FAMILY SUPPORT AND YOUNG ENTREPRENEURS’ START-UP ACTIVITIES IN

advertisement

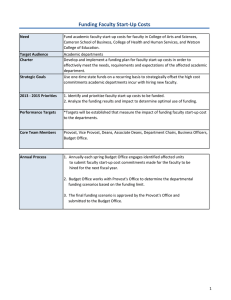

FAMILY SUPPORT AND YOUNG ENTREPRENEURS’ START-UP ACTIVITIES IN AN EMERGING AND DEVELOPED ECONOMY CONTEXT: AN EMPIRICAL EXPLORATION Tatiana S. Manolova, Bentley University and St. Petersburg State University Galina Shirokova, St. Petersburg State University Tatyana Tsukanova, St. Petersburg State University Linda F. Edelman, Bentley University and St. Petersburg State University SUMMARY Research Question: What is the effect of the institutional context (emerging vs developed market economies) on the strength of the relationship between family support and the scope of start-up activities of young nascent entrepreneurs? Theoretical Perspectives: Institutional theory (Tolbert et al., 2011; Scott, 2007; North, 1990), institutional embeddedness (Granovetter, 1985), family embeddedness (Aldrich and Cliff, 2003) Source of Data: 2011 Global University Entrepreneurial Spirit Students’ Survey (GUESSS) project (n = 33,925 university students, aged 18-34, from 13 developed and 10 emerging economies). Major Findings: The higher the family support in the form of financial capital (b=-0.029, p<0.001), the lower the scope of start-up activities (H1a rejected). The higher the family support in the form of social capital (b=0.026, p<0.001), the greater the scope of start-up activities undertaken by young entrepreneurs (Hypothesis H1b supported). Hypothesis H2a received ambivalent support, in that the effect of family financial support was indeed stronger in emerging economies, as H2a predicted, but in a direction opposite to what H1a predicted. The interaction between social capital and emerging economy (b=0.016, p<0.001) was positive and statistically significant (H2b supported). Contributions: Our study contributes to the literature on nascent entrepreneurship by improving our understanding of how different types of family resources influence the start-up activities of young nascent entrepreneurs. Further, our study highlights the important interplay between family and institutional influences, providing an important link between the family embeddedness and the institutional embeddedness literatures. Finally, our study offers the potential to predict the viability of a nascent venture. If, as our hypotheses suggest, greater family support leads to additional start-up activities, and we know from prior research that the greater the number of start-up activities, the more likely the firm is to survive in the short run (Brush et al., 2008), then developing an understanding of the family’s role in the start-up process may help us predict which entrepreneurial initiatives are high risk or high potential. Acknowledgements: This research has been conducted with financial support from a Russian Science Foundation grant (Project No. 14-18-01093). of the effects Hierarchical Poisson regression estimates on the scope of start-up activities * Variable Controls Age Gender Bachelor Field of Study: Nat Sci Field of Study: Soc Sci Field of Study: Others Family background Previous experience Level of commitment Number of partners University Industry Family Support Financial capital Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 0.016*** (0.001) -0.255*** (0.009) -0.039*** (0.013) -0.059*** (0.013) -0.087*** (0.018) -0.055*** (0.012) 0.100*** (0.009) 0.360*** (0.009) 0.002*** (0.000) 0.101*** (0.004) YES YES 0.016*** (0.001) -0.260*** (0.009) -0.042*** (0.013) -0.058*** (0.013) -0.086*** (0.018) -0.055*** (0.012) 0.091*** (0.009) 0.356*** (0.009) 0.002*** (0.000) 0.101*** (0.004) YES YES 0.016*** (0.001) -0.260*** (0.009) -0.042*** (0.013) -0.058*** (0.013) -0.086*** (0.018) -0.055*** (0.012) 0.091*** (0.009) 0.356*** (0.009) 0.002*** (0.000) 0.101*** (0.004) YES YES 0.016*** (0.001) -0.260*** (0.009) -0.042*** (0.013) -0.058*** (0.013) -0.085*** (0.018) -0.055*** (0.012) 0.091*** (0.009) 0.356*** (0.009) 0.002*** (0.000) 0.101*** (0.004) YES YES 0.016*** (0.001) -0.260*** (0.009) -0.042*** (0.013) -0.059*** (0.013) -0.087*** (0.018) -0.056*** (0.012) 0.093*** (0.009) 0.356*** (0.009) 0.002*** (0.000) 0.101*** (0.004) YES YES 0.016*** (0.001) -0.260*** (0.009) -0.040*** (0.013) -0.058*** (0.013) -0.086*** (0.018) -0.055*** (0.012) 0.093*** (0.009) 0.356*** (0.009) 0.002*** (0.000) 0.101*** (0.004) YES YES -0.029*** (0.003) 0.026*** (0.003) -0.029*** (0.003) 0.026*** (0.003) 0.010 (0.069) -0.023*** (0.004) 0.026*** (0.003) 0.010 (0.069) -0.010* (0.005) -0.029*** (0.003) 0.015*** (0.004) 0.010 (0.069) 0.016*** (0.004) -0.013*** (0.004) 0.008* (0.004) 0.008 (0.069) -0.028*** (0.006) 0.030*** (0.005) -0.148* (0.082) 0.0623 33925 -0.177** (0.083) 0.0625 33925 Social capital Emerging economy Financial Capital x Emerging Social Capital x Emerging Regression Function Constant Pseudo R2 N -0.183** (0.081) 0.0611 33925 -0.175** (0.082) 0.0622 33925 -0.175** (0.082) 0.0622 33925 -0.193** (0.083) 0.0622 33925 * Poisson regression coefficients are reported (standard errors in parentheses). Prob>chi2=0.000 for all models, all models are statistically significant; ***p<0.001, **p<0.01, *p<0.05.