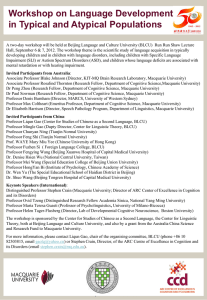

Macquarie

advertisement