FirstChoice Pension Product Disclosure Statement

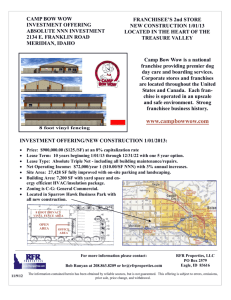

advertisement