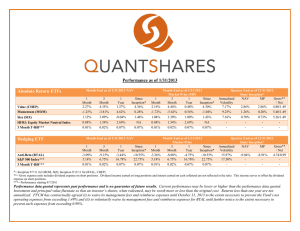

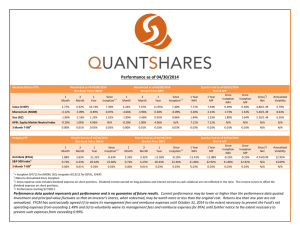

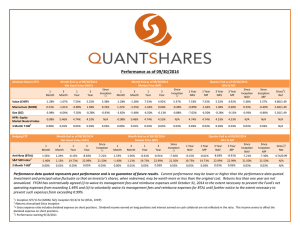

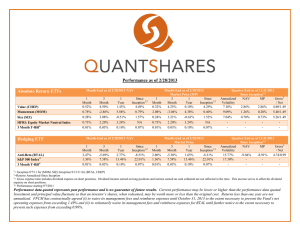

Performance as of 12/31/2014

advertisement

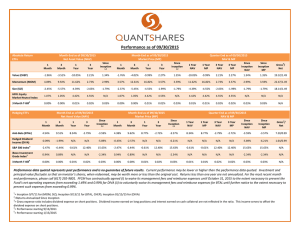

Performance as of 12/31/2014 Absolute Return ETFs Month-End as of 12/31/2014 Net Asset Value (NAV) 1 Month 3 Month 1 Year 3 Year Value (CHEP) 0.59% -2.48% -1.52% Momentum (MOM) -0.49% -0.37% Size (SIZ) -0.21% HFRI: Equity Market Neutral Index 3 Month T-Bill4 Month-End as of 12/31/2014 Market Price (MP) Since Inception 1,2 1 Month 3 Month 1 Year 3 Year 3.37% 4.17% 0.04% -2.91% -2.03% -4.63% 0.93% 0.19% -1.52% -0.29% 0.66% -4.90% -1.21% -0.66% -0.25% 0.88% 1.96% 3.87% 4.43% N/A 0.00% 0.00% 0.02% 0.03% 0.03% Hedging ETF 3 Month 1 Year 3 Year Anti-Beta (BTAL) 0.05% 2.61% 4.37% S&P 500 Index4 -0.25% 4.93% 4 0.00% 0.00% 3 Month T-Bill Gross3/ Net 4.17% 4.02% 19.32/1.49 0.14% 0.19% -0.45% 22.47/1.49 -1.21% -1.09% -0.66% -0.69% 18.14/1.49 3.87% 4.43% 4.43% N/A N/A N/A 0.03% 0.03% 0.03% 0.03% 0.03% N/A Since Inception MP Gross3/ Net 1 Year NAV 3.19% 4.02% -1.52% -2.03% 3.37% 3.19% -6.21% 0.14% -0.45% -4.63% -6.21% 0.93% 0.41% -5.01% -1.09% -0.69% -4.90% -5.01% 0.88% 1.96% 3.87% 4.43% N/A 3.87% 0.00% 0.00% 0.02% 0.03% 0.03% 0.03% Month-End as of 12/31/2014 Market Price (MP) Since Inception Since Inception MP 1,2 Month-End as of 12/31/2014 Net Asset Value (NAV) 1 Month Since Inception Quarter End as of 12/31/2014 NAV & MP Since 1 Year 3 Year 3 Year Inception MP NAV MP NAV 1,2 1 Month 3 Month 1 Year 3 Year -5.24% -5.94% 1.51% 3.64% 5.10% 13.69% 20.41% 21.48% -0.25% 4.93% 0.02% 0.03% 0.03% 0.00% 0.00% Since Inception Quarter End as of 12/31/2014 NAV & MP Since 1 Year 3 Year 3 Year Inception MP NAV MP NAV 1,2 1 Year NAV -4.94% -5.74% 4.37% 5.10% -5.24% -4.94% -5.94% -5.74% 7.20/1.49 13.69% 20.41% 21.48% 13.69% 13.69% 20.41% 20.41% 21.48% 21.48% N/A 0.02% 0.03% 0.03% 0.03% 0.03% 0.03% 0.03% 0.03% 0.03% N/A Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment and principal value fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Returns less than one year are not annualized. FFCM has contractually agreed (i) to waive its management fees and reimburse expenses until October 31, 2015 to the extent necessary to prevent the Fund’s net operating expenses from exceeding 1.49%. 1 = Inception 9/7/11 for (MOM, SIZ); Inception 9/13/11 for (BTAL, CHEP) =Returns Annualized Since Inception 3 = Gross expense ratio includes dividend expense on short positions. Dividend income earned on long positions and interest earned on cash collateral are not reflected in the ratio. This income serves to offset the dividend expense on short positions. 4 = Performance starting 9/13/2011 2 Company Overview: QuantShares designs and manages Market Neutral ETFs to provide exposure to well-known equity factors such as Momentum, Value, Beta and Size. QuantShares Market Neutral ETFs are the first ETFs that have the capability to short physical stocks (as opposed to derivatives) that passively track indexes. Our ETFs offer investors a diversifying asset that is both highly liquid and fully transparent. The ETFs are designed to generate spread returns, diversify risk and reduce volatility. Value, Size and Momentum tend to be more strategic in nature and provide strong risk-adjusted returns; Anti-Beta tends to be more tactical and allows investors to hedge or express short term investment convictions. QuantShares Market Neutral ETFs provide a liquid alternative to help dampen volatility and enhance the risk return profile of an investment portfolio. Disclosures: Before investing you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. This and other information is in the prospectus, a copy of which can be obtained by visiting the Fund’s website at www.quant-shares.com. Please read the prospectus carefully before you invest. Foreside Fund Service, LLC, Distributor. Shares are not individually redeemable and can be redeemed only in Creation Units. The market price of shares can be at, below or above the NAV. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00PM Eastern time (when NAV is normally determined), and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the possible loss of principal amount invested. See prospectus for specific risks regarding each Fund. There is a risk that during a “bull” market, when most equity securities and long only ETFs are increasing in value, the Funds’ short positions will likely cause the Fund to underperform the overall U.S. equity market and such ETFs. The Funds may not be suitable for all investors. Short selling could cause unlimited losses, derivatives could result in losses beyond the amount invested, and the value of an investment in the Fund may fall sharply. Beta is a measure of an asset’s sensitivity to an underlying index. Long is purchasing a stock with the expectation that it is going to rise in value. Short is selling stock with the expectation of profiting by buying it back later at a lower price. Negative correlation is a relationship between two variables in which one variable increases as the other decreases. HFRI EH: Equity Market Neutral Index incorporates equity market neutral strategies including both Factor-based and Statistical Arbitrage/Trading Strategies. Equity Market Neutral Strategies typically maintain characteristic net equity market exposure no greater than 10% long or short. S&P 500 is an index of 500 large cap common stocks actively traded on the NYSE and NASDAQ. One cannot invest directly in an index.